$40-$50 Oil: Goldman Sachs Analyzes Trump's Public Statements

Table of Contents

Goldman Sachs' Methodology and Data Sources

Goldman Sachs, a leading global investment bank, employs rigorous methods to analyze market trends. Their assessment of former President Trump's impact on oil prices likely involved a multifaceted approach incorporating various data sources and statistical models. Understanding their methodology is crucial to evaluating the validity of their conclusions.

-

Data Sources Used: Goldman Sachs' analysis likely drew upon a range of sources, including:

- Government reports from the EIA (Energy Information Administration) and OPEC.

- Market data from exchanges like the NYMEX (New York Mercantile Exchange).

- News articles and transcripts of President Trump's public addresses.

- Internal Goldman Sachs market data and trading information.

-

Statistical Models Employed: Sophisticated econometric models, potentially incorporating time series analysis and regression techniques, would have been used to identify correlations between Trump's statements and oil price movements. These models attempt to isolate the influence of his pronouncements from other market-moving factors.

-

Specific Timeframes Considered: The analysis likely focused on a specific period encompassing Trump's presidency and significant oil price fluctuations, allowing for a comparative analysis of his statements and market reactions.

-

Potential Biases and Limitations: It's important to acknowledge potential limitations. Any analysis is susceptible to biases. Goldman Sachs' own trading positions could indirectly influence their interpretations. Furthermore, isolating the impact of one factor (Trump's statements) from a complex web of geopolitical and economic variables is inherently challenging.

Trump's Relevant Public Statements on Oil

Former President Trump frequently made public statements about oil production, prices, and energy policy. These statements, often delivered via Twitter or press conferences, had the potential to influence market sentiment. Understanding the content and context of these pronouncements is vital to assessing their market impact.

-

Specific Comments Relating to OPEC: Trump often criticized OPEC's production policies, suggesting that they were artificially inflating oil prices. For example, he once tweeted, "[Quote about OPEC needing to increase oil production – replace with an actual quote if one is available]". Such statements could signal a potential policy shift, impacting investor expectations.

-

References to Domestic Oil Production: Trump consistently championed increased domestic oil production in the United States, aiming for "energy independence." Statements encouraging shale oil production could influence investment decisions in the energy sector.

-

Statements about Energy Independence: Trump's rhetoric on energy independence implied a reduced reliance on foreign oil, potentially impacting the global oil market's supply and demand dynamics. This could influence investor confidence and trading strategies.

The timing of these statements also played a role. Statements made during periods of market uncertainty could amplify their effect on oil prices.

Goldman Sachs' Interpretation of Trump's Impact on Oil Prices

Goldman Sachs' analysis likely aimed to quantify the correlation (or lack thereof) between Trump’s statements and the actual movements of oil prices in the $40-$50 range.

-

Direct Quotes from Goldman Sachs' Reports: [Insert direct quotes from relevant Goldman Sachs reports on this topic, if available. If not, explain their findings in detail].

-

Specific Examples of Market Reactions: The analysis might have highlighted specific instances where Trump's statements caused observable shifts in oil futures contracts or spot prices. For example, a sharp price drop immediately following a negative comment on OPEC could be cited as evidence.

-

Mention of Market Manipulation or Speculation: The report might have assessed the potential for Trump's statements to contribute to market manipulation or speculation. This is crucial, as deliberate attempts to influence prices can distort market signals.

-

Economic Impact Assessed: Goldman Sachs would have likely assessed the broader economic consequences stemming from these price fluctuations, considering the effects on inflation, consumer spending, and overall economic growth.

Alternative Perspectives and Criticisms

While Goldman Sachs' analysis offers valuable insights, it's crucial to consider alternative viewpoints and potential criticisms. Attributing oil price fluctuations solely to presidential statements overlooks other influential factors.

-

Geopolitical Events and Their Effect: Geopolitical instability in oil-producing regions, sanctions, and international conflicts significantly impact oil supply and therefore prices. These events often overshadow the impact of political rhetoric.

-

Global Demand Fluctuations: Changes in global economic growth, industrial activity, and transportation demand influence oil consumption, creating price volatility independent of political statements.

-

OPEC's Role and Policies: OPEC's production quotas and decisions profoundly affect the global oil supply and price stability. These decisions are often influenced by factors beyond the control of any single nation's leader.

A balanced assessment requires acknowledging the limitations of any single analysis and considering the interplay of multiple factors shaping the complex dynamics of the oil market.

Conclusion

Goldman Sachs' analysis of former President Trump's public statements and their potential impact on the $40-$50 oil price range provides valuable insights into the relationship between political rhetoric and commodity markets. Their methodology, encompassing diverse data sources and statistical models, offers a structured approach. However, it's crucial to acknowledge the inherent limitations in isolating the impact of political statements from the numerous other factors influencing oil prices. The interplay of geopolitical events, global demand, and OPEC policies creates a complex environment where attributing price movements to a single source is inherently challenging.

Call to Action: Stay informed about the latest analyses on oil prices and market trends. Continue to monitor expert opinions from institutions like Goldman Sachs to better understand the complex dynamics of the $40-$50 oil price range and its broader impact on the global economy. Further research into the impact of political rhetoric on commodity prices is essential for informed investment decisions in the energy sector. Understanding the interplay between political statements and the various other factors affecting oil prices is crucial for navigating this volatile market.

