10%+ Gains On BSE: Sensex Rally And Top Performing Stocks

Table of Contents

Understanding the Sensex Rally: Factors Driving 10%+ Gains

The recent surge in the BSE Sensex, resulting in significant 10%+ gains, is a confluence of several factors, both global and domestic. Let's examine the key drivers:

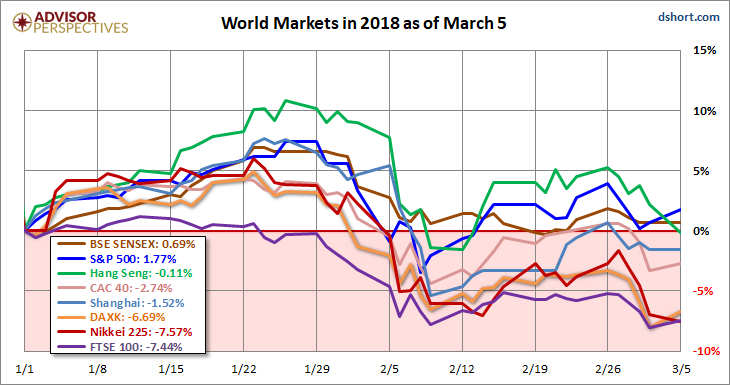

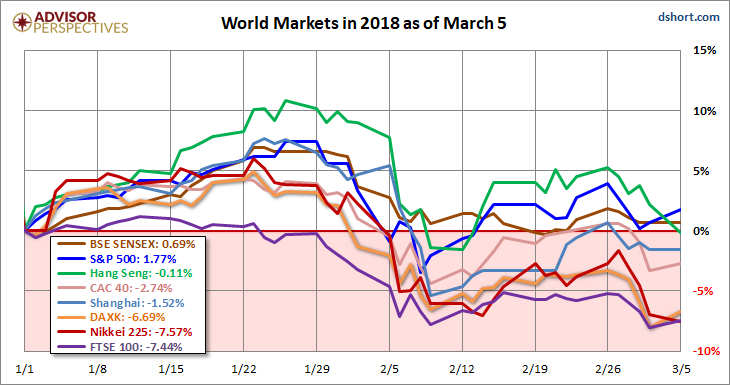

Global Economic Indicators and their Impact

Positive global economic news has played a crucial role in the Sensex rally. Easing inflation in several major economies, coupled with positive economic growth forecasts, has boosted investor confidence worldwide. This positive sentiment has spilled over into emerging markets, including India.

- Improved investor confidence: Reduced inflation fears lead to increased risk appetite among investors.

- Increased foreign institutional investment (FII): Positive global outlook attracts significant foreign investment into the Indian stock market.

- Positive sentiment towards emerging markets: India's strong fundamentals make it an attractive destination for global investors seeking growth opportunities.

For example, the recent downward trend in US inflation figures has significantly impacted global market sentiment, positively affecting the Indian stock market's performance.

Domestic Economic Growth and Policy Decisions

Strong domestic economic indicators have further fueled the Sensex rally. India's robust GDP growth, coupled with positive industrial production figures, showcases the country's economic resilience. Government policies and reforms have also played a significant role in boosting investor confidence.

- Stronger-than-expected GDP growth: Sustained economic expansion creates a positive outlook for corporate earnings.

- Government's infrastructure push: Massive investments in infrastructure development stimulate economic activity and create opportunities for various sectors.

- Positive reforms in specific sectors: Targeted reforms aimed at improving ease of doing business attract investment and boost growth.

Initiatives like the government's focus on infrastructure development and digitalization have significantly contributed to the positive market sentiment.

Sector-Specific Performance

The Sensex rally hasn't been uniform across all sectors. Certain sectors have significantly outperformed others, driven by specific industry trends and strong earnings.

- IT: Strong export demand and robust order books have propelled the IT sector's exceptional performance.

- FMCG: Increased consumer spending and a recovery in rural demand have fueled growth in the Fast-Moving Consumer Goods sector.

- Banking: Improving credit growth and positive regulatory changes have boosted the banking sector's performance.

Top Performing Stocks: Analyzing the Winners of the Sensex Rally

Identifying the top-performing stocks requires a clear methodology. Our analysis considers percentage gains and market capitalization to ensure a balanced representation of the market's best performers during the recent Sensex rally.

Methodology for Stock Selection

The top-performing stocks listed below were selected based on their percentage gains over the past [Specify timeframe, e.g., three months] and their market capitalization, ensuring a mix of large-cap and mid-cap companies.

List of Top Performing Stocks (with brief analysis)

| Stock Ticker | Stock Name | Percentage Gain | Key Performance Drivers |

|---|---|---|---|

| (Example) | Reliance Industries | 15% | Strong Q[Quarter] results, positive outlook for future growth |

| (Example) | Infosys | 12% | Robust export demand, strong deal pipeline |

| (Example) | HDFC Bank | 10% | Improving credit growth, positive regulatory environment |

| (Example) | TCS | 11% | Strong client acquisition, positive industry outlook |

| (Example) | Hindustan Unilever | 8% | Increased consumer spending, market share gains |

(Note: Replace example data with actual data of top-performing stocks.)

Risk and Disclaimer

Investing in the stock market involves inherent risks. The information provided here is for educational purposes only and should not be considered financial advice. Past performance is not indicative of future results. It's crucial to conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions.

Capitalize on the Sensex Rally and Achieve 10%+ Gains

The Sensex rally, delivering 10%+ gains, is a result of a combination of positive global economic indicators, strong domestic growth, and supportive government policies. Identifying and investing in top-performing stocks like those highlighted above can be crucial for maximizing your returns. Understanding the factors driving this Sensex rally and identifying top-performing stocks can significantly contribute to your investment success. Begin your research today and explore the potential for 10%+ gains on BSE! Remember to always conduct your own thorough research and seek professional advice before making any investment decisions.

Featured Posts

-

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective On The Odd Pairing

May 15, 2025

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective On The Odd Pairing

May 15, 2025 -

Leme I Ovechkin Odinakovoe Kolichestvo Golov V Pley Off N Kh L

May 15, 2025

Leme I Ovechkin Odinakovoe Kolichestvo Golov V Pley Off N Kh L

May 15, 2025 -

Andor First Look A 31 Year Wait Culminates

May 15, 2025

Andor First Look A 31 Year Wait Culminates

May 15, 2025 -

Fatal West Broad Street Foot Locker Incident Details From Crime Insider Sources

May 15, 2025

Fatal West Broad Street Foot Locker Incident Details From Crime Insider Sources

May 15, 2025 -

Colman Domingo Shares Support After Eric Danes Als Diagnosis

May 15, 2025

Colman Domingo Shares Support After Eric Danes Als Diagnosis

May 15, 2025