$5000 Personal Loans For Bad Credit: Direct Lenders

Table of Contents

Understanding Your Credit Score and its Impact

Your credit score is a three-digit number that represents your creditworthiness. Lenders use it to assess the risk of lending you money. A higher credit score means a lower risk, resulting in better loan terms (lower interest rates, more favorable repayment periods). Conversely, a lower score indicates higher risk, potentially leading to higher interest rates or even loan denial.

-

Credit Score Ranges and Implications: Credit scoring models like FICO vary slightly, but generally, scores range from 300 to 850. Scores below 670 are typically considered bad credit, making it harder to secure loans at favorable rates. Scores above 750 are considered excellent.

-

Checking Your Credit Report: You can check your credit report for free annually at AnnualCreditReport.com. This is crucial for identifying any errors that may be affecting your score.

-

Factors Affecting Credit Scores: Several factors influence your credit score, including:

- Payment History: Consistent on-time payments are crucial.

- Amounts Owed: High debt utilization (using a large percentage of your available credit) negatively impacts your score.

- Length of Credit History: A longer credit history generally leads to a better score.

- New Credit: Applying for many new loans in a short period can lower your score.

- Credit Mix: Having a mix of credit accounts (credit cards, loans) can positively influence your score.

Keywords: credit report, credit score, credit history, FICO score, credit repair.

Finding Reputable Direct Lenders for $5000 Loans

Navigating the world of lenders can be tricky, especially with bad credit. It's crucial to avoid predatory lenders who charge exorbitant fees and interest rates. Direct lenders, on the other hand, offer several advantages:

- Faster Processing: Direct lenders often process applications faster than intermediaries.

- Potentially Lower Interest Rates: By cutting out the middleman, you might secure a better interest rate.

Identifying Reputable Direct Lenders:

- Check Online Reviews: Look for reviews from other borrowers on sites like Trustpilot or the Better Business Bureau.

- Verify Licensing: Ensure the lender is properly licensed and regulated in your state.

- Transparency: A reputable lender will be transparent about fees, interest rates, and loan terms.

Resources for Finding Trustworthy Lenders:

- Better Business Bureau (BBB): Check the BBB website for complaints and ratings.

- Consumer Financial Protection Bureau (CFPB): The CFPB offers resources and guidance on choosing lenders.

Keywords: reputable lenders, direct loan lenders, online lenders, loan comparison, bad credit loan lenders.

The $5000 Loan Application Process

Applying for a $5000 personal loan involves several steps:

- Fill out an Application: You'll need to complete an online application providing personal and financial information.

- Provide Documentation: This typically includes proof of income (pay stubs, tax returns), identification (driver's license, passport), and bank statements.

- Undergo a Credit Check: The lender will perform a credit check to assess your creditworthiness.

- Loan Approval: If approved, you'll receive a loan offer outlining the terms.

- Loan Disbursement: Once you accept the offer, the funds will be disbursed to your account.

Loan Terms:

- Interest Rates: These will vary based on your credit score and the lender.

- Repayment Periods: Loans can have repayment periods ranging from several months to several years.

- Fees: Be aware of any origination fees or other charges.

Keywords: loan application, loan approval, loan terms, interest rate, repayment plan, loan documents.

Alternatives to $5000 Personal Loans for Bad Credit

If a personal loan isn't the best option, consider these alternatives:

- Secured Loans: These loans require collateral (like a car or savings account), reducing the lender's risk and potentially securing better terms.

- Credit Unions: Credit unions often offer more lenient lending criteria than banks.

- Debt Consolidation: Consolidating high-interest debts into a single loan can simplify payments and potentially lower your overall interest payments.

Each alternative has its pros and cons; carefully weigh them before making a decision.

Keywords: secured loans, credit union loans, debt consolidation loan, alternative financing.

