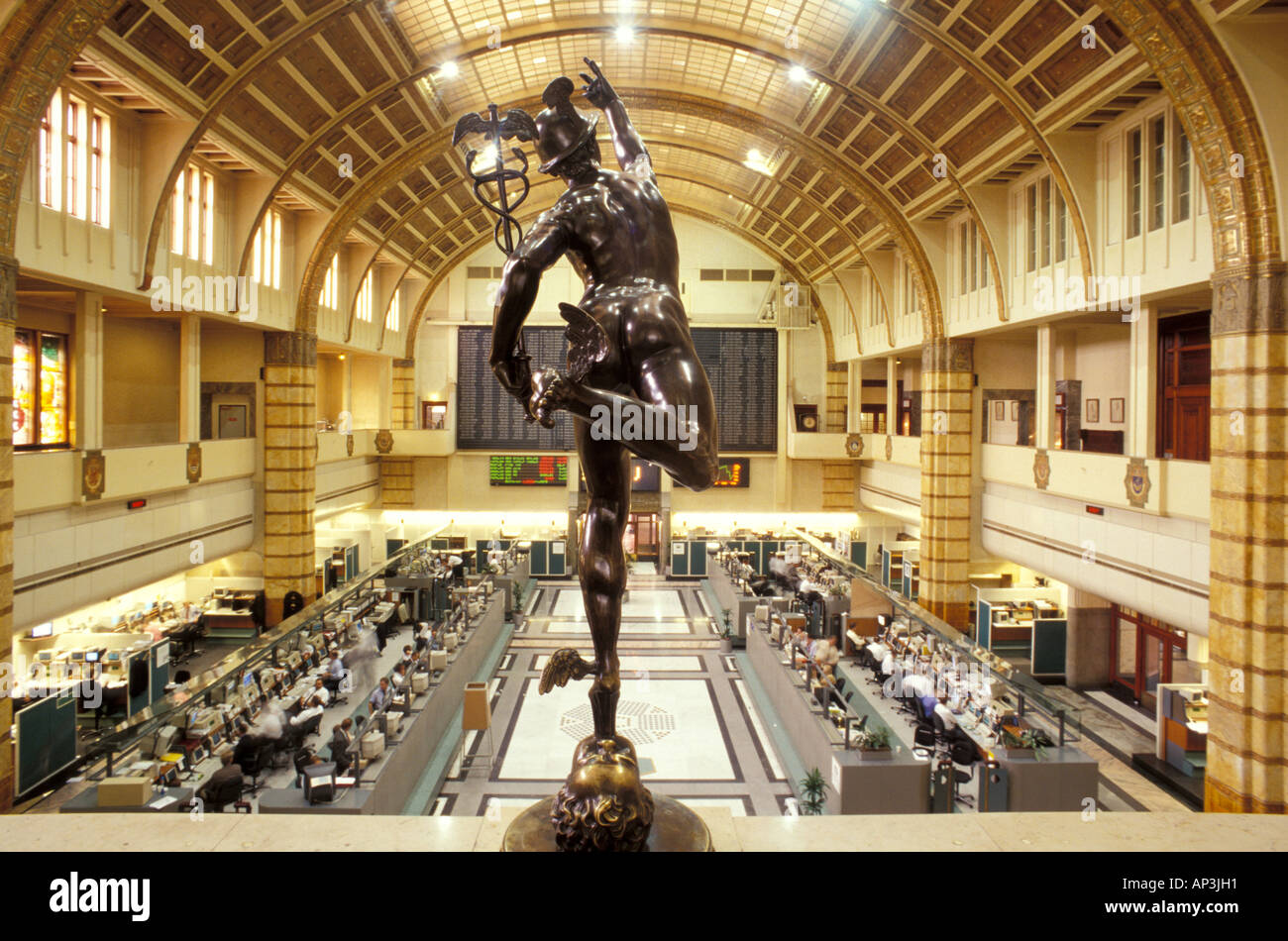

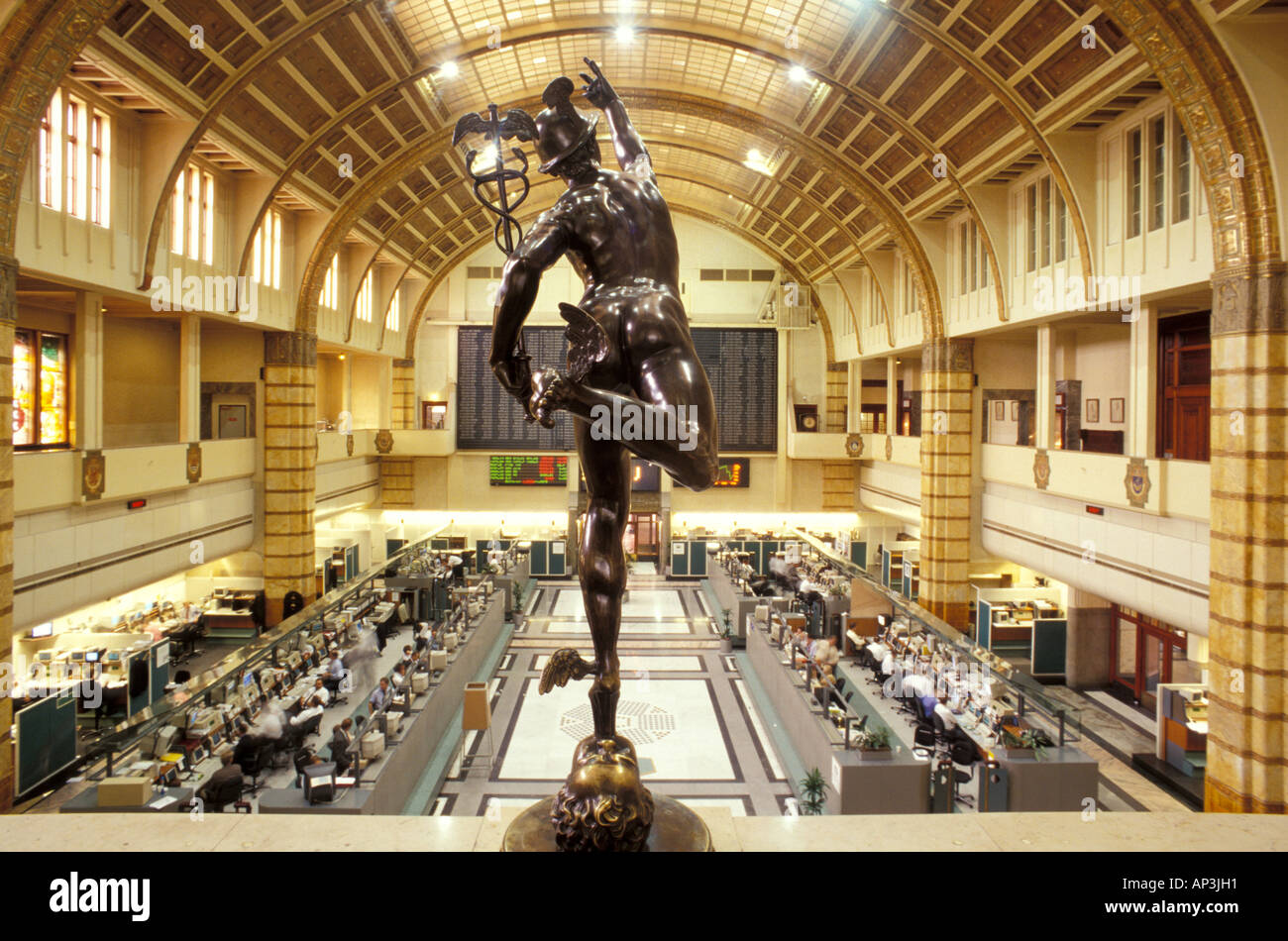

11% Drop: Amsterdam Stock Exchange Faces Continued Market Decline

Table of Contents

Analyzing the 11% Drop: Key Factors Contributing to the AEX Decline

The 11% drop in the AEX represents a substantial decline, exceeding the average yearly fluctuations observed in recent years. While market corrections are a normal part of the economic cycle, the speed and magnitude of this fall warrant careful examination. This isn't simply a minor dip; it signals deeper underlying issues.

Global Economic Uncertainty and its Impact on the AEX

The AEX decline is inextricably linked to broader global economic uncertainty. Several factors are converging to create a perfect storm:

- High Inflation: Persistent inflation in many countries is forcing central banks to aggressively raise interest rates, dampening economic growth and impacting corporate earnings.

- Interest Rate Hikes: The rise in interest rates increases borrowing costs for businesses, hindering investment and potentially leading to reduced profitability.

- Geopolitical Instability: The ongoing war in Ukraine has created significant energy price volatility and disrupted global supply chains, impacting numerous Dutch companies.

- Energy Crisis: The energy crisis in Europe, exacerbated by the war in Ukraine, poses a significant threat to energy-intensive industries in the Netherlands, impacting their stock prices.

These global headwinds are directly impacting Dutch companies listed on the AEX. For example, energy companies are facing volatile prices, while technology firms are grappling with reduced consumer spending.

