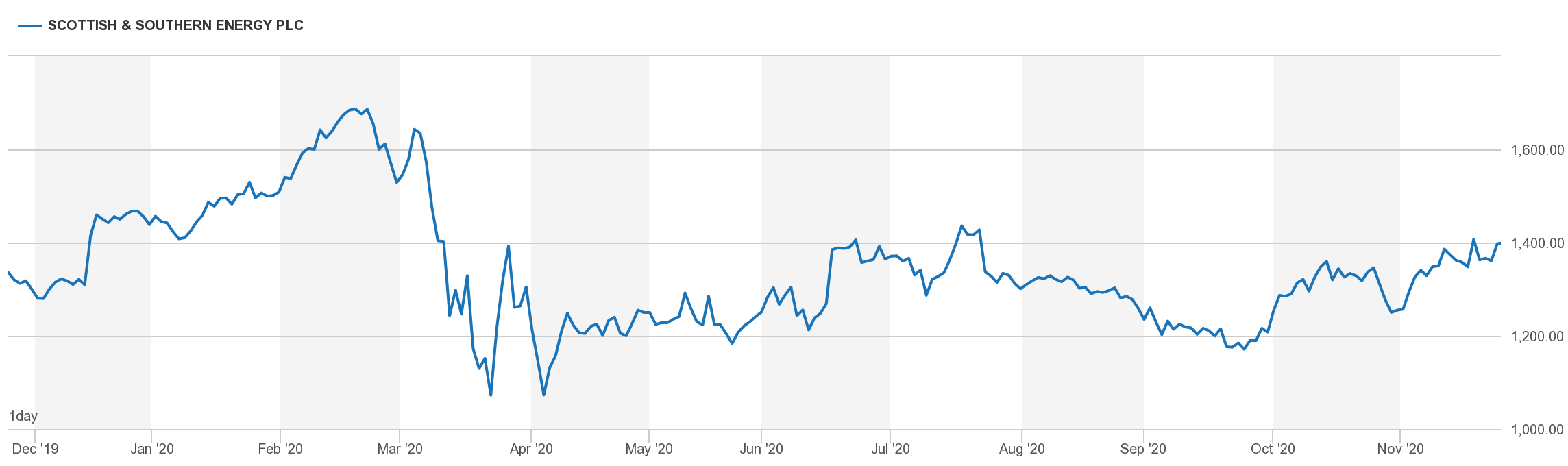

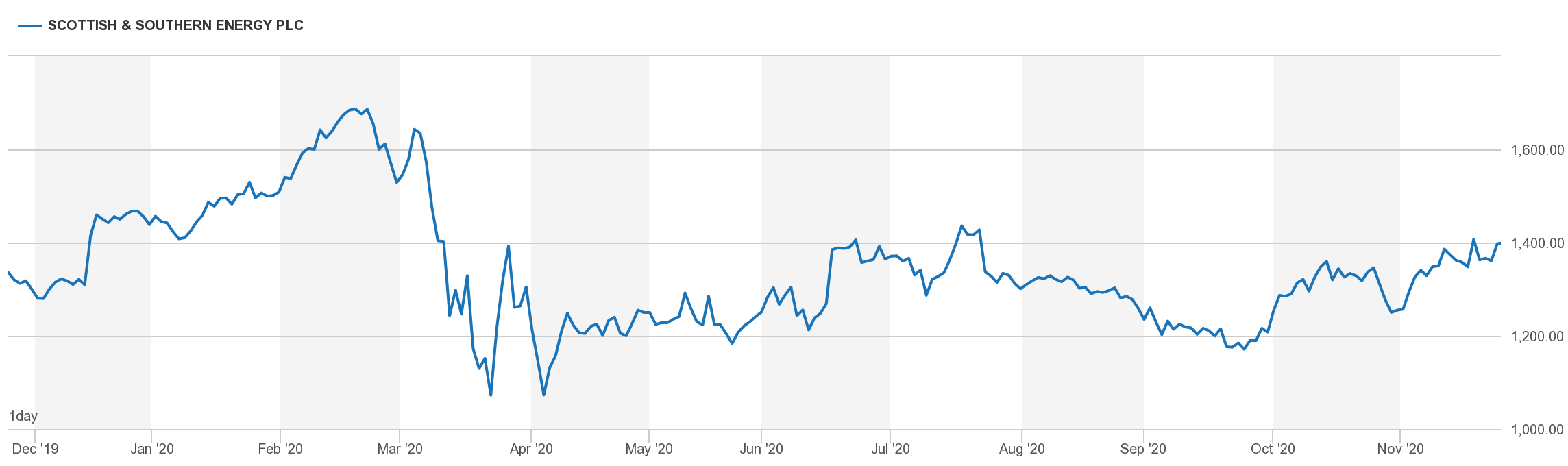

£3 Billion Slash To SSE Spending Plan Due To Slowing Growth

Table of Contents

Reasons Behind the £3 Billion Spending Cut

The decision to slash £3 billion from SSE's spending plan stems from a confluence of factors, each contributing significantly to the company's reassessment of its investment strategy.

Slowing Economic Growth

The UK's slowing economic growth is a primary driver behind SSE's decision. Reduced consumer demand for energy, coupled with already high energy prices, has directly impacted SSE's projected returns on investment (ROI) for new projects.

- Reduced energy consumption: Lower energy consumption translates to lower demand for new energy infrastructure, making large-scale investments less attractive.

- Increased difficulty securing financing: The economic slowdown makes securing favorable financing for large-scale projects significantly more challenging. Lenders are more risk-averse in uncertain economic times.

