270MWh BESS Financing In Belgium: Challenges And Opportunities In The Merchant Market

Table of Contents

The Belgian energy market is undergoing a rapid transformation, driven by the ambitious integration of renewable energy sources like solar and wind power. This transition presents both exciting opportunities and significant challenges. At the heart of this transformation lies the crucial need for robust and scalable energy storage solutions. Large-scale Battery Energy Storage Systems (BESS), particularly those with capacities like 270MWh, are emerging as key players in stabilizing the grid and maximizing the utilization of renewable energy. This article explores the complexities of securing finance for a substantial 270MWh BESS project within Belgium's competitive merchant market, analyzing the hurdles and highlighting the attractive investment prospects.

Understanding the Belgian Energy Landscape and its Impact on BESS Financing

The Belgian energy landscape significantly influences the feasibility and financing of large-scale BESS projects.

The Role of Renewable Energy Integration:

Belgium's commitment to renewable energy is driving the need for advanced energy storage solutions.

- Increased Renewable Energy Penetration: The increasing share of intermittent renewable energy sources (solar and wind) creates fluctuations in electricity supply, necessitating flexible energy storage to maintain grid stability.

- Grid Stability and Balancing: BESS systems provide crucial grid support services, including frequency regulation and voltage control, enhancing the reliability of the electricity network. This is particularly important given Belgium's interconnected European grid.

- Government Policies and Incentives: The Belgian government actively promotes renewable energy integration through various policies and financial incentives, creating a favorable environment for BESS deployment and potentially offering support for 270MWh BESS financing.

The Merchant Market Model and its Implications:

Belgium's merchant market structure impacts how BESS projects generate revenue.

- Merchant Market Structure: In a merchant market, BESS operators sell energy storage services directly to the market, earning revenue based on price fluctuations and demand. This contrasts with regulated markets where revenue is more predictable.

- Revenue Streams: Profitability in the merchant market relies on multiple revenue streams, including frequency regulation, arbitrage (buying energy at low prices and selling at high prices), and capacity market participation.

- Risks of Market Volatility: Price volatility and market uncertainty inherent in the merchant model introduce significant financial risks. Accurate forecasting is paramount.

- Revenue Forecasting: Sophisticated revenue forecasting models are essential for securing financing, accurately predicting future energy prices and demand patterns, and mitigating the risks of market fluctuations.

Key Challenges in Securing 270MWh BESS Financing

Securing financing for a substantial 270MWh BESS project presents several challenges.

High Capital Expenditure (CAPEX):

The upfront investment for a 270MWh BESS project is considerable.

- Significant Upfront Investment: The sheer scale of a 270MWh system necessitates a substantial initial capital outlay, a major hurdle for securing funding.

- Financing Structures: Mitigating CAPEX risk requires exploring diverse financing structures, including equity financing, debt financing from banks or specialized lenders, and hybrid models combining equity and debt.

- Government Support: Seeking government grants, subsidies, or tax incentives designed to support renewable energy projects can significantly reduce the overall financial burden.

Revenue Risk and Forecasting Uncertainty:

Predicting future energy prices and market dynamics is crucial but challenging.

- Market Price Volatility: Fluctuations in electricity prices introduce significant uncertainty in projected revenue streams.

- Hedging Strategies: Implementing hedging strategies to mitigate price volatility risk is crucial. This could involve entering into power purchase agreements (PPAs) or utilizing financial instruments to lock in future prices.

- Robust Financial Modeling: Rigorous financial modeling and sensitivity analysis are crucial to assess the project's viability under various market scenarios.

Technological Risks and Project Development Challenges:

Technological and logistical hurdles pose additional risks.

- Battery Technology Risks: Risks associated with battery technology include degradation over time, lifespan limitations, and safety concerns. Careful selection of battery technology and robust maintenance plans are critical.

- Permitting and Regulation: Navigating the permitting and regulatory processes for deploying a large-scale BESS project in Belgium can be complex and time-consuming.

- Experienced Project Developers: Engaging experienced project developers and Engineering, Procurement, and Construction (EPC) contractors is vital for efficient project execution and risk management.

