$1.231 Billion In Oil Company Funds: Representatives Pledge To Secure Recovery

Table of Contents

The Scale of the Problem: Understanding the $1.231 Billion

The $1.231 billion in question represents funds designated for environmental remediation following a major oil spill incident. These funds, originally intended to cover cleanup costs, habitat restoration, and compensation for affected communities, have been mismanaged and are now subject to a complex recovery process. The sheer scale of this loss is alarming. In the context of the oil industry, this sum represents a significant portion of the budgets allocated to environmental responsibility and reflects a substantial failure in corporate governance.

- Environmental Impact: This lost money could have funded extensive environmental cleanup efforts, potentially mitigating long-term ecological damage and accelerating the recovery of affected ecosystems. The failure to secure these funds directly impacts the environment and the communities that rely on it.

- Shareholder Impact: The loss of $1.231 billion significantly impacts shareholders and investors. This loss of capital erodes confidence in the company's management and financial stability, potentially leading to decreased stock value and investor lawsuits.

- Comparison to Similar Cases: This case echoes similar instances of financial mismanagement within the oil and gas industry. While specific details vary, the common thread is a lack of sufficient oversight and transparency, leading to substantial financial losses and environmental consequences.

Representatives' Pledges and Proposed Actions for Oil Company Funds Recovery

Several key representatives, including Senator [Senator's Name], Representative [Representative's Name], and Attorney General [Attorney General's Name], have publicly pledged to recover the missing $1.231 billion. Their proposed actions involve a multi-pronged approach to ensure accountability and secure the funds.

- Legislative Actions: Senator [Senator's Name] has introduced a bill aimed at strengthening financial reporting requirements for oil companies and enhancing penalties for misappropriation of funds.

- Investigations: A joint investigation involving federal and state agencies is underway. This investigation will utilize independent audits to trace the flow of funds and determine the extent of the mismanagement. Criminal investigations are also underway to identify and prosecute individuals responsible for the loss.

- International Cooperation: Given the potential involvement of international entities in the financial transactions, there is ongoing collaboration with international regulatory bodies to facilitate the recovery process across jurisdictions. This international cooperation is crucial to navigate complex cross-border financial issues.

Challenges and Obstacles to Oil Company Funds Recovery

Recovering the $1.231 billion will not be without significant challenges. Several factors complicate the recovery process and could potentially hinder its success.

- Jurisdictional Issues: The funds may have been moved across multiple jurisdictions, making it challenging to track their flow and enforce legal action. International cooperation is essential to overcome this hurdle.

- Complex Financial Structures: The use of complex financial instruments and shell companies could obfuscate the trail of the funds, making it difficult to locate and recover them. Sophisticated financial investigations will be needed.

- Legal Battles: Lengthy legal battles are anticipated. The oil company involved may challenge the recovery efforts, resulting in delays and potentially reducing the amount that can ultimately be recovered. This necessitates a robust legal strategy.

Implications for the Future of Oil Company Financial Oversight

This case underscores the urgent need for enhanced financial oversight within the oil industry. The loss of $1.231 billion highlights critical weaknesses in current regulatory frameworks and necessitates comprehensive reforms.

- Improved Transparency: Increased transparency in financial reporting, including mandatory independent audits and publicly accessible financial data, is crucial to prevent future misappropriations.

- Strengthened Regulations: More stringent regulations governing the handling of environmental remediation funds are necessary. This could include stricter penalties for non-compliance and more robust oversight mechanisms.

- Independent Oversight Bodies: Establishing independent oversight bodies with the authority to monitor oil company finances and investigate suspected wrongdoing can enhance accountability.

Conclusion

The $1.231 billion in oil company funds currently under scrutiny underscores the critical need for stronger financial oversight within the industry. Representatives' pledges to secure the recovery of these crucial funds offer a glimmer of hope, but the road ahead is fraught with challenges. The success of these oil company funds recovery efforts will not only determine the fate of this significant sum but will also shape the future of accountability and transparency in the oil sector. Stay informed about the progress of the oil company funds recovery effort and demand continued transparency and action from those responsible for safeguarding these vital assets. We must ensure that such significant financial losses are prevented in the future through strengthened regulatory measures and heightened industry accountability. Demand action and transparency regarding the recovery of oil company funds.

