5 Essential Commodity Market Charts To Watch Closely This Week

Table of Contents

Navigating the complex world of commodity trading requires a keen eye on market indicators. This week, five key commodity market charts stand out as particularly crucial for investors and traders to monitor closely. Understanding the trends within these charts can significantly impact your trading strategies and overall portfolio performance. Let's dive into the essential commodity market charts you need to be watching.

<h2>Crude Oil Price Chart – Monitoring Global Energy Demand</h2>

Crude oil remains the lifeblood of the global economy, significantly impacting transportation, manufacturing, and energy production. Fluctuations in the crude oil price chart have far-reaching consequences, affecting everything from inflation rates to geopolitical stability. Monitoring this chart is paramount for understanding broader economic trends.

- OPEC+ Production Decisions: The Organization of the Petroleum Exporting Countries (OPEC+) plays a pivotal role in influencing global oil supply. Their production decisions, often shrouded in political maneuvering, directly impact prices. A reduction in production can lead to price increases, while an increase can put downward pressure on prices.

- Geopolitical Events and Sanctions: Geopolitical instability, wars, and sanctions on oil-producing nations can drastically disrupt supply chains, causing significant price volatility. Events in regions like the Middle East and Eastern Europe consistently affect the crude oil market.

- Inflationary Pressures: Oil prices have a strong correlation with inflation. Rising oil prices contribute to higher transportation costs, increased production expenses, and ultimately, higher consumer prices. Central banks carefully watch oil prices as a key inflation indicator.

- Technical Indicators: Traders utilize various technical indicators, including moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and Bollinger Bands, to analyze price trends, identify potential support and resistance levels, and predict future price movements.

- Relevant ETFs and Futures Contracts: Investors can access the crude oil market through various exchange-traded funds (ETFs) and futures contracts, allowing for diversified exposure and leveraged trading strategies. Popular examples include USO (United States Oil Fund) and CL (Crude Oil Futures).

<h2>Natural Gas Price Chart – Tracking Seasonal Demand and Supply</h2>

Natural gas, a crucial energy source for heating and electricity generation, exhibits pronounced seasonal variations in demand and price. Understanding these seasonal patterns is vital for effective trading strategies in this volatile commodity market.

- Weather Patterns: Extreme weather conditions, such as harsh winters and scorching summers, directly impact natural gas demand. Cold snaps increase heating demand, driving prices upwards, while unusually warm weather can lead to lower demand and price decreases.

- Storage Levels: Natural gas storage levels provide insights into future supply and demand dynamics. Low storage levels indicate potential supply shortages and price increases, while high storage levels suggest ample supply and potentially lower prices.

- LNG Exports and Imports: The global trade in liquefied natural gas (LNG) significantly influences natural gas prices. Changes in export and import volumes can create price fluctuations in different regions.

- Technical Indicators: As with crude oil, technical indicators like moving averages, RSI, and MACD are valuable tools for analyzing natural gas price trends and identifying trading opportunities.

- Relevant ETFs and Futures Contracts: Investors can gain exposure to the natural gas market through ETFs and futures contracts, such as UNG (United States Natural Gas Fund) and NG (Natural Gas Futures).

