$254 Apple Stock Price Prediction: Should You Buy Now?

Table of Contents

<p><strong>Meta Description:</strong> Is Apple stock poised to hit $254? Analyze the potential, risks, and whether now's the right time to invest. Read our expert prediction and analysis.</p>

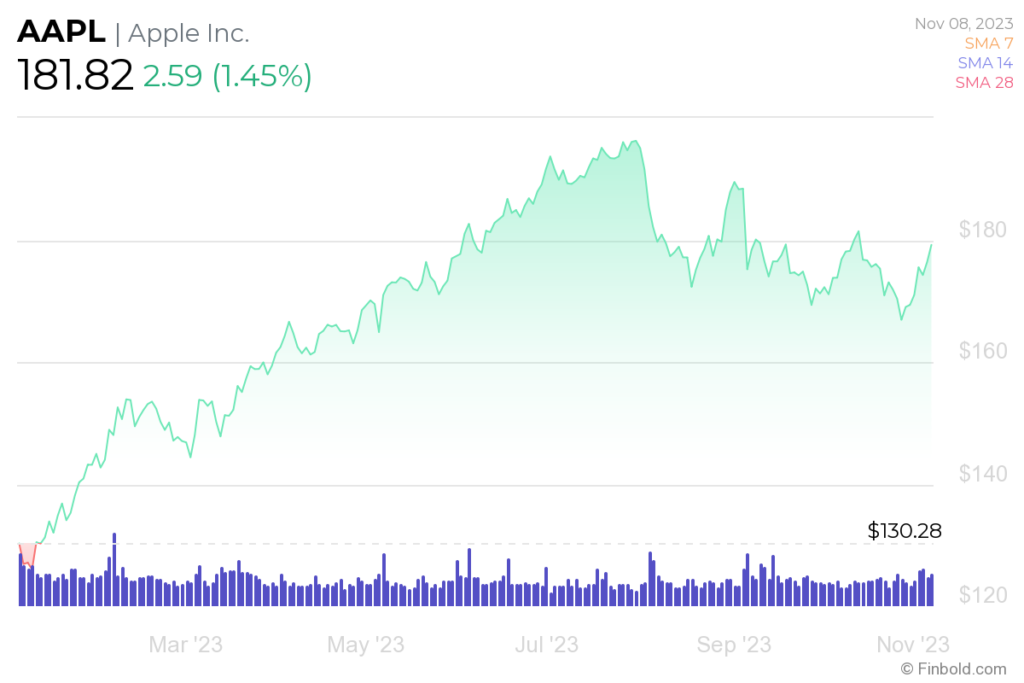

<p>The tantalizing prospect of Apple stock reaching $254 has many investors wondering: should I buy now? This article delves into the current market conditions, Apple's financial performance, and future growth projections to help you make an informed decision. We'll examine factors influencing the potential price surge and assess the associated risks. Understanding the potential for Apple to reach a $254 stock price requires a careful analysis of various factors.</p>

<h2>Apple's Current Financial Performance and Future Projections</h2>

<h3>Revenue Growth and Profitability</h3>

<p>Analyzing Apple's recent financial reports reveals a generally robust picture. Key metrics like revenue, earnings per share (EPS), and profit margins paint a picture of continued growth, though not always at the breakneck pace of previous years. Let's examine the details:</p>

<ul> <li><strong>iPhone Sales:</strong> While iPhone sales growth has shown some moderation recently, the iPhone remains a major revenue driver for Apple. The introduction of new models and ongoing upgrades contribute significantly to this segment's performance. However, increased competition in the smartphone market is a factor to watch.</li> <li><strong>Services Revenue Growth:</strong> Apple's services segment, including the App Store, Apple Music, iCloud, and AppleCare, continues to demonstrate strong growth. This recurring revenue stream provides a level of stability and predictability, cushioning the impact of fluctuations in hardware sales.</li> <li><strong>Wearables, Mac, and iPad Performance:</strong> Apple's wearables category, encompassing Apple Watch and AirPods, has shown consistent growth, reflecting a rising demand for smart wearable technology. Mac sales have also remained healthy, while iPad sales continue to perform moderately. This diversification across product lines contributes to overall financial resilience.</li> </ul>

<p><em>[Insert relevant charts and graphs illustrating revenue growth, EPS, and profit margins over the past few years. Source the data appropriately.]</em></p>

