1050% VMware Price Hike: AT&T's Concerns Over Broadcom's Proposed Acquisition

Table of Contents

AT&T's Stance on the VMware Price Hike

AT&T, a significant user of VMware's virtualization and cloud computing solutions, has publicly expressed deep concern over the potential 1050% price increase following Broadcom's acquisition. Their statements emphasize the substantial financial burden such a hike would impose and its potential to disrupt their services.

- Significant Reliance on VMware: AT&T relies heavily on VMware's vSphere, vSAN, and NSX products for its critical infrastructure, supporting a vast network and diverse range of services.

- Massive Financial Impact: A 1050% increase in VMware pricing would represent a colossal financial burden for AT&T, potentially impacting their budget for other crucial technological investments and potentially affecting their bottom line significantly. The exact figures remain undisclosed, but the scale of the potential increase suggests a substantial impact on their operational costs.

- Specific Products Affected: While not all VMware products are expected to face the same drastic increase, the core virtualization products like vSphere, crucial for AT&T's operations, are expected to be significantly impacted. This could lead to cascading effects across their entire IT infrastructure.

- Impact on Services and Customer Offerings: The substantial price hike could force AT&T to either absorb the increased costs, impacting their profit margins, or pass the costs onto their customers, potentially leading to higher prices for their services. This could make AT&T less competitive in the market.

Antitrust Concerns and Regulatory Scrutiny

The proposed Broadcom-VMware merger has triggered significant antitrust concerns, with the potential 1050% VMware price hike significantly strengthening these worries. This dramatic price increase suggests a potential for Broadcom to leverage its market power to stifle competition and exploit its dominant position post-acquisition.

- Regulatory Investigations: Regulatory bodies, including the Federal Trade Commission (FTC) in the US and the European Union's competition authorities, are actively investigating the merger, closely scrutinizing the potential anti-competitive implications.

- Strengthened Antitrust Arguments: The sheer magnitude of the projected VMware price hike provides strong evidence supporting antitrust arguments. This substantial increase demonstrates a clear potential for Broadcom to monopolize the market and harm consumers.

- Potential Consequences of Blocked Merger: If the merger is blocked or approved with significant conditions, it could dramatically alter the competitive landscape. This could result in a reassessment of Broadcom's acquisition strategy or lead to major restructuring within VMware.

- Legal Challenges: Several lawsuits and legal challenges have already been filed, highlighting the serious concerns surrounding the deal's potential to harm competition and increase prices for VMware's enterprise customers.

Impact on the Broader Cloud Computing Market

The Broadcom-VMware merger and the potential 1050% VMware price hike have significant implications for the broader cloud computing market, potentially impacting competition, innovation, and pricing strategies.

- Reduced Competition and Innovation: The acquisition could lead to reduced competition in the virtualization and cloud computing space, potentially stifling innovation and limiting customer choice. With a less competitive market, the incentive for innovation and improving services may decline.

- Impact on VMware Customers and Competitors: Existing VMware customers may face significantly increased costs and potentially reduced service quality. Competitors will likely need to adapt their strategies, potentially leading to market consolidation or the emergence of alternative virtualization solutions.

- Effect on Cloud Computing Pricing: The potential VMware price hike could trigger a domino effect across the cloud computing market, leading to higher prices for related services and products. This would increase the overall cost of cloud-based infrastructure for businesses of all sizes.

- Alternative Virtualization Solutions: Companies are likely to explore alternative virtualization solutions such as OpenStack, Proxmox VE, or other hypervisors, in an effort to mitigate the risk of massive price increases associated with VMware.

The Future of VMware Pricing Under Broadcom

The acquisition raises many questions regarding Broadcom’s future pricing strategies for VMware. Several scenarios are possible, each with significant implications for the market.

- Potential Pricing Scenarios: Broadcom might employ aggressive pricing to quickly gain market share, offer bundled products at a premium, or implement tiered pricing to target specific customer segments.

- Impact on Different Customer Segments: Large enterprises might be more directly affected by price increases, while smaller businesses may find it harder to afford the higher costs.

- Long-Term Effects on Customer Loyalty and Market Share: The price increase could lead to customer churn, prompting a shift towards alternative solutions and potentially impacting VMware’s long-term market share.

Conclusion

AT&T's concerns regarding the potential 1050% VMware price hike underscore the significant implications of Broadcom's proposed acquisition. The substantial price increase raises serious antitrust concerns and threatens to disrupt the competitive landscape of the cloud computing market, impacting businesses of all sizes. The regulatory scrutiny and potential legal challenges highlight the gravity of the situation. The future of VMware pricing under Broadcom remains uncertain, with potential impacts ranging from increased costs and reduced innovation to shifts in market share and customer loyalty.

Call to Action: Stay informed about developments in the Broadcom-VMware merger and its impact on VMware pricing. Monitor regulatory decisions closely and consider exploring alternative virtualization solutions to mitigate the potential risk of a significant VMware price hike. Follow the ongoing discussion on the VMware price hike and Broadcom's acquisition to stay informed about the evolving situation.

Featured Posts

-

Echo Valley Images Reveal The Atmosphere Of The Sydney Sweeney Julianne Moore Thriller

May 21, 2025

Echo Valley Images Reveal The Atmosphere Of The Sydney Sweeney Julianne Moore Thriller

May 21, 2025 -

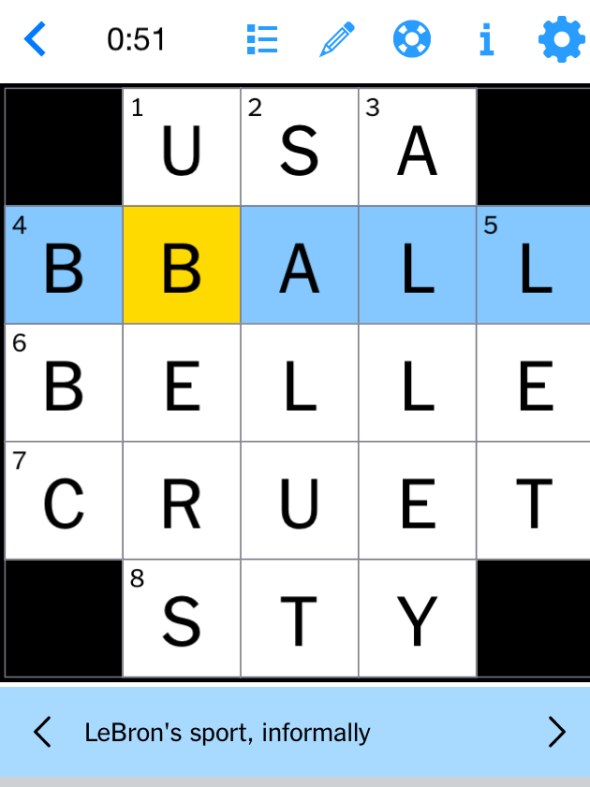

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025 -

Premier League 2024 25 The Champions A Photo Retrospective

May 21, 2025

Premier League 2024 25 The Champions A Photo Retrospective

May 21, 2025 -

Wintry Mix Rain And Snow Forecast

May 21, 2025

Wintry Mix Rain And Snow Forecast

May 21, 2025 -

William Goodge Sets New Standard For Fastest Australian Foot Crossing

May 21, 2025

William Goodge Sets New Standard For Fastest Australian Foot Crossing

May 21, 2025

Latest Posts

-

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025 -

Rtl Groups Streaming Strategy Profitability Projections And Key Milestones

May 21, 2025

Rtl Groups Streaming Strategy Profitability Projections And Key Milestones

May 21, 2025 -

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025 -

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025