5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about building meaningful relationships that can lead to opportunities.

Leverage LinkedIn:

Actively engage with private credit professionals on LinkedIn. This platform is a goldmine for connecting with potential employers and industry leaders.

- Personalize your connection requests: Avoid generic messages. Mention something specific about their profile or experience that resonates with you.

- Share insightful content: Post articles, comments, or analyses related to private credit investing, market trends, and relevant news. This positions you as a knowledgeable professional.

- Attend virtual and in-person industry events: Many LinkedIn groups host virtual events. Actively participate and network with attendees. In-person conferences offer even greater networking potential.

Attend Industry Conferences and Events:

Private credit conferences and workshops offer unparalleled networking opportunities. These events bring together key players from across the industry.

- Prepare talking points: Highlight your skills, experience, and career aspirations. Be ready to articulate your value proposition concisely.

- Actively seek out conversations: Don't be shy! Approach senior professionals and introduce yourself. Engage in meaningful conversations, showing your genuine interest.

- Follow up: After the event, send personalized emails to valuable contacts, reiterating your interest and sharing any relevant resources.

Informational Interviews:

Reach out to professionals in private credit for informational interviews. These informal conversations are invaluable for learning about career paths, gaining insights, and making connections.

- Be respectful of their time: Keep your requests concise and focused. Clearly state your purpose and the value you hope to gain.

- Prepare thoughtful questions: Research the individual beforehand and tailor your questions to their experience and expertise.

- Express gratitude: Always thank them for their time and insights. Consider sending a thank-you note or email.

DO: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Generic applications rarely succeed in a competitive market like private credit. Each application should be meticulously tailored to the specific requirements of the job description.

Keyword Optimization:

Incorporate relevant keywords from job descriptions into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a relevant match. Examples include: "structured credit," "direct lending," "distressed debt," "private debt," "credit analysis," "financial modeling," and "portfolio management."

- Use a consistent and professional format: Choose a clean and easy-to-read template.

- Quantify your accomplishments: Use numbers and data to demonstrate the impact of your work (e.g., "Increased portfolio returns by 15%").

- Highlight transferable skills: Even if your background isn't directly in private credit, emphasize skills applicable to the role (e.g., financial analysis, problem-solving, communication).

Showcase Relevant Experience:

Emphasize experience in areas directly related to private credit, such as financial modeling, credit analysis, portfolio management, or legal work related to private debt.

- Tailor each application: Customize your resume and cover letter to highlight the skills and experiences most relevant to each specific job description.

- Use action verbs: Start your bullet points with strong action verbs (e.g., "managed," "analyzed," "developed").

- Focus on results and impact: Quantify your accomplishments and demonstrate how your contributions added value to previous employers.

