2025 Outlook: 30% Tariffs On Chinese Imports Remain In Effect

Table of Contents

The Continued Impact of 30% Tariffs on Import Costs

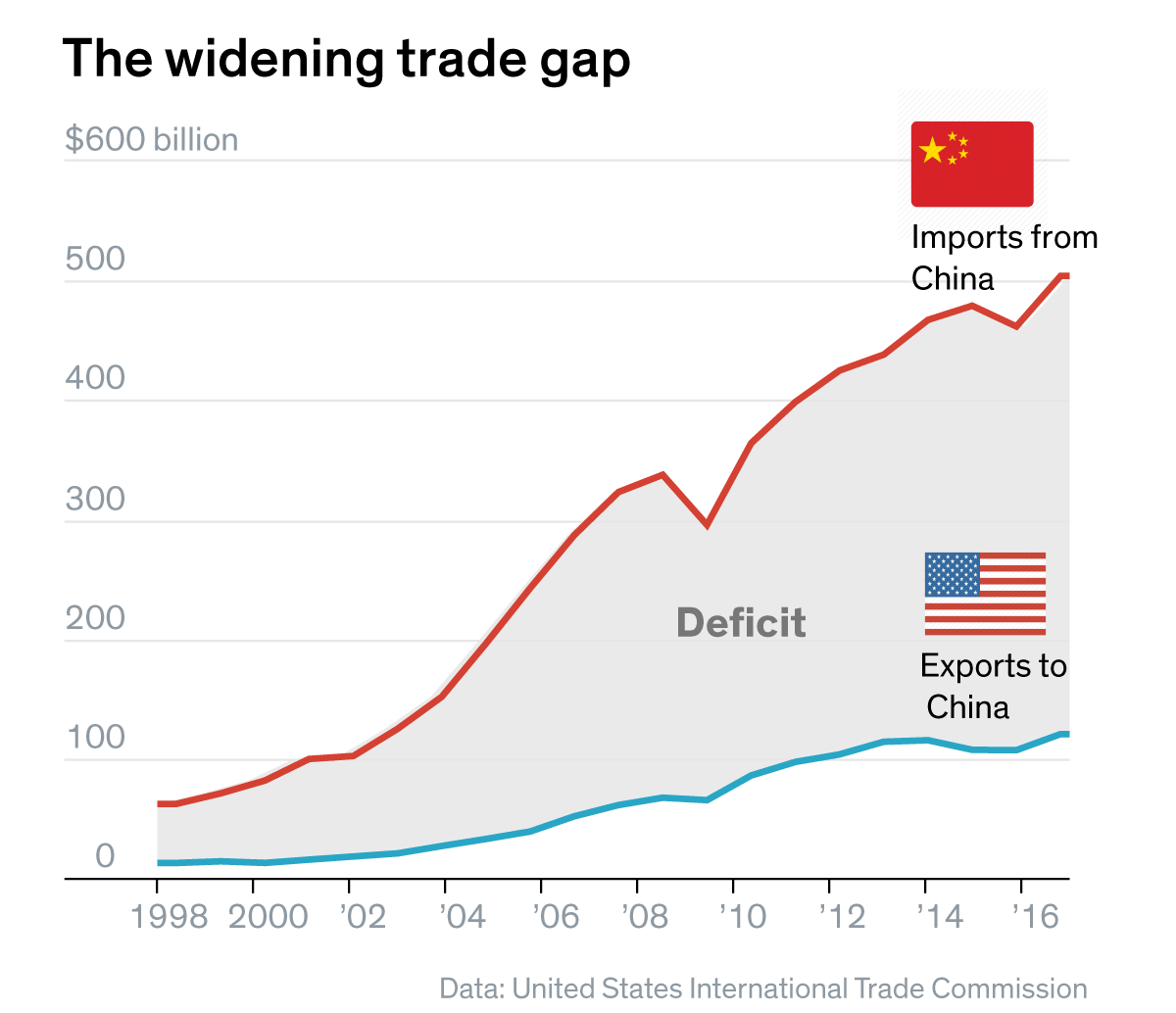

The 30% tariffs on Chinese imports have undeniably increased import costs for businesses sourcing goods from China. This tariff impact analysis reveals a ripple effect throughout the global supply chain and ultimately, on consumer prices.

-

Increased costs for businesses sourcing goods from China: Companies reliant on Chinese manufacturing face significantly higher expenses, impacting profit margins and competitiveness. The added 30% increases the landed cost of goods substantially, making products more expensive to produce and sell.

-

Analysis of the impact on consumer prices and inflation: The increased import costs are frequently passed on to consumers, contributing to inflation and potentially reducing purchasing power. This price increase can affect various sectors, from electronics and apparel to furniture and industrial components.

-

Strategies for mitigating increased import costs: Businesses are adopting several strategies to counter the impact. These include:

- Diversification: Sourcing goods from alternative countries to reduce reliance on China.

- Price adjustments: Carefully evaluating pricing strategies to balance profitability with consumer demand.

