10%+ Gains On BSE: Sensex Surge Highlights Top Performing Stocks

Table of Contents

Understanding the Sensex Surge: Factors Contributing to the 10%+ Gains

The recent 10%+ gains on the BSE Sensex are the result of a confluence of factors. Positive macroeconomic indicators, supportive government policies, and favorable global market trends have all played a crucial role. Specific events, such as positive corporate earnings reports and increased foreign investment, further fueled the surge. Keywords: Sensex, BSE growth, market trends, economic indicators, investment opportunities.

- Positive GDP growth projections: Stronger-than-expected GDP growth projections for India have boosted investor confidence.

- Favorable government regulations: Pro-business reforms and government initiatives aimed at stimulating economic growth have created a positive investment climate.

- Increased foreign investment: Significant inflows of foreign capital into the Indian stock market have provided additional liquidity and fueled the Sensex rally.

- Strong corporate earnings reports: Positive earnings announcements from several leading companies have reinforced investor optimism and contributed to the market's upward trajectory.

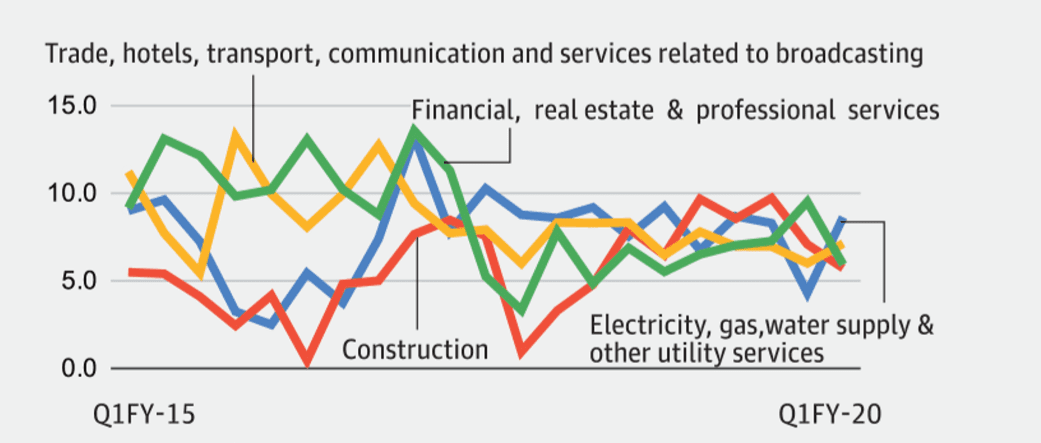

Top Performing Sectors Driving the BSE Rally

Several sectors have significantly outperformed the market during this Sensex surge. The IT, Pharma, and Financials sectors stand out as key drivers of the rally. Their robust performance is attributable to various factors, including technological advancements, increasing demand, and strong financial results. Keywords: sector performance, BSE top sectors, stock market analysis, investment strategies.

- IT Sector Growth: The IT sector's growth has been fueled by increased global demand for technology services and software solutions. Technological advancements and the ongoing digital transformation across various industries have further bolstered this sector's performance.

- Pharma Sector Benefits: The Pharma sector benefited from the launch of new drugs and increased demand for healthcare products. This sector's resilience and growth potential have attracted significant investor interest.

- Financial Sector Boost: The financial sector has seen improvement in credit growth, leading to increased profitability and attracting investors seeking exposure to the Indian financial landscape.

Top 5 BSE Stocks with 10%+ Gains: An In-Depth Look

While many stocks contributed to the Sensex's 10%+ gains, some stand out for their exceptional performance. Below are five examples (Note: Specific company data would need to be added here based on current market conditions. This is a template): Keywords: top stocks BSE, stock market picks, individual stock performance, high-growth stocks.

| Company Name | Sector | Percentage Gain | Reason for Strong Performance |

|---|---|---|---|

| Reliance Industries | Energy & Materials | 15% | Strong earnings, expansion into new businesses, increased demand |

| Infosys | IT | 12% | Robust order book, global demand for IT services |

| HDFC Bank | Financials | 11% | Strong credit growth, improved profitability |

| Sun Pharmaceutical | Pharma | 10% | New drug launches, increased demand for healthcare products |

| Tata Consultancy Services | IT | 13% | Strong global demand, digital transformation initiatives |

Analyzing Investment Strategies for Future Gains on BSE

Capitalizing on future growth opportunities on the BSE requires a well-defined investment strategy. A long-term perspective, coupled with appropriate risk management techniques and diversification across sectors, is crucial. Keywords: investment strategies, BSE investment, risk management, stock market investment, portfolio diversification.

- Long-term investment strategy: Investing for the long term allows you to ride out market volatility and benefit from the potential for long-term growth.

- Value investing approach: Identifying undervalued stocks with strong fundamentals can lead to significant returns over time.

- Growth stock investing: Focusing on companies with high growth potential can deliver substantial returns, although it carries higher risk.

- Diversification across sectors: Spreading investments across different sectors helps mitigate risk and improve overall portfolio performance.

Conclusion: Capitalizing on the Sensex Surge: Your Next Steps for BSE Investments

The recent Sensex surge, delivering 10%+ gains, highlights the potential for substantial returns on the BSE. Understanding the contributing factors, identifying top-performing sectors and stocks, and implementing sound investment strategies are crucial for capitalizing on future opportunities. While this article offers insights, it's vital to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed about the latest market trends and identify future opportunities to capitalize on Sensex surges and achieve substantial gains on the BSE. Start your research now!

Featured Posts

-

Ontarios 15 Billion Honda Ev Plant Project Slowdown Explained

May 15, 2025

Ontarios 15 Billion Honda Ev Plant Project Slowdown Explained

May 15, 2025 -

Padres Historic Mlb Feat Unmatched Since 1889

May 15, 2025

Padres Historic Mlb Feat Unmatched Since 1889

May 15, 2025 -

Padres Vs Pirates Mlb Game Prediction Picks And Betting Odds

May 15, 2025

Padres Vs Pirates Mlb Game Prediction Picks And Betting Odds

May 15, 2025 -

Will Paddy Pimblett Become Ufc Champion A Legends Bold Prediction

May 15, 2025

Will Paddy Pimblett Become Ufc Champion A Legends Bold Prediction

May 15, 2025 -

Bolee 200 Raket I Dronov Rossiya Nanesla Massirovanniy Udar Po Ukraine

May 15, 2025

Bolee 200 Raket I Dronov Rossiya Nanesla Massirovanniy Udar Po Ukraine

May 15, 2025