110% Potential Gains? Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

Rumors of a BlackRock ETF promising 110% potential gains have sent ripples through the investment world, attracting the attention of high-net-worth individuals and billionaires alike. But is this hype justified? Let's delve into the details surrounding this particular BlackRock ETF and explore whether it's a worthwhile investment for you.

Understanding the BlackRock ETF in Question

The BlackRock ETF generating significant buzz is the iShares Global Clean Energy ETF (ticker: ICLN). This ETF focuses on companies involved in the global clean energy sector, encompassing renewable energy sources like solar, wind, and hydropower, as well as energy efficiency technologies. Its investment strategy involves tracking a specific index designed to reflect the performance of this sector.

- Investment Objective: To track the performance of the global clean energy market.

- Expense Ratio: [Insert current expense ratio – requires research]. Keep in mind that lower expense ratios generally mean lower costs for investors.

- Historical Performance: While ICLN has demonstrated impressive growth in the past, it's crucial to remember that past performance is not indicative of future results. Market conditions, technological advancements, and regulatory changes can significantly impact its future performance.

The Billionaire Factor: Why High-Net-Worth Individuals Are Investing

The interest from billionaires in ICLN and similar clean energy investments likely stems from several factors:

-

Access to Exclusive Information: High-net-worth individuals often have access to exclusive market research and insights that may inform their investment decisions.

-

Long-Term Growth Potential: The clean energy sector is poised for substantial growth in the coming decades, driven by increasing environmental concerns and government regulations promoting renewable energy sources. Billionaires may see this as a long-term, high-growth investment opportunity.

-

Portfolio Diversification: Investing in clean energy provides a way to diversify portfolios away from traditional sectors, reducing overall risk.

-

Specific Examples: While specific billionaire investments are often kept private, the increasing interest in sustainable and ESG (Environmental, Social, and Governance) investing among high-net-worth individuals is well-documented in financial news. [Optional: Cite relevant news articles or reports here].

Analyzing the 110% Potential Gains Claim

The 110% potential gains claim needs careful scrutiny. Such projections are often based on optimistic forecasts of sector growth and are not guaranteed.

- Assumptions Behind the Projection: This projection likely assumes significant growth in the clean energy sector, driven by factors like increasing government subsidies, technological advancements leading to lower production costs, and rising consumer demand for green energy solutions.

- Potential Downsides and Risks: Market volatility, unexpected economic downturns, changes in government policy, technological disruptions, and competition within the clean energy sector all pose significant risks. A global economic recession, for example, could severely impact the performance of ICLN.

- Alternative Perspectives: Some analysts might argue that the current valuations in the clean energy sector are already inflated, suggesting a potential for correction in the future.

Is This BlackRock ETF Right for You?

Whether ICLN is suitable for you depends entirely on your individual circumstances:

-

Risk Tolerance: ICLN is a relatively high-risk investment due to the volatility inherent in the clean energy sector. Only investors with a high-risk tolerance and a long-term investment horizon should consider this ETF.

-

Investment Goals: If your investment goals align with long-term growth in the clean energy sector, this ETF may be suitable. However, it's not suitable for short-term gains.

-

Comparison to Alternatives: Consider comparing ICLN to other investment options, such as diversified index funds or other sector-specific ETFs, to determine the best fit for your portfolio.

-

Steps Before Investing: Before investing in any ETF, thoroughly research the underlying assets, understand the risks involved, and, crucially, consult with a qualified financial advisor to ensure the investment aligns with your financial goals and risk tolerance.

Conclusion

The potential for high returns with the iShares Global Clean Energy ETF (ICLN) is enticing, especially given the interest from some billionaires. However, it's crucial to approach such claims with realism and understand the significant risks involved. The clean energy sector offers substantial growth potential, but also presents significant volatility. Remember that past performance is not a guarantee of future success.

Ready to explore the potential of this BlackRock ETF? Conduct thorough due diligence, compare it to other investment options, and, above all, consult a financial advisor before making any BlackRock ETF investment decisions. Remember that investing in any BlackRock ETF, or any investment for that matter, involves inherent risk.

Featured Posts

-

Fydyw Alshmrany Yuelq Ela Antqal Jysws Almhtml Lflamnghw

May 09, 2025

Fydyw Alshmrany Yuelq Ela Antqal Jysws Almhtml Lflamnghw

May 09, 2025 -

High Potential Roman Empire Replacement Show A Season 2 Spoiler And Streaming Guide

May 09, 2025

High Potential Roman Empire Replacement Show A Season 2 Spoiler And Streaming Guide

May 09, 2025 -

9 4000 360

May 09, 2025

9 4000 360

May 09, 2025 -

The Bitcoin Rebound What Investors Need To Know

May 09, 2025

The Bitcoin Rebound What Investors Need To Know

May 09, 2025 -

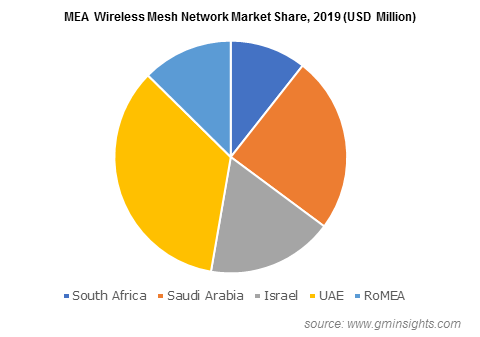

8 Cagr Projected For Wireless Mesh Networks Market Growth

May 09, 2025

8 Cagr Projected For Wireless Mesh Networks Market Growth

May 09, 2025