5 Key Dos And Don'ts To Secure A Role In The Private Credit Boom

Table of Contents

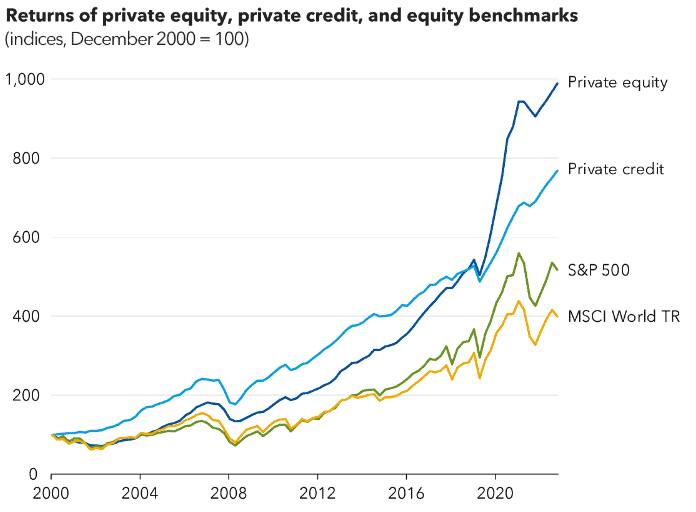

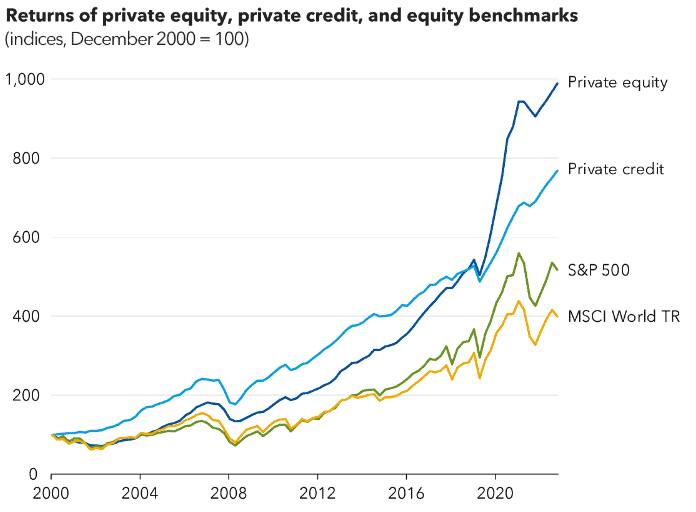

The private credit market is experiencing a boom, creating a surge in demand for skilled professionals. Navigating this competitive landscape requires a strategic approach. This article outlines five key dos and don'ts to help you secure a coveted role in this exciting sector of finance, whether you're seeking Credit Analyst Jobs, Alternative Lending Jobs, or other Investment Jobs within the Private Credit Boom.

<h2>Do: Network Strategically within the Private Credit Industry</h2>

Building a strong network is paramount in the private credit industry. Effective Private Credit Networking can significantly increase your chances of landing a job. Leveraging your connections and actively seeking new ones is crucial for accessing hidden job opportunities.

- Attend industry conferences and events: Focus on private credit and alternative lending events. These provide excellent opportunities to meet professionals and learn about new openings. Look for events related to private equity, alternative investments, and credit funds.

- Engage on LinkedIn: LinkedIn for Finance professionals is invaluable. Connect with individuals working in private credit firms, participate in relevant groups, and share insightful content.

- Leverage your existing network: Inform your contacts about your job search; you never know who might have a connection at a private credit firm.

- Informational interviews: These are crucial. Reach out to professionals working in your target roles for informational interviews to learn about their experiences and gain insights.

- Build relationships with recruiters: Connect with recruiters specializing in private credit placements. They often have exclusive access to unadvertised job openings.

<h2>Do: Develop Specialized Skills and Knowledge in Private Credit</h2>

Demonstrating specialized skills is vital for securing a Private Credit Job. Proficiency in specific areas sets you apart from the competition. Focus on developing expertise in areas directly relevant to the industry.

