1,050% VMware Price Jump: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

AT&T's Concerns Regarding Reduced Competition

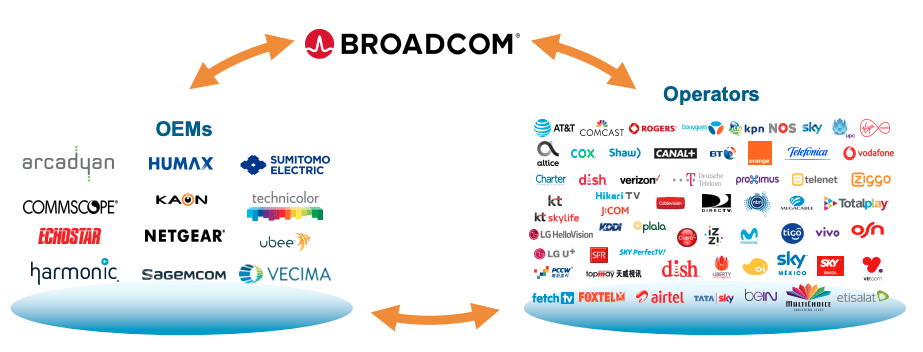

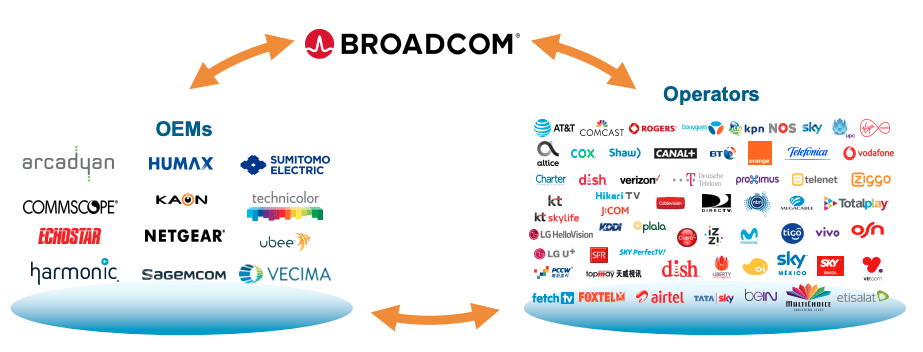

The potential merger of Broadcom and VMware has raised serious concerns about reduced competition within the enterprise software market. AT&T, a significant user of VMware's virtualization and cloud computing solutions, is particularly anxious about the implications.

Monopoly Power and Stifled Innovation

Broadcom's acquisition of VMware could create a near-monopoly in several key areas of enterprise software, potentially stifling innovation and harming consumers. This consolidation of power could lead to:

- Loss of VMware's independent innovation: VMware, as an independent entity, has historically driven innovation in virtualization and cloud technologies. The acquisition risks stifling this independent innovation.

- Reduced product choice: A combined Broadcom-VMware entity could limit the choices available to companies like AT&T, forcing them into a less competitive market.

- Higher prices for AT&T and other clients: Reduced competition often leads to increased prices for enterprise software and services. AT&T could face significantly higher costs for VMware's products and support.

- Decreased bargaining power: AT&T and other large clients will have less leverage to negotiate favorable pricing and service agreements with a dominant Broadcom-VMware.

AT&T relies heavily on VMware's vSphere platform for its data center virtualization and cloud management. A less competitive market could leave AT&T with fewer options and less control over its IT infrastructure costs.

Impact on Network Infrastructure

VMware's virtualization technologies are deeply integrated into AT&T's network infrastructure. The acquisition could significantly impact AT&T's network operations in several ways:

- Dependence on VMware solutions: AT&T's network is heavily reliant on VMware's products, creating a significant vendor lock-in.

- Potential for vendor lock-in: Migrating away from VMware solutions could be costly and disruptive to AT&T’s operations if Broadcom decides to change pricing or service levels.

- Difficulties in migrating to alternative solutions: Switching to alternative virtualization platforms would require substantial time, resources, and expertise.

- Security concerns: Consolidation of this magnitude could raise security risks and concerns about potential vulnerabilities in the unified system.

