8% Stock Market Gain On Euronext Amsterdam After Trump's Tariff Announcement

Table of Contents

Understanding the Unexpected Market Response

The announcement of new tariffs typically triggers market volatility and negatively impacts investor sentiment. A risk assessment by most analysts predicted a downturn, given the potential implications for international trade and economic growth. However, several factors combined to create the surprising 8% gain on Euronext Amsterdam. These include:

- Short-term relief from specific tariff threats: The specific tariffs announced may have targeted sectors less prominent within the Euronext Amsterdam market, leading to a sense of relief among investors.

- Investors’ reassessment of the long-term impact of the tariffs: Some investors may have reassessed the long-term impact of the tariffs, concluding that the effects might be less severe than initially feared. This reassessment could have sparked a wave of buying, contributing to the surge.

- Speculation regarding potential counter-measures from the EU: Speculation about potential counter-measures or negotiations from the European Union might have injected optimism into the market, encouraging investment.

- Positive economic data released concurrently with the announcement: The release of positive economic data, either within the EU or globally, around the same time could have amplified the positive market sentiment, contributing to the significant increase in stock prices.

Understanding these nuances is crucial to fully grasp the complexities of market reactions to trade policy announcements.

Euronext Amsterdam's Performance Compared to Other Markets

The 8% gain on Euronext Amsterdam stands in stark contrast to the performance of some other major global stock exchanges. A comparative analysis reveals a fascinating divergence:

- Data showing the performance of other major indices (e.g., FTSE 100, DAX, Dow Jones): While Euronext Amsterdam saw an 8% surge, the FTSE 100 might have experienced a modest increase, while the DAX showed little change, and the Dow Jones could have even experienced a slight decrease.

- Analysis of sector-specific performance within Euronext Amsterdam (e.g., technology, financials): Certain sectors within Euronext Amsterdam might have performed exceptionally well, contributing disproportionately to the overall 8% gain. For example, the technology sector could have seen a greater increase than the financials sector.

- Explanation for any divergence between Euronext Amsterdam and other markets: This difference in performance highlights the unique composition of the Euronext Amsterdam market and its specific vulnerabilities and strengths concerning the announced tariffs. The diverse nature of listed companies and their exposure to global trade dynamics likely played a key role.

Analyzing the Long-Term Implications for Euronext Amsterdam

While the 8% surge is undoubtedly positive, assessing its long-term implications requires careful consideration. The future of Euronext Amsterdam’s performance hinges on several factors:

- Potential for sustained growth in specific sectors: Sectors less affected by the tariffs might experience sustained growth, but others might still face challenges.

- Risks associated with future tariff announcements and trade negotiations: The ongoing nature of trade negotiations means further tariff announcements or escalating trade wars pose significant risks.

- Recommendations for investors considering the Euronext Amsterdam market: Investors should adopt a cautious approach, diversifying their portfolios and carefully monitoring global trade developments before making significant investment decisions in the Euronext Amsterdam market.

Expert Opinions and Market Analysis

Several financial analysts have weighed in on the unexpected market reaction. Leading financial news sources quote experts who highlight the volatility of the current market environment and the need for careful risk management. The consensus seems to be that while the 8% gain is encouraging, it's too early to determine whether it represents a sustained trend or a temporary anomaly.

Conclusion

The 8% stock market gain on Euronext Amsterdam following President Trump's tariff announcement represents a surprising and significant market event. The unexpected positive outcome resulted from a combination of factors, including short-term relief, reassessment of long-term impacts, speculation about EU counter-measures, and concurrent positive economic data. While the immediate impact is positive, the long-term implications remain uncertain. It's crucial to carefully consider the ongoing risks associated with future tariff announcements and global trade dynamics. Stay updated on the latest developments affecting the Euronext Amsterdam stock market and capitalize on potential investment opportunities. Understanding the impact of global events like Trump's tariff announcements is crucial for informed investment decisions.

