3 Financial Blunders Women Often Commit: A Guide To Better Financial Health

Table of Contents

Underestimating the Importance of Retirement Planning

Many women underestimate the importance of early and consistent retirement planning, leading to significant financial challenges later in life. This often stems from a combination of factors impacting women's financial health, including career breaks, lower earning potential, and societal expectations.

Delayed Savings

Delayed retirement savings can have a devastating impact on your long-term financial security. Even a few years of delay can significantly reduce your nest egg due to the power of compound interest.

- Examples of Delayed Savings: Taking extended career breaks for childcare, focusing on family responsibilities over career advancement, or accepting lower-paying jobs perceived as more family-friendly.

- Impact of Delayed Saving: A woman starting retirement savings at 35 instead of 25 will need to save considerably more each month to achieve the same retirement income. Financial calculators can easily demonstrate this impact. Consider seeking professional advice for personalized calculations.

- Catching Up: If you've delayed saving, don't despair! Start saving aggressively now. Consider increasing your contribution percentage to your retirement plan, exploring high-yield savings accounts, or consulting a financial advisor to create a catch-up plan tailored to your specific situation. Keywords: retirement planning for women, women's retirement savings, retirement planning strategies for women, early retirement planning

Ignoring Investment Opportunities

Relying solely on low-yield savings accounts is a common mistake. Diversifying your investments is crucial for building wealth and mitigating risk.

- Types of Investments: Explore various investment options like stocks, bonds, mutual funds, and ETFs, understanding their risk profiles and potential returns. Consider working with a financial advisor to create a diversified portfolio suited to your risk tolerance and financial goals.

- Risk Tolerance Assessment: Determine your comfort level with investment risk. Conservative investors might prefer bonds and low-risk funds, while those with higher risk tolerance can explore stocks and other growth-oriented investments.

- Professional Financial Advice: A qualified financial advisor can help you create a personalized investment strategy aligned with your retirement goals and risk profile. Keywords: women investing, investment strategies for women, investment accounts for women, financial advisors for women

Failing to Negotiate Salary and Benefits

The gender pay gap is a persistent issue significantly impacting women's financial health throughout their lifetimes. Failing to negotiate salary and benefits exacerbates this disparity.

The Gender Pay Gap and its Long-Term Effects

The gender pay gap means women earn less than men for the same work, leading to a significant difference in lifetime earnings and retirement savings.

- Statistics on the Gender Pay Gap: Research consistently shows a persistent gap between men's and women's earnings, varying across industries and career stages.

- Long-Term Financial Implications: This gap compounds over time, affecting retirement savings, ability to purchase a home, and overall financial security.

- Actionable Advice on Salary Negotiation: Research industry salary benchmarks, quantify your achievements, and confidently present your value during salary negotiations. Practice your negotiation skills and be prepared to walk away if your demands aren't met. Keywords: gender pay gap, salary negotiation for women, negotiating salary, women in the workplace, equal pay

Overlooking Benefits Packages

Employer-provided benefits are a valuable part of your compensation package and shouldn't be overlooked.

- Valuable Benefits: Health insurance, retirement plans (401k, pension), paid parental leave, and flexible work arrangements can significantly impact your overall financial well-being.

- Evaluating Benefit Packages: Carefully review your benefits package during job interviews and annual open enrollment periods to fully understand the offerings and maximize their value.

- Resources: Utilize online resources and employee handbooks to understand your benefits fully. Keywords: employee benefits, health insurance, retirement plans, paid leave, women's benefits

Not Prioritizing Financial Literacy and Education

A lack of financial knowledge can hinder your ability to make sound financial decisions.

The Importance of Financial Knowledge

Financial literacy empowers women to manage their finances effectively, make informed investment choices, and plan for their financial future.

- Resources for Learning: Utilize online courses, workshops, books, and reputable financial websites to enhance your knowledge of budgeting, investing, and debt management.

- Budgeting Tips: Create a realistic budget that tracks your income and expenses, identifies areas for savings, and helps you manage your debt effectively.

- Debt Management Strategies: Develop strategies to pay off high-interest debt and avoid accumulating further debt. Understand credit scores and their impact on your borrowing ability. Keywords: financial literacy for women, women's financial education, personal finance tips for women, budgeting, debt management, credit score

Seeking Professional Financial Advice

Seeking advice from a qualified financial advisor can provide invaluable support in navigating complex financial matters.

- Benefits of Professional Advice: Financial advisors offer personalized guidance, helping you develop a comprehensive financial plan tailored to your individual needs and goals.

- Finding a Reputable Advisor: Research advisors carefully, verifying their credentials and experience. Look for certified financial planners (CFPs) or other qualified professionals.

- Questions to Ask: Prepare a list of questions to ask potential advisors, ensuring their approach aligns with your values and financial goals. Keywords: financial advisor for women, financial planning for women, financial advice for women, women's financial planning

Conclusion

We've explored three significant financial blunders women often make: underestimating retirement planning, failing to negotiate salary and benefits, and neglecting financial literacy. These mistakes can have profound long-term consequences, impacting your financial security and overall well-being. The key takeaways are to proactively engage in financial planning, acquire financial knowledge, and address the unique financial challenges women face.

