A Financial Planner's Guide To Student Loan Repayment

Table of Contents

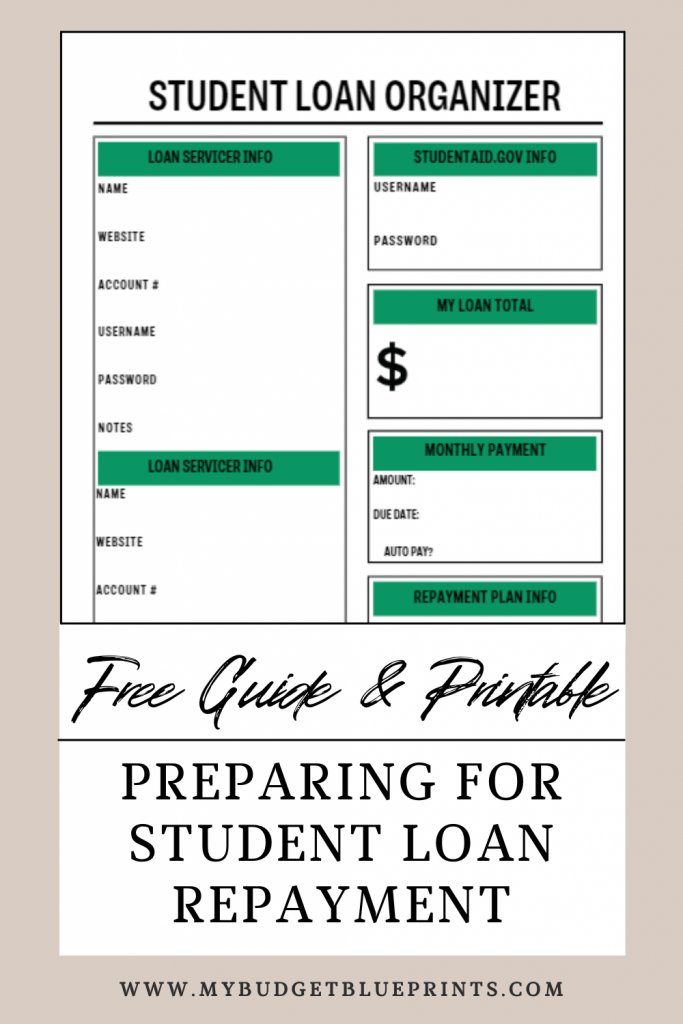

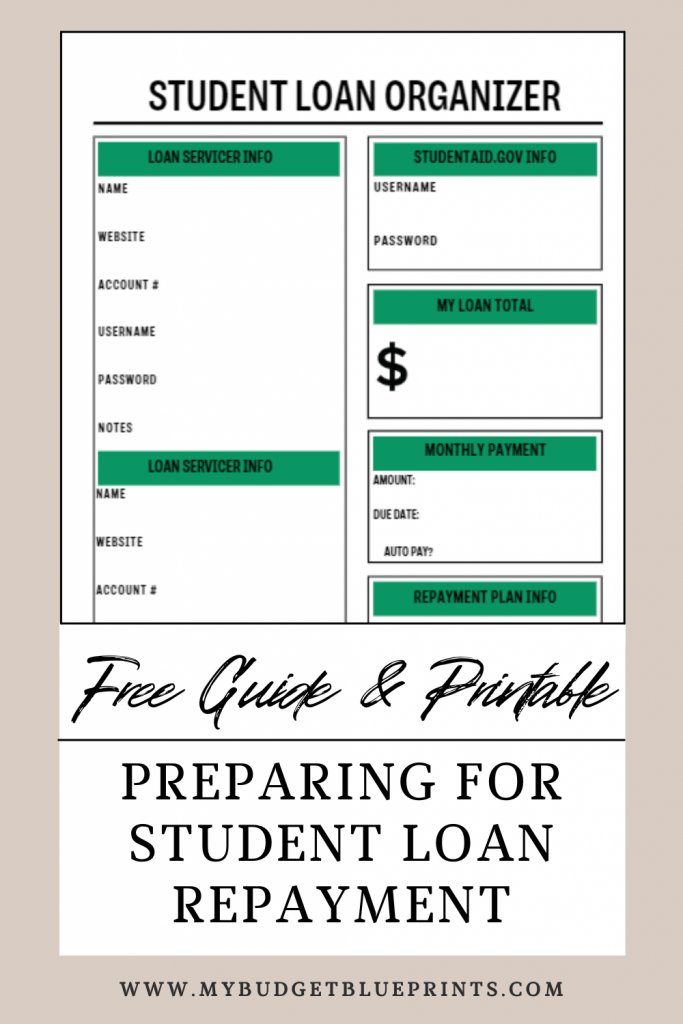

Understanding Your Student Loan Debt

Before developing a repayment strategy, it's crucial to understand the specifics of your student loan debt. This involves identifying loan types, interest rates, and the total amount owed.

Identifying Loan Types and Interest Rates

Understanding the difference between federal and private student loans, as well as fixed vs. variable interest rates, is crucial for effective repayment planning.

- Federal loan programs: Direct Subsidized Loans (where the government pays the interest while you're in school), Direct Unsubsidized Loans (where interest accrues while you're in school), and Direct PLUS Loans (for parents or graduate students).

- Private loan variations: These loans come from banks and credit unions, often with varying interest rates and repayment terms. They typically lack the same borrower protections as federal loans.

- Importance of understanding interest capitalization: This is when accrued interest is added to your principal loan balance, increasing the total amount you owe. Understanding this is vital for accurately projecting your total repayment cost.

The implications of each loan type and interest rate significantly impact your overall repayment strategy. For instance, federal loans often offer income-driven repayment plans and potential loan forgiveness programs, while private loans typically do not. Higher interest rates lead to significantly higher overall repayment costs.

Consolidating Student Loans

Student loan consolidation involves combining multiple loans into a single loan. This can simplify your payments and potentially lower your interest rate, making it easier to manage your debt. However, there are drawbacks.

- Direct Consolidation Loan program: This federal program allows you to combine eligible federal student loans.