Featured Posts

-

Atyximata Sidirodromon Pos Na Beltiothei I Asfaleia

May 20, 2025

Atyximata Sidirodromon Pos Na Beltiothei I Asfaleia

May 20, 2025 -

Find The Answers Nyt Mini Crossword April 2nd

May 20, 2025

Find The Answers Nyt Mini Crossword April 2nd

May 20, 2025 -

Agatha Christies Poirot A Critical Look At The Stories And Adaptations

May 20, 2025

Agatha Christies Poirot A Critical Look At The Stories And Adaptations

May 20, 2025 -

Wwe Raw May 19 2025 Full Results And Match Grades

May 20, 2025

Wwe Raw May 19 2025 Full Results And Match Grades

May 20, 2025 -

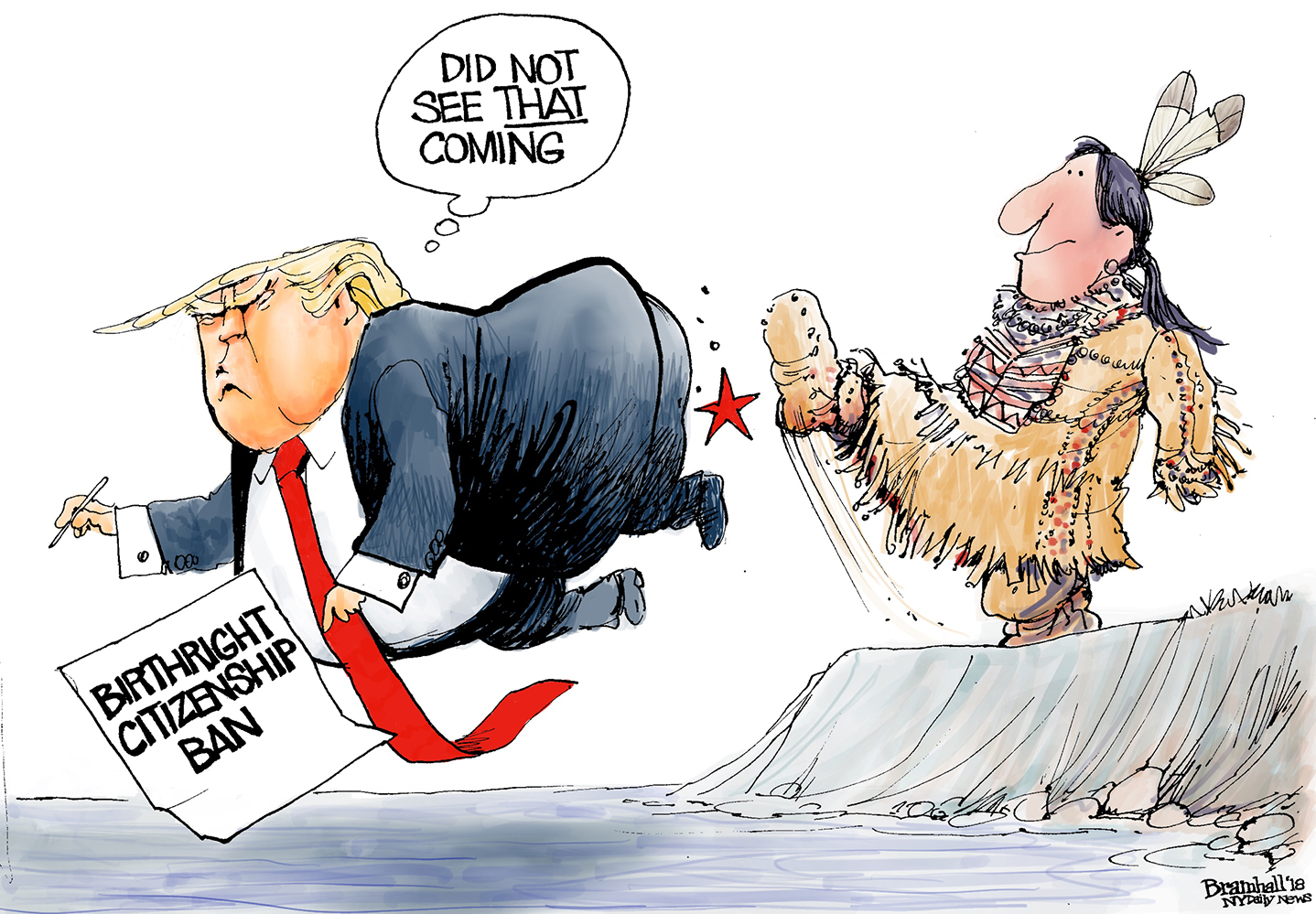

Leaving The Us Americans Pursuit Of European Citizenship After Trump

May 20, 2025

Leaving The Us Americans Pursuit Of European Citizenship After Trump

May 20, 2025