<h3>Upcoming Product Launches and Innovations</h3>

<p>Apple's future growth hinges significantly on upcoming product releases and technological innovations. Anticipated launches, such as new iPhone models, updated Apple Watch series, and potential advancements in AR/VR technology, could significantly impact the stock price.</p>

<ul> <li><strong>New iPhones:</strong> Annual iPhone releases typically generate significant sales and hype, influencing investor confidence. New features, improved camera technology, and enhanced processing power are key drivers of demand.</li> <li><strong>Apple Watch Innovations:</strong> Further advancements in health monitoring capabilities, improved fitness tracking, and potentially even more integrated functionalities could broaden the appeal of the Apple Watch and boost sales.</li> <li><strong>AR/VR Devices:</strong> The potential entry into the augmented and virtual reality market could be a game-changer for Apple. Success in this area would open up new revenue streams and potentially reshape the tech landscape, significantly affecting the $254 Apple stock price prediction and beyond.</li> </ul>

<h2>Market Analysis and External Factors</h2>

<h3>Macroeconomic Conditions</h3>

<p>Global macroeconomic conditions play a crucial role in influencing Apple's stock price. Factors such as inflation, interest rates, and recessionary fears directly impact consumer spending and corporate profitability.</p>

<ul> <li><strong>Inflation and Interest Rates:</strong> High inflation and rising interest rates can decrease consumer discretionary spending, potentially affecting demand for Apple products. This would impact both sales and investor sentiment.</li> <li><strong>Recessionary Fears:</strong> Concerns about an economic downturn can lead to investors moving away from riskier assets like tech stocks, potentially depressing Apple's stock price.</li> </ul>

<p><em>[Insert relevant economic data and forecasts, citing reliable sources.]</em></p>

<h3>Competitive Landscape</h3>

<p>Apple faces stiff competition from tech giants like Samsung, Google, and others. Their innovative products and aggressive marketing strategies pose a constant challenge.</p>

<ul> <li><strong>Samsung's Competitive Edge:</strong> Samsung's robust smartphone lineup and wider range of consumer electronics constantly pressure Apple's market share.</li> <li><strong>Google's Ecosystem:</strong> Google's integrated ecosystem, encompassing Android, Google services, and hardware, poses a significant threat, especially in the smartphone market.</li> </ul>

<h3>Analyst Predictions and Stock Ratings</h3>

<p>Financial analysts offer a range of opinions on Apple's future price target and stock rating. While consensus is not always easy to determine, monitoring these predictions provides valuable insight.</p>

<ul> <li><strong>Average Price Target:</strong> [Insert the average price target from reputable analysts, citing sources.]</li> <li><strong>Range of Opinions:</strong> Analyst ratings often vary between "Buy," "Hold," and "Sell," reflecting diverse perspectives on Apple's future prospects.</li> </ul>

<h2>Risks and Considerations Before Investing in Apple Stock</h2>

<h3>Volatility and Market Risk</h3>

<p>Investing in the stock market inherently carries risk, and tech stocks like Apple can experience significant price volatility. It's crucial to understand and accept these risks.</p>

<ul> <li><strong>Price Fluctuations:</strong> Apple's stock price can fluctuate significantly based on various factors, including news events, financial reports, and overall market sentiment.</li> <li><strong>Portfolio Diversification:</strong> Diversifying your investment portfolio is essential to mitigate risk. Don't put all your eggs in one basket.</li> </ul>

<h3>Geopolitical Risks</h3>

<p>Global geopolitical events can significantly impact Apple's business and stock price. Factors such as trade wars, political instability, and supply chain disruptions can have a substantial effect.</p>

<ul> <li><strong>Trade Wars and Tariffs:</strong> Trade disputes and tariffs can impact Apple's manufacturing and distribution costs, affecting profitability and investor confidence.</li> <li><strong>Supply Chain Disruptions:</strong> Geopolitical instability can disrupt Apple's global supply chain, leading to production delays and potential shortages.</li> </ul>

<h3>Company-Specific Risks</h3>

<p>Apple also faces company-specific risks that could impact its stock price. These include:</p>