Opportunities in 270MWh BESS Investment in Belgium

Despite the challenges, significant investment opportunities exist.

Attractive Return on Investment (ROI):

The growing demand for energy storage services offers potential for high ROI.

- High ROI Potential: The increasing importance of BESS in supporting renewable energy integration and enhancing grid stability points to a strong long-term demand and attractive returns for investors.

- Revenue Streams Analysis: Analyzing potential revenue streams from various sources (capacity market, ancillary services, and energy arbitrage) is critical in demonstrating a compelling ROI.

- Long-Term Value Proposition: The long-term value proposition of BESS projects is enhanced by their contribution to grid stability and the transition towards a decarbonized energy system.

Alignment with Belgium's Climate Goals:

BESS investments contribute to Belgium's decarbonization objectives.

- Contribution to Climate Goals: BESS projects significantly contribute to Belgium's renewable energy targets and broader decarbonization efforts.

- ESG Considerations: Environmental, Social, and Governance (ESG) factors are increasingly important for investors, and BESS projects align well with these criteria.

- Green Financing Options: Accessing green financing options, such as green bonds or sustainability-linked loans, can be advantageous for BESS projects.

Strategic Partnerships and Collaboration:

Collaboration enhances project success and secures financing.

- Collaboration Benefits: Strategic partnerships between energy producers, grid operators, and financial institutions are crucial for sharing risks and expertise.

- Long-Term PPAs: Securing long-term Power Purchase Agreements (PPAs) provides revenue certainty and strengthens the investment case.

- Public-Private Partnerships: Public-private partnerships can combine public sector support with private sector investment expertise.

Conclusion

Financing a 270MWh BESS project in Belgium's merchant market presents a complex but ultimately compelling investment opportunity. While high CAPEX and revenue uncertainty necessitate robust risk mitigation strategies, the potential for strong ROI, alignment with Belgium's climate goals, and the growing demand for grid-scale energy storage make it an attractive proposition. By carefully considering the challenges and opportunities outlined above, and by leveraging strategic partnerships and innovative financing structures, investors can successfully navigate the complexities and contribute significantly to the modernization of Belgium's energy infrastructure. Explore the potential of 270MWh BESS investments in Belgium today and become a key player in the future of renewable energy.

