5 Dos And Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do: Network Strategically in the Private Credit Industry

Building a strong network is paramount in the private credit industry. It’s not just about collecting business cards; it's about forging genuine relationships that can open doors to exciting opportunities.

Attend Industry Events

Private credit networking thrives at industry events. Make an effort to attend relevant conferences, workshops, and seminars. These events provide invaluable opportunities to meet private credit professionals, learn about current market trends, and build relationships. Remember to engage in meaningful conversations, actively listen, and follow up after meeting someone. Keywords: private credit networking, industry conferences, relationship building.

Leverage LinkedIn Effectively

LinkedIn is your digital networking hub. Optimize your profile to highlight your relevant skills and experience in the private credit sector. Join private credit groups to engage in discussions, share insights, and connect with professionals in your field. Participate in thoughtful conversations, offering valuable contributions and showing your expertise. Keywords: LinkedIn profile optimization, private credit groups, professional networking.

Informational Interviews

Don’t underestimate the power of informational interviews. Reach out to private credit professionals you admire, requesting a brief conversation to learn more about their career path and gain valuable insights into the industry. This demonstrates your initiative and can lead to unexpected opportunities. Keywords: informational interviews, private credit professionals, career advice.

Don't: Underestimate the Importance of Financial Modeling Skills

Proficiency in financial modeling is non-negotiable in the private credit world. Your ability to analyze financial statements, build complex models, and interpret data will significantly impact your success.

Master Excel & Financial Modeling Software

Become highly proficient in Excel and learn to use specialized financial modeling software such as Bloomberg Terminal and Argus. These tools are essential for performing due diligence, valuation, and other critical tasks within private credit. Keywords: Financial modeling skills, Excel proficiency, Argus, Bloomberg Terminal.

Neglect Industry-Specific Knowledge

A strong understanding of private credit structures, valuation methods, and due diligence procedures is crucial. Stay updated on industry regulations, market trends, and best practices. Keywords: Private credit structures, valuation methods, due diligence, credit analysis.

Ignore Continuous Learning

The private credit market is constantly evolving. Continuous learning is essential to stay ahead of the curve. Pursue professional development opportunities, attend webinars, read industry publications, and expand your knowledge base. Keywords: Continuing education, private credit training, professional development.

Do: Tailor Your Resume and Cover Letter to Each Application

Generic applications rarely cut it in a competitive job market. Take the time to tailor your resume and cover letter to each specific job description.

Highlight Relevant Experience

Even if your experience isn't directly in private credit, showcase transferable skills and achievements that demonstrate your capabilities. Focus on experiences that align with the requirements and responsibilities of the target role. Keywords: Private credit resume, tailored resume, cover letter.

Quantify Achievements

Use numbers and data to quantify your accomplishments in previous roles. Instead of simply stating responsibilities, showcase the impact you made – for example, "Increased sales by 15%," or "Reduced operational costs by 10%." Keywords: Quantifiable results, resume achievements, impactful results.

Use Keywords Effectively

Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a potential match. Keywords: Keyword optimization, resume keywords, ATS optimization.

Don't: Neglect the Importance of Soft Skills

Technical skills are crucial, but soft skills are equally important for success in the collaborative environment of private credit.

Communication & Presentation Skills

Effective communication is vital. You need to clearly articulate complex financial information, both verbally and in writing. Strong presentation skills are also essential for conveying your ideas and analysis to colleagues and clients. Keywords: Communication skills, presentation skills, private credit communication.

Teamwork & Collaboration

Private credit involves working closely with various teams and stakeholders. Demonstrate your ability to collaborate effectively, contribute to a team environment, and build positive relationships. Keywords: Teamwork, collaboration, private credit teams.

Problem-solving & Analytical Skills

Analytical thinking and creative problem-solving are essential for navigating the complexities of private credit transactions. Highlight your ability to identify issues, analyze data, and develop effective solutions. Keywords: Analytical skills, problem-solving, critical thinking.