- Potential benefits and drawbacks: Benefits include simplified payments and potentially a lower monthly payment (though not always a lower total cost). Drawbacks include potentially losing access to certain benefits tied to specific loan types, such as income-driven repayment plans or loan forgiveness programs.

- When consolidation is a good/bad idea: Consolidation is generally a good idea if you want to simplify your payments and have a consistent monthly payment. However, carefully consider the potential loss of benefits before consolidating.

A thorough analysis of the financial implications is necessary before consolidating. Consider the weighted average interest rate of your current loans compared to the offered rate on a consolidated loan. Factor in any potential loss of benefits.

Exploring Repayment Plans

Several repayment plans are available, each with its own terms and conditions. Choosing the right plan depends on your individual financial circumstances.

Standard Repayment Plan

This is the most basic plan, offering fixed monthly payments over a 10-year period.

- Fixed monthly payments: These payments remain constant throughout the repayment term.

- Total repayment time: 10 years.

- Eligibility criteria: Generally applicable to most federal student loans.

This plan is suitable for borrowers who can comfortably afford fixed monthly payments and want to pay off their loans quickly. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $316, leading to a total repayment of $37,920.

Income-Driven Repayment (IDR) Plans

IDR plans adjust your monthly payment based on your income and family size. If your income is low, your monthly payment may be significantly lower than with a standard plan. These plans are designed to make repayment more manageable.

- IBR (Income-Based Repayment), PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), ICR (Income-Contingent Repayment): Each plan has slightly different eligibility requirements and payment calculation methods. It is crucial to understand the specifics of each program.

- Key differences and eligibility criteria for each: Eligibility criteria often differ based on loan type and income levels. Payment calculations vary, leading to differences in monthly payments and total repayment costs.