DO: Master the Fundamentals of Private Credit Investing

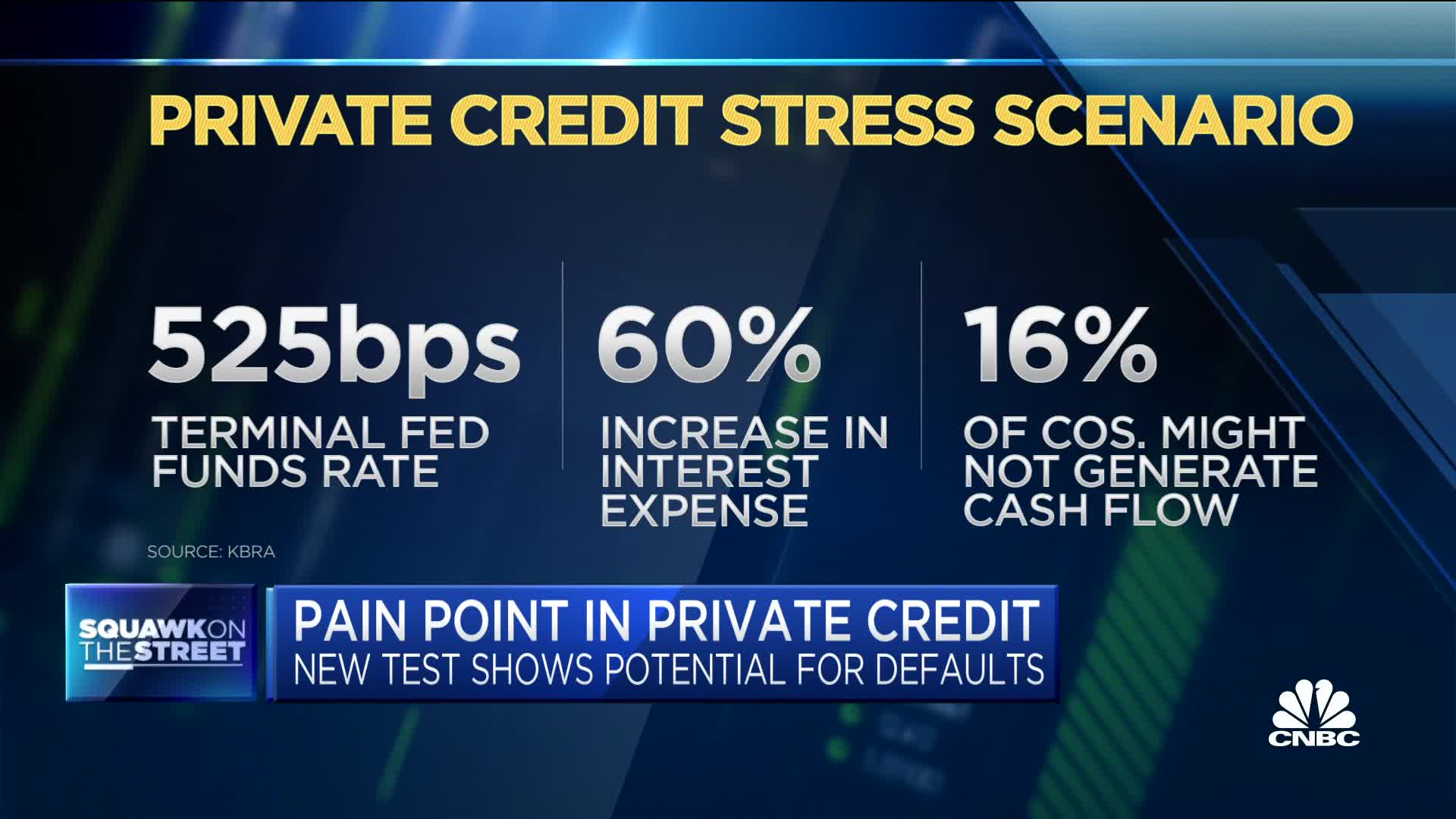

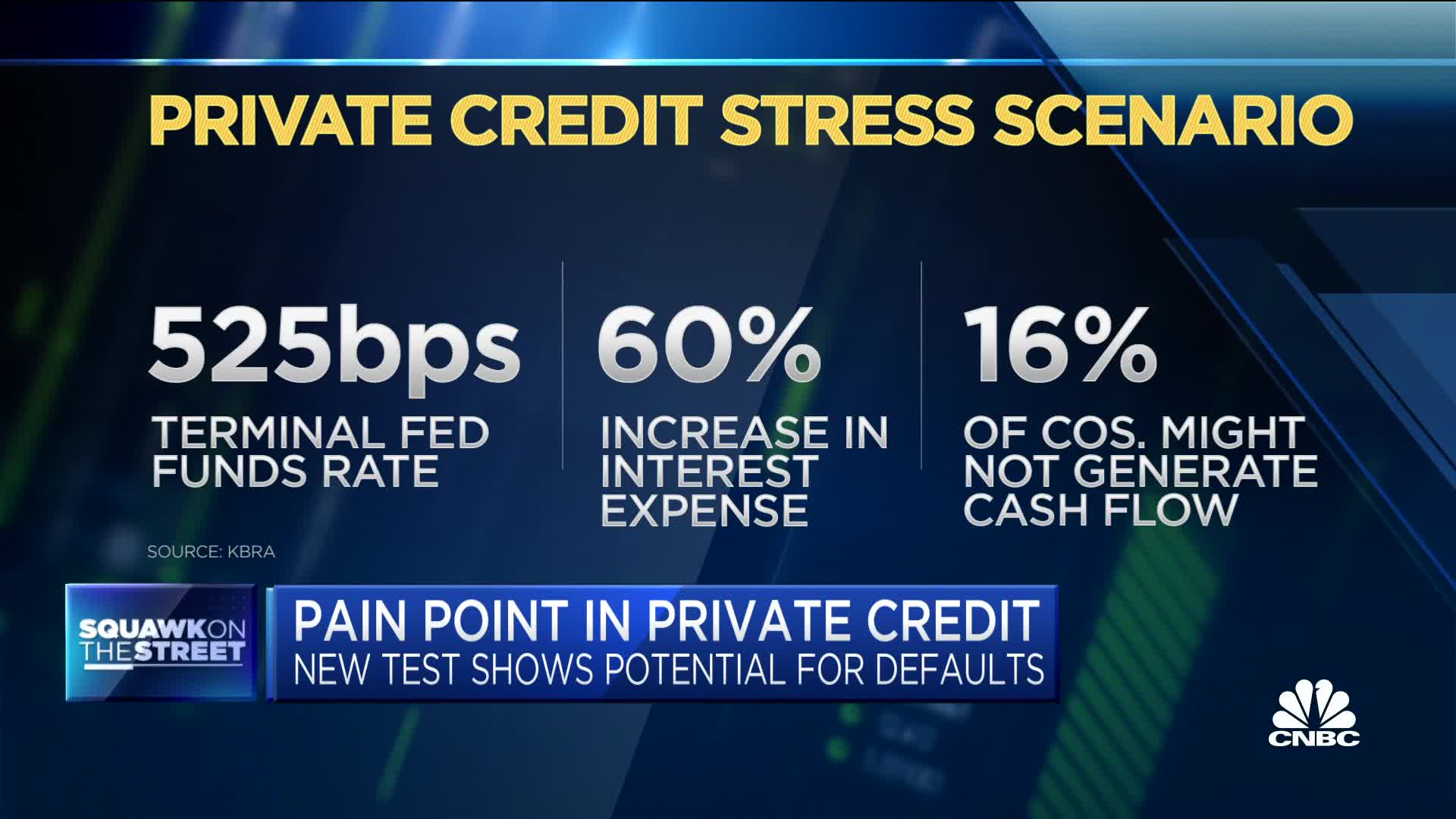

A strong understanding of private credit fundamentals is crucial for success in this field. This involves both technical skills and a deep understanding of the market.