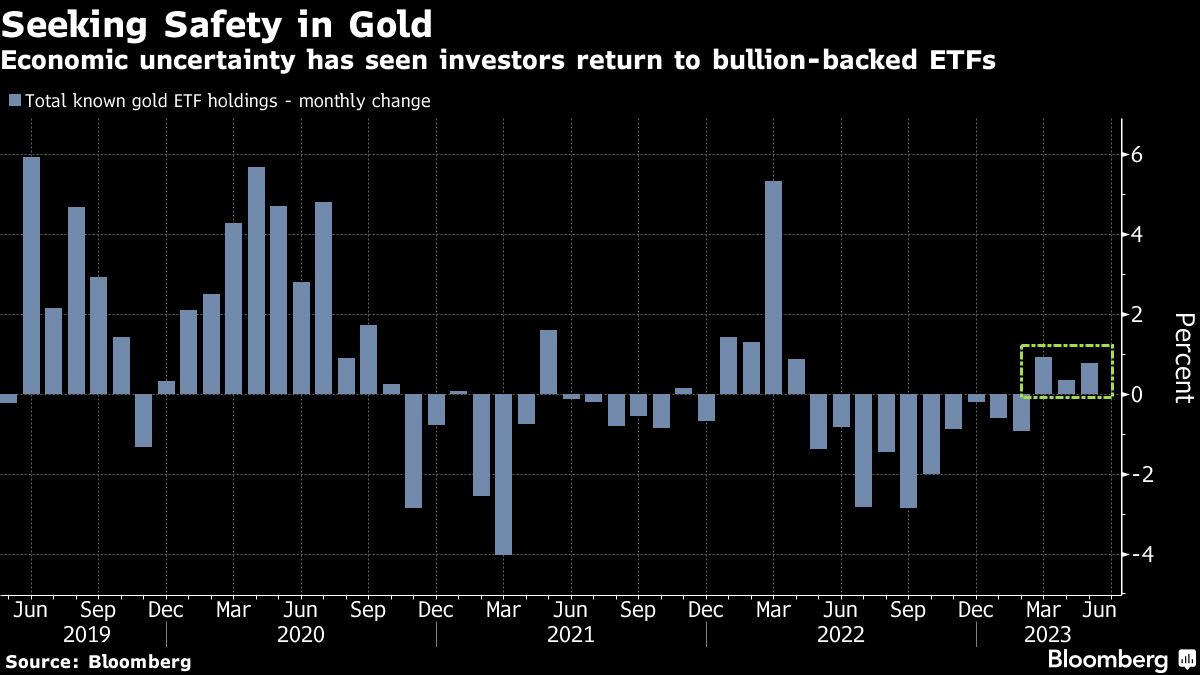

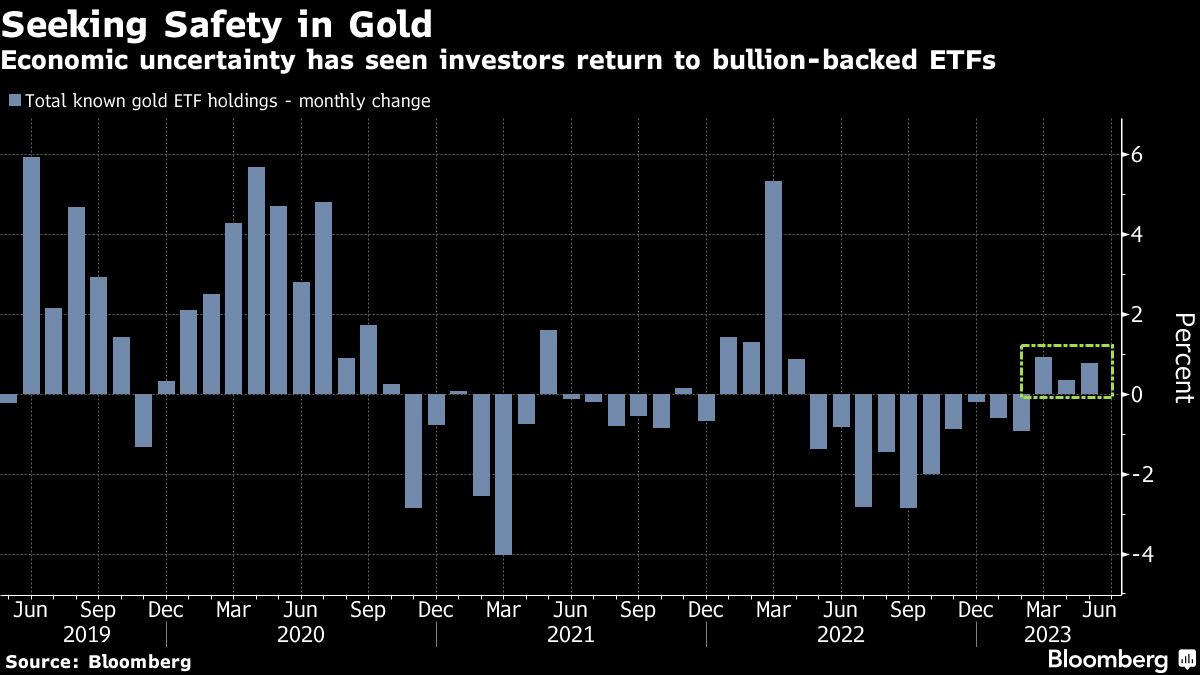

<h2>Gold Price Chart – A Safe Haven Asset in Times of Uncertainty</h2>

Gold, a traditional safe-haven asset, often sees increased demand during times of economic uncertainty, inflation, and geopolitical turmoil. Tracking the gold price chart is crucial for understanding investor sentiment and risk appetite.

- US Dollar Strength: Gold prices often have an inverse relationship with the US dollar. A stronger dollar can put downward pressure on gold prices, while a weaker dollar tends to boost gold demand.

