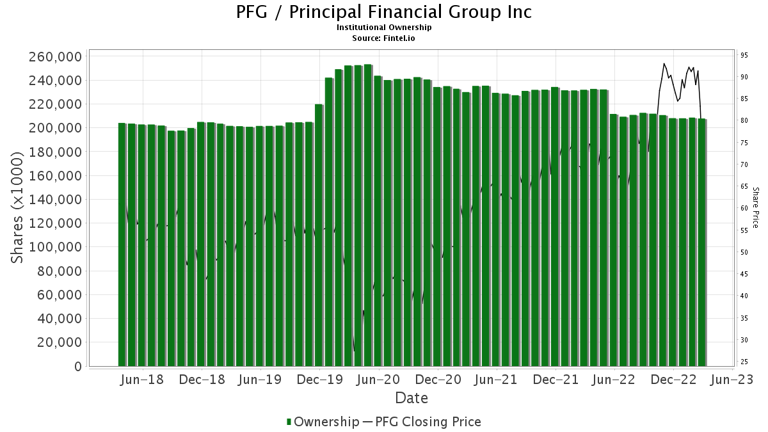

13 Analyst Opinions: A Comprehensive Look At Principal Financial Group (PFG)

Table of Contents

Analyst Ratings Summary: A Breakdown of Buy, Hold, and Sell Recommendations for PFG Stock

Analyzing analyst ratings offers a quick snapshot of market sentiment towards PFG stock. Out of the 13 analysts surveyed, the distribution of recommendations was as follows:

- Buy: 6 analysts

- Hold: 5 analysts

- Sell: 2 analysts

This translates to an average rating leaning towards a "Buy" or "Strong Buy," suggesting a generally positive outlook on Principal Financial Group's future performance. It's important to remember that:

- A Buy rating indicates the analyst believes the stock is undervalued and likely to appreciate.

- A Hold rating suggests the stock is fairly valued, with limited upside potential in the short term.

- A Sell rating implies the analyst believes the stock is overvalued and likely to decline.

| Rating | Number of Analysts |

|---|---|

| Buy | 6 |

| Hold | 5 |

| Sell | 2 |

Target Price Analysis: Projecting the Future Value of Principal Financial Group (PFG)

The 13 analysts offered a range of target prices for PFG stock, providing insights into their future value projections. The target prices ranged from a low of $65 to a high of $82, with an average target price of $73. This average target price represents a potential upside (or downside, depending on the current market price) for investors. The variation in target prices stems from:

- Differing growth forecasts: Analysts hold varying opinions on PFG's future revenue growth and profitability.

- Risk assessments: Analysts may differ in their assessment of the risks facing Principal Financial, such as interest rate sensitivity or competitive pressures.

Currently, comparing the average analyst target price against the current market price of PFG stock is critical for determining if the stock is considered undervalued or overvalued by the market.

Key Themes & Rationale Behind Analyst Opinions on PFG

Several recurring themes emerged from the 13 analyst reports on Principal Financial Group (PFG):

- Interest rate sensitivity: Many analysts expressed concerns about PFG's sensitivity to interest rate fluctuations, given its significant exposure to the fixed-income market.

- Positive outlook on specific segments: Several analysts highlighted the strong performance of certain business segments within PFG, such as retirement services or asset management.

- Strong capital position: The company's robust capital position was often cited as a positive factor influencing analysts' views.

The rationales behind these opinions often included:

- Economic forecasts: Analysts' macroeconomic projections significantly impacted their outlook on PFG's future performance.

- Company performance: Recent financial results and management's strategic initiatives influenced the analysts' assessments.

- Competitive landscape: The competitive dynamics within the financial services sector played a role in shaping analysts' views on PFG's prospects.

Comparison with Industry Peers: How Principal Financial Group (PFG) Stacks Up

Comparing PFG's performance and analyst ratings to its competitors offers valuable context. While a detailed peer comparison requires a separate analysis, we can note that, in general, PFG's ratings and target prices are in line with or slightly better than some of its major competitors, based on metrics such as P/E ratio, dividend yield, and revenue growth. However, a direct comparison requires deeper research into specific competitors' performance and analyst sentiment. Further investigation is recommended to complete this analysis.

