7-Year Prison Term For GPB Capital Founder David Gentile In Fraud Case

Table of Contents

The GPB Capital Fraud Scheme

The GPB Capital fraud involved a complex scheme that defrauded hundreds of investors out of millions of dollars. The company primarily offered investments in various alternative assets, including automotive dealerships and healthcare businesses. However, the reality behind these investments was drastically different from what was presented to potential investors. The core of the fraud lay in the systematic misrepresentation of the company's financial health and the performance of its underlying assets.

- Misrepresentation of assets and profitability: Gentile and his associates consistently overstated the value and profitability of GPB Capital's portfolio companies. Financial statements were manipulated to present a far rosier picture than the actual financial reality.

- Inflated valuations of portfolio companies: Independent appraisals were ignored or manipulated to inflate the value of the assets, making the investments appear much more attractive than they truly were.

- Diversion of investor funds for personal use: A significant portion of the investor funds was diverted for the personal enrichment of Gentile and other key figures within the company, rather than being used for the intended investments.

- Lack of transparency and proper accounting practices: GPB Capital lacked transparency in its financial reporting, making it incredibly difficult for investors to independently verify the accuracy of the information provided. Proper accounting procedures were routinely bypassed or ignored.

- Targeting of vulnerable investors: The company targeted vulnerable investors, including those with limited financial sophistication, making them more susceptible to the deceptive investment strategies.

The Charges Against David Gentile

David Gentile faced multiple serious charges related to his role in the GPB Capital fraud. These included wire fraud, securities fraud, and conspiracy to commit both wire and securities fraud. These charges reflect the gravity and multifaceted nature of the fraudulent activities.

- Specific examples of fraudulent activities: The prosecution presented evidence demonstrating Gentile's direct involvement in manipulating financial statements, misleading investors, and diverting funds.

- Evidence presented during the trial: The trial involved a significant amount of documentary evidence, including emails, financial records, and testimony from former employees and investors, all pointing towards Gentile's culpability.

- The role of other individuals involved in the scheme: While Gentile was a central figure, the scheme involved a network of individuals who played supporting roles in perpetrating the fraud. Several other individuals have also faced charges in connection with the GPB Capital case.

The Sentencing and its Significance

David Gentile received a seven-year prison sentence, along with significant financial penalties. This sentence is significant because it serves as a strong deterrent to others considering engaging in similar financial crimes. It demonstrates that authorities take such schemes very seriously. The sentence also carries significant weight for the victims of the GPB Capital fraud, offering some measure of justice after suffering substantial financial losses.

The Impact on Investors and the Market

The GPB Capital fraud resulted in substantial financial losses for hundreds of investors. The exact total remains to be fully calculated, but it amounts to tens, if not hundreds, of millions of dollars. The scale of the fraud significantly impacted investor confidence, particularly in alternative investment vehicles.

- The number of investors affected: The exact number of affected investors is still being determined, but it is estimated to be in the hundreds.

- The total amount of losses: While the full extent of the losses is still being assessed, it represents a significant financial blow to many investors, some of whom lost their life savings.

- The regulatory response to the fraud: The SEC and other regulatory bodies are investigating the case and have taken steps to prevent similar frauds from occurring in the future. This includes increased scrutiny of alternative investment funds and stricter enforcement of regulations.

- Lessons learned for future investors: The GPB Capital case highlights the importance of due diligence, independent verification of financial information, and seeking professional advice before making any significant investments.

Legal Ramifications and Ongoing Investigations

The legal ramifications of the GPB Capital fraud are still unfolding. Civil lawsuits are ongoing, seeking restitution for investors who suffered losses. Further investigations and potential criminal charges remain a possibility against other individuals involved in the scheme.

- Status of any civil lawsuits: Numerous civil lawsuits have been filed against GPB Capital and its associated individuals, seeking compensation for the losses incurred by investors.

- Potential for further criminal charges: The investigation is ongoing, and further charges could be filed against individuals who participated in the scheme.

- Regulatory changes in response to the fraud: Regulatory bodies are reviewing their oversight of alternative investment funds to prevent future occurrences of similar fraudulent schemes.

