2 Stocks Poised To Surpass Palantir's Value In 3 Years: A Prediction

Table of Contents

Stock #1: Datavant – The Data Analytics Disruptor

Keywords: Datavant, data analytics, AI, machine learning, big data, market share, competitive advantage, revenue growth, stock valuation

Disruptive Technology and Market Leadership:

Datavant operates in the rapidly expanding data analytics market, offering a unique platform that connects and harmonizes disparate healthcare data sets. Its technology uses advanced AI and machine learning algorithms to provide actionable insights, empowering healthcare organizations with data-driven decision-making. This sets it apart from competitors.

- Superior AI Capabilities: Datavant's proprietary algorithms offer superior accuracy and speed in data analysis compared to traditional methods.

- Cost-Effectiveness: Its platform streamlines data integration, reducing the time and cost associated with manual processes.

- Wider Application: Its applications extend beyond healthcare, with potential in other data-rich sectors like finance and retail.

Market analysts project Datavant to capture a significant market share in the coming years, driven by the increasing demand for data-driven solutions in healthcare and beyond. Its rapid revenue growth and innovative approach solidify its position as a leader in this space.

Strong Financial Performance and Future Outlook:

While Datavant is a privately held company, its impressive growth trajectory and strategic partnerships suggest a strong financial foundation. Reports indicate significant year-over-year revenue increases, fueled by robust customer acquisition and expansion into new markets. Its strong cash flow positions the company for continued investment in R&D and further market penetration.

- Revenue Growth: Reports suggest consistently high revenue growth rates, indicating strong market demand for its services.

- Strategic Partnerships: Collaborations with major players in the healthcare industry will likely accelerate its market penetration and revenue streams.

- Future Projections: Based on current trends and its competitive advantages, Datavant's future performance is expected to remain robust.

Stock #2: Global-e – The E-commerce Innovator

Keywords: Global-e, e-commerce, innovation, technological advancement, emerging markets, expansion strategy, global reach, investment opportunities, long-term growth

Innovation and First-Mover Advantage:

Global-e is a leading cross-border e-commerce platform, enabling merchants to seamlessly expand their sales into international markets. Its innovative technology simplifies the complexities of international shipping, payments, and localization, giving it a significant first-mover advantage.

- Proprietary Technology: Global-e's proprietary technology provides a comprehensive solution for cross-border e-commerce, streamlining logistics and reducing friction for both merchants and consumers.

- Expanding Market Reach: The company actively expands into new markets, catering to the ever-growing global demand for online shopping.

- Strategic Partnerships: Collaborations with major e-commerce platforms and merchants contribute to its rapid growth and expansion.

Scalability and Global Market Potential:

Global-e’s platform is highly scalable, capable of handling significant increases in transaction volume as its customer base expands. The global e-commerce market is massive and continues to grow exponentially, presenting a vast opportunity for Global-e to capitalize on its leading position.

- Global Market Size: The global cross-border e-commerce market is projected to reach trillions of dollars in the coming years.

- Competitive Landscape: While competition exists, Global-e's technological advantage and brand recognition give it a strong competitive edge.

- Expansion Strategy: Global-e's strategic expansion into new markets and its focus on emerging economies will further fuel its growth.

Conclusion:

This analysis suggests that Datavant and Global-e are poised to surpass Palantir's market capitalization within three years. Their technological advantages, strong financial performance, and immense market potential make them compelling investment opportunities. The potential for high returns on investment is significant, given their disruptive technologies and rapid growth trajectories.

While this analysis provides a compelling case for investing in these high-growth stocks poised to outperform Palantir, it's crucial to conduct your own thorough due diligence before making any investment decisions. Begin your research on these promising stocks and consider them for your portfolio to potentially capitalize on their future growth exceeding Palantir's. Remember to consult a financial advisor before making investment decisions. Learn more about Datavant and Global-e to discover if they fit your investment strategy for outperforming Palantir.

Featured Posts

-

Hollywood Shut Down Wga And Sag Aftra Strike Impacts Production

May 09, 2025

Hollywood Shut Down Wga And Sag Aftra Strike Impacts Production

May 09, 2025 -

Fydyw Alshmrany Yuelq Ela Antqal Jysws Almhtml Lflamnghw

May 09, 2025

Fydyw Alshmrany Yuelq Ela Antqal Jysws Almhtml Lflamnghw

May 09, 2025 -

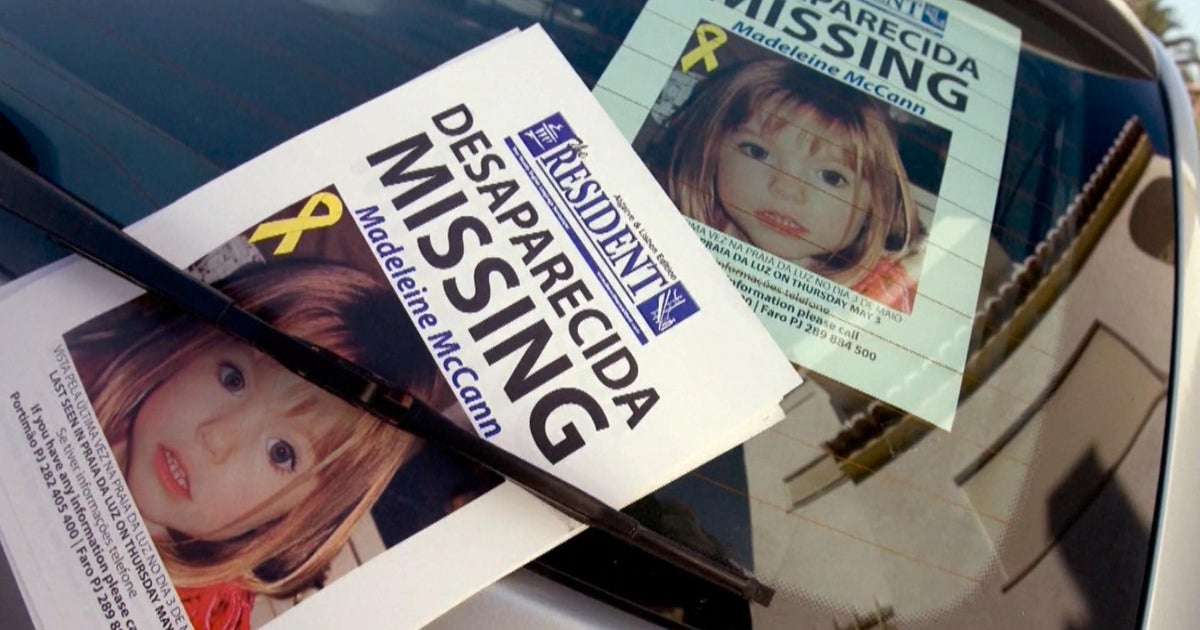

Woman Impersonating Madeleine Mc Cann Accused Of Stalking

May 09, 2025

Woman Impersonating Madeleine Mc Cann Accused Of Stalking

May 09, 2025 -

Xionia Imalaion 23 Xronia Ksirasias

May 09, 2025

Xionia Imalaion 23 Xronia Ksirasias

May 09, 2025 -

2025 Iditarod Ceremonial Start A Downtown Anchorage Spectacle

May 09, 2025

2025 Iditarod Ceremonial Start A Downtown Anchorage Spectacle

May 09, 2025