Risks and Opportunities for Principal Financial Group (PFG) Investment

Investing in PFG stock, like any investment, involves risks and opportunities:

Risks:

- Regulatory changes: Changes in financial regulations could impact PFG's operations and profitability.

- Macroeconomic factors: Economic downturns or shifts in market sentiment could negatively affect PFG's performance.

- Competitive pressures: Intense competition within the financial services industry presents ongoing challenges.

Opportunities:

- Expansion into new markets: PFG's potential for growth through expansion into new geographic markets or product lines.

- Technological innovation: Leveraging technology to improve efficiency and offer new services presents a significant opportunity.

- Improved profitability: Opportunities exist to enhance profitability through cost optimization and strategic investments.

These risks and opportunities are reflected in the diverse range of analyst opinions on PFG.

Conclusion: Making Informed Investment Decisions on Principal Financial Group (PFG)

This analysis of 13 analyst opinions on Principal Financial Group (PFG) reveals a mixed but generally positive sentiment. While the average rating leans towards a "Buy," the range of target prices and the underlying rationales highlight the importance of conducting thorough due diligence. Remember to carefully consider the analyst opinions on PFG, but remember that they are just one piece of the puzzle. Research PFG stock further, assess your own risk tolerance, and consult with a financial advisor before making any investment decisions about PFG. Only through comprehensive research and careful consideration can you make truly informed decisions about Principal Financial Group.