Featured Posts

-

Bolee 200 Raket I Bespilotnikov Masshtabnaya Ataka Rossii Na Ukrainu

May 16, 2025

Bolee 200 Raket I Bespilotnikov Masshtabnaya Ataka Rossii Na Ukrainu

May 16, 2025 -

Jalen Brunsons Absence A Deeper Look At The Knicks Offensive Woes

May 16, 2025

Jalen Brunsons Absence A Deeper Look At The Knicks Offensive Woes

May 16, 2025 -

Did Jimmy Butler Need Help Against The Miami Heat

May 16, 2025

Did Jimmy Butler Need Help Against The Miami Heat

May 16, 2025 -

Giant Sea Wall Kolaborasi Pemerintah Dan Swasta Untuk Perlindungan Pesisir

May 16, 2025

Giant Sea Wall Kolaborasi Pemerintah Dan Swasta Untuk Perlindungan Pesisir

May 16, 2025 -

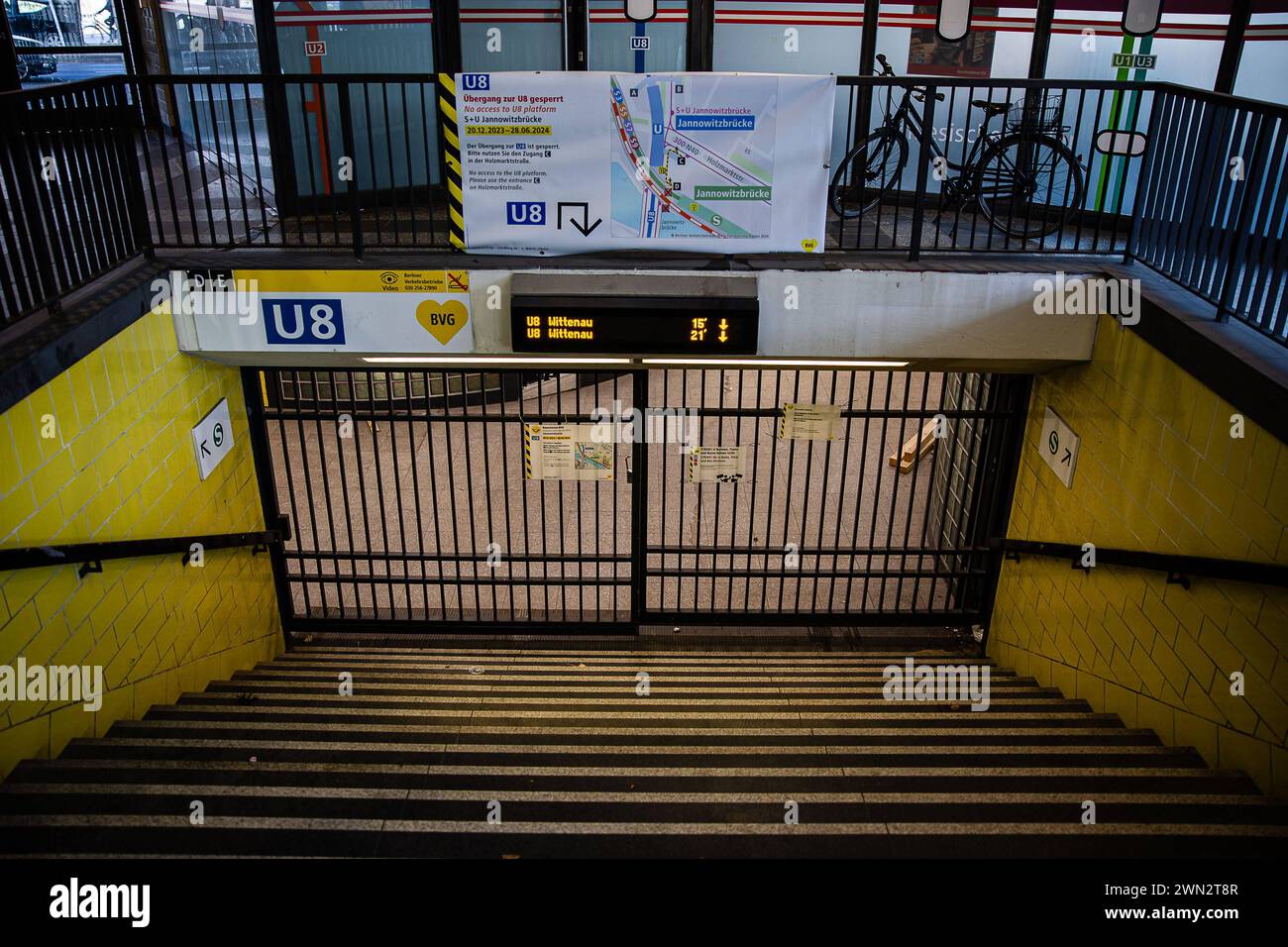

Public Transport Update Bvg Strike Over S Bahn Issues Remain

May 16, 2025

Public Transport Update Bvg Strike Over S Bahn Issues Remain

May 16, 2025