Conclusion

Securing a $5000 personal loan with bad credit requires careful planning and research. Understanding your credit score, finding reputable direct lenders, navigating the application process, and exploring alternative options are all crucial steps. By following the guidance in this article, you can increase your chances of successfully obtaining the financial assistance you need. Start your search for a $5000 personal loan from a direct lender today, or explore the alternative options discussed to find the best solution for your financial situation. Remember to compare offers from multiple lenders to secure the most favorable terms for your bad credit personal loans or direct lender loans. Consider also exploring $5000 loans for bad credit tailored to your specific needs.

FAQ:

- Q: What is the minimum credit score required for a $5000 loan? A: It varies by lender, but lenders specializing in bad credit loans may have lower minimum requirements.

- Q: How long does it take to get approved for a loan? A: Approval times vary but can range from a few days to a few weeks.

- Q: What happens if I miss a payment? A: Late payments can negatively affect your credit score and may incur late fees.

Remember to always borrow responsibly and only take out a loan you can afford to repay.

Featured Posts

-

Cybercriminal Accused Of Millions In Office 365 Executive Account Hacks

May 28, 2025

Cybercriminal Accused Of Millions In Office 365 Executive Account Hacks

May 28, 2025 -

Rent Control Changes Impact On Tenants And The Fight For Fair Housing

May 28, 2025

Rent Control Changes Impact On Tenants And The Fight For Fair Housing

May 28, 2025 -

Increased Rainfall In Western Massachusetts Due To Climate Change

May 28, 2025

Increased Rainfall In Western Massachusetts Due To Climate Change

May 28, 2025 -

Bon Plan Smartphone Samsung Galaxy S25 512 Go 985 56 E 5 Etoiles

May 28, 2025

Bon Plan Smartphone Samsung Galaxy S25 512 Go 985 56 E 5 Etoiles

May 28, 2025 -

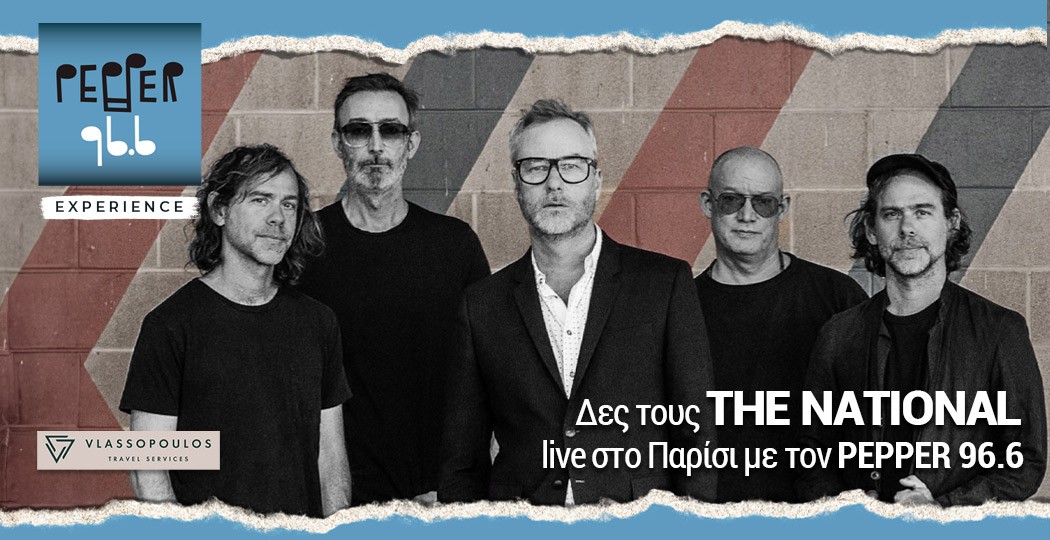

Pepper Premiere Programacion Y Noticias De Pepper 96 6 Fm

May 28, 2025

Pepper Premiere Programacion Y Noticias De Pepper 96 6 Fm

May 28, 2025

Latest Posts

-

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025 -

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025 -

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025 -

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025