Conclusion

The seven-year prison sentence handed down to David Gentile in the GPB Capital fraud case underscores the severe consequences of financial malfeasance. This case highlights the importance of due diligence, transparency, and proper regulatory oversight in the investment industry. The significant losses suffered by investors serve as a cautionary tale. Understanding the intricacies of the GPB Capital fraud is crucial for protecting yourself from similar investment scams.

Call to Action: Understanding the intricacies of the GPB Capital fraud is crucial for protecting yourself from similar investment scams. Stay informed about financial regulations and practice due diligence before investing your hard-earned money. Research thoroughly and avoid high-risk investments lacking transparency. Learn more about protecting yourself from GPB Capital-type fraud and similar investment schemes to safeguard your financial future.

Featured Posts

-

Analyzing The Impact Tech Billionaires Losses After Donating To The Trump Inauguration

May 10, 2025

Analyzing The Impact Tech Billionaires Losses After Donating To The Trump Inauguration

May 10, 2025 -

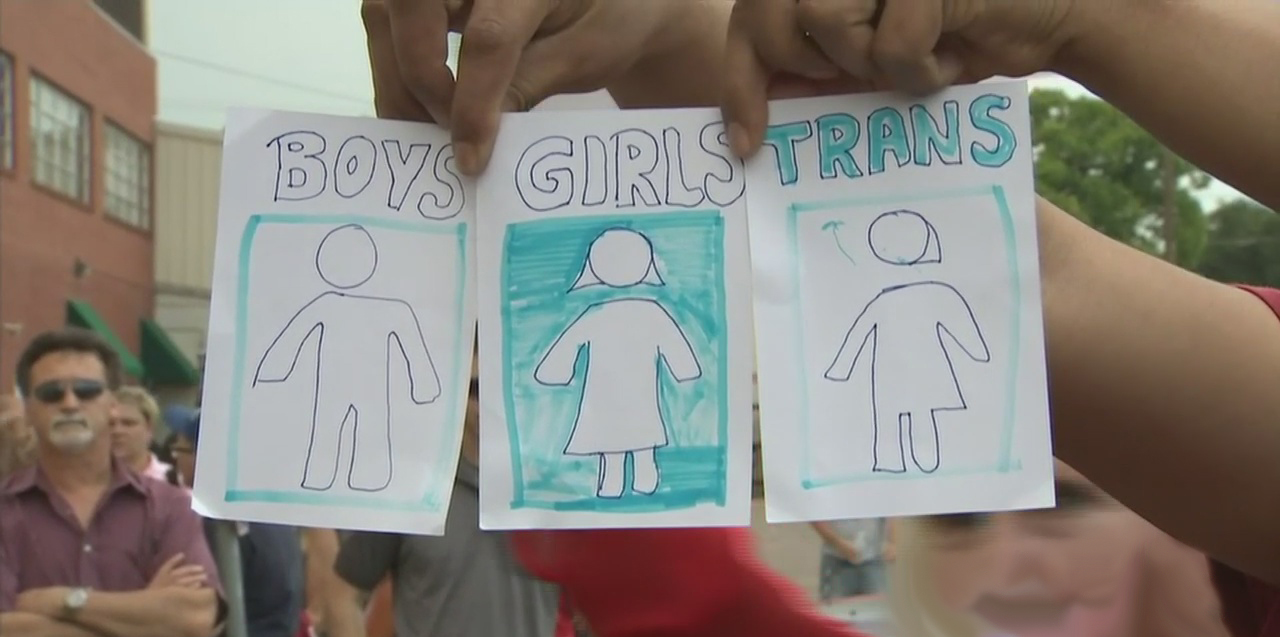

Controversia Por Arresto De Estudiante Transgenero En Bano Femenino

May 10, 2025

Controversia Por Arresto De Estudiante Transgenero En Bano Femenino

May 10, 2025 -

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025 -

Where To Invest Now A Comprehensive Guide To The Countrys Hottest Business Markets

May 10, 2025

Where To Invest Now A Comprehensive Guide To The Countrys Hottest Business Markets

May 10, 2025 -

Bodycam Video Shows Police Officers Quick Response To Choking Toddler

May 10, 2025

Bodycam Video Shows Police Officers Quick Response To Choking Toddler

May 10, 2025