3%+ S&P 500 Gain: Positive Impact Of US-China Trade Deal

Table of Contents

Reduced Trade Tensions and Increased Investor Confidence

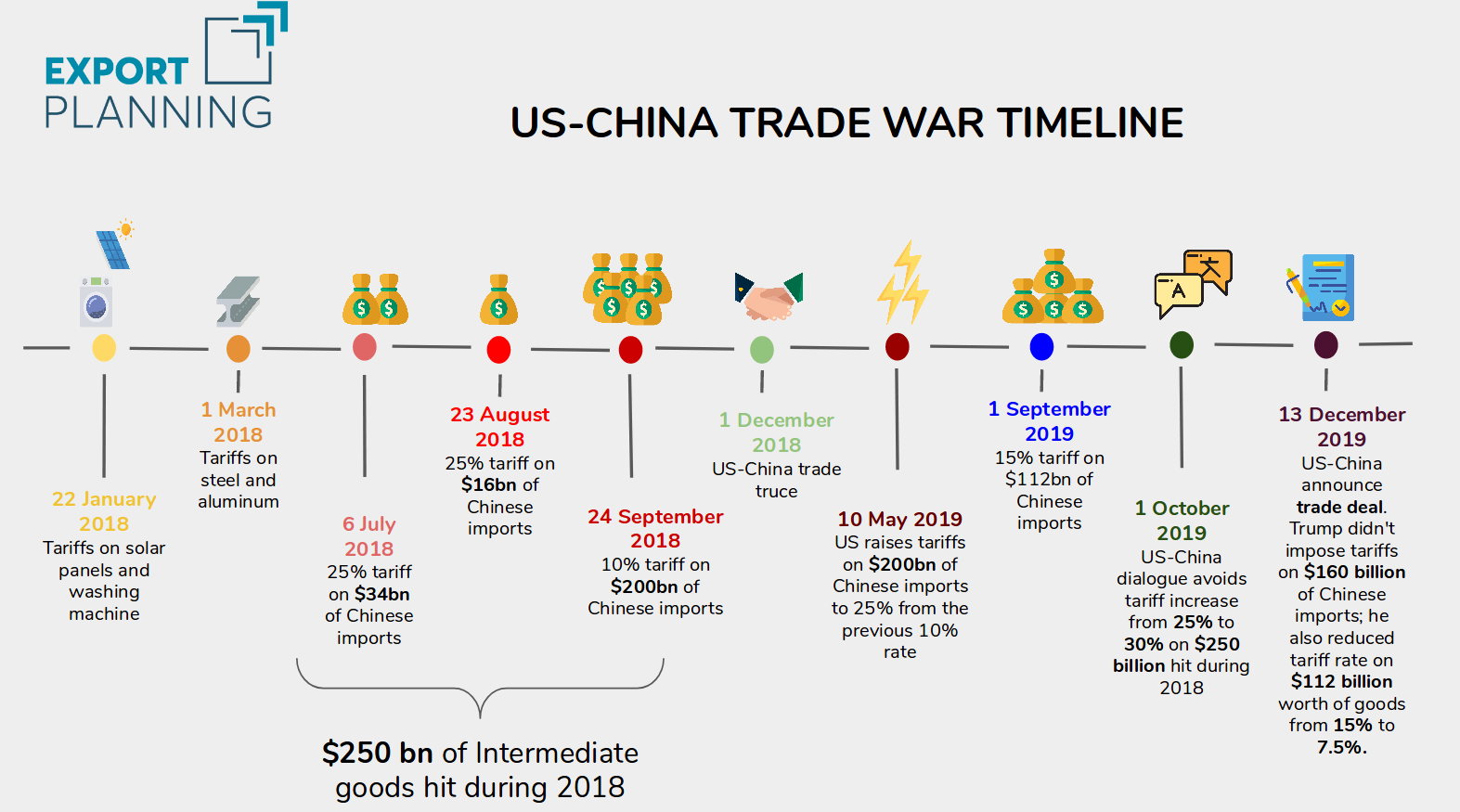

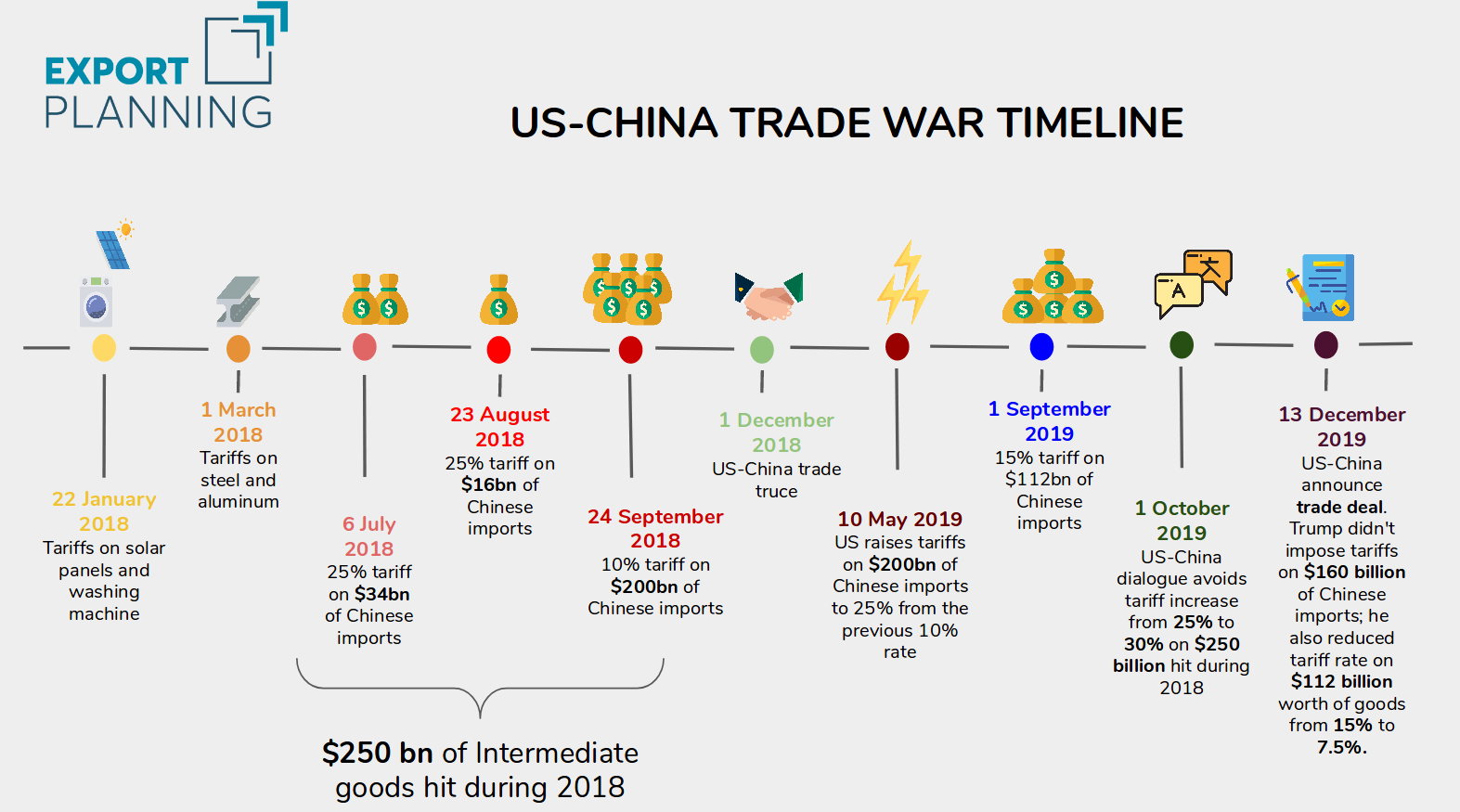

The US-China trade war had cast a long shadow over the global economy, creating uncertainty and hindering investment. The trade deal, by significantly reducing tariffs and fostering a more predictable trade environment, eased these tensions. This, in turn, boosted investor confidence, leading to increased investment in the US stock market.

- Lower tariffs: Decreased import costs for US businesses translate to higher profit margins and increased competitiveness.

- Improved predictability: Businesses can now plan long-term strategies with greater confidence, leading to increased investment in expansion and job creation.

