400% XRP Price Jump: Smart Investment Or Risky Gamble?

Table of Contents

The cryptocurrency market is known for its volatility, and XRP, Ripple's native token, recently experienced a dramatic 400% price jump. This significant surge has sparked intense debate: is this a smart investment opportunity or a risky gamble? This article delves into the factors behind this price increase and explores the potential implications for investors. We'll weigh the pros and cons to help you determine if XRP aligns with your risk tolerance and investment goals.

Factors Driving the 400% XRP Price Surge

Several factors contributed to XRP's astonishing price increase. Understanding these factors is crucial for assessing its future potential.

Ripple's Legal Victory

The partial victory for Ripple in its legal battle against the Securities and Exchange Commission (SEC) significantly boosted investor confidence.

- The court ruling clarified that XRP sales on certain exchanges were not securities, reducing regulatory uncertainty.

- This positive development led to increased market sentiment and a surge in buying pressure, driving up the price.

- [Link to relevant news article 1]

- [Link to relevant news article 2]

However, it's crucial to note that the legal battle isn't entirely over. Ongoing uncertainty remains, and future regulatory actions could still impact XRP's price. The ruling was a partial victory, not a complete exoneration.

Increased Institutional Interest

Growing institutional interest in cryptocurrencies, including XRP, played a crucial role in the price surge.

- Several large financial institutions are exploring the use of XRP for cross-border payments due to its speed and efficiency.

- Increased institutional adoption often signifies greater market maturity and stability, attracting more investors.

- [Cite relevant data or reports on institutional XRP adoption]

This influx of institutional capital can significantly impact the price, particularly in a market driven by supply and demand.

Market Speculation and FOMO (Fear of Missing Out)

Market speculation and FOMO significantly amplified XRP's price rise.

- Rapid price increases often trigger a "fear of missing out" (FOMO) mentality among investors, leading to further buying.

- This speculative buying pressure can create a self-fulfilling prophecy, driving the price even higher in a short period.

- The rapid increase itself became a catalyst, attracting more speculative traders.

It's crucial to understand that FOMO-driven investment decisions can be highly risky and often lead to losses when the bubble bursts.

Potential Risks Associated with Investing in XRP

Despite the recent price surge, investing in XRP carries significant risks. It's crucial to acknowledge these risks before making any investment decisions.

Regulatory Uncertainty

Regulatory uncertainty remains a significant challenge for XRP and the cryptocurrency market as a whole.

- Different jurisdictions have varying regulations regarding cryptocurrencies, creating complexities for investors.

- Future regulatory changes, including potential stricter regulations or outright bans, could drastically impact XRP's price.

- This uncertainty creates volatility and makes long-term investment planning difficult.

Ongoing legal battles and changing regulatory landscapes make XRP a high-risk investment.

Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Sharp price fluctuations are common, and significant losses can occur quickly.

- The price of XRP can be influenced by various factors, including news events, market sentiment, and technological developments.

- This volatility makes it unsuitable for risk-averse investors.

Investors must have a high risk tolerance to withstand potential significant price drops.

Technological Risks

While Ripple's technology is generally considered robust, technological risks are always present.

- Security vulnerabilities in the XRP Ledger or the Ripple network could negatively impact the price.

- Competition from other cryptocurrencies and blockchain technologies could also affect XRP's long-term prospects.

Weighing the Risks and Rewards: Is XRP a Smart Investment?

Determining whether XRP is a smart investment depends on your individual risk tolerance and investment goals.

Risk Tolerance and Investment Goals

Before investing in XRP, carefully consider your risk tolerance and investment goals.

- XRP is a high-risk, high-reward investment. Only invest what you can afford to lose.

- Diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

Understanding your risk profile is crucial for making informed investment decisions.

Long-Term vs. Short-Term Investment Strategy

Your investment strategy (long-term or short-term) will significantly influence your approach to XRP.

- Long-term investors may view the recent price surge as a buying opportunity, betting on XRP's long-term potential.

- Short-term traders might focus on exploiting short-term price fluctuations for quick profits, but this carries significant risk.

A long-term strategy requires patience and a tolerance for volatility, while short-term trading requires market expertise.

Comparing XRP to Other Cryptocurrencies

Comparing XRP to other cryptocurrencies is essential before making any investment decisions.

- Consider XRP's market capitalization, trading volume, and technological advantages compared to other cryptocurrencies like Bitcoin or Ethereum.

- Assess the potential growth prospects of XRP in relation to its competitors.

Conclusion

The 400% XRP price jump is undoubtedly impressive, fueled by Ripple's legal progress, increased institutional interest, and market speculation. However, this dramatic increase doesn't guarantee future success. The inherent volatility of the cryptocurrency market, combined with ongoing regulatory uncertainty, makes XRP a high-risk investment. Investing in XRP after its recent price jump requires careful consideration of its inherent volatility and the ongoing regulatory uncertainty. Before making any investment decisions regarding XRP or other cryptocurrencies, conduct thorough research and consult with a financial advisor to determine if it aligns with your risk tolerance and investment objectives. Remember, always invest responsibly and only what you can afford to lose in the volatile world of XRP and cryptocurrency investments.

