14%+ Shopify Stock Jump: Nasdaq 100 Inclusion Impact

Table of Contents

The Nasdaq 100 Inclusion: A Catalyst for Growth

Understanding the Nasdaq 100 Index

The Nasdaq 100 is a leading stock market index comprising 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Its composition is heavily weighted towards technology companies, representing some of the most innovative and influential businesses globally. Inclusion in the Nasdaq 100 is highly coveted due to several key reasons:

- Focus on Large-Cap Technology Companies: The index attracts significant investment from funds that track its performance, leading to increased demand for its constituent stocks.

- Weight in the Broader Market: The Nasdaq 100 holds substantial weight within the broader market, making its performance a key indicator of overall market health.

- Influence on Investment Strategies: Both passive (index funds) and active investors closely monitor the Nasdaq 100, impacting investment decisions and trading volumes.

Immediate Market Reaction to Shopify's Inclusion

The announcement of Shopify's inclusion in the Nasdaq 100 triggered an immediate and dramatic reaction in the stock market. The Shopify stock price experienced a sharp increase, reflecting the positive sentiment among investors.

- Percentage Increase: The stock price surged by over 14%, representing a substantial gain for shareholders.

- Trading Volume: Trading volume for Shopify stock significantly increased on the day of the announcement, showcasing the heightened investor interest.

- Comparison to Broader Market Movement: While the broader market also experienced some positive movement, Shopify's jump significantly outperformed general market trends. (Note: Charts and graphs would be inserted here to visually represent the price jump.)

Long-Term Implications of Nasdaq 100 Membership

Beyond the immediate price jump, Shopify's inclusion in the Nasdaq 100 holds several potential long-term benefits:

- Increased Institutional Investment: Inclusion in the index typically attracts significant investment from institutional investors, like mutual funds and pension funds, who track the index.

- Potential for Higher Future Valuation: Increased demand and visibility can lead to a higher market capitalization and future stock price appreciation.

- Improved Liquidity: The increased trading volume associated with index inclusion improves the liquidity of Shopify stock, making it easier for investors to buy and sell shares.

Factors Contributing to the Shopify Stock Surge Beyond Nasdaq Inclusion

While the Nasdaq 100 inclusion was a significant catalyst, other factors contributed to the surge in Shopify's stock price.

Shopify's Strong Financial Performance

Shopify's consistent strong financial performance played a crucial role in bolstering investor confidence. Recent financial reports highlighted:

- Revenue Growth: Consistent year-over-year revenue growth demonstrated the company's ability to expand its market reach and capture increasing market share.

- Profit Margins: Improvement in profit margins indicated increasing operational efficiency and cost management.

- Customer Acquisition Costs: Effective strategies to acquire new customers at a reasonable cost further enhanced investor confidence.

- Expansion into New Markets: Strategic expansion into new geographical markets and market segments showcased Shopify's growth potential.

Positive Market Sentiment Towards E-commerce

The broader positive outlook for the e-commerce sector contributed significantly to Shopify's stock price increase.

- Growth of Online Shopping: The continuous growth of online shopping globally fuels the demand for e-commerce platforms like Shopify.

- Increasing Adoption of E-commerce Platforms: Businesses across various sectors increasingly adopt e-commerce solutions, driving further growth for the sector.

- Market Trends: Positive market trends in the technology sector and the overall economic climate also supported this positive sentiment.

Strategic Initiatives and Future Growth Prospects

Shopify's proactive strategic initiatives and future growth plans further reinforced investor confidence.

- New Features: Continuous innovation and the introduction of new features and functionalities enhance the platform's appeal to merchants.

- Acquisitions: Strategic acquisitions broadened Shopify's capabilities and expanded its market reach.

- International Expansion: Expansion into new international markets unlocks significant growth opportunities.

- Market Share Growth Projections: Positive projections for market share growth further fueled investor optimism.

Analyzing Investor Sentiment and Market Predictions

Understanding investor sentiment and market predictions is crucial to assessing the sustainability of Shopify's stock price.

