2025 Hurun Global Rich List: Elon Musk's $100 Billion Loss And Continued Reign

Table of Contents

Elon Musk's $100 Billion Loss: A Deep Dive

Analysis of the factors contributing to Musk's significant wealth decline.

Several interconnected factors contributed to Elon Musk's substantial net worth reduction.

-

Stock Market Fluctuations (Tesla, SpaceX): The volatile nature of the stock market significantly impacted Musk's wealth. Tesla's stock price, a major component of his net worth, experienced considerable fluctuation throughout 2024 and into 2025, driven by factors including production challenges, increased competition, and broader economic concerns. Similarly, while SpaceX remains a highly valued private company, its valuation is also subject to market sentiment and investor expectations.

-

Economic Downturns: Global economic uncertainties and downturns played a role in reducing valuations across various sectors, affecting the overall value of Musk's assets. The rising interest rates and inflation in 2024 significantly impacted investor confidence and market valuations.

-

Market Volatility: The inherent volatility of the tech sector, where Tesla and SpaceX operate, contributed to the dramatic swings in Musk's net worth. Rapid changes in investor sentiment and unexpected market events can drastically alter valuations in a short period.

-

Impact of Twitter Acquisition: The controversial acquisition of Twitter (now X) and subsequent management decisions resulted in significant financial burdens and reputational risks, negatively affecting investor confidence in Musk's other ventures. The associated debt and operational challenges weighed heavily on his overall financial standing.

-

Spending on Personal Projects: Musk's ambitious and often costly personal projects may have also contributed to a reduction in his readily available liquid assets. These projects, though potentially innovative, often involve substantial upfront investments without immediate returns.

Comparison with previous years' rankings and net worth.

The chart below illustrates the dramatic fluctuation in Elon Musk's net worth over the past few years:

[Insert chart showing Musk's net worth fluctuation from 2022-2025. Data should be sourced from reputable financial news outlets.]

Compared to 2024, where he held an even higher position on the Hurun Global Rich List, the $100 billion loss is a significant setback. However, despite this decline, his overall ranking on the 2025 list reflects the considerable value still associated with his ventures. His net worth still dwarfs that of many other billionaires.

Musk's Continued Dominance on the 2025 Hurun Global Rich List

Reasons behind Musk's sustained top position despite the financial setback.

Despite the substantial loss, Elon Musk retains his top position due to several key factors:

-

Diversification of Assets (Tesla, SpaceX, other ventures): Musk's wealth isn't solely tied to Tesla. His investments in SpaceX, The Boring Company, Neuralink, and other ventures provide a degree of diversification, cushioning the impact of losses in one area.

-

Long-term Investment Strategies: Musk's long-term vision and strategic investments suggest a focus on future growth rather than short-term gains. His companies are positioned for long-term expansion and innovation in crucial sectors.

-

Brand Power and Influence: Musk's personal brand and influence remain incredibly strong, impacting the perception and valuation of his companies. This intangible asset plays a crucial role in maintaining investor confidence.

-

Future Potential of his Companies: The continued innovation and expansion potential of Tesla (in electric vehicles, energy storage, and AI) and SpaceX (in space exploration and satellite technology) contribute to the overall valuation of his holdings, despite short-term market fluctuations.

Comparison with other prominent billionaires on the list.

While Musk's position is secure at the top of the 2025 Hurun Global Rich List, the competitive landscape is fierce. Jeff Bezos, Bernard Arnault, and Bill Gates remain significant contenders, though their rankings may have shifted slightly compared to previous years. The battle for the top spots reflects the dynamic nature of wealth creation and the competitive global economy. Future projections indicate continued competition, with potential shifts in rankings based on market performance and technological advancements.

Implications of Musk's fluctuating wealth on the global economy

Impact on Tesla's stock price and investor confidence.

Musk's fluctuating net worth directly impacts Tesla's stock price and investor sentiment. Significant changes in his personal wealth can trigger market reactions, affecting investor confidence and potentially influencing the broader electric vehicle market. This demonstrates the interconnectedness of individual wealth and global market performance.

Broader economic implications of such significant wealth shifts.

Such dramatic shifts in a single individual's wealth have broader implications:

-

Impact on Global Markets: Musk's financial performance influences the valuation of multiple sectors, creating ripples throughout global markets. The perception of risk and opportunity changes based on his success or setbacks.

-

Potential for Investment Strategies: His success and failures offer case studies for investment strategies, influencing how investors approach risk and reward in technology and innovative sectors.

-

Influence on Technological Advancements: Musk's ventures significantly influence technological advancements, particularly in electric vehicles and space exploration. His financial standing directly impacts the resources available for these innovations.

Conclusion: The Enduring Legacy of the 2025 Hurun Global Rich List and Elon Musk's Position

Elon Musk's $100 billion loss, despite his continued reign on the 2025 Hurun Global Rich List, highlights the volatility of extreme wealth and the complex interplay of market forces and individual entrepreneurial endeavors. His sustained position underscores the significance of long-term vision, diversification, and brand influence. The 2026 Hurun Global Rich List will undoubtedly reveal further shifts, with potential changes in rankings based on market performance and technological innovation. Will Musk retain his top spot? Only time will tell. Stay tuned for updates on the ever-changing dynamics of the Hurun Global Rich List and Elon Musk's continued impact on the global economy. Follow us for the latest news on the 2026 Hurun Global Rich List!

Featured Posts

-

Elizabeth Arden Products Walmart Price Comparison

May 09, 2025

Elizabeth Arden Products Walmart Price Comparison

May 09, 2025 -

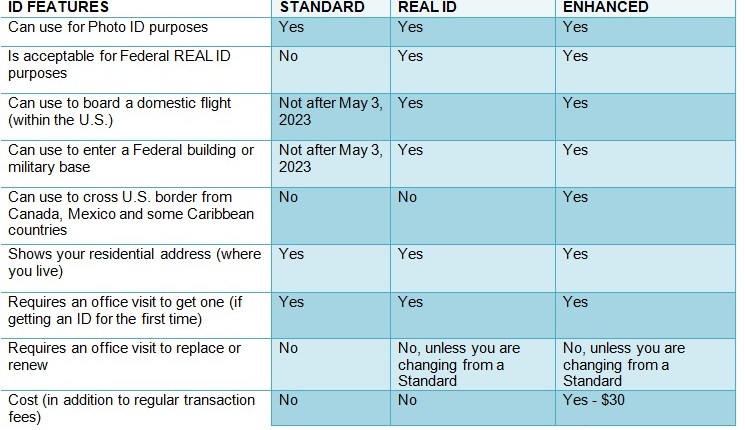

Summer Travel 2024 Navigating Real Id Requirements

May 09, 2025

Summer Travel 2024 Navigating Real Id Requirements

May 09, 2025 -

Elizabeth Hurley Shows Off Her Figure In Maldives Bikini Photos

May 09, 2025

Elizabeth Hurley Shows Off Her Figure In Maldives Bikini Photos

May 09, 2025 -

Uk Government Tightens Visa Rules Which Nationalities Are Affected

May 09, 2025

Uk Government Tightens Visa Rules Which Nationalities Are Affected

May 09, 2025 -

Champions League Semi Finals Barcelona Inter Arsenal Psg Dates

May 09, 2025

Champions League Semi Finals Barcelona Inter Arsenal Psg Dates

May 09, 2025