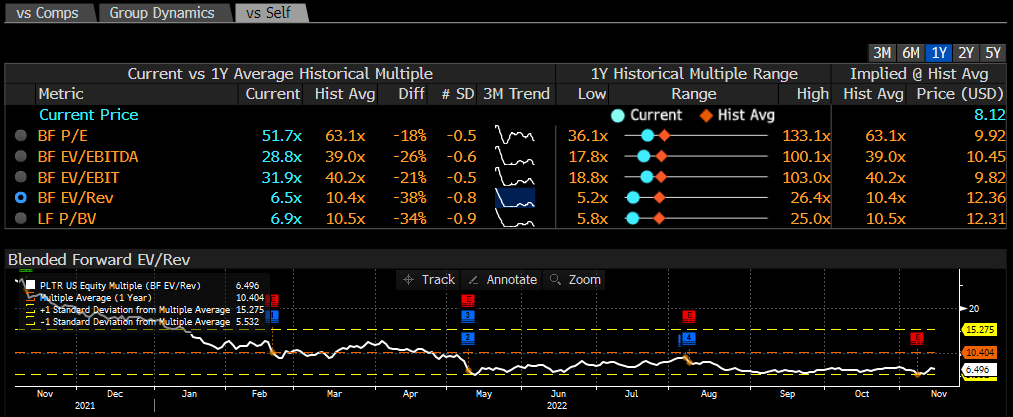

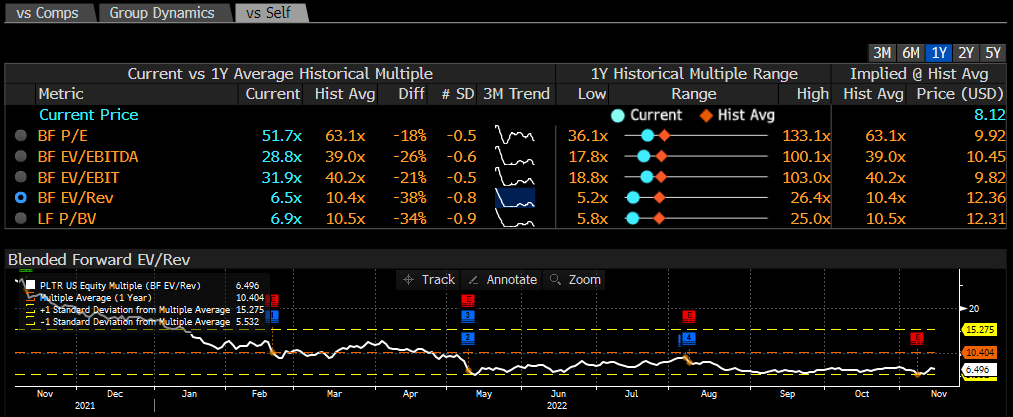

2 Stocks Predicted To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Datadog – A Deep Dive into its Growth Trajectory

Datadog, a leading provider of monitoring and analytics platforms for cloud-scale applications, is rapidly expanding its market share. Its comprehensive suite of tools caters to the burgeoning demand for robust infrastructure monitoring and observability in the cloud-native world.

Disruptive Technology and Market Domination

Datadog's unique value proposition lies in its unified platform, seamlessly integrating various monitoring and analytics functionalities. This consolidated approach simplifies operations and provides valuable insights for optimizing performance and reducing downtime.

- Unified platform: Eliminates the need for multiple disparate tools, enhancing efficiency and reducing complexity.

- Real-time monitoring: Enables proactive identification and resolution of performance bottlenecks, minimizing downtime and ensuring optimal application performance.

- Comprehensive analytics: Provides detailed insights into application behavior, allowing for data-driven decision-making and improved resource allocation.

Market analysis projects significant growth for the observability market, with Datadog positioned to capture a substantial share. Their revenue growth has consistently outpaced industry averages, indicating strong market traction and high demand for their services. For example, Datadog’s Q2 2024 revenue showed a significant year-over-year increase, positioning it for continued expansion and potentially surpassing Palantir's market capitalization within three years. This "high-growth potential" is fueling investor confidence and contributing to a high stock valuation.

