47% Spike In India's Real Estate Investments: Q1 2024 Report

Table of Contents

Key Drivers of the 47% Surge in Indian Real Estate Investments

Several interconnected factors contributed to the extraordinary 47% increase in India real estate investment during Q1 2024. Understanding these drivers is crucial for navigating the current market landscape and anticipating future trends in the Indian property market.

Reduced Interest Rates and Government Incentives

Lower interest rates on home loans have played a pivotal role in boosting affordability and driving demand. Coupled with various government schemes aimed at promoting affordable housing, this has made homeownership more accessible to a wider segment of the population.

- Specific government schemes: The Pradhan Mantri Awas Yojana (PMAY), for instance, has significantly impacted affordability by providing subsidies and financial assistance to eligible individuals.

- Effect on affordability: Lower interest rates have reduced monthly mortgage payments, making it easier for potential homebuyers to qualify for loans.

- Impact on mortgage rates: The decrease in interest rates has led to a substantial reduction in mortgage rates, further stimulating demand. This positive effect is visible across the spectrum of home loan interest rates India. The government's commitment to affordable housing schemes India has clearly had a significant positive impact on the market.

Increased Disposable Incomes and Urbanization

India's burgeoning middle class, coupled with rapid urbanization, has fueled a significant increase in demand for residential and commercial properties.

- Growth in middle class: The expanding middle class has increased purchasing power, leading to greater demand for better housing and lifestyle options.

- Migration to urban centers: Continued migration from rural areas to urban centers is creating a consistently high demand for residential properties in major metropolitan areas. This trend is significantly impacting real estate demand India.

- Increased demand for residential and commercial properties: This increased demand spans both residential and commercial real estate, creating opportunities across various property segments. Urbanization in India continues to be a major driver of this demand and the growth in disposable income India further fuels this trend.

Improved Infrastructure and Connectivity

Significant investments in infrastructure development across India, including improved road networks, metro systems, and airports, are enhancing real estate values and attracting investments.

- Examples of major infrastructure projects: The expansion of metro rail networks in major cities, the development of new highways, and the modernization of airports are all contributing factors.

- Their impact on specific real estate markets: Improved connectivity has increased the desirability and value of properties in previously less accessible areas.

- Increase in property values: The enhanced infrastructure has led to a noticeable increase in property values in areas benefiting from these projects. This positive trend is boosting real estate infrastructure and impacting connectivity impact real estate.

Regional Variations in Real Estate Investment Growth

While the overall growth in real estate investment India is impressive, regional variations exist. Some areas have experienced far more substantial growth than others.

Top Performing Cities

Several Indian cities witnessed exceptionally high growth in real estate investment during Q1 2024.

- Specific cities: Mumbai, Bangalore, and Delhi NCR remain top performers, consistently attracting significant investments.

- Reasons for their high growth: Strong economic activity, a large pool of potential buyers, and robust infrastructure development contribute to this high growth.

- Investment trends: Investment trends in these cities indicate a preference for luxury apartments and commercial properties. The markets of Mumbai real estate, Bangalore real estate, and Delhi NCR real estate are among the most dynamic in the country. These are consistently ranked amongst the top performing cities real estate India.

Emerging Markets with High Potential

Beyond the major metropolitan areas, several emerging markets show significant potential for future growth.

- Specific cities or regions: Tier-2 and Tier-3 cities are increasingly attracting investor attention due to their affordability and growth potential.

- Factors contributing to their growth potential: These cities are benefiting from improving infrastructure, increasing employment opportunities, and a rising middle class.

- Investment outlook: These emerging markets present attractive investment opportunities for those willing to take a slightly higher risk. The emerging real estate markets India offer significant potential for high returns, although they also carry higher risk. These areas show high growth potential real estate.

Future Outlook for India's Real Estate Market

The future of India's real estate market looks bright, with continued growth predicted for the coming years. However, potential challenges and opportunities exist.

Predictions and Forecasts

Experts predict continued growth in the Indian real estate market throughout 2024 and beyond, although several factors could influence the pace of expansion.

- Expert opinions: Most experts foresee continued positive growth, but caution against potential headwinds.

- Market predictions: Predictions vary depending on the segment and location, but overall positive growth is anticipated.

- Potential risks: Inflation and potential interest rate hikes are potential risks that could slow down growth.

- Opportunities in specific sectors: Opportunities remain strong in affordable housing and commercial real estate. The India real estate market forecast is positive, although informed investment is key to navigate potential risks. The future of real estate India looks promising.

Investment Strategies and Recommendations

For investors, careful due diligence and a well-defined strategy are essential for success in the Indian real estate market.

- Due diligence recommendations: Thorough research, professional advice, and legal counsel are crucial.