- Negotiation: Seeking better terms and conditions with existing suppliers.

- Efficiency improvements: Streamlining operations to reduce overall costs.

-

Case studies of companies affected by increased import costs due to the tariffs: Many businesses have publicly reported the negative financial consequences of the tariffs. Case studies reveal the challenges faced in maintaining competitiveness and adapting to the higher import costs, highlighting the need for proactive strategic planning.

Supply Chain Restructuring and Diversification Efforts

Supply chain disruption caused by the 30% tariffs on Chinese imports has spurred significant restructuring and diversification efforts. Businesses are actively seeking supply chain resilience through nearshoring and reshoring initiatives.

-

Examination of companies' efforts to diversify their supply chains away from China: Many companies are actively exploring alternative sourcing options in countries like Vietnam, Mexico, and India. This involves significant investment in establishing new supplier relationships and potentially relocating production facilities.

-

Discussion of nearshoring and reshoring trends: Nearshoring (moving production to nearby countries) and reshoring (bringing production back to the home country) are gaining traction as companies seek to reduce transportation costs, improve lead times, and enhance supply chain visibility.

-

Analysis of the challenges and benefits of reshaping global supply chains: While diversification offers advantages in mitigating risk, it also presents challenges such as higher initial investment costs, longer lead times with new suppliers, and the need for navigating different regulatory environments.

-

Examples of successful supply chain diversification strategies: Successful companies have demonstrated that a phased approach to diversification, coupled with thorough due diligence and strong supplier relationships, can effectively mitigate the impact of tariffs.

Government Policies and Trade Negotiations

Government policies and ongoing trade negotiations play a crucial role in shaping the landscape affected by the 30% tariffs on Chinese imports. Understanding these factors is vital for business planning.

-

Overview of current government policies related to the tariffs: Governments continue to monitor the impact of the tariffs and may implement supportive measures for businesses affected. This could include subsidies, tax incentives, or trade adjustment assistance programs.

-

Analysis of the potential for future trade negotiations and agreements: The possibility of future trade negotiations and agreements between the US and China remains a key uncertainty. Any changes to the tariff structure could significantly impact businesses.

-

Discussion of the political implications of the tariffs: The 30% tariffs are deeply intertwined with broader geopolitical considerations and the overall relationship between the US and China. These political factors add complexity to the economic impact.

-

Exploration of any changes in government support for businesses affected by tariffs: Governments are continually evaluating the effectiveness of their support programs and may adjust their policies based on the evolving economic conditions.

The Future of US-China Trade Relations

The future of US-China trade relations remains a critical factor in determining the long-term impact of the 30% tariffs.

-

Analysis of the long-term prospects for US-China trade relations: The relationship is complex and dynamic, influenced by various geopolitical and economic factors. A sustained period of tension could prolong the impact of the tariffs.

-

Discussion of the potential for future tariff adjustments or removal: While the possibility of tariff adjustments or removal exists, it remains uncertain. Businesses must be prepared for different scenarios.

-

Assessment of the overall impact on global trade: The tariffs on Chinese imports have broader implications for global trade flows, potentially reshaping global supply chains and impacting international competitiveness.

Conclusion

The 30% tariffs on Chinese imports continue to be a major factor shaping the global economic landscape in 2025. Businesses must adapt to these persistent tariffs by diversifying their supply chains, adjusting their pricing strategies, and closely monitoring government policies. The future of US-China trade relations remains uncertain, making proactive strategic planning crucial for navigating this complex trade environment. Understanding the long-term implications of the 30% tariffs on Chinese imports is essential for businesses to thrive. Learn more about adapting your import strategy to the current economic climate and developing a resilient approach to mitigating the risks associated with these persistent 30% tariffs on Chinese imports.

