$2.5 Trillion Vanished: The Stunning Losses Of The Magnificent Seven Stocks

Table of Contents

The Rise and Fall of the Magnificent Seven

For years, the Magnificent Seven reigned supreme, their meteoric rise fueled by technological innovation and seemingly unstoppable growth. These growth stocks commanded massive market capitalization, reshaping the global tech landscape and becoming synonymous with technological progress. The tech stock bubble seemed invincible. However, recent market corrections have exposed the fragility of even the most dominant companies.

- Apple: Years of consistent iPhone sales and expansion into services.

- Microsoft: Dominance in cloud computing (Azure) and software licensing.

- Amazon: E-commerce giant, expanding into cloud services (AWS) and other sectors.

- Alphabet (Google): Search engine dominance and diversified investments in AI and other technologies.

- Nvidia: Leader in graphics processing units (GPUs), crucial for AI and gaming.

- Tesla: Revolutionizing the electric vehicle (EV) industry.

- Meta (Facebook): Global social media giant, expanding into metaverse technologies.

Previous market corrections, such as the dot-com bubble burst, impacted these companies differently, with some experiencing sharper declines than others. This time, however, the collective loss represents a significantly larger impact on the overall market.

Factors Contributing to the $2.5 Trillion Loss

Several interconnected factors contributed to the dramatic decline in the Magnificent Seven's valuations. Understanding these factors is critical for investors navigating this volatile market.

Inflation and Rising Interest Rates

Inflation and aggressive interest rate hikes by central banks worldwide have significantly impacted tech valuations.

- Higher interest rates: Increase the discount rate used to calculate the present value of future earnings. Growth stocks, which derive much of their value from projected future earnings, are particularly sensitive to rising interest rates.

- Inflationary pressures: Reduce consumer spending, impacting the revenue streams of many tech companies, particularly those reliant on consumer discretionary spending.

Geopolitical Uncertainty

Geopolitical instability, including the war in Ukraine and escalating US-China tensions, further fueled market uncertainty.

- Supply chain disruptions: Geopolitical events caused significant supply chain disruptions, impacting the production and delivery of tech products.

- Investor risk aversion: Uncertainty about global events prompted investors to move towards safer assets, leading to a sell-off in riskier growth stocks.

Overvaluation and Market Correction

The rapid growth of the Magnificent Seven led to concerns about overvaluation in the tech sector.

- High P/E ratios: Many of these companies traded at exceptionally high Price-to-Earnings (P/E) ratios, indicating a potentially inflated market valuation.

- Market bubble concerns: The sustained period of rapid growth created concerns about a market bubble, with the subsequent correction leading to significant price declines.