<ul> <li><strong>Supply Chain Issues:</strong> Relying on a global supply chain makes Apple vulnerable to disruptions and shortages.</li> <li><strong>Product Recalls:</strong> Product defects or safety concerns could lead to costly recalls and damage Apple's reputation.</li> <li><strong>Regulatory Challenges:</strong> Increased regulatory scrutiny or legal challenges could negatively affect Apple's operations and profitability.</li> </ul>

<h2>Conclusion</h2>

<p>Reaching a $254 Apple stock price prediction requires a positive confluence of factors. While Apple's strong financial performance, innovative products, and potential future growth offer reasons for optimism, significant risks remain. Market volatility, macroeconomic conditions, geopolitical instability, and company-specific challenges all need to be carefully considered. The $254 Apple stock price prediction, therefore, remains a possibility but is not guaranteed.</p>

<p><strong>Call to Action:</strong> While a $254 Apple stock price prediction is possible, remember to conduct your own due diligence before investing. Carefully consider your financial goals and risk tolerance before making any decisions related to the $254 Apple stock price prediction or any Apple stock investment. Consult with a financial advisor for personalized guidance. Thoroughly researching the $254 Apple stock price prediction and understanding the associated risks is crucial before investing.</p>

Featured Posts

-

Ryujinx Emulator Project Closure Following Nintendo Contact

May 24, 2025

Ryujinx Emulator Project Closure Following Nintendo Contact

May 24, 2025 -

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025 -

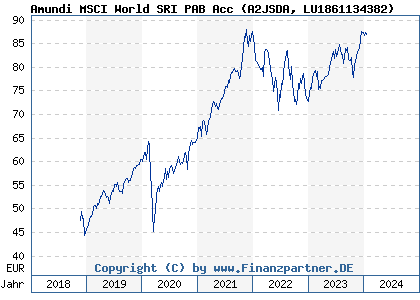

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025 -

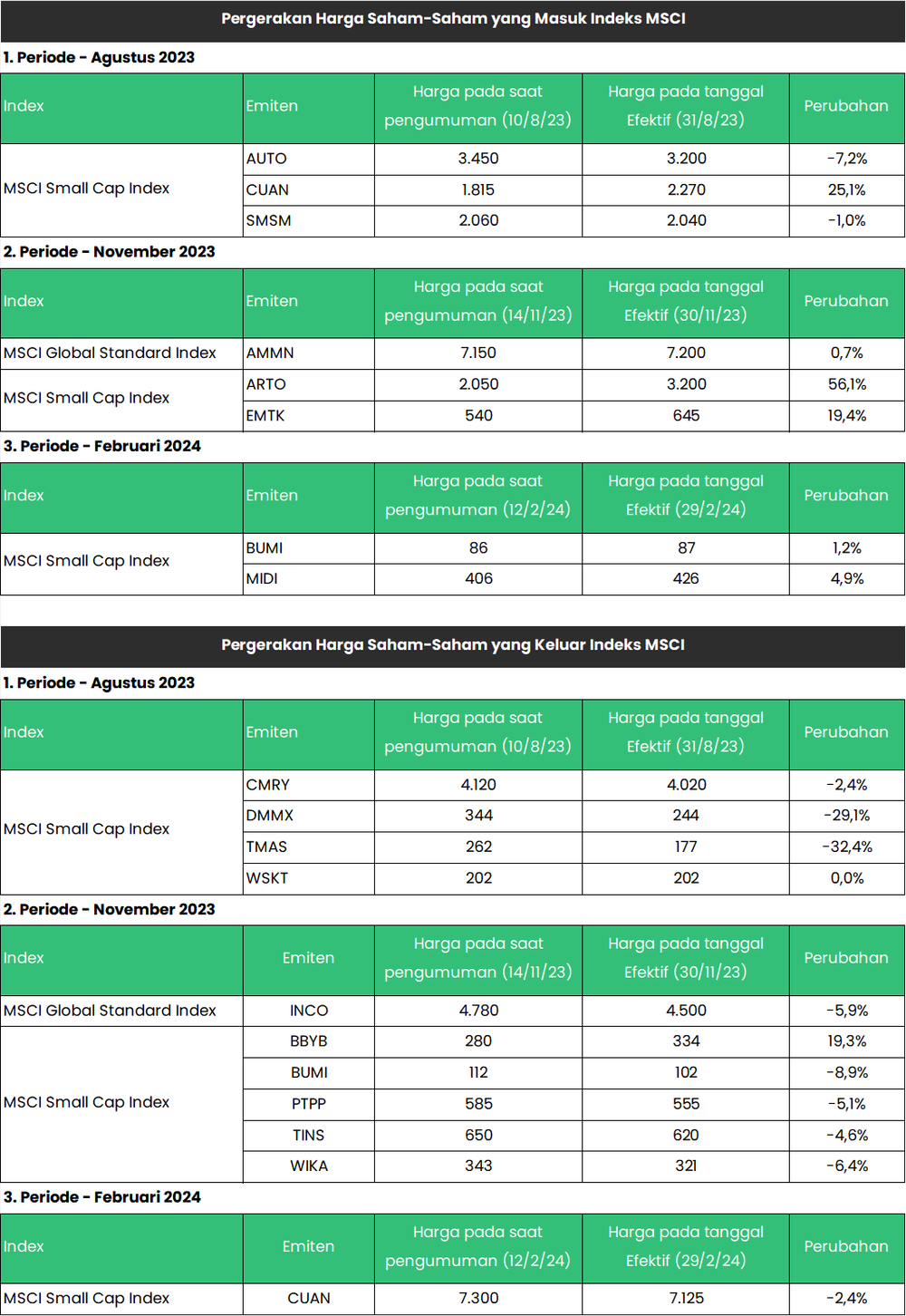

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 24, 2025

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 24, 2025 -

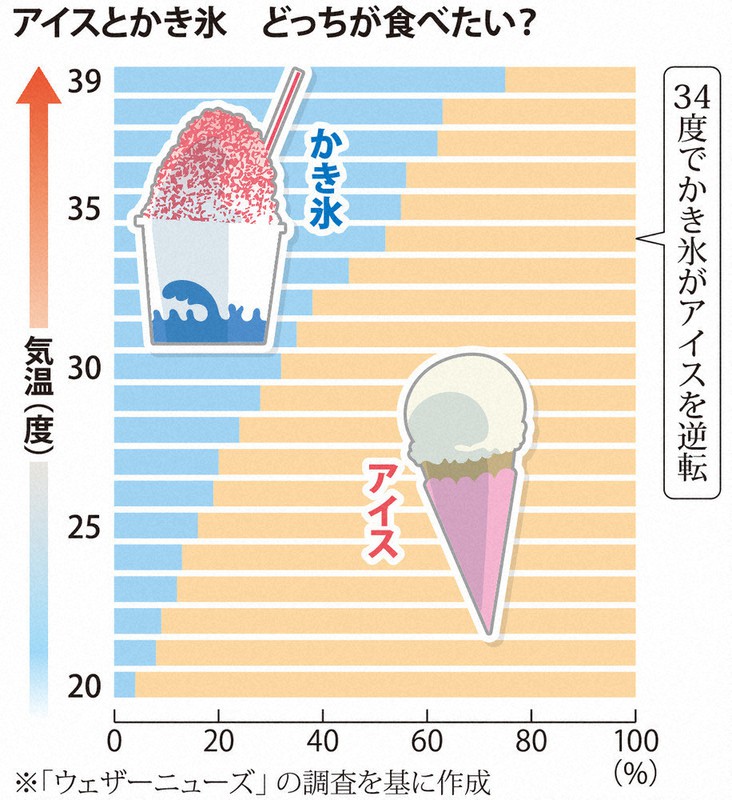

Ueberraschung In Essen Diese Eissorte Ist Der Nrw Favorit

May 24, 2025

Ueberraschung In Essen Diese Eissorte Ist Der Nrw Favorit

May 24, 2025

Latest Posts

-

Guevenilir Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025

Guevenilir Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025 -

Horoscopo Del 4 Al 10 De Marzo De 2025 Descubre Tu Pronostico Astral

May 24, 2025

Horoscopo Del 4 Al 10 De Marzo De 2025 Descubre Tu Pronostico Astral

May 24, 2025 -

Tutumlu Olmak Icin 3 Burctan Ilham Alin Para Tasarruf Ipuclari

May 24, 2025

Tutumlu Olmak Icin 3 Burctan Ilham Alin Para Tasarruf Ipuclari

May 24, 2025 -

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 24, 2025

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 24, 2025 -

En Az Harcayan 3 Burc Maddi Guevenligin Sirri

May 24, 2025

En Az Harcayan 3 Burc Maddi Guevenligin Sirri

May 24, 2025