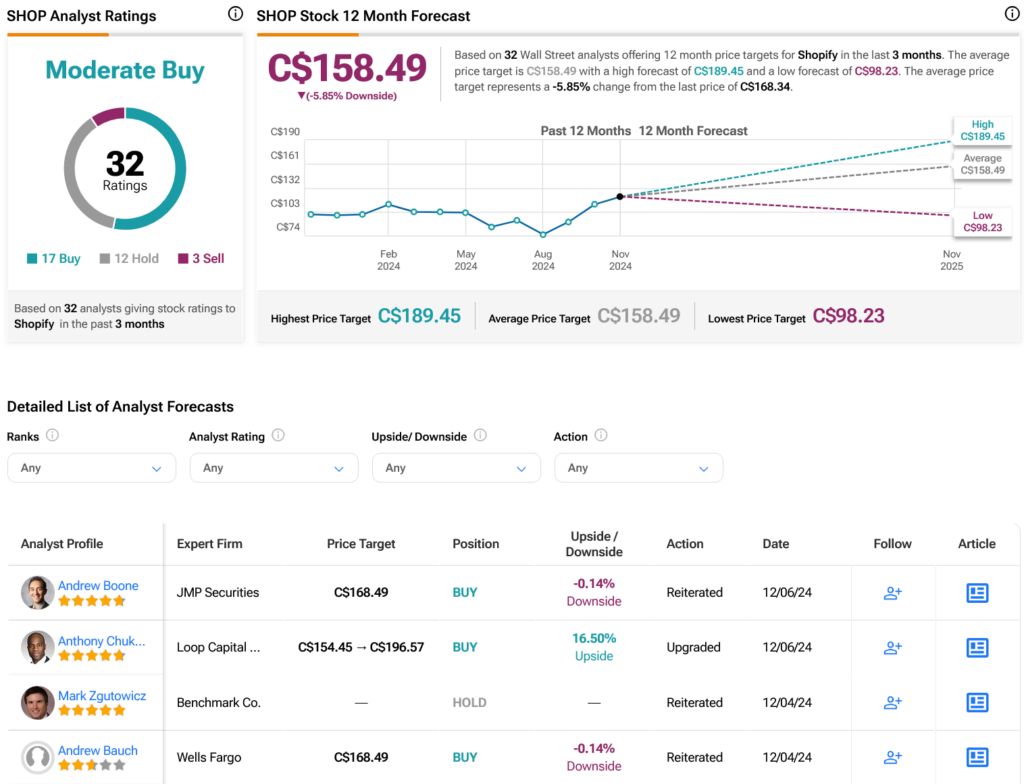

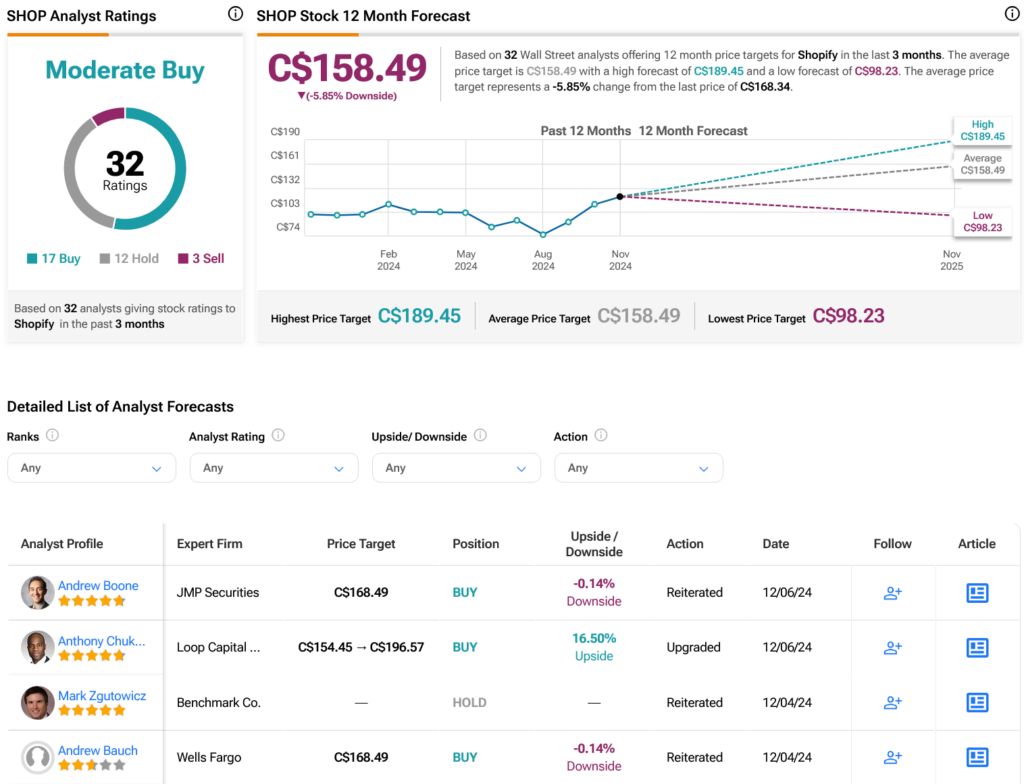

Analyst Ratings and Price Targets

Following the Nasdaq 100 inclusion, financial analysts largely reacted positively, with many upgrading their ratings and increasing price targets for Shopify stock. (Note: Specific analyst quotes and ratings would be inserted here.)

Investor Confidence and Market Volatility

While the overall market conditions generally supported the positive sentiment, it's essential to consider market volatility and macroeconomic factors. Interest rate changes, inflation concerns, and other global economic events could influence investor confidence and Shopify's stock price.

Risks and Potential Challenges

Despite the positive outlook, several risks and challenges could impact Shopify's future stock performance:

- Competition: Intense competition from other e-commerce platforms poses a potential threat.

- Economic Downturns: Economic downturns can significantly impact consumer spending and, consequently, the demand for e-commerce services.

- Regulatory Changes: Changes in regulations and policies could affect Shopify's operations and profitability.

Conclusion

The 14%+ jump in Shopify's stock price following its inclusion in the Nasdaq 100 index resulted from a confluence of factors. These include the index's significant impact on investor sentiment, Shopify's strong financial performance, a