Featured Posts

-

Smart Ring For Fidelity Hype Or Hope For Relationships

May 03, 2025

Smart Ring For Fidelity Hype Or Hope For Relationships

May 03, 2025 -

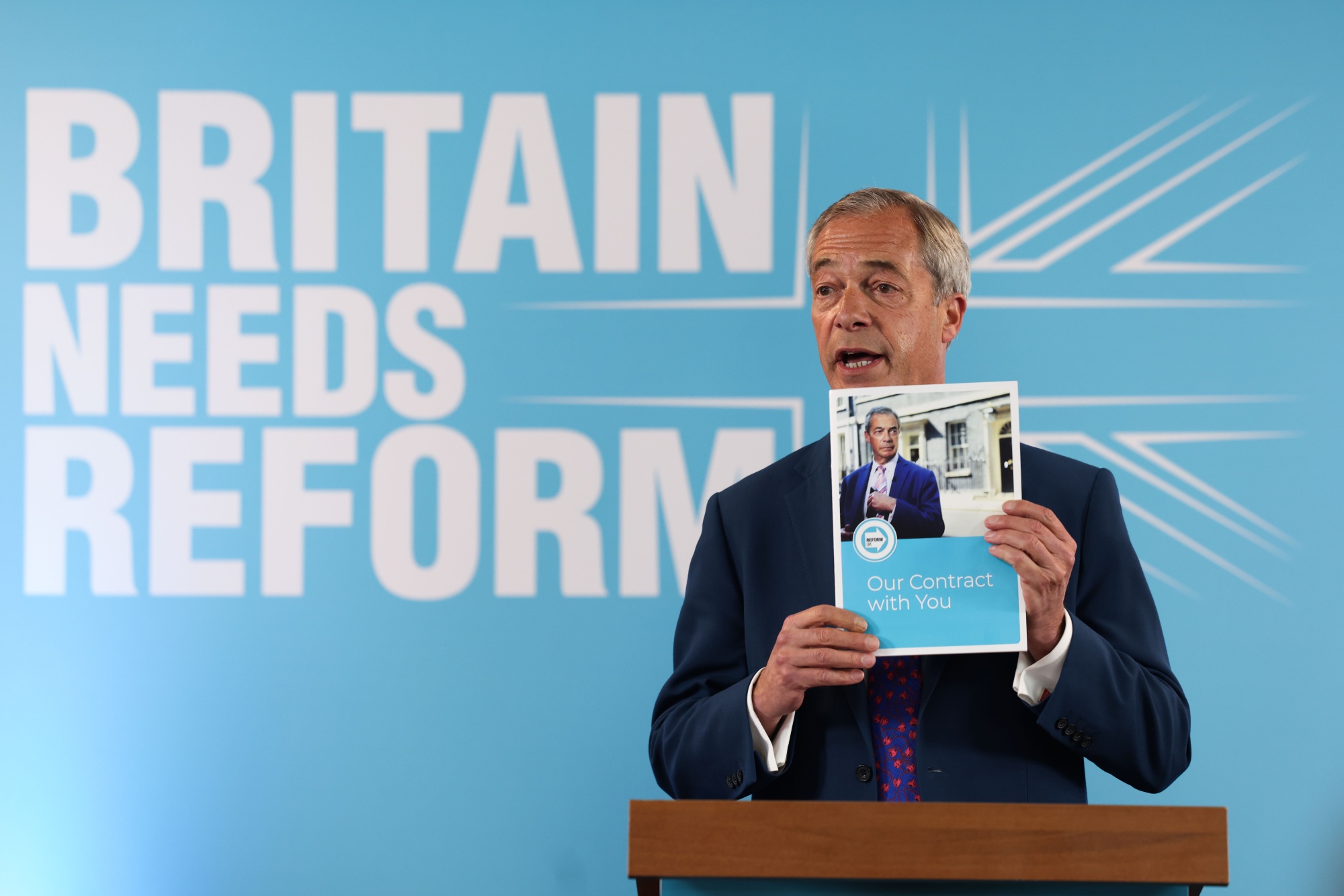

Uk Poll Farage Overtakes Starmer As Preferred Prime Minister In Over Half Of Constituencies

May 03, 2025

Uk Poll Farage Overtakes Starmer As Preferred Prime Minister In Over Half Of Constituencies

May 03, 2025 -

A Place In The Sun A Realistic Look At Buying Abroad

May 03, 2025

A Place In The Sun A Realistic Look At Buying Abroad

May 03, 2025 -

Reform Uks Surprise Farage Hints At Snp Victory Preference

May 03, 2025

Reform Uks Surprise Farage Hints At Snp Victory Preference

May 03, 2025 -

Would This Iconic Band Play A Music Festival Only If It Was Life Or Death

May 03, 2025

Would This Iconic Band Play A Music Festival Only If It Was Life Or Death

May 03, 2025

Latest Posts

-

Unexpected Tv Presenter Absence Host Takes Over

May 03, 2025

Unexpected Tv Presenter Absence Host Takes Over

May 03, 2025 -

Channel Selena Gomez The Perfect High Waisted Suit For A Modern Office Look

May 03, 2025

Channel Selena Gomez The Perfect High Waisted Suit For A Modern Office Look

May 03, 2025 -

Selena Gomezs High Waisted Power Suit 80s Style Inspiration

May 03, 2025

Selena Gomezs High Waisted Power Suit 80s Style Inspiration

May 03, 2025 -

Selena Gomezs Sophisticated High Waisted Suit An 80s Office Dream

May 03, 2025

Selena Gomezs Sophisticated High Waisted Suit An 80s Office Dream

May 03, 2025 -

Cotswolds Mansion Paint Job Lands Daisy May Cooper In Legal Trouble

May 03, 2025

Cotswolds Mansion Paint Job Lands Daisy May Cooper In Legal Trouble

May 03, 2025