Specific Sectoral Performance on the Amsterdam Stock Exchange

The impact of the market decline isn't uniform across all sectors. Some sectors have been hit harder than others:

- Energy: Energy companies have been particularly vulnerable due to fluctuating gas prices and supply disruptions.

- Technology: The tech sector, sensitive to interest rate hikes and changing consumer sentiment, has also seen significant losses.

- Financials: Banks and other financial institutions are facing challenges due to increased regulatory scrutiny and economic uncertainty.

Charts illustrating the relative performance of these sectors would visually underscore this point, demonstrating the uneven impact of the market decline. For instance, a specific company like [Insert Example Company Name] in the energy sector could be used to illustrate the impact of fluctuating gas prices on share prices.

Investor Sentiment and Market Volatility

Declining investor confidence is a major driver of the AEX decline. Fear and uncertainty are fueling market volatility and leading to increased selling pressure. Panic selling, driven by fear of further losses, has exacerbated the downturn. The increased volatility translates directly to higher risks for investors and contributes significantly to the market's downward trajectory.

The Broader Implications of the Amsterdam Stock Exchange Decline

The AEX decline doesn't exist in a vacuum; it has significant implications for the broader Dutch economy.

Impact on the Dutch Economy

The fall in the AEX index has several potential repercussions for the Dutch economy:

- Reduced Investment: Lower stock prices can discourage investment, potentially slowing down economic growth.

- Decreased Consumer Spending: Concerns about personal wealth and job security may lead to decreased consumer spending, further weakening the economy.

- Government Revenue: Lower corporate profits can reduce tax revenue for the government, impacting public spending and economic stimulus programs.

- Employment: Companies facing financial difficulties may resort to layoffs, increasing unemployment.

The Dutch government is likely to closely monitor the situation and may implement measures to mitigate the negative impacts on the economy.

Long-Term Outlook and Predictions for the AEX

Predicting the future of the AEX is inherently challenging. While a further decline is possible, several factors could contribute to a market rebound:

- Easing Inflation: If inflation begins to cool down, central banks may slow down interest rate hikes, potentially boosting investor confidence.

- Resolution of Geopolitical Tensions: A resolution to the conflict in Ukraine would remove a significant source of uncertainty.

- Government Interventions: Government policies aimed at stimulating economic growth could have a positive impact.

However, predicting the timing of a potential recovery is difficult and requires careful monitoring of several economic indicators.

Strategies for Investors Navigating the AEX Decline

The current market climate requires a cautious and strategic approach to investing.

Risk Management and Portfolio Diversification

Investors should prioritize risk management during periods of market instability:

- Diversification: Spread investments across different asset classes to reduce exposure to any single sector or market.

- Hedging Strategies: Consider using hedging techniques to protect against potential losses.

- Stop-Loss Orders: Utilize stop-loss orders to limit potential losses on individual investments.

These strategies can help mitigate the impact of market volatility on your portfolio.

Opportunities in a Bear Market

While a bear market presents challenges, it also offers opportunities for savvy investors:

- Value Investing: Identify undervalued companies with strong fundamentals that may be trading at discounted prices.

- Bargain Hunting: Look for companies with solid long-term prospects that have been unfairly impacted by the market downturn.

However, caution is paramount; thorough due diligence is critical before making any investment decisions during a period of market decline.

Conclusion

The 11% drop in the Amsterdam Stock Exchange (AEX index) is a significant event with far-reaching consequences for investors and the Dutch economy. Global economic uncertainty, high inflation, interest rate hikes, geopolitical instability, and declining investor confidence are all contributing factors. While the short-term outlook remains uncertain, understanding these factors and implementing sound risk management strategies are crucial for navigating this challenging market. Monitor the AEX index closely, understand the risks associated with investing in the Amsterdam Stock Exchange, and learn more about navigating market declines. Adapting investment strategies in light of the continued Amsterdam Stock Exchange market decline is vital for long-term success.

Featured Posts

-

Frank Sinatra And His Four Wives A Retrospective On His Love Life

May 25, 2025

Frank Sinatra And His Four Wives A Retrospective On His Love Life

May 25, 2025 -

M56 Motorway Incident Car Overturns Traffic Disruption Reported

May 25, 2025

M56 Motorway Incident Car Overturns Traffic Disruption Reported

May 25, 2025 -

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Hareketleri

May 25, 2025

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Hareketleri

May 25, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents Sue Over Snack Bar Crowds

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents Sue Over Snack Bar Crowds

May 25, 2025 -

Guccis New Creative Director Demnas Vision And Challenges

May 25, 2025

Guccis New Creative Director Demnas Vision And Challenges

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025