- Potential for loan forgiveness after 20-25 years: Depending on the plan and your income throughout the repayment period, a portion of your remaining loan balance may be forgiven after 20-25 years. This is not guaranteed and has tax implications.

A comparison table outlining the key features of each IDR plan would be beneficial for making an informed decision.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years. This lowers monthly payments, but you'll pay significantly more in interest over the life of the loan.

- Longer repayment period: Up to 25 years.

- Higher total interest paid: Due to the extended repayment period, the total interest paid is substantially higher than with shorter repayment plans.

- When this plan might be beneficial: This plan might be helpful for borrowers who need a lower monthly payment to manage their current finances, even if it means paying more interest over time.

The trade-off between a shorter repayment timeline and a lower monthly payment is crucial to consider when choosing a repayment plan.

Strategies for Accelerated Student Loan Repayment

Several strategies can help you repay your student loans faster and reduce the total interest paid.

Making Extra Payments

Making extra payments, beyond your required minimum monthly payment, can significantly accelerate your repayment process.

- Bi-weekly payments: Paying half your monthly payment every two weeks adds the equivalent of one extra monthly payment per year.

- One-time lump-sum payments: Unexpected income, such as a tax refund or bonus, can be directed towards your loan principal.

- Impact on total interest paid: Even small extra payments can dramatically decrease the total interest you pay over the life of the loan.

Calculations illustrating the impact of extra payments on your total interest and repayment time are crucial for showcasing the benefits.

Refinance Your Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate.

- Eligibility criteria: Generally requires a good credit score and stable income.

- Interest rate comparison: Shop around for the best interest rates from different lenders.

- Potential risks and drawbacks: You may lose federal loan benefits, such as income-driven repayment plans or loan forgiveness programs, when refinancing federal loans.

A step-by-step guide to the refinancing process, highlighting crucial aspects such as comparing lenders and understanding the terms of the new loan, is invaluable for borrowers considering this option.

Seeking Professional Help

Navigating the complexities of student loan repayment can be challenging. Seeking professional advice is highly recommended.

The Role of a Financial Planner

A financial planner can provide personalized guidance and create a comprehensive student loan repayment strategy tailored to your financial situation.

- Personalized strategies: They can analyze your specific circumstances and recommend the best repayment plan and strategies for you.

- Debt management planning: They can help you integrate student loan repayment into a broader debt management plan.

- Long-term financial planning: They can help you achieve your long-term financial goals, such as buying a home or saving for retirement, while managing your student loans.

Financial planners offer invaluable support in navigating the complexities of student loan repayment and developing a personalized strategy for long-term financial success.

Conclusion

Effectively managing student loan repayment requires a thorough understanding of available options and a strategic approach. This guide has provided a framework for financial planners to assist their clients in developing personalized student loan repayment plans. By carefully considering loan types, repayment plans, and strategies for accelerated repayment, you can help your clients minimize their debt burden and achieve their long-term financial goals. Contact us today to learn more about how we can help you navigate student loan repayment and develop a customized strategy to achieve financial freedom.

Featured Posts

-

Uber Calls Off Foodpanda Taiwan Purchase Amid Regulatory Hurdles

May 17, 2025

Uber Calls Off Foodpanda Taiwan Purchase Amid Regulatory Hurdles

May 17, 2025 -

Tam Krwz Awr Mdah Jwtwn Ka Waqeh Swshl Mydya Pr Chrcha Ka Mwdwe

May 17, 2025

Tam Krwz Awr Mdah Jwtwn Ka Waqeh Swshl Mydya Pr Chrcha Ka Mwdwe

May 17, 2025 -

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Mdah Ka Waqeh Awr Adakar Ka Jwab

May 17, 2025

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Mdah Ka Waqeh Awr Adakar Ka Jwab

May 17, 2025 -

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025 -

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025

Latest Posts

-

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025 -

Recession Proof Stocks Is Uber One Of Them

May 17, 2025

Recession Proof Stocks Is Uber One Of Them

May 17, 2025 -

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025 -

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025 -

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025