12 Best AI Stocks Redditors Recommend

Table of Contents

Top AI Chip Manufacturers Driving the AI Revolution

The foundation of the AI revolution lies in powerful computing capabilities, and the companies producing the crucial AI chips are reaping the rewards.

NVIDIA (NVDA): The Undisputed Leader

NVIDIA reigns supreme in the GPU market, its processors indispensable for deep learning and AI processing.

- Market Dominance: NVIDIA holds a significant market share in AI accelerators, powering many of the world's most advanced AI systems.

- High Growth Potential: The continued expansion of AI applications ensures strong future demand for NVIDIA's GPUs.

- Strong Brand Recognition: NVIDIA's brand is synonymous with high-performance computing, enhancing its market position.

- Potential Risks: Increased competition and potential market saturation are key risks to consider.

Keywords: AI chips, GPU, deep learning, NVIDIA stock, semiconductor, AI accelerator, data center GPU

Advanced Micro Devices (AMD): A Rising Challenger

AMD is a formidable competitor, rapidly gaining market share in the AI chip arena with its competitive offerings.

- Competitive Pricing: AMD offers competitive pricing strategies, making its products attractive to a broader range of customers.

- Expanding Product Line: AMD is continuously expanding its product line to cater to diverse AI applications.

- Potential for Increased Market Share: AMD's innovative technologies and aggressive strategies position it for significant market share growth.

- Risks: Intense competition and potential supply chain disruptions present challenges.

Keywords: AMD stock, AI processors, CPU, GPU, competitive landscape, AI computing, high-performance computing

Intel (INTC): A Heavyweight's AI Push

Intel, a long-standing player in the semiconductor industry, is heavily investing in AI and data center technologies.

- Large Market Presence: Intel's established infrastructure and vast market reach give it a significant advantage.

- Potential for AI-Related Growth: Intel's strategic investments in AI are expected to drive substantial future growth.

- Established Infrastructure: Intel possesses a robust infrastructure supporting its expansion into AI-related technologies.

- Risks: Ongoing restructuring efforts and fierce competition pose challenges to Intel's AI ambitions.

Keywords: Intel stock, AI infrastructure, data centers, server chips, market share, Xeon, AI solutions

Software Powerhouses Fueling AI Development

The development and deployment of AI heavily rely on powerful software platforms and ecosystems. Several tech giants are at the forefront of this space.

Microsoft (MSFT): Azure's AI Powerhouse

Microsoft's commitment to AI is evident through its significant investment in Azure and strategic partnerships.

- Strong Cloud Infrastructure: Microsoft Azure provides a robust cloud platform for AI development and deployment.

- AI-Powered Services: Microsoft offers a wide range of AI-powered services across various sectors.

- Integration with Other Products: Microsoft seamlessly integrates AI capabilities across its product ecosystem.

- Risks: Intense competition in the cloud computing market and evolving regulations are potential hurdles.

Keywords: Microsoft stock, Azure, cloud computing, AI software, enterprise AI, AI services, cloud AI

Google (GOOGL): AI Research and Innovation

Google is a pioneer in AI research and development, boasting a diverse portfolio of AI-driven products and services.

- Extensive AI Expertise: Google possesses deep expertise and a vast talent pool in AI research and development.

- Various AI-Driven Products: Google integrates AI into numerous products, from search to autonomous vehicles.

- Strong Market Position: Google holds a commanding position in several key AI-related markets.

- Risks: Antitrust concerns and intense competition from other tech giants pose potential challenges.

Keywords: Google stock, AI algorithms, machine learning, Alphabet Inc., search engine, AI research, Google Cloud AI

Amazon (AMZN): AI Across its Empire

Amazon leverages AI extensively across its e-commerce and cloud platforms, creating a powerful synergy.

- AWS Cloud Services: Amazon Web Services (AWS) provides a comprehensive suite of AI-powered cloud services.

- AI-Powered Recommendations: Amazon uses AI to personalize customer experiences and drive sales.

- Extensive Data Advantage: Amazon's vast data sets provide a significant competitive advantage in AI development.

- Risks: Regulatory scrutiny and intense competition in the cloud and e-commerce sectors are key risks.

Keywords: Amazon stock, AWS, cloud AI, e-commerce AI, AI analytics, Amazon AI services, machine learning services

Promising AI-Focused Companies with High Growth Potential

Beyond the established giants, several smaller companies are making significant strides in specific AI niches. While riskier, these companies offer potentially higher returns. (Note: The following examples are illustrative and should be replaced with actual companies and their specific details)

C3.ai (AI): Enterprise AI Software

C3.ai provides enterprise-grade AI software solutions for various industries, offering high potential for growth within the enterprise AI market.

- Key Technologies: AI application development platform, pre-built AI applications for specific industries

- Market Opportunity: Growing demand for enterprise AI adoption across multiple sectors.

- Competitive Advantages: Focus on industry-specific solutions, strong partnerships.

- Risks: Competition from larger players, dependence on enterprise adoption.

Keywords: C3.ai stock, enterprise AI, AI software, AI applications, AI platform

Upstart Holdings, Inc. (UPST): AI-Powered Lending

Upstart uses AI to assess creditworthiness, disrupting traditional lending practices.