Do: Prepare Thoroughly for Interviews

Thorough interview preparation is key to making a strong impression.

Research the Firm and Interviewers

Before each interview, conduct thorough research on the firm and the interviewers. Understand their investment strategy, recent transactions, and the team dynamics. This demonstrates your genuine interest and allows you to ask insightful questions. Keywords: Interview preparation, private credit firms, due diligence on firms.

Practice Behavioral Questions

Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result). This will help you structure your responses effectively and highlight your relevant skills and experiences. Keywords: Behavioral interview questions, STAR method, interview practice.

Ask Thoughtful Questions

Asking thoughtful questions demonstrates your engagement and genuine interest in the role and the firm. Prepare a list of insightful questions that go beyond the basics and showcase your knowledge of the private credit industry. Keywords: Interview questions, private credit questions, engaging questions.

Conclusion: Securing Your Place in the Private Credit Job Market

Successfully navigating the private credit job market requires a strategic approach. By focusing on strategic networking, developing essential financial modeling and soft skills, and preparing meticulously for interviews, you significantly increase your chances of securing your dream role. Remember to tailor your applications, highlight your achievements, and showcase your understanding of the industry. Start building your private credit career today!

Featured Posts

-

Ftc To Appeal Microsoft Activision Merger Decision

Apr 29, 2025

Ftc To Appeal Microsoft Activision Merger Decision

Apr 29, 2025 -

Private University Consortium Pushes Back Against Trump Agenda

Apr 29, 2025

Private University Consortium Pushes Back Against Trump Agenda

Apr 29, 2025 -

Ray Epps V Fox News A Defamation Lawsuit Over Jan 6th Allegations

Apr 29, 2025

Ray Epps V Fox News A Defamation Lawsuit Over Jan 6th Allegations

Apr 29, 2025 -

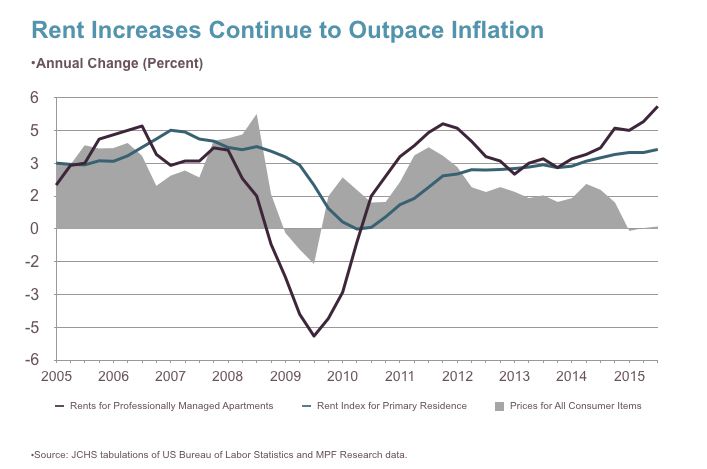

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025 -

Investigation Reveals Horrific Details Of D C Blackhawk Plane Crash

Apr 29, 2025

Investigation Reveals Horrific Details Of D C Blackhawk Plane Crash

Apr 29, 2025

Latest Posts

-

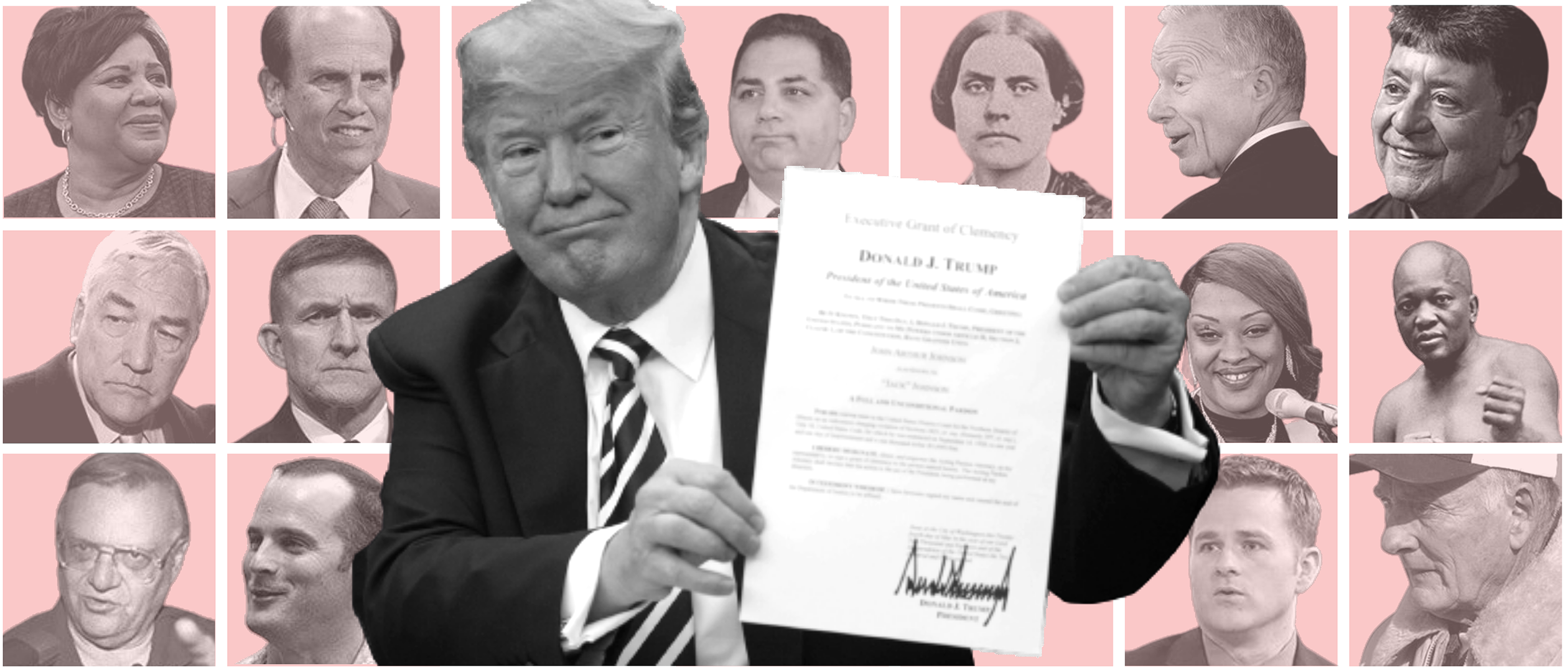

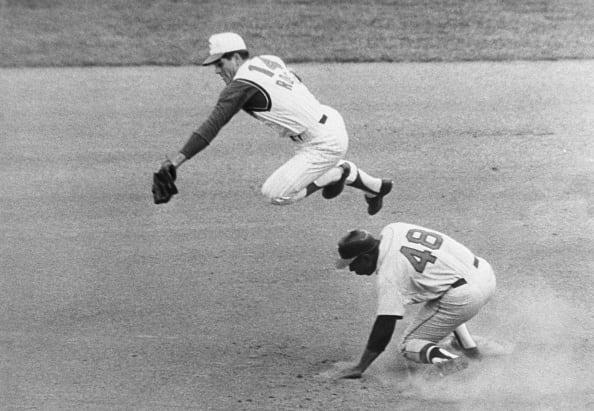

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025 -

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025 -

Will Pete Rose Be Pardoned President Trump Weighs In

Apr 29, 2025

Will Pete Rose Be Pardoned President Trump Weighs In

Apr 29, 2025 -

Trumps Outrage Pete Rose And A Promised Posthumous Pardon From The Former President

Apr 29, 2025

Trumps Outrage Pete Rose And A Promised Posthumous Pardon From The Former President

Apr 29, 2025 -

Donald Trump Advocates For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Advocates For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025