5 Essential Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do's: Mastering the Private Credit Job Search

Do Your Research: Laying the Foundation for Success

Thoroughly investigating target firms and their investment strategies is paramount. Understanding a firm's approach to private debt investments is key to showcasing your alignment with their values and goals. This research goes beyond simply reading their website.

- Understand their portfolio companies: Analyze the types of businesses they invest in, their industry focus, and the size and structure of their deals. Look for common threads in their portfolio – this reveals their investment thesis.

- Analyze recent transactions: Review press releases and financial news to understand their recent activity. What types of deals are they pursuing? What are their exit strategies?

- Leverage LinkedIn: LinkedIn is an invaluable tool. Research individuals working at your target firms – their backgrounds, experience, and career paths can offer insights into the company culture and hiring preferences. Connect with them and engage with their posts.

- Research industry news and trends: Stay updated on the latest developments in the private credit space. Reading industry publications like Private Equity International, PEI Media, and credible financial news sources demonstrates your commitment and knowledge. This shows potential employers you're passionate about the private credit job market and its evolving landscape.

Craft a Compelling Resume & Cover Letter: Showcasing Your Strengths

Your resume and cover letter are your first impression. They must be tailored to each specific private credit role and firm, highlighting your relevant skills and experiences. Generic applications are a surefire way to get overlooked in this competitive private credit job market.

- Highlight relevant skills: Focus on skills directly applicable to private credit, such as financial modeling, credit analysis, due diligence, portfolio management, and valuation. Use action verbs to describe your accomplishments.

- Quantify your achievements: Instead of saying "Improved efficiency," say "Improved efficiency by 15% by implementing a new workflow, resulting in X cost savings." Use numbers to demonstrate your impact.

- Use keywords: Incorporate keywords relevant to private credit and investment management, such as "leveraged buyouts," "distressed debt," "mezzanine financing," "credit underwriting," "debt restructuring," and "private debt funds." Use these terms naturally, not as forced keywords.

- Showcase relevant experience: Highlight experience in areas like debt financing, leveraged buyouts (LBOs), distressed debt investing, or credit structuring. Tailor the descriptions to reflect the specific requirements of each job description.

Network Strategically: Building Relationships for Success

Networking is crucial in the private credit job market. It's not just about collecting business cards; it's about building genuine relationships.

- Informational interviews: Reach out to professionals in the field for informational interviews. These conversations provide invaluable insights and can lead to unexpected opportunities.

- Engage actively online: Participate in relevant online forums, LinkedIn groups, and industry discussions. Share your insights and engage with others' posts to establish yourself as a knowledgeable and engaged professional in the private credit industry.

- Attend industry events: Conferences, workshops, and networking events are excellent opportunities to meet potential employers and build connections. Prepare questions beforehand and actively participate in discussions.

Don'ts: Avoiding Common Private Credit Job Search Mistakes

Don't Neglect Your Network: Leveraging Your Connections

Your existing network is a valuable asset. Don't underestimate the power of referrals and warm introductions.

- Actively engage: Don't passively wait for opportunities. Reach out to your contacts, update them on your job search, and ask for advice or introductions.

- Follow up: After networking events or informational interviews, always send a thank-you note expressing your gratitude and reiterating your interest.

Don't Submit Generic Applications: The Importance of Customization

Submitting the same resume and cover letter to multiple firms is a significant mistake. Each application needs to be tailored to the specific firm and role.

- Demonstrate understanding: Show that you've researched the firm's investment strategy, its portfolio companies, and its recent activities.

- Align your skills: Highlight the specific skills and experiences that align with the job description and the firm's investment focus.

Don't Underestimate the Importance of Soft Skills: Beyond the Technical

Technical skills are important, but soft skills are equally crucial in private credit. Employers look for individuals who can communicate effectively, work collaboratively, and solve problems creatively.

- Highlight soft skills: In your resume and cover letter, use examples to demonstrate your communication, teamwork, problem-solving, and interpersonal skills.

- Show your personality: Let your passion for private credit shine through. This demonstrates genuine enthusiasm and commitment.

Don't Neglect Due Diligence on Potential Employers: Research is Key

Before accepting a job offer, thoroughly research the firm's culture, reputation, and compensation.

- Go beyond the website: Look for employee reviews on sites like Glassdoor to gain insights into the work environment and company culture.

- Network internally: If possible, connect with current or former employees to gather firsthand perspectives.

- Understand compensation: Clearly understand the salary, benefits, and bonus structure before accepting any offer.

Conclusion: Securing Your Private Credit Career

Successfully navigating the private credit job market requires a strategic and proactive approach. By following these essential do's and don'ts – from thorough research and compelling application materials to strategic networking and careful due diligence – you can significantly increase your chances of securing a fulfilling career in private credit. Remember to tailor your approach to each opportunity and consistently showcase your expertise in the private credit job market. Start your search today and unlock your potential in this exciting and rewarding field!