- Reduced geopolitical risk: A more stable US-China relationship makes the US market more attractive to foreign investors, leading to increased foreign direct investment (FDI). Studies show a marked increase in FDI following the signing of the trade deal. For example, [cite a relevant source with data on FDI increase].

- Increased consumer spending: Lower prices due to reduced tariffs lead to higher disposable income for consumers, fueling increased spending and further stimulating economic growth.

Stimulus to Specific Sectors of the S&P 500

The positive effects of the US-China trade deal weren't uniform across all sectors. Certain sectors experienced a disproportionately positive impact.

- Technology: The deal eased concerns about intellectual property theft and facilitated technology collaboration, benefiting major tech companies listed on the S&P 500. [Cite specific examples of technology companies and their stock performance].

- Agriculture: Increased access to the vast Chinese market led to a surge in agricultural exports, benefiting companies involved in agricultural production and distribution. For example, [cite a specific agricultural company and its sales increase to China].

- Manufacturing: Reduced tariffs on imported components and intermediate goods significantly lowered production costs for many manufacturers, boosting profitability and driving stock prices higher.

Broader Economic Growth and its Ripple Effect on the S&P 500

The benefits of the US-China trade deal extend far beyond the stock market. The deal contributed to positive macroeconomic changes, creating a ripple effect that further boosted the S&P 500.

- Increased GDP growth: Increased trade and investment fueled significant GDP growth, a key driver of stock market performance. [Cite data supporting GDP growth post-trade deal].

- Job creation: Sectors impacted by the deal experienced a surge in job creation, further contributing to positive consumer sentiment and increased spending.

- Improved consumer sentiment: Greater economic certainty and job security boosted consumer confidence, leading to higher spending and driving overall economic growth.

- Positive impact on global supply chains: The deal improved the stability and efficiency of global supply chains, reducing disruptions and benefitting businesses across various sectors.

Potential Long-Term Implications for the S&P 500

While the immediate impact of the US-China trade deal on the S&P 500 has been overwhelmingly positive, it's crucial to consider potential long-term implications.

- Geopolitical instability: Future geopolitical tensions or unexpected shifts in US-China relations could undermine the deal's positive effects.

- Economic slowdown: A global economic slowdown could dampen the positive effects of the trade deal on the S&P 500.

- Further positive impacts: Successful implementation of the trade deal and continued cooperation between the US and China could lead to further positive impacts on the S&P 500 in the long term. [Include expert predictions or market analysis to support this point].

Conclusion: Capitalizing on the Positive Impact of the US-China Trade Deal on the S&P 500

The US-China trade deal has had a demonstrably positive effect on the S&P 500, contributing to a significant 3%+ gain. This positive impact stems from reduced trade tensions, increased investor confidence, sector-specific boosts, and broader economic growth. Understanding these factors is crucial for investors seeking to capitalize on future opportunities. To learn more about investing in the S&P 500 and capitalizing on future opportunities related to US-China trade relations, explore resources on S&P 500 investment strategies and the impact of US-China trade relations on market analysis. Stay informed on market trends and consider consulting a financial advisor to develop a comprehensive investment strategy.

Featured Posts

-

Serie A 2025 Atalanta Vs Lazio Cuando Y Donde Ver El Partido En Vivo

May 13, 2025

Serie A 2025 Atalanta Vs Lazio Cuando Y Donde Ver El Partido En Vivo

May 13, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness Shares Her Story

May 13, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness Shares Her Story

May 13, 2025 -

Gotovnost K Dialogu Britaniya Predlagaet Es Obsudit Bezopasnost

May 13, 2025

Gotovnost K Dialogu Britaniya Predlagaet Es Obsudit Bezopasnost

May 13, 2025 -

Atalanta Vs Bologna En Vivo Serie A Fecha 32 Minuto A Minuto

May 13, 2025

Atalanta Vs Bologna En Vivo Serie A Fecha 32 Minuto A Minuto

May 13, 2025 -

Cassie Venturas Mob Land Premiere Photos Of Pregnant Celebrity Couple

May 13, 2025

Cassie Venturas Mob Land Premiere Photos Of Pregnant Celebrity Couple

May 13, 2025