Financial Modeling:

Develop strong financial modeling skills. These are essential for analyzing potential investments, assessing risk, and making informed decisions.

- Practice with various modeling software: Become proficient in Excel, Argus, or other relevant software.

- Understand key financial ratios and metrics: Master concepts like LTV, DSCR, and IRR.

- Develop proficiency in discounted cash flow analysis (DCF): This is a fundamental tool for valuing investments.

Credit Analysis:

Develop a deep understanding of credit analysis techniques and risk assessment methodologies. This is core to evaluating the creditworthiness of borrowers and mitigating risk.

- Study different credit scoring models: Familiarize yourself with various scoring methods and their limitations.

- Learn about various debt structures and instruments: Understand the nuances of different types of debt, such as senior secured loans, subordinated debt, and mezzanine financing.

- Familiarize yourself with industry best practices: Stay updated on current regulations, market trends, and industry standards.

DON'T: Neglect Soft Skills

Technical skills are important, but soft skills are equally crucial for success in private credit. The ability to communicate effectively, collaborate, and build relationships is paramount.

Communication:

Excellent communication skills are vital for interacting with clients, colleagues, and investors. This includes both written and verbal communication.

- Practice clear and concise communication: Learn to convey complex information clearly and concisely.

- Develop strong presentation skills: Practice presenting financial information and analysis to different audiences.

- Learn to actively listen and engage in effective dialogue: Be a good listener and engage in meaningful conversations.

Teamwork and Collaboration:

Private credit often involves working in teams, so teamwork and collaboration are essential skills.

- Highlight experiences where you successfully worked in a team environment: Provide specific examples of your contributions to team projects.

- Emphasize your ability to collaborate effectively: Show that you can work well with others, share ideas, and resolve conflicts constructively.

- Demonstrate your ability to contribute to a positive team dynamic: Show that you are a supportive and collaborative team member.

DON'T: Underestimate the Importance of Due Diligence

Thorough due diligence is crucial at every stage of the job search process. This includes researching firms, preparing for interviews, and understanding the industry landscape.

Researching Firms:

Before applying for private credit jobs, thoroughly research potential employers. Understanding their investment strategies and culture is vital.

- Understand their investment strategies and target markets: Research their portfolio companies and investment thesis.

- Research the team and their experience: Learn about the key individuals involved and their backgrounds.

- Assess the firm's culture and values: Determine whether the firm's culture aligns with your personal and professional goals.

Preparing for Interviews:

Practice your interview skills and prepare thoughtful answers to common questions. Preparation is key to showcasing your knowledge and enthusiasm.

- Research the interviewer and the firm: This will help you tailor your answers and ask relevant questions.

- Prepare questions to ask the interviewer: Asking insightful questions demonstrates your interest and initiative.

- Practice behavioral questions (STAR method): The STAR method (Situation, Task, Action, Result) is a powerful framework for answering behavioral questions.

Conclusion

Securing a position in the competitive field of private credit requires a strategic and multifaceted approach. By following these "do's" and "don'ts," you significantly increase your chances of landing your dream job within this exciting and rapidly growing industry. Remember to network effectively, tailor your applications, master the fundamentals, hone your soft skills, and perform thorough due diligence. Start actively pursuing your private credit jobs today and unlock the opportunities within this booming sector!

Featured Posts

-

Converse Signs Celtics Guard Payton Pritchard

May 12, 2025

Converse Signs Celtics Guard Payton Pritchard

May 12, 2025 -

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025 -

Eric Antoine En Couple Devoilement De Sa Vie Sentimentale Et Sa Relation Avec Une Personnalite M6

May 12, 2025

Eric Antoine En Couple Devoilement De Sa Vie Sentimentale Et Sa Relation Avec Une Personnalite M6

May 12, 2025 -

Ai And Design A Conversation With Figmas Ceo

May 12, 2025

Ai And Design A Conversation With Figmas Ceo

May 12, 2025 -

Regalo Inusual De Uruguay A China Claves Para El Exito De Las Exportaciones Ganaderas

May 12, 2025

Regalo Inusual De Uruguay A China Claves Para El Exito De Las Exportaciones Ganaderas

May 12, 2025

Latest Posts

-

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025 -

Analyzing The 2025 Cubs Performance In Game 16

May 13, 2025

Analyzing The 2025 Cubs Performance In Game 16

May 13, 2025 -

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025 -

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025 -

Edmans Homer Yamamotos Shutout Pitching Power Dodgers Past Cubs

May 13, 2025

Edmans Homer Yamamotos Shutout Pitching Power Dodgers Past Cubs

May 13, 2025