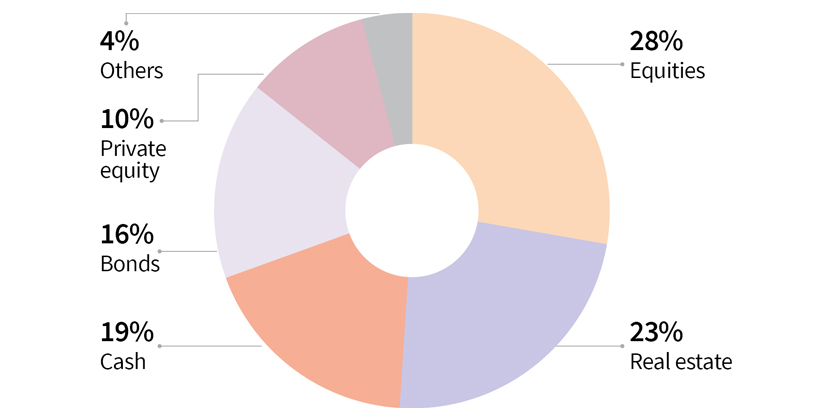

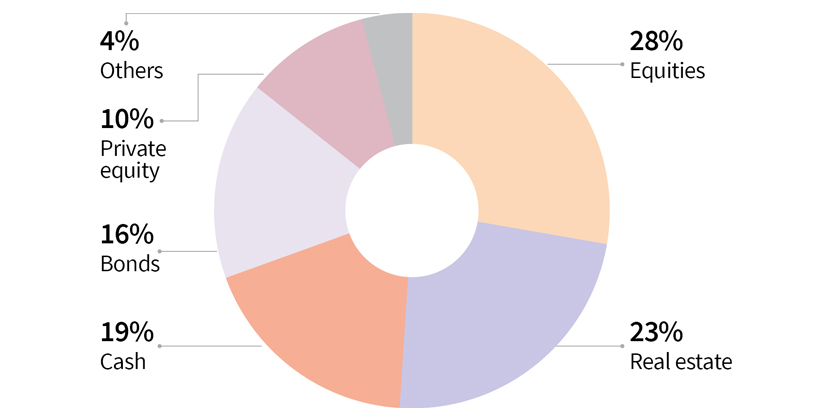

- Risk mitigation strategies: Diversification across different property types and locations is recommended.

- Potential investment opportunities: Affordable housing and commercial real estate offer promising investment opportunities.

- Diversification strategies: Spreading investments across different geographic locations and property types is a prudent approach. Successful real estate investment strategies India prioritize diversification and thorough research. This is key to accessing the best real estate investment opportunities India. Seeking professional real estate investment advice India is a recommended step.

Conclusion: Capitalize on the Booming Indian Real Estate Market

The 47% surge in India real estate investment during Q1 2024 marks a significant milestone. This remarkable growth is driven by a confluence of factors, including reduced interest rates, government initiatives, increased disposable incomes, urbanization, and improved infrastructure. While potential challenges exist, the overall outlook for the India real estate market remains positive. The real estate investment outlook is strong, with numerous opportunities for those who conduct thorough due diligence and adopt appropriate strategies. Invest wisely in India's booming real estate market. Explore opportunities and secure your future!

Featured Posts

-

The Trump Family A Comprehensive Genealogy

May 17, 2025

The Trump Family A Comprehensive Genealogy

May 17, 2025 -

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025 -

El Colapso De Koriun Inversiones El Impacto De Su Esquema Ponzi

May 17, 2025

El Colapso De Koriun Inversiones El Impacto De Su Esquema Ponzi

May 17, 2025 -

New York Daily News Back Pages May 2025 Archive

May 17, 2025

New York Daily News Back Pages May 2025 Archive

May 17, 2025 -

Nbas No Call Controversy Pistons Game 4 Loss And The Aftermath

May 17, 2025

Nbas No Call Controversy Pistons Game 4 Loss And The Aftermath

May 17, 2025

Latest Posts

-

La Lakers In Depth Analysis And News From Vavel

May 17, 2025

La Lakers In Depth Analysis And News From Vavel

May 17, 2025 -

Stay Updated On The La Lakers With Vavel United States

May 17, 2025

Stay Updated On The La Lakers With Vavel United States

May 17, 2025 -

La Lakers Coverage Game Recaps Player Stats And More From Vavel Us

May 17, 2025

La Lakers Coverage Game Recaps Player Stats And More From Vavel Us

May 17, 2025 -

Doctor Who Christmas Special Future Uncertain

May 17, 2025

Doctor Who Christmas Special Future Uncertain

May 17, 2025 -

Alan Carr And Amanda Holdens Stunning Spanish Townhouse Now On The Market

May 17, 2025

Alan Carr And Amanda Holdens Stunning Spanish Townhouse Now On The Market

May 17, 2025