$200 Million Tariff Impact: Colgate (CL) Announces Reduced Sales And Profits

Table of Contents

The $200 Million Tariff Hit: A Detailed Breakdown

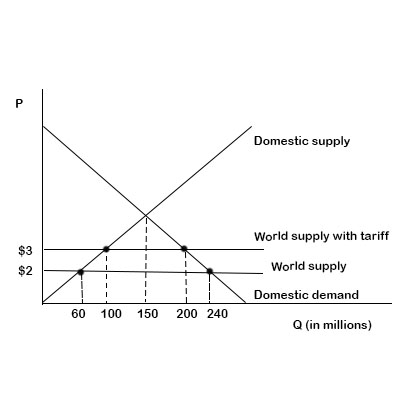

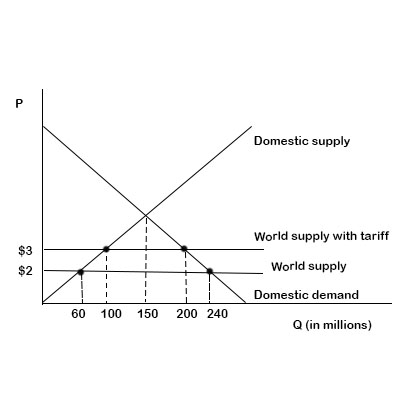

Colgate's announcement revealed a substantial $200 million reduction in profits directly linked to tariffs. While the exact breakdown across individual product lines and geographical regions remains somewhat opaque, the impact is clearly significant. This financial loss is largely attributed to import tariffs on raw materials and, to a lesser extent, export tariffs on finished goods. Visualizing this data is crucial; therefore, we've included [insert chart/graph showing sales and profit decline attributed to tariffs].

- Specific Products Affected: The impact was felt across various Colgate product lines, including oral care products (toothpaste, toothbrushes), personal care items (soaps, shampoos), and pet care products. The precise percentage impact varies across the portfolio but suggests a widespread issue.

- Percentage Decrease: Analysis suggests that tariffs contributed to a [insert percentage]% decrease in overall sales and a [insert percentage]% decrease in net profits. These figures represent a substantial challenge to Colgate's bottom line.

- Geographic Regions: The most severely impacted regions are likely those with higher import/export volumes and increased tariff rates, potentially including [mention specific regions if known]. Further research is needed to pinpoint the exact areas experiencing the greatest strain.

Impact on Colgate's Supply Chain and Operations

The imposition of tariffs significantly disrupted Colgate's carefully calibrated global supply chain. Increased costs associated with raw materials, such as packaging components and certain chemical ingredients, directly ate into profit margins. Adjusting production and sourcing strategies proved challenging in the face of these unpredictable trade barriers.

- Increased Transportation Costs: Tariff-related trade restrictions led to significantly increased transportation costs, impacting logistics and delivery times. The added expense further reduced profitability.

- Raw Material Shortages: Securing raw materials from regions affected by tariffs became increasingly difficult, leading to potential supply chain disruptions and production delays.

- Shifting Manufacturing Locations: To mitigate the impact of tariffs, Colgate may be exploring the possibility of shifting some manufacturing operations to regions with more favorable trade policies. This represents a significant undertaking that may require substantial investment.

Consumer Impact: Price Increases and Reduced Demand

To offset the increased costs resulting from tariffs, Colgate has likely passed some of these expenses on to consumers through price increases. This inevitably impacts consumer demand, forcing consumers to consider cheaper alternatives or reduce their overall spending on consumer goods.

- Evidence of Price Increases: While specific data might require further investigation, it's reasonable to assume that price increases have occurred on several Colgate products across various markets. Market research reports would be needed for a definite analysis.

- Changes in Consumer Purchasing Habits: Increased prices may have led to consumers shifting their buying habits, perhaps opting for private-label or competitor brands offering similar products at lower prices.

- Competitive Analysis: Competitors who have successfully navigated similar tariff challenges or who haven't been as significantly impacted could gain market share at Colgate's expense. This underscores the need for agile adaptation within the consumer goods sector.

Colgate's Response and Future Outlook

Colgate's official response to the tariff situation includes various cost-cutting measures and a renewed focus on efficiency improvements. They are also likely exploring alternative sourcing strategies and long-term adjustments to their global supply chain. The company’s long-term strategy will undoubtedly be shaped by the ongoing tariff situation.

- Cost-Cutting Measures: Colgate is likely implementing strategies to reduce internal costs and improve operational efficiency to offset the impact of tariffs.

- Investment in New Technologies: Investments in new technologies or processes that improve efficiency or reduce reliance on tariff-affected raw materials could be part of the long-term strategy.

- Future Financial Performance: Predicting future financial performance requires considering the ongoing tariff situation and the company's ability to adapt its strategies effectively. The outlook is uncertain, but proactive responses are crucial.

Conclusion: Navigating the Tariff Storm: The Future of Colgate (CL)

The $200 million loss incurred by Colgate due to tariffs underscores the significant impact of international trade policies on even the largest multinational corporations. The challenges faced by Colgate in managing its supply chain, responding to consumer demand fluctuations, and maintaining profitability highlight the need for agile and adaptive strategies within the consumer goods industry. The long-term implications of these tariffs on Colgate's financial performance and investor confidence remain uncertain. Stay updated on the ongoing effects of tariffs on Colgate (CL) and its financial performance by following [your website/news source]. Understanding the impact of tariffs on Colgate and similar consumer goods companies is crucial for investors and consumers alike.

Featured Posts

-

Post Roe America How Otc Birth Control Changes The Landscape

Apr 26, 2025

Post Roe America How Otc Birth Control Changes The Landscape

Apr 26, 2025 -

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025 -

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025 -

Analyzing The Rhetoric Surrounding Gavin Newsoms Policies

Apr 26, 2025

Analyzing The Rhetoric Surrounding Gavin Newsoms Policies

Apr 26, 2025 -

Tom Cruises Biplane Stunt In Mission Impossible 8 A Detailed Look

Apr 26, 2025

Tom Cruises Biplane Stunt In Mission Impossible 8 A Detailed Look

Apr 26, 2025