- Concerns about future profitability: Uncertainty about future energy demand and prices increases the risk associated with large capital expenditures, prompting a more cautious approach to investment.

Increased Uncertainty in the Energy Market

Volatility in global energy markets adds another layer of complexity. Fluctuating fossil fuel prices and the ongoing energy transition create substantial uncertainty for long-term investments in the energy sector.

- Risk associated with renewable energy: Government policies supporting renewable energy can change, creating investment risk for companies like SSE. The fluctuating nature of renewable energy generation also poses challenges.

- Uncertainties surrounding carbon pricing: The future trajectory of carbon pricing mechanisms remains uncertain, impacting the long-term profitability of low-carbon energy projects.

- Increased competition: Intense competition from other energy providers and rapid technological advancements add to the uncertainty, necessitating a more strategic and cautious approach to investment.

Rising Inflation and Interest Rates

The current inflationary environment and significantly higher interest rates have increased the cost of borrowing, making large-scale energy projects less financially viable.

- Increased construction and material costs: Inflation has driven up the cost of materials and labor, impacting the overall cost of new energy projects.

- Higher borrowing costs: The higher interest rates make borrowing money for large-scale projects considerably more expensive, reducing their potential profitability.

- Impact on ROI: The combined effect of inflation and higher interest rates significantly diminishes the projected return on investment for many energy projects, leading to a reassessment of their viability.

Impact of the Spending Cuts on SSE's Future Plans

The £3 billion reduction in SSE's spending plan will have significant ramifications for the company's future activities and strategic direction.

Delayed or Cancelled Projects

The spending cuts will likely lead to delays or outright cancellations of planned renewable energy projects, potentially impacting SSE's commitment to achieving its net-zero targets. While specific projects haven't been publicly named, the impact on the UK's renewable energy infrastructure rollout is undeniable.

- Delayed renewable energy deployment: This could slow the transition to cleaner energy sources and impact the UK's overall decarbonization efforts.

- Impact on employment: Cancellations or delays could lead to job losses within SSE and related supply chains.

Focus Shift on Existing Infrastructure

With reduced investment in new projects, SSE will likely prioritize maintaining and upgrading its existing infrastructure. This will involve a shift in focus towards:

- Grid modernization: Investments in upgrading and modernizing the electricity grid to improve efficiency and reliability.

- Digitalization and smart grid technologies: Implementing smart grid technologies to optimize energy distribution and reduce waste.

- Cost-effective maintenance: Focusing on cost-effective maintenance and repairs to extend the lifespan of existing assets.

Potential Job Losses

Although not explicitly confirmed, the significant reduction in spending could lead to job losses, particularly within SSE's investment and project development teams. This has broader implications for the UK economy and necessitates proactive workforce reskilling and retraining initiatives.

Implications for the Wider Energy Sector

SSE's decision sends a significant signal to the wider UK energy sector, highlighting the challenges and uncertainties facing the industry.

Signal to Other Energy Companies

The £3 billion spending cut by SSE could signal a broader trend of reduced investment across the energy sector, impacting future energy supply and security in the UK.

- Impact on investor confidence: The decision may reduce investor confidence in the energy sector, leading to further investment hesitancy.

- Reduced energy investment: This could lead to a slower transition to cleaner energy sources, potentially increasing the UK's reliance on fossil fuels.

Slowdown in the Energy Transition

The decreased investment in renewable energy projects will likely slow down the UK's transition to a low-carbon energy system, hindering progress toward its net-zero targets. This could lead to:

- Increased carbon emissions: A potential increase in greenhouse gas emissions due to increased reliance on fossil fuels.

- Challenges in meeting climate goals: The slowdown in renewable energy deployment will make it more challenging to meet the UK's ambitious climate goals.

Conclusion

SSE's £3 billion spending cut is a significant development with potentially far-reaching consequences. The confluence of economic slowdown, market uncertainty, and high interest rates has forced a strategic reassessment of investment priorities. This shift towards prioritizing existing infrastructure and potentially delaying or cancelling renewable projects could have wide-ranging implications for jobs, energy security, and the UK's net-zero ambitions. Staying informed about further developments regarding this significant financial decision and its impact on the future of energy in the UK is crucial. Therefore, continue to follow updates on the £3 billion slash to SSE's spending plan and its wider implications for the energy market.

Featured Posts

-

Ooredoo Qatar And Qtspbf Extend Successful Partnership

May 23, 2025

Ooredoo Qatar And Qtspbf Extend Successful Partnership

May 23, 2025 -

Ipl 2025 In Depth Look At Kkr And Rcbs New Player Additions

May 23, 2025

Ipl 2025 In Depth Look At Kkr And Rcbs New Player Additions

May 23, 2025 -

Understanding Kartels Influence On Guyanese Rum Culture

May 23, 2025

Understanding Kartels Influence On Guyanese Rum Culture

May 23, 2025 -

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025 -

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Aries Tauro Geminis

May 23, 2025

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Aries Tauro Geminis

May 23, 2025

Latest Posts

-

Expect Low Gas Prices This Memorial Day Weekend

May 23, 2025

Expect Low Gas Prices This Memorial Day Weekend

May 23, 2025 -

Memorial Day Weekend Gas Prices To Hit Decade Lows

May 23, 2025

Memorial Day Weekend Gas Prices To Hit Decade Lows

May 23, 2025 -

Memorial Day Weekend Gas Prices Lowest In Decades

May 23, 2025

Memorial Day Weekend Gas Prices Lowest In Decades

May 23, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025