The integration of VMware into Broadcom could lead to challenges for AT&T in maintaining its existing infrastructure and adapting to future technological advancements. The potential for difficulties in transitioning away from VMware makes the acquisition especially concerning for AT&T's long-term IT strategy.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware deal faces significant regulatory hurdles, primarily concerning antitrust concerns and potential monopolies.

Government Investigations and Potential Roadblocks

Several regulatory bodies are investigating the potential impact of the acquisition, which could lead to delays or even a complete block of the deal. These investigations include:

- FTC investigation: The Federal Trade Commission (FTC) in the United States is likely to scrutinize the merger for potential antitrust violations.

- Potential lawsuits from competitors: Competitors may file lawsuits challenging the legality of the acquisition, claiming it will harm competition.

- EU regulatory review: The European Union is also likely to review the merger for its compliance with EU competition laws.

- Public pressure for a thorough investigation: Public pressure and concerns about reduced competition could fuel a more thorough and extensive regulatory review.

The potential for significant fines and penalties adds to the uncertainty surrounding the acquisition, making the outcome far from guaranteed.

The Role of AT&T in Regulatory Actions

AT&T's stance on the acquisition will likely play a significant role in the regulatory process. Their potential actions include:

- Statements made by AT&T executives: Public statements by AT&T executives expressing concerns could influence public opinion and regulatory decisions.

- Potential lobbying efforts: AT&T might engage in lobbying efforts to influence regulatory bodies and policymakers.

- Alliance with other companies to oppose the deal: AT&T may join forces with other companies to present a unified front against the acquisition.

AT&T's involvement in the regulatory process could significantly shape the outcome of the Broadcom-VMware merger.

The Broader Implications for the Enterprise Software Market

The Broadcom-VMware merger has significant implications for the broader enterprise software market, extending far beyond AT&T's concerns.

Impact on VMware's Customers

The acquisition could negatively affect many VMware clients, including:

- Price increases: Reduced competition could lead to higher prices for VMware products and services.

- Reduced product quality: A focus on maximizing profits might lead to a decline in product quality and customer support.

- Lack of innovation: Monopoly power can stifle innovation, hindering the development of new and improved virtualization technologies.

- Vendor lock-in: Customers may become increasingly locked into VMware products, limiting their options and bargaining power.

The potential for industry consolidation raises serious concerns about the long-term health and competitiveness of the enterprise software market.

Long-term Effects on Technological Advancement

The acquisition could hinder innovation within the virtualization and cloud computing sectors:

- Less competition leading to slower innovation: A lack of competitive pressure can stifle innovation and slow down the development of new technologies.

- Reduced choices for consumers: Fewer competitors mean fewer choices for consumers, leading to reduced flexibility and potentially higher prices.

- Potential for higher prices across the industry: The consolidation could lead to higher prices across the industry, impacting all businesses using virtualization technologies.

The long-term impact on technological advancement could be substantial, potentially slowing progress in cloud computing and virtualization.

Conclusion

The 1,050% VMware price jump serves as a stark warning of the potential ramifications of Broadcom's acquisition. AT&T's concerns, along with antitrust issues and the broader implications for the enterprise software market, warrant a thorough and careful examination by regulatory bodies. The outcome of this deal will significantly impact the future of virtualization, cloud computing, and the competitive landscape of enterprise software. Keeping a close watch on the unfolding regulatory scrutiny surrounding this massive VMware acquisition is crucial for anyone involved in the tech industry. Stay informed about the latest developments in the Broadcom-VMware deal to better understand the potential impact on your organization’s software and infrastructure.

Featured Posts

-

Strengthening Rcn Vet Nursing Partnerships Lessons From A Plastic Glove Project

May 31, 2025

Strengthening Rcn Vet Nursing Partnerships Lessons From A Plastic Glove Project

May 31, 2025 -

East London High Street Shop Fire Over 100 Firefighters Respond

May 31, 2025

East London High Street Shop Fire Over 100 Firefighters Respond

May 31, 2025 -

Miley Cyrus Drops Stunning Visuals For End Of The World Single

May 31, 2025

Miley Cyrus Drops Stunning Visuals For End Of The World Single

May 31, 2025 -

Building The Good Life Strategies For Personal Growth And Well Being

May 31, 2025

Building The Good Life Strategies For Personal Growth And Well Being

May 31, 2025 -

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025