Featured Posts

-

Gyoekeres Viktor Arsenal Statisztikak Es Teljesitmenyertekeles

May 28, 2025

Gyoekeres Viktor Arsenal Statisztikak Es Teljesitmenyertekeles

May 28, 2025 -

Mlb Betting Brewers Vs Diamondbacks Predictions And Best Odds Today

May 28, 2025

Mlb Betting Brewers Vs Diamondbacks Predictions And Best Odds Today

May 28, 2025 -

Blue Jays Fall To Angels After Six Run 8th Inning

May 28, 2025

Blue Jays Fall To Angels After Six Run 8th Inning

May 28, 2025 -

Padres Position Shifts In Recent Mlb Power Rankings

May 28, 2025

Padres Position Shifts In Recent Mlb Power Rankings

May 28, 2025 -

French Open 2024 Sinner Faces Packed Top Half Of Draw

May 28, 2025

French Open 2024 Sinner Faces Packed Top Half Of Draw

May 28, 2025

Latest Posts

-

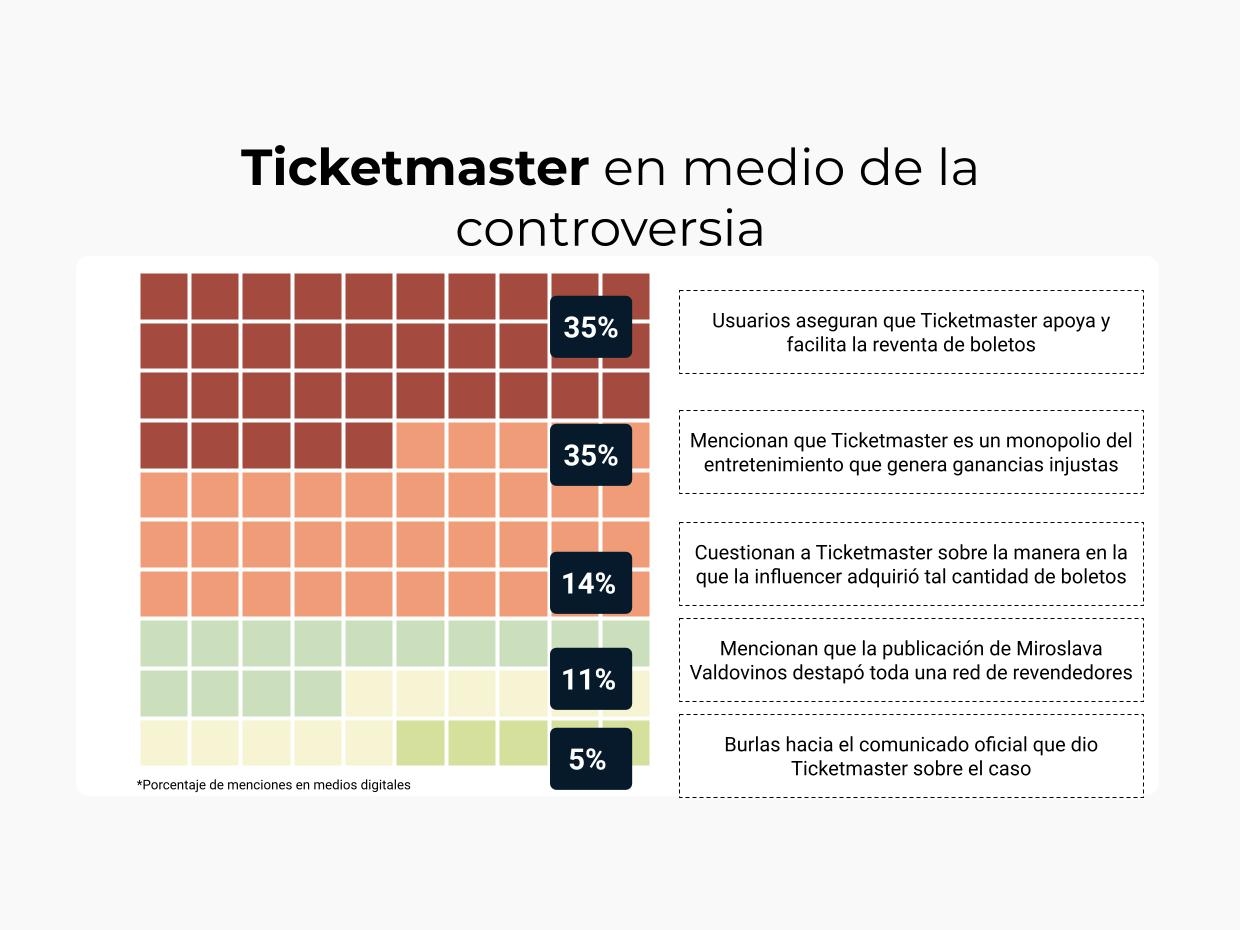

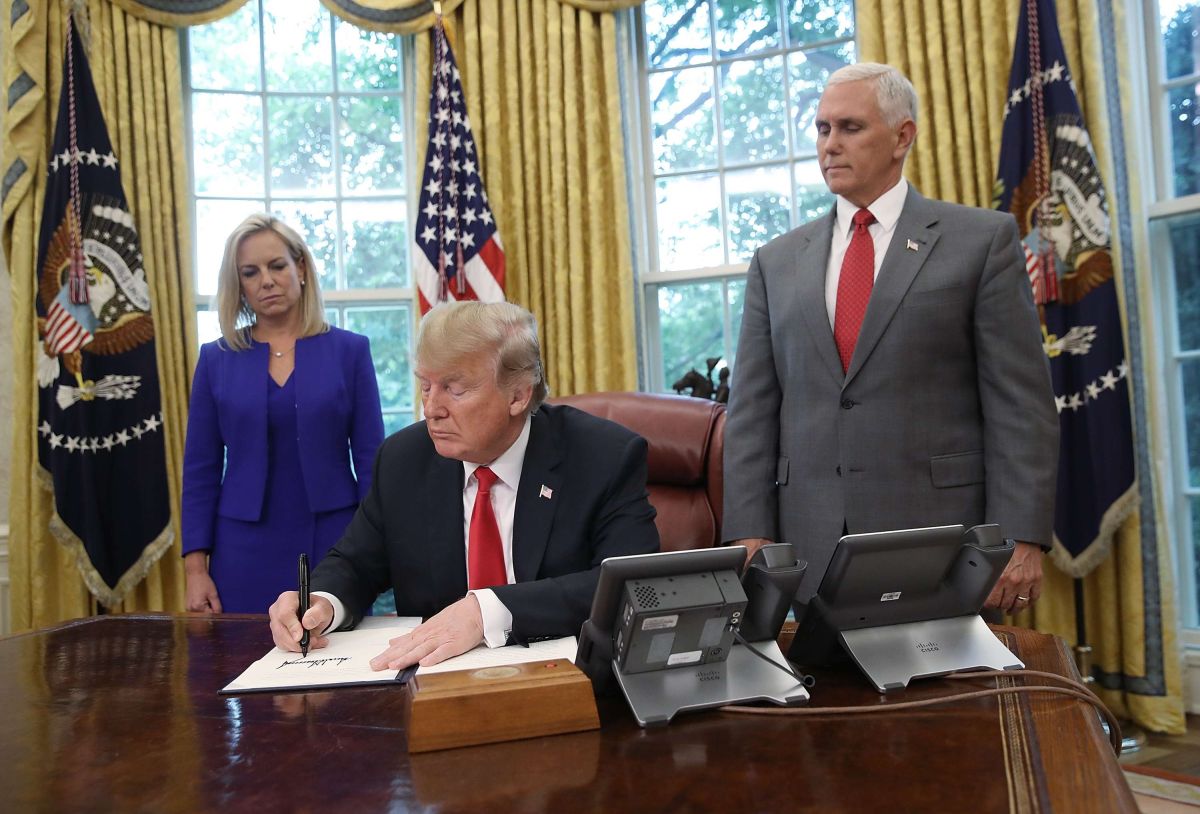

La Orden Ejecutiva De Trump Un Golpe A Ticketmaster Y La Especulacion Con Boletos

May 30, 2025

La Orden Ejecutiva De Trump Un Golpe A Ticketmaster Y La Especulacion Con Boletos

May 30, 2025 -

El Plan De Trump Para Acabar Con La Reventa De Boletos De Ticketmaster

May 30, 2025

El Plan De Trump Para Acabar Con La Reventa De Boletos De Ticketmaster

May 30, 2025 -

Nuevos Cambios En La Politica De Precios De Ticketmaster

May 30, 2025

Nuevos Cambios En La Politica De Precios De Ticketmaster

May 30, 2025 -

Ticketmaster Bajo La Lupa La Orden Ejecutiva De Trump Y Sus Consecuencias

May 30, 2025

Ticketmaster Bajo La Lupa La Orden Ejecutiva De Trump Y Sus Consecuencias

May 30, 2025 -

Ticketmaster Ofrece Mayor Transparencia En El Precio De Las Entradas

May 30, 2025

Ticketmaster Ofrece Mayor Transparencia En El Precio De Las Entradas

May 30, 2025