Strong Financials and Future Projections

Datadog's robust financial performance further solidifies its position as a compelling investment. The company demonstrates strong profitability, healthy revenue streams, and manageable debt levels.

- High revenue growth: Consistent double-digit year-over-year revenue growth demonstrates strong market demand.

- Improving profitability: Datadog is steadily improving its profit margins, indicating efficient operations and scalability.

- Positive cash flow: The company generates positive cash flow, providing financial flexibility for future growth initiatives.

Analyst predictions consistently point towards continued growth, suggesting Datadog is well-positioned to outperform Palantir's financial performance in the coming years. Their financial strength, combined with their innovative technology, makes Datadog a strong contender for surpassing Palantir's value.

Stock #2: CrowdStrike – Riding the Wave of Innovation

CrowdStrike, a cybersecurity leader specializing in cloud-delivered endpoint protection, is experiencing phenomenal growth fueled by its innovative approach to threat detection and response.

First-Mover Advantage and Market Penetration

CrowdStrike’s early adoption of cloud-native technology and its focus on artificial intelligence (AI)-powered threat detection has given it a significant first-mover advantage in the endpoint security market.

- Early adoption of cloud technology: Enabled rapid scalability and global reach, allowing CrowdStrike to rapidly expand its customer base.

- AI-powered threat detection: Offers superior accuracy and speed in identifying and responding to cyber threats, significantly enhancing security posture for its clients.

- High customer retention: CrowdStrike boasts impressive customer retention rates, demonstrating the value and effectiveness of its platform.

The company's scalable business model allows it to efficiently service a rapidly expanding customer base, driving significant revenue growth and market penetration. Case studies highlighting successful threat detections and incident responses showcase CrowdStrike's effectiveness and strengthen its market position. This “innovation” is a key driver of their exceptional growth, making them a strong competitor against established players like Palantir.

Strategic Partnerships and Future Collaborations

CrowdStrike has established strategic partnerships with major technology players, further enhancing its reach and capabilities. These collaborations expand its product offerings and provide access to a broader customer base.

- Technology integrations: Partnerships with leading cloud providers and security vendors enhance the functionality and interoperability of CrowdStrike's platform.

- Joint marketing initiatives: Collaborations with industry partners extend CrowdStrike's market reach and brand visibility.

- Shared customer solutions: Partnerships enable the delivery of comprehensive security solutions, meeting the diverse needs of a wide range of customers.

These strategic partnerships represent a significant advantage, enabling CrowdStrike to capitalize on synergistic effects and expand into new markets. This strategic approach contrasts with Palantir’s partnership strategy and presents a potentially superior path to growth and market dominance.

Conclusion: Investing in Stocks Predicted to Outperform Palantir

Datadog and CrowdStrike are predicted to surpass Palantir's value within three years due to their disruptive technologies, strong financial performances, and strategic market positioning. Their high-growth potential, fueled by innovation and expanding market share, makes them compelling investment prospects. While any stock market investment carries inherent risks, the potential returns associated with these high-growth stocks are significant. Consider adding these promising stocks to your portfolio and potentially benefit from their predicted growth, outpacing even Palantir’s impressive trajectory. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

La Cite De La Gastronomie De Dijon Intervention Municipale Face Aux Problemes D Epicure

May 10, 2025

La Cite De La Gastronomie De Dijon Intervention Municipale Face Aux Problemes D Epicure

May 10, 2025 -

Could The Monkey Be The Worst Stephen King Movie Of 2025

May 10, 2025

Could The Monkey Be The Worst Stephen King Movie Of 2025

May 10, 2025 -

Massive Fentanyl Bust In Us Bondis Announcement Details Record Seizure

May 10, 2025

Massive Fentanyl Bust In Us Bondis Announcement Details Record Seizure

May 10, 2025 -

New York Times Strands April 9 2025 Clues Theme And Pangram Help

May 10, 2025

New York Times Strands April 9 2025 Clues Theme And Pangram Help

May 10, 2025 -

Ivan Barbashevs Ot Goal Golden Knights Even Series Against Wild With Game 4 Win

May 10, 2025

Ivan Barbashevs Ot Goal Golden Knights Even Series Against Wild With Game 4 Win

May 10, 2025