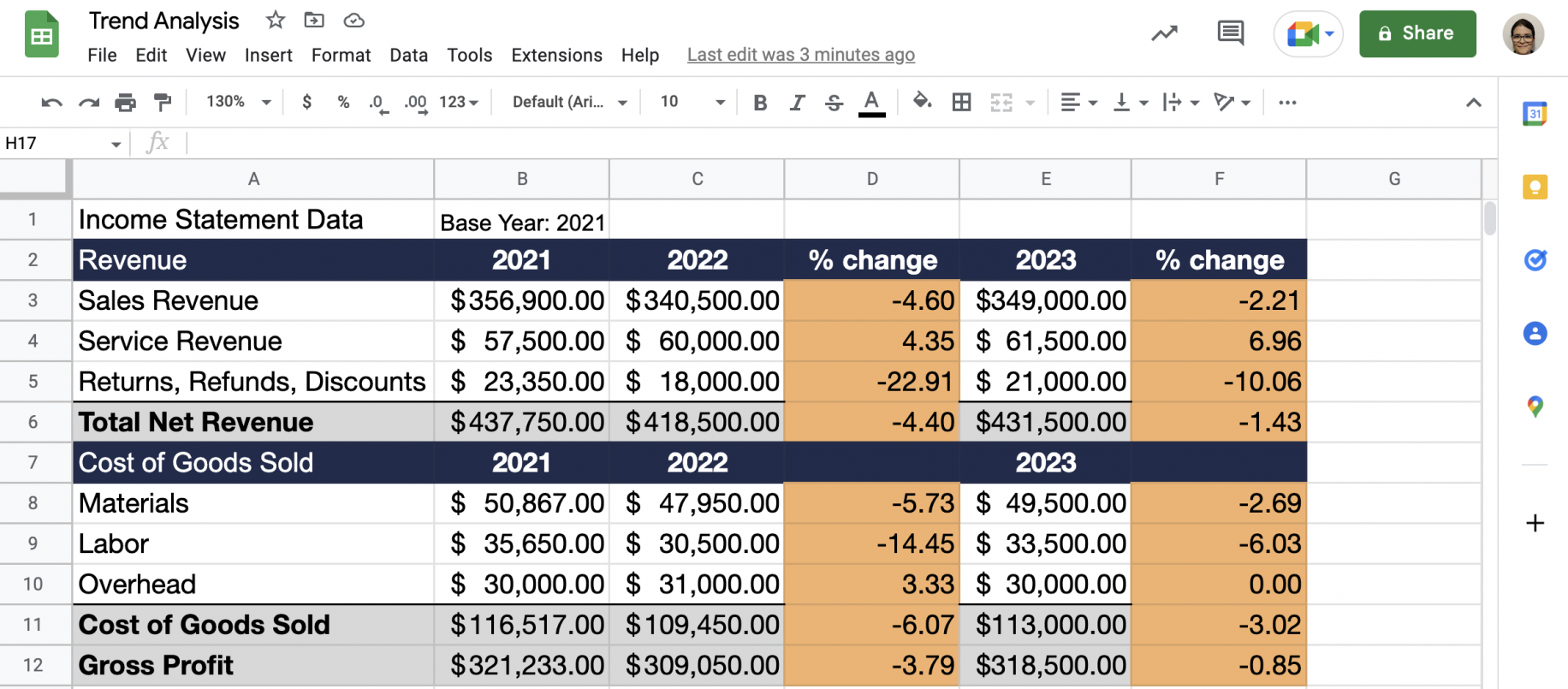

Individual Stock Performance Analysis

Analyzing each stock individually provides a deeper understanding of the specific challenges they faced. (Note: This section would ideally include charts and graphs illustrating individual stock performance.)

- Apple stock price: Impact of supply chain issues and slowing iPhone sales growth.

- Microsoft share price: Cloud computing sector performance and competitive landscape.

- Amazon stock performance: E-commerce competition and profitability concerns.

- Google stock price: Advertising revenue growth and competition from other search engines.

- Nvidia stock performance: Demand for GPUs and the overall AI market.

- Tesla stock performance: Production challenges and competition in the EV market.

- Meta stock price: Advertising revenue and challenges in the metaverse. Each company's performance needs to be compared against the broader market indices for context.

Implications for the Broader Market and Investors

The losses suffered by the Magnificent Seven have had significant ripple effects across the broader market.

-

Increased market volatility: The decline amplified market volatility, increasing uncertainty for all investors.

-

Impact on investor confidence: The significant losses eroded investor confidence, leading to cautious investment strategies.

-

Portfolio diversification: The need for diversified investment portfolios is more critical than ever.

-

Re-evaluating portfolios: Investors must review their holdings and adjust their strategies.

-

Risk mitigation strategies: Implementing strategies to mitigate risk during market downturns is crucial.

Conclusion

The $2.5 trillion loss suffered by the Magnificent Seven underscores the importance of understanding the interplay of macroeconomic factors, geopolitical uncertainty, and the potential for overvaluation in the tech sector. Inflation, rising interest rates, geopolitical instability, and potential overvaluation all contributed to this significant market downturn. Investors must prioritize careful risk assessment and diversified investment strategies to navigate market volatility effectively. Monitor your tech stock portfolio, understand the risks of investing in growth stocks, and learn how to manage your investments during a market downturn. Staying informed about the performance of the Magnificent Seven and other tech stocks through regular market analysis is crucial for making informed investment decisions.

Featured Posts

-

Report Country Music Icons Son Not In Wifes Care

Apr 29, 2025

Report Country Music Icons Son Not In Wifes Care

Apr 29, 2025 -

Louisvilles Early 2025 Disaster A Confluence Of Snow Tornadoes And Floods

Apr 29, 2025

Louisvilles Early 2025 Disaster A Confluence Of Snow Tornadoes And Floods

Apr 29, 2025 -

Cleveland Indians Fan Removed For Verbal Abuse Of Jarren Duran

Apr 29, 2025

Cleveland Indians Fan Removed For Verbal Abuse Of Jarren Duran

Apr 29, 2025 -

The Closure Of Anchor Brewing Company Reflecting On 127 Years Of Brewing

Apr 29, 2025

The Closure Of Anchor Brewing Company Reflecting On 127 Years Of Brewing

Apr 29, 2025 -

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Production Shutdown

Apr 29, 2025

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Production Shutdown

Apr 29, 2025

Latest Posts

-

Trumps Potential Pardon Of Rose Analysis And Reactions

Apr 29, 2025

Trumps Potential Pardon Of Rose Analysis And Reactions

Apr 29, 2025 -

Rose Pardon Trumps Decision And Its Political Fallout

Apr 29, 2025

Rose Pardon Trumps Decision And Its Political Fallout

Apr 29, 2025 -

Trump To Issue Full Pardon For Rose What We Know

Apr 29, 2025

Trump To Issue Full Pardon For Rose What We Know

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025 -

Nostalgia And You Tube How Older Viewers Find Comfort In Familiar Shows

Apr 29, 2025

Nostalgia And You Tube How Older Viewers Find Comfort In Familiar Shows

Apr 29, 2025