£1.8 Billion Acquisition: Honeywell And Johnson Matthey On The Verge Of Deal

Table of Contents

The Deal's Key Details and Implications

This £1.8 billion acquisition represents a major strategic move for both companies. Let's break down the key aspects:

Financial Aspects of the £1.8 Billion Acquisition

- Estimated acquisition cost: While the reported figure is £1.8 billion, the final price may vary slightly depending on due diligence and final negotiations. Reliable sources like the Financial Times and Reuters should be consulted for the most up-to-date information.

- Impact on Honeywell's financial performance: The acquisition is expected to significantly boost Honeywell's revenue and market share within the emissions control sector. Analysts predict substantial growth in the coming years, driven by increased demand for clean technology solutions.

- Funding mechanisms: Honeywell is likely to utilize a combination of internal resources, debt financing, and possibly equity issuance to fund the acquisition. The specific breakdown will be detailed in official filings once the deal is finalized.

- Investor reactions: The market's response will depend on several factors, including the final price, the integration process, and Honeywell's overall financial outlook. Positive investor sentiment is anticipated if the acquisition proves to be strategically sound and financially beneficial.

- Deal valuation: The £1.8 billion valuation reflects the significant value of Johnson Matthey's emissions control technologies, its established market position, and its future growth potential within the rapidly expanding clean energy sector.

Strategic Rationale for Honeywell

Honeywell's acquisition of Johnson Matthey's emissions control business is driven by several strategic factors:

- Expansion into a high-growth market: The global demand for emission control technologies is booming due to tightening environmental regulations and the push towards sustainable transportation. This acquisition provides Honeywell with immediate access to this lucrative market.

- Acquisition of advanced technology and intellectual property (IP): Johnson Matthey possesses cutting-edge technology and valuable patents in catalysts and emission control systems. This IP will significantly enhance Honeywell's technological capabilities and competitive advantage.

- Strengthening Honeywell's position in automotive and clean energy: The acquisition strategically positions Honeywell as a leader in both automotive and broader clean energy sectors, aligning with global sustainability initiatives.

- Synergies and cost-saving opportunities: The merger of these two companies is likely to generate synergies in manufacturing, R&D, and distribution, leading to significant cost reductions and improved efficiency.

- Increased market share and dominance: By acquiring Johnson Matthey's market share, Honeywell aims to become a dominant player in the global emissions control market.

Impact on Johnson Matthey

The sale of its emissions control business will significantly reshape Johnson Matthey's portfolio:

- Restructuring and focus on core businesses: Johnson Matthey plans to use the proceeds to reinvest in its other core businesses and pursue strategic growth opportunities in areas like battery materials.

- Impact on stock price: The sale is expected to have a positive impact on Johnson Matthey's stock price, as it allows the company to focus on its more profitable and strategically important divisions.

- Job security: While some job losses are possible during the integration process, Johnson Matthey has committed to managing employee transitions responsibly and providing support to affected workers.

The Emissions Control Market and its Future

The global emissions control market is experiencing robust growth:

Growing Demand for Emission Control Technologies

- Stricter regulations: Governments worldwide are implementing stricter emission regulations for vehicles and industrial processes, creating a strong demand for advanced emission control technologies.

- Sustainable transportation: The shift towards electric vehicles and other sustainable transportation solutions continues to fuel growth in the emission control market.

- Emerging markets: Developing economies are experiencing rapid industrialization and motorization, creating significant growth opportunities for emission control technology providers.

- Technological advancements: Continuous advancements in catalyst technology, such as the development of more efficient and durable materials, are driving market growth.

Honeywell's Position in the Post-Acquisition Market

Following the acquisition, Honeywell is poised to become a market leader:

- Market leadership: Honeywell will gain a substantial market share, enhancing its competitive position.

- Technological innovation: The combined R&D capabilities of both companies will accelerate innovation in emission control technologies.

- Further acquisitions: Honeywell may explore further acquisitions to consolidate its position in the market.

- Long-term growth: The long-term growth outlook for the emission control sector remains positive, providing significant opportunities for Honeywell.

Potential Challenges and Risks

Despite the potential benefits, the acquisition faces several challenges:

Regulatory Hurdles and Antitrust Concerns

- Antitrust reviews: The deal will likely face scrutiny from antitrust regulators to ensure it doesn't stifle competition. Approval from relevant authorities will be crucial.

- Regulatory complexities: Navigating diverse regulatory environments across different jurisdictions will pose a significant challenge.

Integration Challenges and Synergies

- Cultural differences: Merging the corporate cultures of Honeywell and Johnson Matthey will require careful planning and execution.

- Technology integration: Integrating Johnson Matthey's technology and systems into Honeywell's existing infrastructure could be complex.

- Maximising synergies: Realizing the full potential synergies from the merger will require effective management and operational efficiency.

Conclusion

The proposed £1.8 billion acquisition of Johnson Matthey's emissions control business by Honeywell represents a pivotal moment in the automotive and clean technology sectors. This deal underscores the escalating importance of emission control solutions and Honeywell's strategic drive to dominate this expanding market. The successful integration of Johnson Matthey's expertise and technology will be crucial for Honeywell to fully leverage the acquisition's potential. To stay informed about further developments in this significant £1.8 billion deal and its broader impact on emissions control technology, continue checking for updates on the Honeywell and Johnson Matthey acquisition.

