6% Kering Share Slump After Bleak First Quarter Performance

Table of Contents

Weak Gucci Performance Fuels Kering Share Slump

Gucci, Kering's flagship brand, was the primary driver of the company's disappointing Q1 performance and subsequent Kering stock decline. The brand's sales figures fell significantly short of expectations, fueling concerns among investors. This underperformance can be attributed to several factors: changing consumer preferences, intensifying competition within the luxury market, and potential inventory management issues.

- Significant Decrease in Comparable Sales Growth: Gucci experienced a considerable decrease in comparable sales growth compared to the previous year and market expectations. This indicates a weakening demand for the brand's products.

- Impact of Declining Demand in Key Markets: The decline in Gucci sales was particularly pronounced in key markets such as China and Europe, regions that are traditionally significant contributors to the brand’s revenue. This suggests a broader issue beyond simply regional economic fluctuations.

- Analysis of Gucci's Marketing and Product Strategies: Some analysts suggest that Gucci's marketing and product strategies may require a reassessment. A potential lack of innovation or a disconnect with evolving consumer tastes could be contributing factors to the sales decline. The need for a refreshed brand identity and more targeted marketing campaigns is increasingly apparent. Keywords: Gucci, Gucci sales, Gucci performance, Kering revenue, brand performance, sales decline.