Featured Posts

-

Erdogan Ve Bae Devlet Baskani Arasinda Oenemli Telefon Goeruesmesi

May 17, 2025

Erdogan Ve Bae Devlet Baskani Arasinda Oenemli Telefon Goeruesmesi

May 17, 2025 -

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025 -

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

Grocery Prices And Wages Rep Crockett Sounds The Alarm On Trumps Policies

May 17, 2025

Grocery Prices And Wages Rep Crockett Sounds The Alarm On Trumps Policies

May 17, 2025 -

Uber Uber Investment Potential And Risks

May 17, 2025

Uber Uber Investment Potential And Risks

May 17, 2025

Latest Posts

-

American Manhunt The Osama Bin Laden Documentary Netflix Premiere Date

May 18, 2025

American Manhunt The Osama Bin Laden Documentary Netflix Premiere Date

May 18, 2025 -

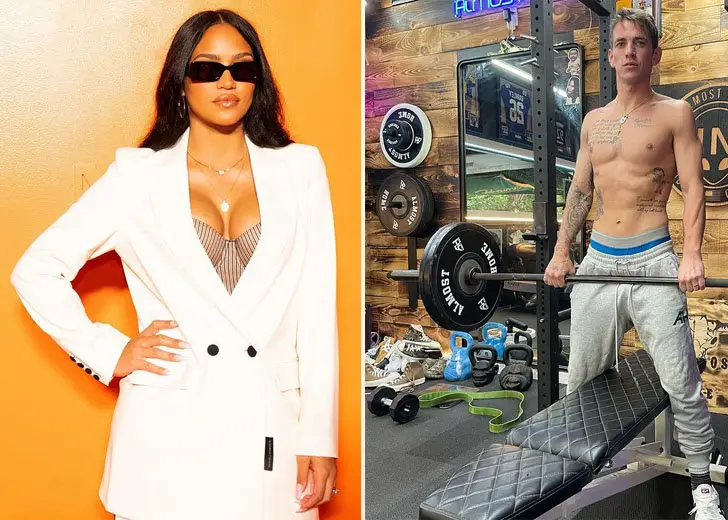

Cassie And Alex Fine Photos From The Mob Land Premiere Red Carpet

May 18, 2025

Cassie And Alex Fine Photos From The Mob Land Premiere Red Carpet

May 18, 2025 -

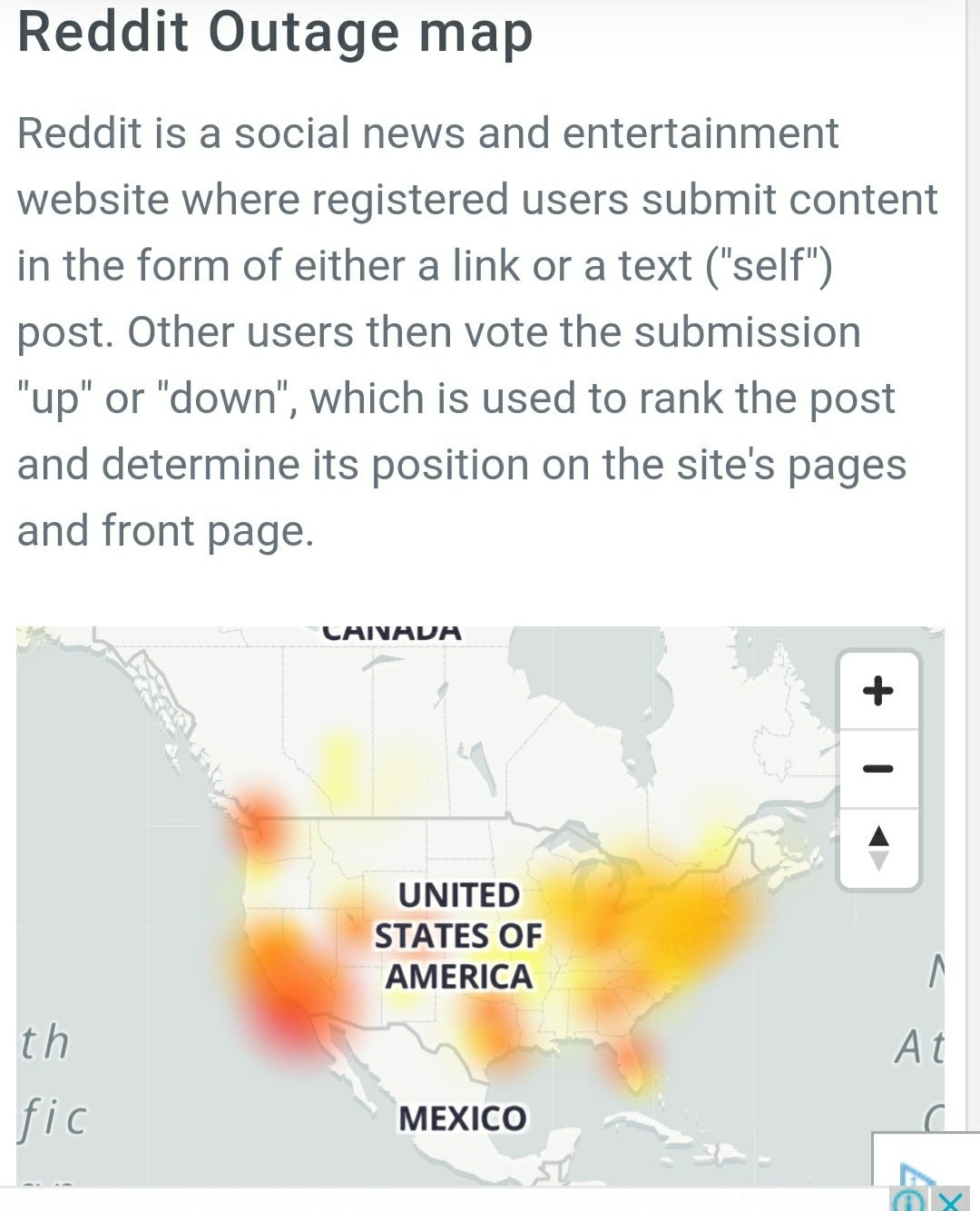

Major Reddit Outage Leaves Thousands Of Users Unable To Access The Platform

May 18, 2025

Major Reddit Outage Leaves Thousands Of Users Unable To Access The Platform

May 18, 2025 -

Pregnant Cassie Ventura And Husband Alex Fine Make First Public Appearance

May 18, 2025

Pregnant Cassie Ventura And Husband Alex Fine Make First Public Appearance

May 18, 2025 -

Reddit Down A Worldwide Service Interruption Affecting Thousands

May 18, 2025

Reddit Down A Worldwide Service Interruption Affecting Thousands

May 18, 2025