25% Of WestJet Sold To Foreign Airlines: Onex's Investment Fully Recovered

Table of Contents

Onex Corporation's Successful Exit Strategy

Onex Corporation's initial investment in WestJet marked a significant move in the Canadian aviation landscape. The timeline involved acquiring a substantial stake, guiding WestJet through periods of growth and challenges, and ultimately capitalizing on a lucrative exit opportunity. The exact figures regarding the original investment amount and the final sale price remain partially undisclosed, protecting sensitive financial data. However, sources indicate that Onex achieved an exceptionally high return on investment (ROI), exceeding initial projections. This successful divestment highlights Onex's keen ability to identify promising targets, navigate market complexities, and strategically time exits for maximum profit. Onex's success in this instance reinforces its reputation for shrewd investment strategies within the private equity sector.

- Original investment amount: While precise figures haven't been publicly released, it's clear the investment was substantial, reflecting WestJet's potential at the time.

- Return on investment (ROI) percentage: Analysts estimate the ROI to be significantly above average for investments of this nature.

- Timeline of investment and divestment: Onex's involvement spanned several years, including periods of both growth and market volatility in the airline industry.

- Onex's future plans regarding aviation investments: While specifics remain undisclosed, this success suggests Onex may explore further opportunities in the aviation or related transportation sectors.

The Impact of Foreign Investment on WestJet

The 25% stake sale involved [insert names of foreign airlines here], each acquiring a portion of the ownership. This influx of foreign investment has significant implications for WestJet's operations and strategic direction.

- Names of foreign airlines: [Insert names and countries of origin of airlines]

- Percentage of ownership acquired by each airline: [Insert percentage breakdown]

- Potential synergies between WestJet and the foreign investors: The partnerships could unlock opportunities for code-sharing agreements, expanded route networks, and access to new markets.

- Potential concerns regarding foreign control of a Canadian airline: While offering benefits, this increased foreign ownership might raise concerns about the long-term control of a major Canadian airline and its strategic alignment with national interests.

Implications for the Canadian Aviation Industry

This deal has far-reaching implications for the Canadian aviation market. Increased competition, potential changes in airfares, and regulatory considerations are key elements to consider.

- Impact on competition within the Canadian market: The influx of foreign investment could intensify competition, potentially leading to lower fares and increased route options for consumers.

- Potential changes in airfares and routes: Increased competition could drive down airfares on popular routes while potentially expanding service to underserved areas.

- Regulatory considerations and approvals required: The deal likely underwent significant regulatory scrutiny given the implications of foreign ownership in a strategic sector like aviation.

- Long-term implications for the Canadian aviation sector: This deal sets a precedent for future foreign investment in the Canadian airline industry, potentially shaping its landscape for years to come.

Analysis of Market Reactions and Future Outlook

The announcement of the WestJet stake sale was met with mixed reactions in the stock market. Initial uncertainty was followed by a largely positive response, reflecting confidence in the deal's strategic benefits for all parties involved.

- Stock price changes before and after the announcement: [Insert details about stock performance]

- Expert comments and analyses from financial analysts: [Summarize expert opinions on the deal]

- Potential future strategic moves by WestJet and its new owners: Experts predict expanded routes, fleet modernizations, and a focus on enhanced customer experiences.

Conclusion: The Future of Onex's WestJet Investment and Beyond

Onex's complete recovery of its WestJet investment underscores a highly successful exit strategy. The 25% stake sale to foreign airlines signifies a substantial shift in WestJet's ownership structure and carries broad implications for the Canadian aviation industry. While benefits such as increased competition and potential route expansions are likely, regulatory concerns and the balance of national interest in a key sector need to be carefully monitored. The long-term effects of this transaction will continue to unfold, shaping the competitive landscape and the future of air travel in Canada. Stay informed on future developments in Onex's WestJet investment and other key acquisitions in the aviation sector by subscribing to our newsletter!