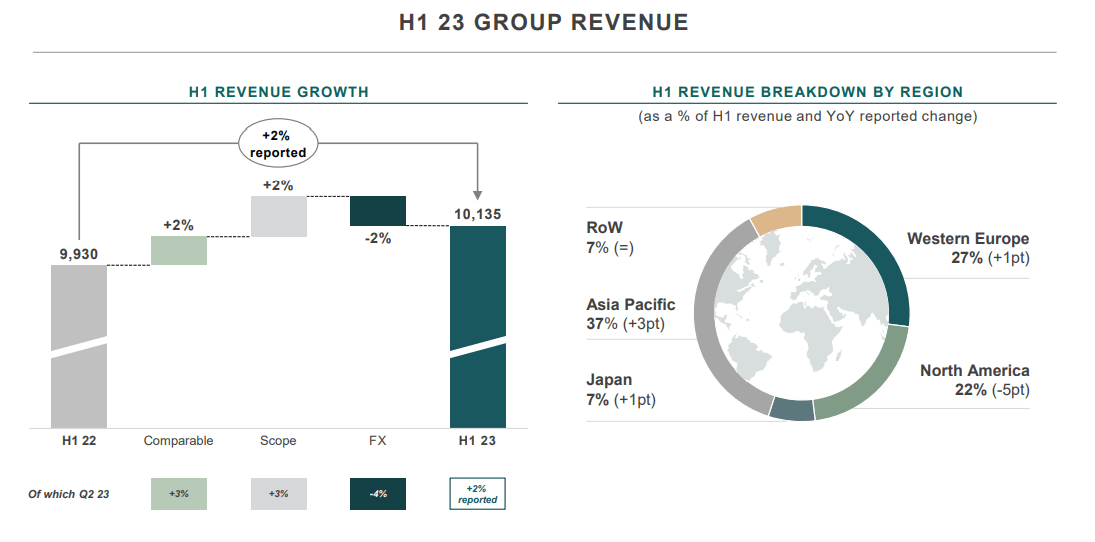

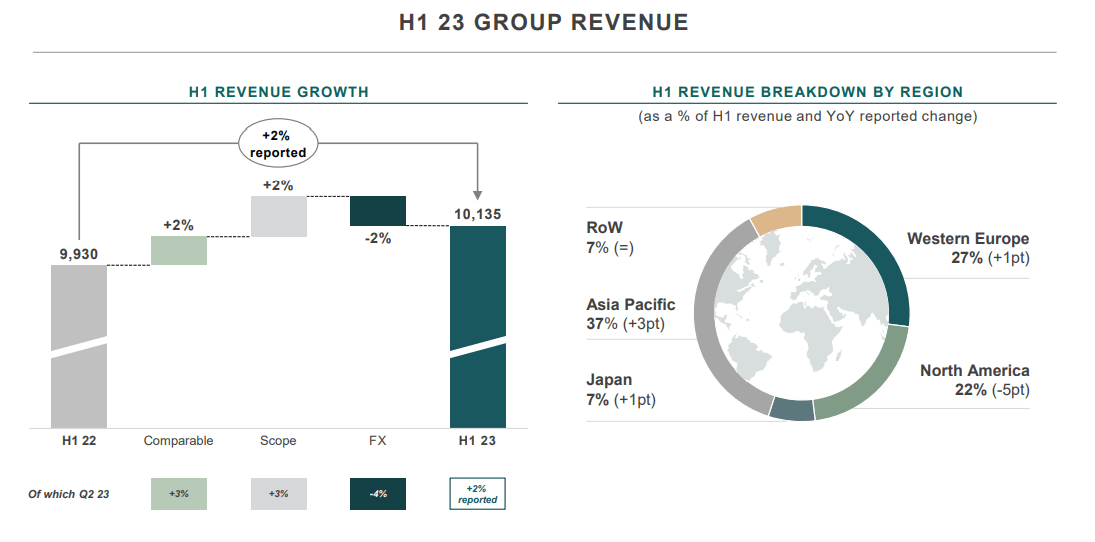

Overall Revenue Miss and Profit Margin Pressure

Kering's overall Q1 revenue significantly missed analyst expectations, further exacerbating the negative impact on the Kering stock price. This revenue shortfall, coupled with the weak Gucci performance, directly impacted profit margins. The company's profitability was also squeezed by rising costs and inflationary pressures, which are impacting the entire luxury goods sector.

- Comparison of Actual Revenue to Analyst Expectations: The reported revenue fell considerably below the consensus forecast among financial analysts, indicating a broader market disappointment.

- Discussion of the Impact of Operating Expenses: Rising operational costs, including raw material expenses and supply chain disruptions, ate into Kering's overall profitability, making the situation even more challenging.

- Analysis of the Company's Guidance for Future Performance: Kering's guidance for the remainder of the year is also under scrutiny, with many analysts expressing caution given the Q1 performance. This uncertainty is contributing to the volatility in the Kering share price. Keywords: Kering revenue, Kering profit, profit margin, financial performance, earnings report.

Investor Reaction and Market Sentiment

The immediate market reaction to Kering's Q1 results announcement was a sharp decline in the Kering stock price, reflecting a significant loss of investor confidence. The substantial drop in the share price underscores the severity of the situation and the concerns regarding the company's short-term and long-term prospects.

- Analysis of Stock Price Movement Following the Announcement: The 6% slump is a substantial drop, signifying a significant negative market sentiment. This dramatic shift reflects investors' concerns about the company's ability to navigate the current challenges.

- Commentary from Financial Analysts and Experts: Many financial analysts and industry experts have expressed concerns about Kering's Q1 performance, further impacting investor sentiment. Negative commentary from key analysts can significantly impact market perception and investor confidence.

- Comparison of Kering's Performance to Competitors: A comparison of Kering's performance to its major competitors in the luxury goods sector will shed light on the relative strength or weakness of its current position within the market. Keywords: Kering stock price, investor confidence, market reaction, stock market, share price volatility.

Potential Strategies for Kering's Recovery

To regain investor confidence and drive future growth, Kering needs to implement several strategic initiatives. Revitalizing the Gucci brand is paramount, along with exploring innovative marketing campaigns and product diversification strategies. Adapting to evolving consumer preferences and emerging market trends will be crucial for long-term success.

- Potential Product Innovations and Marketing Campaigns: Investing in innovative product designs and creating targeted marketing campaigns to reach specific consumer segments could significantly boost sales.

- Expansion into New Markets or Product Categories: Exploring new markets and expanding into complementary product categories may offer opportunities for growth and diversification.

- Restructuring or Cost-Cutting Measures: Kering may need to consider restructuring certain aspects of its operations or implement cost-cutting measures to improve profitability. Keywords: Kering strategy, brand revitalization, marketing strategy, future growth, business strategy.

Conclusion

The 6% slump in Kering's share price following a disappointing first-quarter performance underscores the significant challenges currently facing the luxury goods sector. Weak Gucci sales, missed revenue targets, and pressure on profit margins have contributed to considerable investor concern. The company is now facing the critical task of implementing effective strategies to regain investor confidence and stimulate future growth. The success of these strategies will be key to the future trajectory of the Kering stock price.

Call to Action: Stay informed on the latest developments affecting Kering's share price and the luxury goods market. Continue to monitor the company's performance and strategic responses to the challenges outlined above. Follow our coverage for further in-depth analysis and insights into Kering stock and broader luxury market trends.

Featured Posts

-

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Jymypaukku Taponen F1 Kuljettajaksi

May 25, 2025

Jymypaukku Taponen F1 Kuljettajaksi

May 25, 2025 -

Budget Friendly Country Properties Real Estate Finds Under 1m

May 25, 2025

Budget Friendly Country Properties Real Estate Finds Under 1m

May 25, 2025 -

Making The Escape To The Country A Reality A Step By Step Plan

May 25, 2025

Making The Escape To The Country A Reality A Step By Step Plan

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025