- Interest Rate Hikes: Central bank interest rate hikes can affect gold prices. Higher interest rates increase the opportunity cost of holding non-interest-bearing assets like gold, potentially leading to decreased demand.

- Geopolitical Factors: Global conflicts, political instability, and economic crises often drive investors towards gold as a safe haven, pushing prices higher.

- Technical Indicators: Technical analysis tools are useful for identifying trends and potential turning points in the gold market.

- Relevant ETFs and Futures Contracts: Investors can access the gold market through ETFs like GLD (SPDR Gold Shares) and futures contracts on gold.

<h2>Agricultural Commodity Charts (Corn, Soybeans, Wheat) – Food Security and Global Supply Chains</h2>

Agricultural commodities, such as corn, soybeans, and wheat, are essential for food security and global supply chains. Their prices are influenced by a complex interplay of weather patterns, global politics, and consumer demand.

- Extreme Weather Conditions: Droughts, floods, and other extreme weather events can severely impact crop yields, leading to price spikes in agricultural commodities.

- Export Restrictions and Trade Policies: Government policies, trade agreements, and export restrictions can significantly influence the supply and demand dynamics of agricultural commodities.

- Biofuel Production: The growing demand for biofuels, which utilize crops like corn and soybeans, can impact their prices and availability for food consumption.

- Food Inflation: Fluctuations in agricultural commodity prices directly impact food inflation, affecting consumer costs and global food security.

- Technical Indicators: Technical analysis is valuable for understanding price trends and patterns within the agricultural commodities market.

- Relevant ETFs and Futures Contracts: Various ETFs and futures contracts offer exposure to agricultural commodities, allowing investors to manage risk and capitalize on market opportunities.

<h2>Industrial Metals Chart (Copper, Aluminum) – Monitoring Global Economic Activity</h2>

Industrial metals, like copper and aluminum, serve as key indicators of global economic activity. Their prices are closely tied to the performance of the construction, manufacturing, and transportation sectors.

- Demand in Construction and Manufacturing: Strong growth in construction and manufacturing activities typically boosts demand for industrial metals, driving prices higher.

- Supply Chain Disruptions: Supply chain bottlenecks and disruptions can lead to shortages and price increases in industrial metals.

- Government Policies and Environmental Regulations: Government policies, including infrastructure spending and environmental regulations, can significantly influence the demand for and price of industrial metals.

- Technical Indicators: Analyzing price trends and patterns using technical indicators is crucial for making informed trading decisions.

- Relevant ETFs and Futures Contracts: ETFs and futures contracts allow investors to gain exposure to the industrial metals market.

<h2>Conclusion</h2>

This week's commodity market outlook requires careful consideration of these five essential charts. Monitoring price fluctuations in crude oil, natural gas, gold, agricultural commodities, and industrial metals provides a comprehensive view of the global economic landscape and potential investment opportunities. Stay informed by regularly checking these key commodity market charts to make well-informed trading decisions. Understanding the dynamics within these commodity markets is crucial for successfully navigating the complexities of commodity trading. Don't miss out – continue monitoring these essential commodity market charts throughout the week!

Featured Posts

-

Sukces Nitro Chem Polski Trotyl Trafia Do Armii Usa

May 06, 2025

Sukces Nitro Chem Polski Trotyl Trafia Do Armii Usa

May 06, 2025 -

Diana Rosss Nyc Show Retirement Plans Officially Off The Table

May 06, 2025

Diana Rosss Nyc Show Retirement Plans Officially Off The Table

May 06, 2025 -

The Masked Singer Uk Unmasking Dressed Crab All Theories Explored

May 06, 2025

The Masked Singer Uk Unmasking Dressed Crab All Theories Explored

May 06, 2025 -

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025 -

Los Angeles Cool Patrick Schwarzenegger And His Vintage Bronco

May 06, 2025

Los Angeles Cool Patrick Schwarzenegger And His Vintage Bronco

May 06, 2025

Latest Posts

-

Patrick Schwarzenegger Reveals Why He Didnt Get The Superman Role

May 06, 2025

Patrick Schwarzenegger Reveals Why He Didnt Get The Superman Role

May 06, 2025 -

Pratt Comments On Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Pratt Comments On Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Understanding The Delay Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025

Understanding The Delay Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Patrick Schwarzeneggers Wedding To Abby Champion A Postponement

May 06, 2025

Patrick Schwarzeneggers Wedding To Abby Champion A Postponement

May 06, 2025