Featured Posts

-

Sses Revised Spending Plan A 3 Billion Reduction Explained

May 23, 2025

Sses Revised Spending Plan A 3 Billion Reduction Explained

May 23, 2025 -

Andrew Tate Dupa Dubai Noi Provocari Si Riscuri Conducerea Cu Viteza In Vizor

May 23, 2025

Andrew Tate Dupa Dubai Noi Provocari Si Riscuri Conducerea Cu Viteza In Vizor

May 23, 2025 -

Investigation Reveals Flaws In Trumps Air Traffic Control Plan Newark Suffers

May 23, 2025

Investigation Reveals Flaws In Trumps Air Traffic Control Plan Newark Suffers

May 23, 2025 -

Metallica Announces Two Night Stand At Dublins Aviva Stadium In June 2026

May 23, 2025

Metallica Announces Two Night Stand At Dublins Aviva Stadium In June 2026

May 23, 2025 -

Kieran Culkin In A Real Pain Theater Het Kruispunt Review

May 23, 2025

Kieran Culkin In A Real Pain Theater Het Kruispunt Review

May 23, 2025

Latest Posts

-

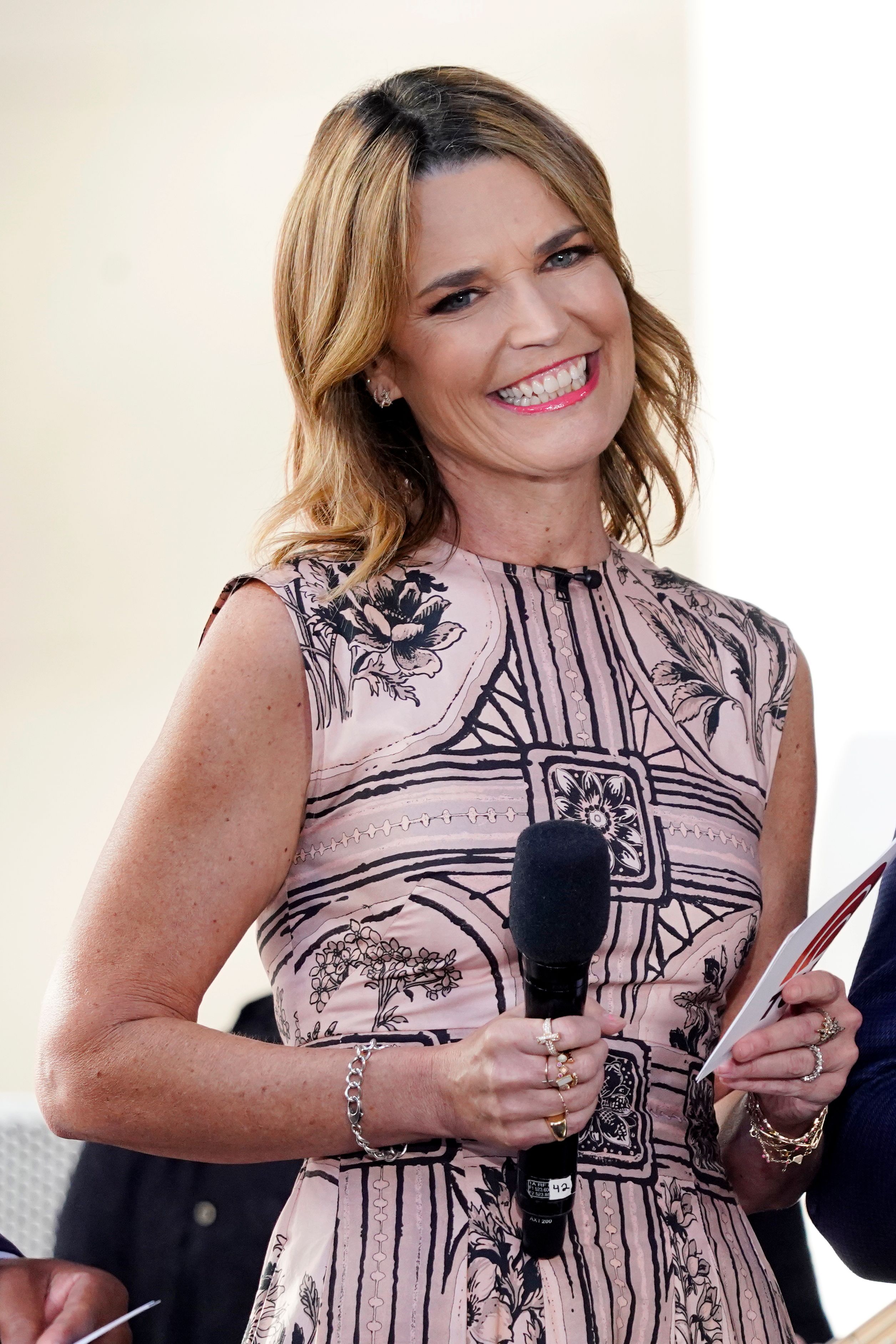

Savannah Guthries Co Host Absence A Mid Week Switch

May 23, 2025

Savannah Guthries Co Host Absence A Mid Week Switch

May 23, 2025 -

Today Show Shakeup Savannah Guthries Co Host Change

May 23, 2025

Today Show Shakeup Savannah Guthries Co Host Change

May 23, 2025 -

Sheinelle Jones Update Co Host Reveals Health Status After 4 Month Absence

May 23, 2025

Sheinelle Jones Update Co Host Reveals Health Status After 4 Month Absence

May 23, 2025 -

Sheinelle Jones Discussing Her Daily Life Amidst Absence From Today Show

May 23, 2025

Sheinelle Jones Discussing Her Daily Life Amidst Absence From Today Show

May 23, 2025 -

Savannah Guthrie Gets A Temporary Co Host Meet The Replacement

May 23, 2025

Savannah Guthrie Gets A Temporary Co Host Meet The Replacement

May 23, 2025