- Master financial modeling techniques: Private credit transactions require sophisticated financial modeling skills. Develop your expertise in building models for leveraged buyouts, debt financing, and other relevant transactions.

- Become proficient in credit analysis: This includes assessing credit risk, understanding financial statements, and structuring deals. Gain experience in evaluating borrowers' creditworthiness and determining appropriate lending terms.

- Gain expertise in due diligence: Due diligence is crucial in private credit. Develop your ability to conduct thorough investigations of potential investments.

- Understand different private credit strategies: Familiarize yourself with direct lending, mezzanine financing, distressed debt, and other strategies employed by private credit firms.

- Pursue relevant certifications: The Chartered Financial Analyst (CFA) designation is highly valued in the finance industry and can be particularly beneficial for private credit roles.

<h2>Do: Tailor Your Resume and Cover Letter to the Specific Role</h2>

A generic application won't cut it in the competitive private credit market. A tailored resume and cover letter demonstrate your understanding of the specific role and the firm's needs.

- Quantify your accomplishments: Use numbers to showcase your achievements and demonstrate your impact in previous roles. For example, instead of saying "improved efficiency," say "increased efficiency by 15%."

- Highlight relevant skills and experience: Carefully read the job description and tailor your resume and cover letter to highlight the skills and experience that directly match the requirements.

- Use keywords: Incorporate keywords from the job posting to optimize your application for Applicant Tracking Systems (ATS).

- Craft a compelling cover letter: Demonstrate your passion for private credit, your understanding of the industry, and your specific interest in the particular role.

- Showcase relevant projects: Include details of projects related to alternative lending strategies, portfolio management, or other relevant experiences.

<h2>Don't: Underestimate the Importance of Soft Skills</h2>

Technical skills are important, but soft skills are equally crucial in the private credit industry. Strong communication, teamwork, and problem-solving skills are essential for success.

- Strong communication skills: You'll need to effectively communicate with clients, colleagues, and senior management. This includes both written and verbal communication.

- Teamwork and collaboration: Private credit transactions often involve working closely with teams. Collaborative skills are highly valued.

- Problem-solving abilities: The ability to analyze complex situations, identify solutions, and make sound decisions under pressure is essential.

- Adaptability and resilience: The private credit market is dynamic. The ability to adapt to changing circumstances and demonstrate resilience is vital.

- Cultural fit: Research the firm's culture and values to ensure alignment.

<h2>Don't: Neglect Your Online Presence</h2>

Your online presence reflects your professional brand. A strong and consistent online presence enhances your credibility and makes you more visible to recruiters.

- Maintain a professional LinkedIn profile: Ensure your profile is up-to-date, showcases your skills and experience, and presents a professional image.

- Be mindful of your social media: Maintain a professional image across all social media platforms. Ensure your online presence aligns with your career goals.

- Build a strong professional brand: Showcase your expertise and knowledge in private credit through your online activities and content.

- Stay up-to-date: Utilize online resources like industry publications and websites to stay informed about current trends and news within the private credit sector.

<h2>Conclusion</h2>

Securing a role in the private credit boom requires a well-rounded approach combining specialized skills, networking prowess, and a strong professional brand. By following these dos and don'ts, you can significantly improve your chances of landing your dream job in this dynamic and rewarding field. Don't delay – start building your private credit career today! Begin networking, refining your skills, and optimizing your application materials to take advantage of the opportunities within the exciting private credit boom. The demand for skilled professionals in Private Credit Jobs is high – make your move now!