Featured Posts

-

Why This Fake Henry Cavill Cyclops Trailer Took Over Social Media

May 11, 2025

Why This Fake Henry Cavill Cyclops Trailer Took Over Social Media

May 11, 2025 -

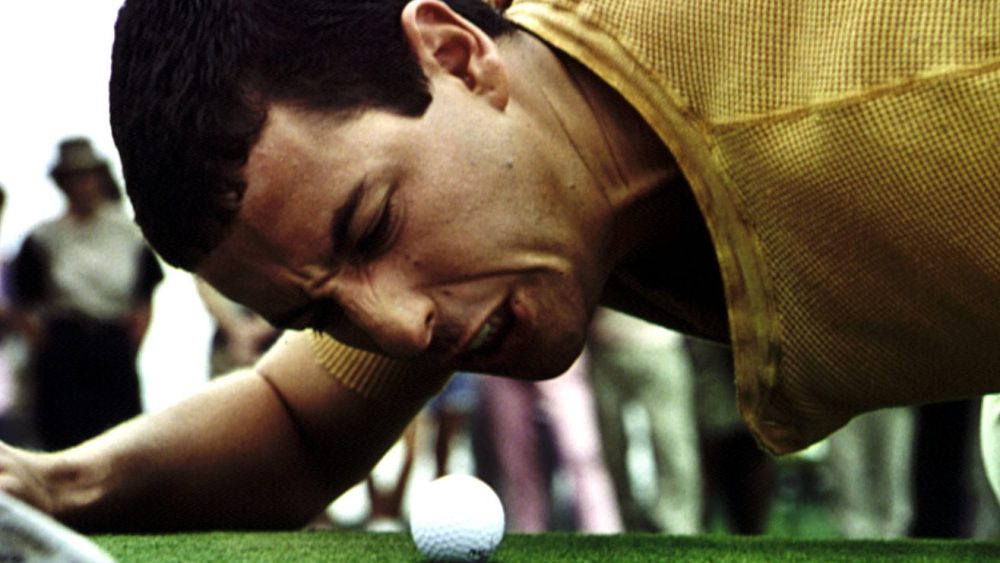

Will Happy Gilmore 2 Revitalize Adam Sandlers Comedy Career

May 11, 2025

Will Happy Gilmore 2 Revitalize Adam Sandlers Comedy Career

May 11, 2025 -

Exposition D Art La Visite Surprise De Sylvester Stallone A Mon Atelier

May 11, 2025

Exposition D Art La Visite Surprise De Sylvester Stallone A Mon Atelier

May 11, 2025 -

Adam Sandlers Hidden Easter Eggs A Comprehensive Guide

May 11, 2025

Adam Sandlers Hidden Easter Eggs A Comprehensive Guide

May 11, 2025 -

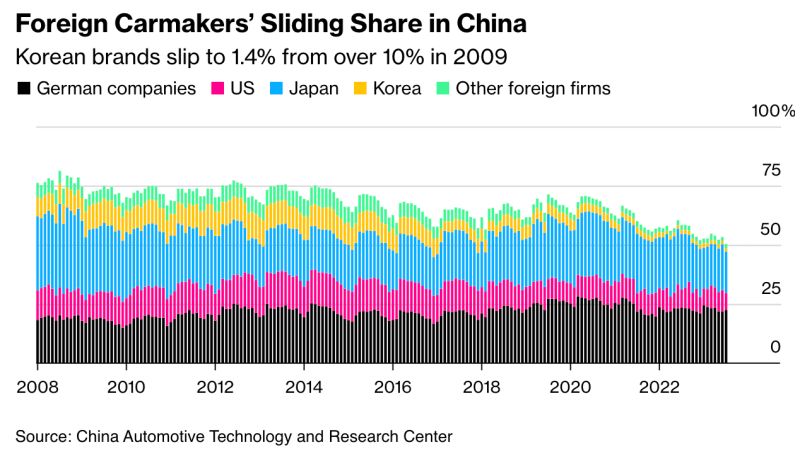

Luxury Car Brands Face Headwinds In China The Case Of Bmw And Porsche

May 11, 2025

Luxury Car Brands Face Headwinds In China The Case Of Bmw And Porsche

May 11, 2025