Featured Posts

-

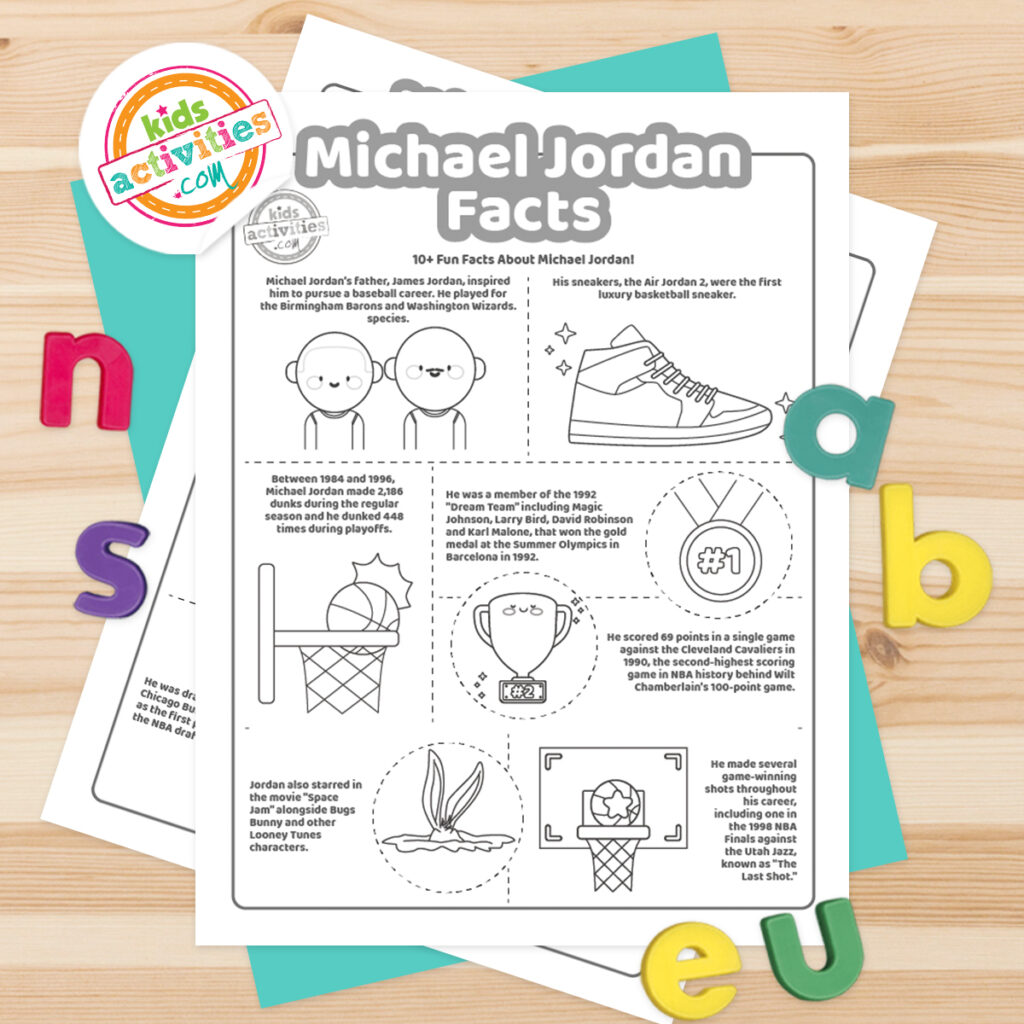

The Essential Michael Jordan Fast Facts

May 01, 2025

The Essential Michael Jordan Fast Facts

May 01, 2025 -

Six Nations Italys Defeat Irelands Warning

May 01, 2025

Six Nations Italys Defeat Irelands Warning

May 01, 2025 -

21 Point Game Sets Up Colorados Matchup Against Texas Tech

May 01, 2025

21 Point Game Sets Up Colorados Matchup Against Texas Tech

May 01, 2025 -

Nrc Reactor Power Uprate A Strategic Approach To Project Success

May 01, 2025

Nrc Reactor Power Uprate A Strategic Approach To Project Success

May 01, 2025 -

Ziaire Williams Nba Redemption Hard Work And Improved Performance

May 01, 2025

Ziaire Williams Nba Redemption Hard Work And Improved Performance

May 01, 2025

Latest Posts

-

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025 -

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025 -

Dallas Icon Passes Away At The Age Of 100

May 01, 2025

Dallas Icon Passes Away At The Age Of 100

May 01, 2025 -

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025