Featured Posts

-

French Open Sinner And Djokovic Face Stiff Competition

May 30, 2025

French Open Sinner And Djokovic Face Stiff Competition

May 30, 2025 -

Dara O Briain A Voice Of Reason In Comedy And Beyond

May 30, 2025

Dara O Briain A Voice Of Reason In Comedy And Beyond

May 30, 2025 -

Alcaraz In Monte Carlo Final After Musettis Injury Withdrawal

May 30, 2025

Alcaraz In Monte Carlo Final After Musettis Injury Withdrawal

May 30, 2025 -

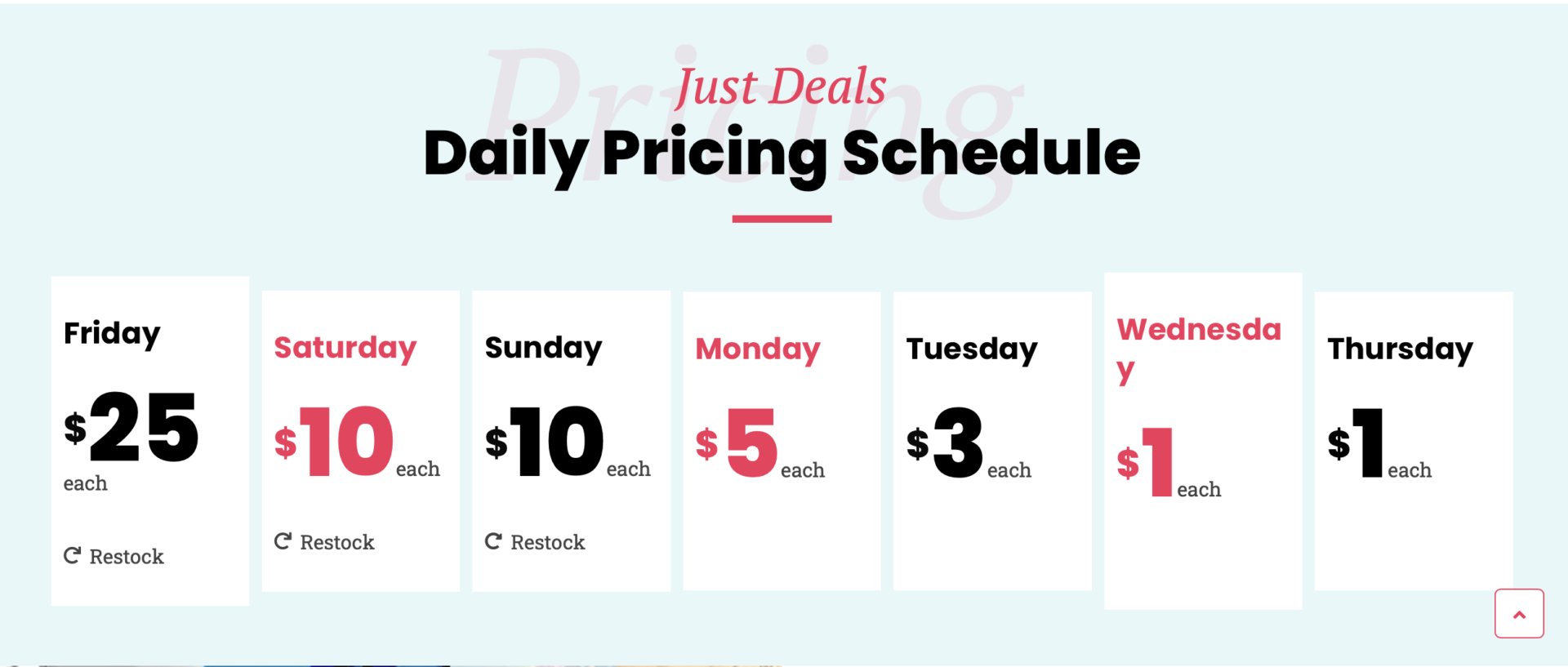

Bargain Hunt Success How To Find Unbeatable Prices

May 30, 2025

Bargain Hunt Success How To Find Unbeatable Prices

May 30, 2025 -

Gorillaz 25th Anniversary Exhibition And Special Shows Announced