Avoid these common financial blunders women make and take control of your financial future. Start building a stronger financial future by understanding and addressing these key financial blunders women often commit. Begin by reviewing your retirement savings, negotiating your salary, and seeking further financial education – even small steps can make a significant difference. Take advantage of the numerous resources available to support your journey toward greater financial health and independence. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Occasionmarkt Bloeit Abn Amro Ziet Forse Groei In Autoverkopen

May 22, 2025

Occasionmarkt Bloeit Abn Amro Ziet Forse Groei In Autoverkopen

May 22, 2025 -

Ev Mandate Opposition Car Dealers Push Back

May 22, 2025

Ev Mandate Opposition Car Dealers Push Back

May 22, 2025 -

Lazio And Juventus Draw In Tense Serie A Match

May 22, 2025

Lazio And Juventus Draw In Tense Serie A Match

May 22, 2025 -

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionmarkt En De Rol Van Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionmarkt En De Rol Van Autobezit

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025 -

Used Car Dealership Fire Crews On Scene

May 22, 2025

Used Car Dealership Fire Crews On Scene

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

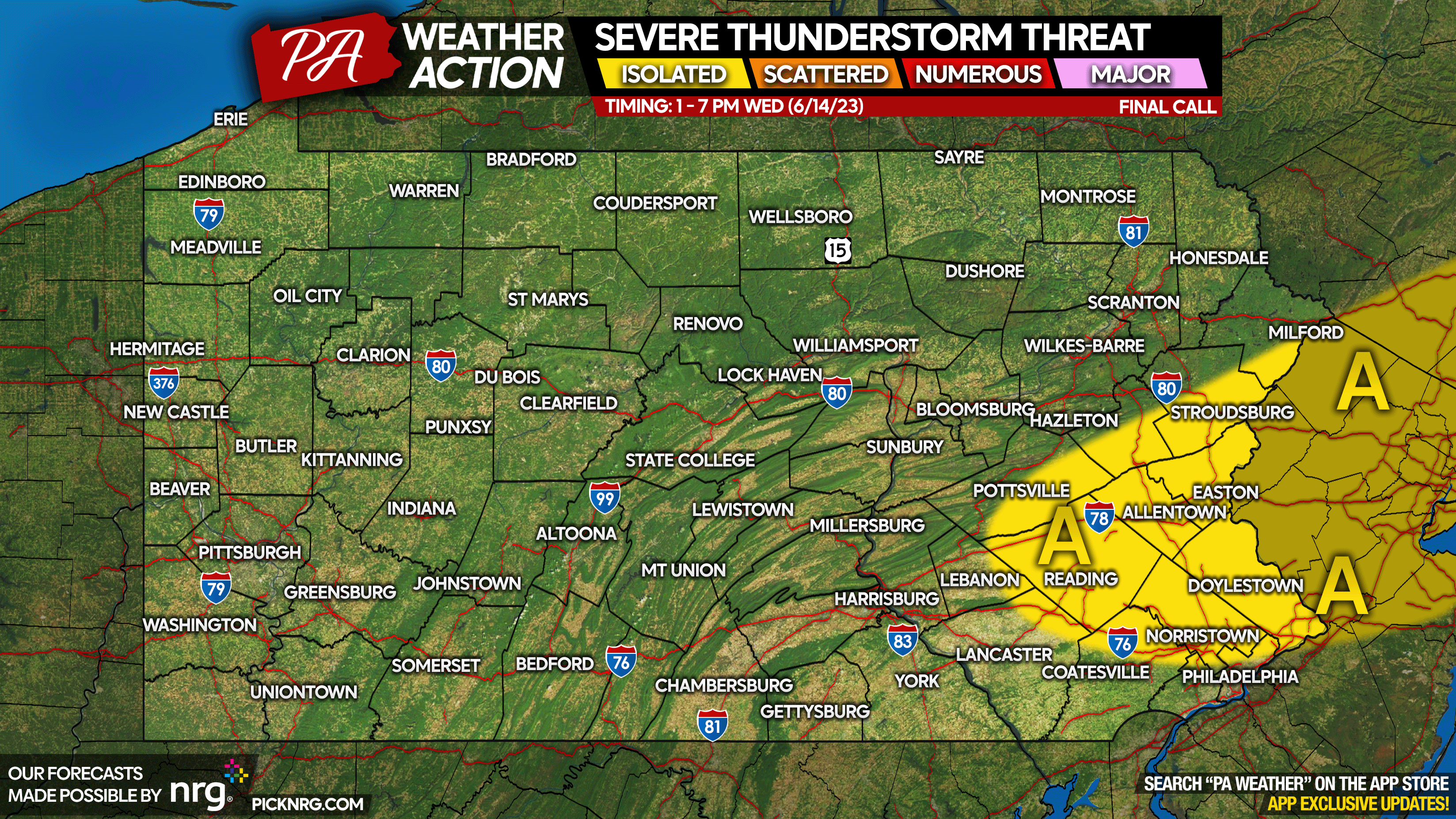

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025