Featured Posts

-

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025 -

Eurowizja Bez Zelmerloewa Zwyciezca Przegrywa Melodifestivalen

May 19, 2025

Eurowizja Bez Zelmerloewa Zwyciezca Przegrywa Melodifestivalen

May 19, 2025 -

Eurovision 2025 Austrias Jj Triumphs With Wasted Love

May 19, 2025

Eurovision 2025 Austrias Jj Triumphs With Wasted Love

May 19, 2025 -

Paige Bueckers Open Invitation A Mavericks Star At A Wings Game

May 19, 2025

Paige Bueckers Open Invitation A Mavericks Star At A Wings Game

May 19, 2025 -

Steczkowska Na Eurowizji Reakcja Fanow I Miejsce W Rankingu

May 19, 2025

Steczkowska Na Eurowizji Reakcja Fanow I Miejsce W Rankingu

May 19, 2025

Latest Posts

-

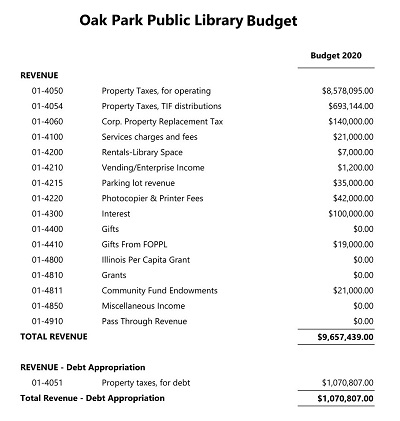

Evaluating A Phillies Triple A Prospects Readiness For The Majors

May 19, 2025

Evaluating A Phillies Triple A Prospects Readiness For The Majors

May 19, 2025 -

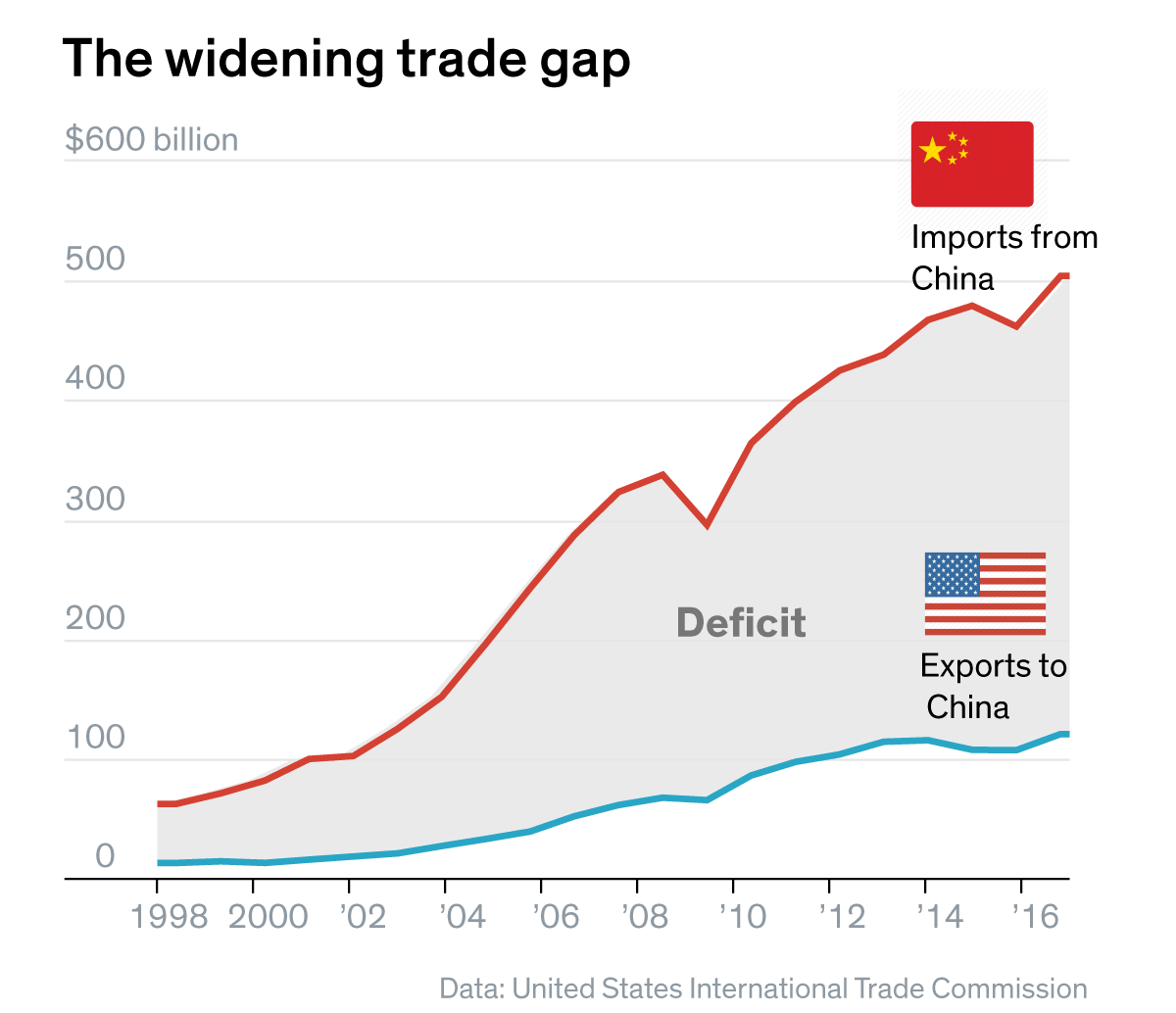

Reduced Library Hours And Services A Consequence Of Budget Cuts

May 19, 2025

Reduced Library Hours And Services A Consequence Of Budget Cuts

May 19, 2025 -

High Performing Phillies Triple A Prospect Promotion Time

May 19, 2025

High Performing Phillies Triple A Prospect Promotion Time

May 19, 2025 -

Libraries Under Pressure Examining The Effects Of The Trump Order

May 19, 2025

Libraries Under Pressure Examining The Effects Of The Trump Order

May 19, 2025 -

Should The Phillies Call Up Their Triple A Star

May 19, 2025

Should The Phillies Call Up Their Triple A Star

May 19, 2025