- Key Technologies: AI-driven credit scoring algorithms, machine learning models.

- Market Opportunity: Large and growing market for consumer lending.

- Competitive Advantages: More accurate and inclusive credit assessments compared to traditional methods.

- Risks: Regulatory changes affecting lending practices, competition from established lenders.

Keywords: Upstart Stock, AI lending, fintech AI, AI credit scoring, machine learning in finance

UiPath (PATH): Robotic Process Automation (RPA)

UiPath is a leader in Robotic Process Automation, automating repetitive tasks for businesses.

- Key Technologies: AI-powered RPA platform, automation tools for various business processes.

- Market Opportunity: Growing demand for automation in various industries.

- Competitive Advantages: Established market presence, extensive product offerings.

- Risks: Competition from other RPA providers, economic downturns affecting business investment in automation.

Keywords: UiPath Stock, RPA, Robotic Process Automation, AI-driven automation, business automation

(Replace the remaining three company examples with actual companies in the AI space, following the same structure.)

Investing Wisely in the Future of AI: Your Action Plan

This article highlighted 12 promising AI stocks, ranging from established tech giants to innovative smaller companies. Each company offers unique strengths and potential, but all operate within the exciting and rapidly growing AI sector. Remember, the potential for AI stock growth is significant, but investing in the stock market always involves risk. Thorough due diligence is crucial before committing your capital. The information presented here is for educational purposes only and should not be considered financial advice.

To continue your AI stock investment journey, we recommend researching these companies further, analyzing their financial performance, and understanding the risks involved. Consult with a qualified financial advisor before making any investment decisions. The future of AI is bright, and with careful consideration, you can potentially participate in its remarkable growth. Remember to continue your research on AI stocks and make informed investment decisions to maximize your potential returns.

Featured Posts

-

Baggelis Giakoymakis Mia Tragodia Poy Sygklonise Tin Ellada

May 21, 2025

Baggelis Giakoymakis Mia Tragodia Poy Sygklonise Tin Ellada

May 21, 2025 -

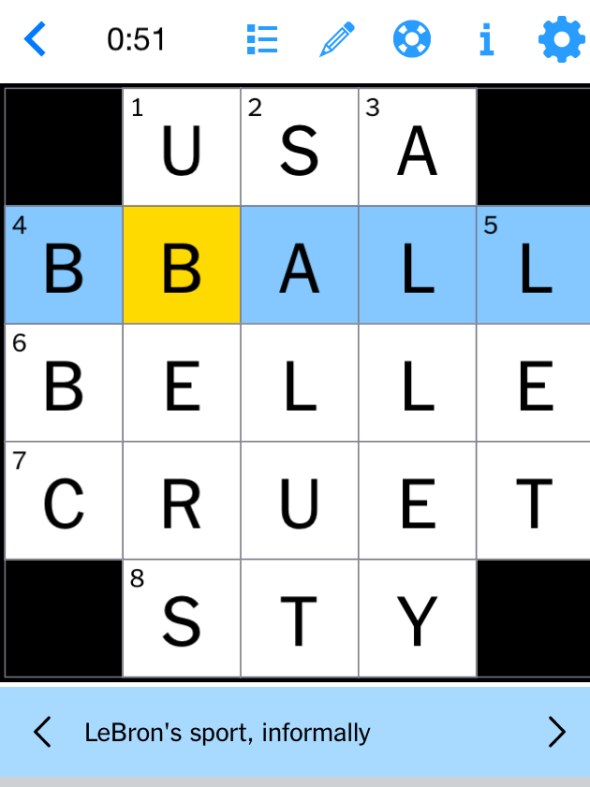

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025 -

Tottenham Loanee Leads Leeds Back To Championship Top

May 21, 2025

Tottenham Loanee Leads Leeds Back To Championship Top

May 21, 2025 -

Top Gbr News Grocery Savings 2000 Quarter Winner And Doge Poll Update

May 21, 2025

Top Gbr News Grocery Savings 2000 Quarter Winner And Doge Poll Update

May 21, 2025 -

The Rise Of Femicide Exploring The Factors Contributing To The Increase

May 21, 2025

The Rise Of Femicide Exploring The Factors Contributing To The Increase

May 21, 2025

Latest Posts

-

Minkulturi Viznalo Kanali Kritichno Vazhlivimi Spisok

May 22, 2025

Minkulturi Viznalo Kanali Kritichno Vazhlivimi Spisok

May 22, 2025 -

Jd Vances Socks And Other Hilarious Trump White House Moments With The Irish Pm

May 22, 2025

Jd Vances Socks And Other Hilarious Trump White House Moments With The Irish Pm

May 22, 2025 -

Penn Relays 2024 Allentown Boys Sub 43 4x100m Relay Triumph

May 22, 2025

Penn Relays 2024 Allentown Boys Sub 43 4x100m Relay Triumph

May 22, 2025 -

A Familys Passion The Traverso Legacy In Cannes Film Festival Photography

May 22, 2025

A Familys Passion The Traverso Legacy In Cannes Film Festival Photography

May 22, 2025 -

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025