May 30, 2025

Gorillaz 25th Anniversary Exhibition And Special Shows Announced

May 30, 2025

Latest Posts

-

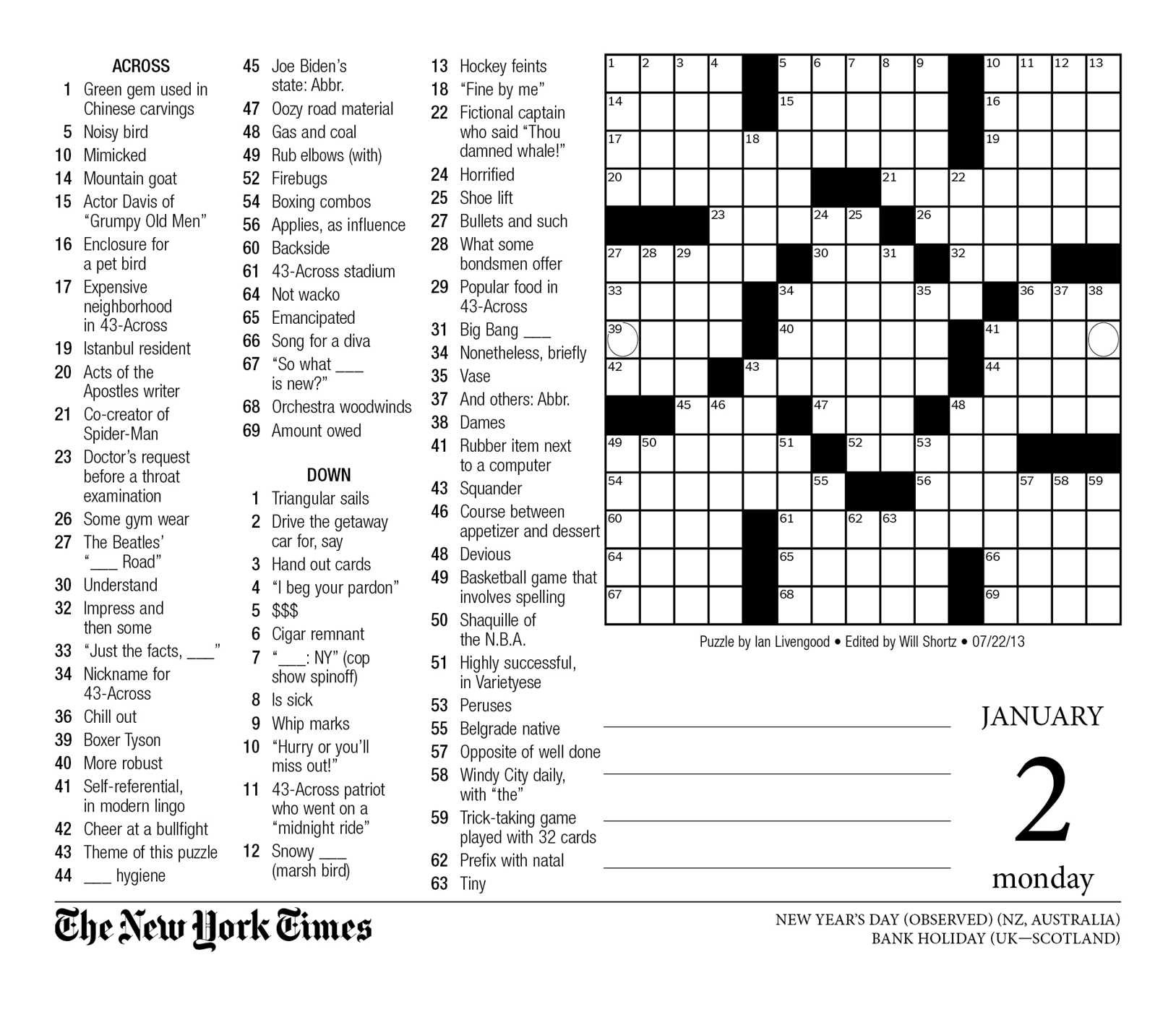

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025 -

Dry And Sunny Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025

Dry And Sunny Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025 -

Tuesday Forecast For Northeast Ohio Sunshine Returns

May 31, 2025

Tuesday Forecast For Northeast Ohio Sunshine Returns

May 31, 2025 -

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025 -

Northeast Ohio Weather Tuesdays Sunny Skies And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesdays Sunny Skies And Dry Conditions

May 31, 2025