5 Key Actions To Secure A Role In The Booming Private Credit Industry

Table of Contents

Develop In-Demand Skills for the Private Credit Industry

Landing a job in private credit requires a specific skillset. This section highlights the crucial areas you need to master.

Master Financial Modeling & Analysis

Proficiency in financial modeling is paramount. Private credit professionals need to analyze complex financial statements and project future performance accurately. Essential skills include:

- LBO Modeling: Understanding leveraged buyout transactions and their impact on a company's financials.

- Discounted Cash Flow (DCF) Analysis: Valuing companies and projects based on their future cash flows.

- Credit Risk Modeling: Assessing the probability of default and potential losses.

- Proficiency in Excel and Financial Software: Tools like Bloomberg Terminal, Argus, and Capital IQ are industry standards.

Relevant certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) can significantly boost your credentials.

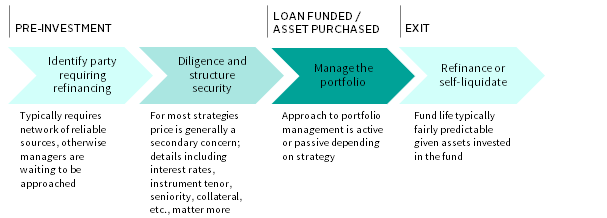

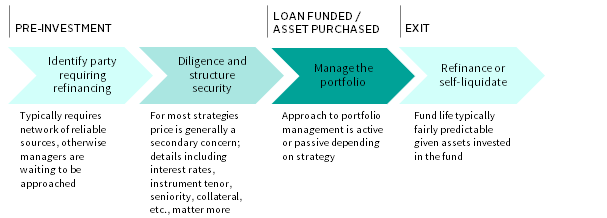

Understand Credit Underwriting Principles

Credit underwriting is the heart of private credit. You need to thoroughly understand how to assess the creditworthiness of borrowers. This includes:

- Financial Statement Analysis: Interpreting balance sheets, income statements, and cash flow statements to identify key risks and opportunities.

- Collateral Valuation: Determining the value of assets used as security for loans.

- Credit Scoring and Risk Assessment: Utilizing various credit metrics to gauge the likelihood of repayment.

- Understanding Different Credit Structures: Knowing the nuances of senior secured loans, subordinated debt, mezzanine financing, and other credit structures.

Key credit metrics like debt-to-equity ratio, interest coverage ratio, and leverage ratios are critical for effective credit analysis.

Network Strategically Within the Private Credit Sector

Networking is crucial in this industry. Building relationships can open doors to opportunities that aren't publicly advertised.

- Attend Industry Events: Conferences, seminars, and networking events provide valuable opportunities to meet professionals.

- Leverage LinkedIn: Use LinkedIn to connect with professionals in private credit, engage in relevant discussions, and follow industry influencers.

- Informational Interviews: Reach out to people working in private credit for informational interviews to learn about their experiences and gain insights.

Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. Make them count!

Highlight Relevant Experience and Skills

Even if your experience isn't directly in private credit, highlight transferable skills from related fields like investment banking, accounting, or asset management.

Use Keywords Effectively

Incorporate relevant keywords throughout your resume and cover letter. Examples include: "credit underwriting," "debt financing," "private equity," "alternative investments," "structured credit," "private debt," and "distressed debt."

Quantify Achievements

Whenever possible, quantify your achievements to demonstrate your impact. Instead of saying "improved efficiency," say "improved efficiency by 15% resulting in cost savings of $X."

Ace the Private Credit Interview

The interview is your chance to showcase your skills and knowledge.

Prepare for Technical Questions

Expect questions on financial modeling, credit analysis, valuation, and market trends. Practice answering common questions such as: "Walk me through a DCF analysis," "How would you assess the credit risk of a borrower?" "What are the current market trends in private credit?"

Showcase Your Understanding of the Market

Demonstrate your understanding of the private credit market, including current interest rates, economic conditions, and industry trends. Stay updated by reading industry publications and following market news.

Demonstrate Your Soft Skills

Private credit requires strong communication, teamwork, and problem-solving skills. Highlight these skills during the interview.

Seek Out Relevant Experience (Internships, Entry-Level Roles)

Gaining practical experience is essential.

Target Private Credit Firms Directly

Apply directly to firms specializing in private credit, even for entry-level positions or internships.

Explore Related Roles in Finance

Consider roles in investment banking, asset management, or commercial lending, as these can provide valuable experience and transferable skills.

Network Your Way In

Networking can help you uncover hidden opportunities and gain insights into the industry.

Continuously Learn and Stay Updated

The private credit industry is constantly evolving.

Follow Industry News and Publications

Stay informed by following reputable sources like trade publications, financial news outlets, and industry blogs.

Pursue Continuing Education

Consider pursuing relevant certifications or taking courses to enhance your knowledge and skills.

Stay Ahead of the Curve

Continuous learning is vital for success in this dynamic industry.

Conclusion:

Securing a role in the booming private credit industry requires a strategic approach. By developing in-demand skills, crafting a compelling application, acing the interview, gaining relevant experience, and continuously learning, you can significantly improve your chances of success. Start implementing these five key actions today to secure your place in the dynamic and rewarding world of the private credit industry. Don't miss out on this exciting career opportunity in private debt and alternative credit markets!

Featured Posts

-

Childproof Your Makeup Simple Storage Ideas For Teen Proofing

Apr 25, 2025

Childproof Your Makeup Simple Storage Ideas For Teen Proofing

Apr 25, 2025 -

Harrogate Spring Flower Show A Guide For 2025

Apr 25, 2025

Harrogate Spring Flower Show A Guide For 2025

Apr 25, 2025 -

Pope Francis Body Public Viewing At St Peters Basilica Before Funeral

Apr 25, 2025

Pope Francis Body Public Viewing At St Peters Basilica Before Funeral

Apr 25, 2025 -

Visa Crackdown Fears Prompt College Students To Delete Published Work

Apr 25, 2025

Visa Crackdown Fears Prompt College Students To Delete Published Work

Apr 25, 2025 -

Herro Wins Thrilling Nba 3 Point Contest Defeats Hield In Miami

Apr 25, 2025

Herro Wins Thrilling Nba 3 Point Contest Defeats Hield In Miami

Apr 25, 2025

Latest Posts

-

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

Apr 26, 2025

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

Apr 26, 2025 -

Subsystem Failure Forces Blue Origin To Cancel Rocket Launch

Apr 26, 2025

Subsystem Failure Forces Blue Origin To Cancel Rocket Launch

Apr 26, 2025 -

How Trumps Presidency Will Shape Zuckerbergs Future

Apr 26, 2025

How Trumps Presidency Will Shape Zuckerbergs Future

Apr 26, 2025 -

Zuckerbergs Meta And The Trump Administration Impacts And Challenges

Apr 26, 2025

Zuckerbergs Meta And The Trump Administration Impacts And Challenges

Apr 26, 2025