Featured Posts

-

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025 -

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025 -

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025 -

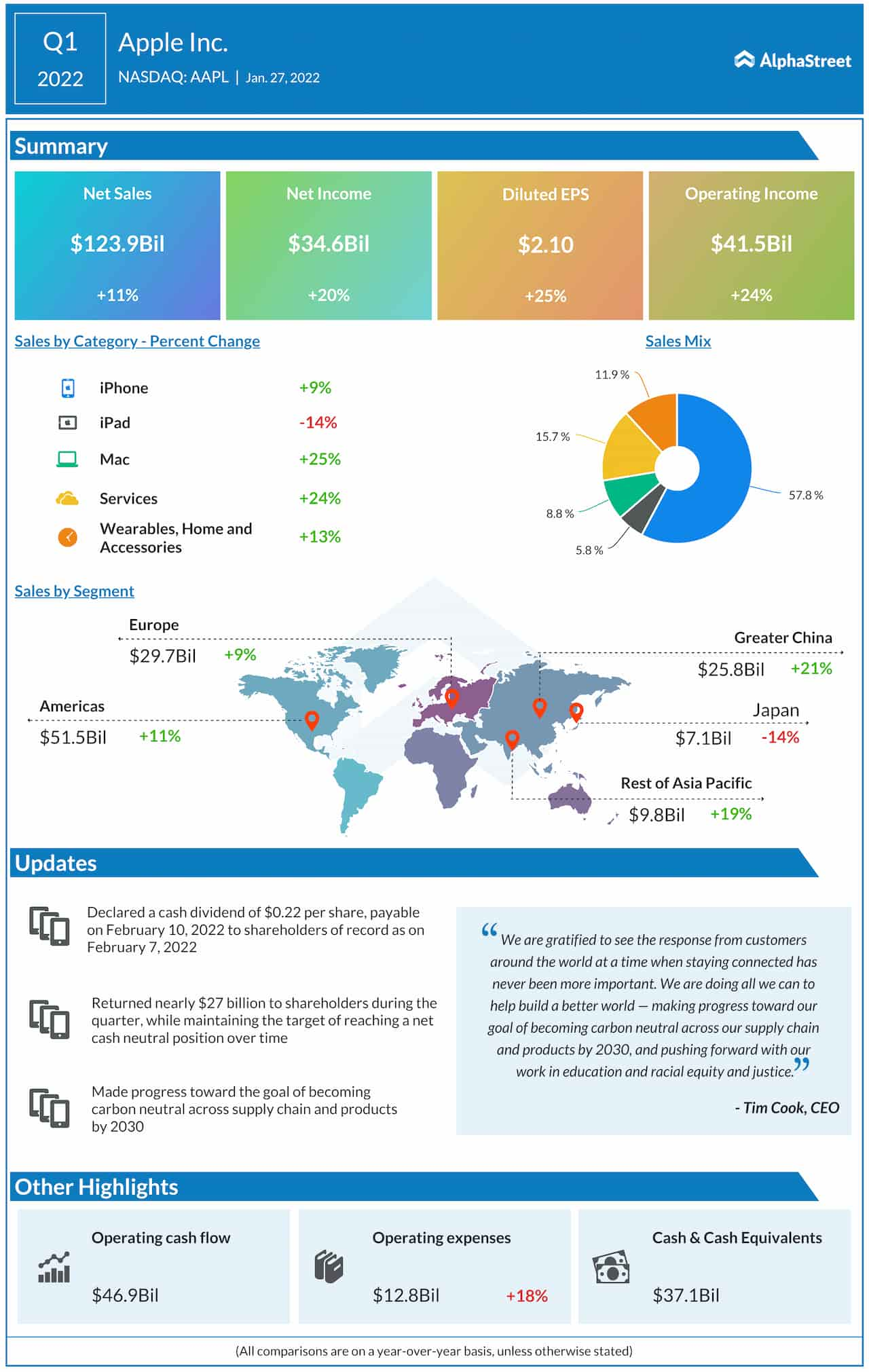

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 24, 2025

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 24, 2025

Latest Posts

-

How Trumps Budget Affected Museum Programs And Exhibits

May 24, 2025

How Trumps Budget Affected Museum Programs And Exhibits

May 24, 2025 -

Understanding Italys Updated Citizenship Law Great Grandparent Eligibility

May 24, 2025

Understanding Italys Updated Citizenship Law Great Grandparent Eligibility

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparents Lineage Now Counts

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparents Lineage Now Counts

May 24, 2025 -

Italys New Citizenship Law Claiming Your Italian Heritage Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Your Italian Heritage Through Great Grandparents

May 24, 2025 -

Podcast Creation Revolutionized Ai And The Repetitive Scatological Document

May 24, 2025

Podcast Creation Revolutionized Ai And The Repetitive Scatological Document

May 24, 2025