positive outlook for the e-commerce sector, and the company's strategic initiatives. Understanding the interplay between these factors is critical for investors seeking to analyze Shopify's future performance. While the Nasdaq 100 inclusion provides a strong foundation, monitoring ongoing market conditions and potential challenges is crucial for informed investment decisions. Stay updated on Shopify stock, monitor the Shopify stock price, and learn more about investing in Shopify to make sound investment choices.

Featured Posts

-

Nuit Des Musees 2025 A La Fondation Seydoux Pathe Une Nocturne Exceptionnelle Sur Le Theme Du Cinema

May 14, 2025

Nuit Des Musees 2025 A La Fondation Seydoux Pathe Une Nocturne Exceptionnelle Sur Le Theme Du Cinema

May 14, 2025 -

Captain America Brave New World Misses A Key Character For Future Mcu

May 14, 2025

Captain America Brave New World Misses A Key Character For Future Mcu

May 14, 2025 -

Eurojackpot Voitot Puolen Miljoonan Euron Voitot Neljaelle Onnekkaalle

May 14, 2025

Eurojackpot Voitot Puolen Miljoonan Euron Voitot Neljaelle Onnekkaalle

May 14, 2025 -

Tommy Dreamer Predicts Logan Pauls Wrestle Mania Main Event

May 14, 2025

Tommy Dreamer Predicts Logan Pauls Wrestle Mania Main Event

May 14, 2025 -

De Prijs Van Informatie Bayerns Onderzoek Naar Een Nederlander

May 14, 2025

De Prijs Van Informatie Bayerns Onderzoek Naar Een Nederlander

May 14, 2025