A Statistical Look At The US Economy During The Trump Years

Table of Contents

GDP Growth and Job Creation Under President Trump

Annual GDP Growth Rates

Analyzing the yearly GDP growth rates under President Trump offers valuable insights into the overall economic performance. Examining "GDP growth Trump" reveals a mixed picture. While initial years showed promising growth, later years faced challenges. Using data from the Bureau of Economic Analysis (BEA), we can compare the "economic growth under Trump" to previous administrations. Focusing on "real GDP growth," which adjusts for inflation, provides a more accurate reflection of economic expansion.

- 2017: GDP growth was approximately 2.3%.

- 2018: GDP growth reached around 2.9%, a relatively strong year.

- 2019: Growth slowed to approximately 2.2%.

- 2020: The COVID-19 pandemic significantly impacted the economy, resulting in a sharp contraction of -3.5%.

- 2021: A rebound occurred, with growth around 5.7%, partially fueled by post-pandemic recovery efforts.

Compared to the Obama administration's average annual GDP growth, the Trump years show a somewhat lower average, although the impact of the pandemic significantly skews the overall comparison. External factors like the Tax Cuts and Jobs Act of 2017 and the ongoing US-China trade war significantly influenced these growth figures.

Job Creation and Unemployment Rates

Examining "job growth Trump presidency" and "Trump unemployment rate" provides another lens through which to assess economic performance. The labor market generally performed well during the pre-pandemic years of the Trump administration.

- Monthly Job Creation: The economy experienced consistent job growth for much of the period, with monthly job creation numbers frequently exceeding expectations.

- Unemployment Rates: Unemployment rates fell to historic lows before the pandemic, reaching a 50-year low in 2019. This decrease was observed across various demographic groups, indicating broad-based improvement in the "labor market Trump".

- Sectoral Shifts: While job creation was widespread, some sectors experienced more significant growth than others, reflecting shifts in the overall economic landscape.

However, the COVID-19 pandemic drastically impacted employment numbers, leading to a sharp rise in unemployment before the subsequent recovery.

Impact of Tax Cuts and Trade Policies

The Tax Cuts and Jobs Act of 2017

The "Tax Cuts and Jobs Act impact" on the US economy remains a subject of ongoing debate. The act significantly lowered corporate and individual income tax rates.

- Key Provisions: Key provisions included reducing the corporate tax rate from 35% to 21%, standard deduction increases for individuals, and changes to the alternative minimum tax.

- Impact on Investment and Consumer Spending: Proponents argued the tax cuts stimulated investment and consumer spending, boosting economic growth. Opponents countered that the benefits disproportionately favored corporations and high-income earners, increasing the national debt without generating sufficient economic growth to offset the cost. The long-term implications of these "Trump tax cuts effect on GDP" are still being assessed.

- Debate on Stimulating Growth: The extent to which the tax cuts actually stimulated economic growth remains a contentious point, with economists offering differing perspectives on their effectiveness.

Trade Wars and their Economic Consequences

The Trump administration's "Trump trade war impact" through the initiation of trade disputes, particularly with China, had significant consequences for the US and global economy.

- Tariffs and Trade Disputes: The administration imposed tariffs on various goods, leading to retaliatory tariffs from other countries.

- Effects on Import/Export Prices: These tariffs increased the prices of imported goods, impacting consumers and businesses.

- Impact on Specific Industries: Certain industries, such as agriculture and manufacturing, were disproportionately affected by these trade disputes, facing increased costs and reduced competitiveness.

- Overall Economic Cost: Studies have estimated the significant economic costs associated with these "US-China trade war economic effects," including reduced GDP growth and increased prices for consumers.

Inflation, Interest Rates, and National Debt Under the Trump Administration

Inflation Rates

Examining "inflation Trump presidency" and "CPI Trump years" reveals relatively moderate inflation during much of the period.

- Annual Inflation Figures: Inflation rates generally remained within the Federal Reserve's target range.

- Comparison with Previous Administrations: Compared to previous administrations, inflation rates during the Trump years were not exceptionally high.

- Inflationary Pressures: While inflation remained moderate, various factors, such as trade disputes and fiscal policies, could have exerted inflationary pressures.

Interest Rate Policies

The "Federal Reserve Trump years" and "monetary policy Trump administration" witnessed gradual increases in interest rates initially, followed by a period of rate cuts in response to the economic slowdown caused by the COVID-19 pandemic.

- Changes in Interest Rates: The Federal Reserve raised interest rates several times in 2018, before reversing course in 2019 and 2020.

- Reasons Behind Rate Adjustments: These adjustments were aimed at managing inflation and maintaining economic stability.

- Impact on Borrowing Costs and Investment: Interest rate changes directly impacted borrowing costs for businesses and consumers, affecting investment and spending.

National Debt Growth

Analyzing "national debt Trump" and "US national debt growth Trump years" reveals a significant increase in the national debt during the Trump presidency.

- Yearly Changes in the National Debt: The national debt grew substantially each year, particularly due to tax cuts and increased government spending.

- Comparison with Previous Administrations: The rate of national debt growth under Trump was faster than under previous administrations, although the COVID-19 pandemic played a significant role in escalating the debt in later years.

- Factors Contributing to Debt Growth: Tax cuts, increased military spending, and the economic fallout from the pandemic all contributed to this debt growth. The "debt to GDP ratio Trump" also saw a notable increase.

Conclusion

This statistical overview of the US economy during the Trump years reveals a complex picture. While GDP growth and job creation were positive in certain periods, the impact of tax cuts, trade policies, and rising national debt requires further nuanced examination. Understanding these economic trends is crucial for informed policy discussions. To delve deeper into specific aspects of the US Economy Trump Years, you can explore additional resources from reputable economic organizations and government agencies. Further research into the long-term consequences of the policies implemented during this period is vital for a comprehensive understanding.

Featured Posts

-

Bu Aksamki Diziler 17 Subat Pazartesi Tv Rehberi

Apr 23, 2025

Bu Aksamki Diziler 17 Subat Pazartesi Tv Rehberi

Apr 23, 2025 -

Subsystem Glitch Leads To Blue Origin Rocket Launch Cancellation

Apr 23, 2025

Subsystem Glitch Leads To Blue Origin Rocket Launch Cancellation

Apr 23, 2025 -

Seven Shutout Innings Skubals Masterclass Against Brewers

Apr 23, 2025

Seven Shutout Innings Skubals Masterclass Against Brewers

Apr 23, 2025 -

Canadian Immigration To Us Plummets Survey Points To Trumps Impact

Apr 23, 2025

Canadian Immigration To Us Plummets Survey Points To Trumps Impact

Apr 23, 2025 -

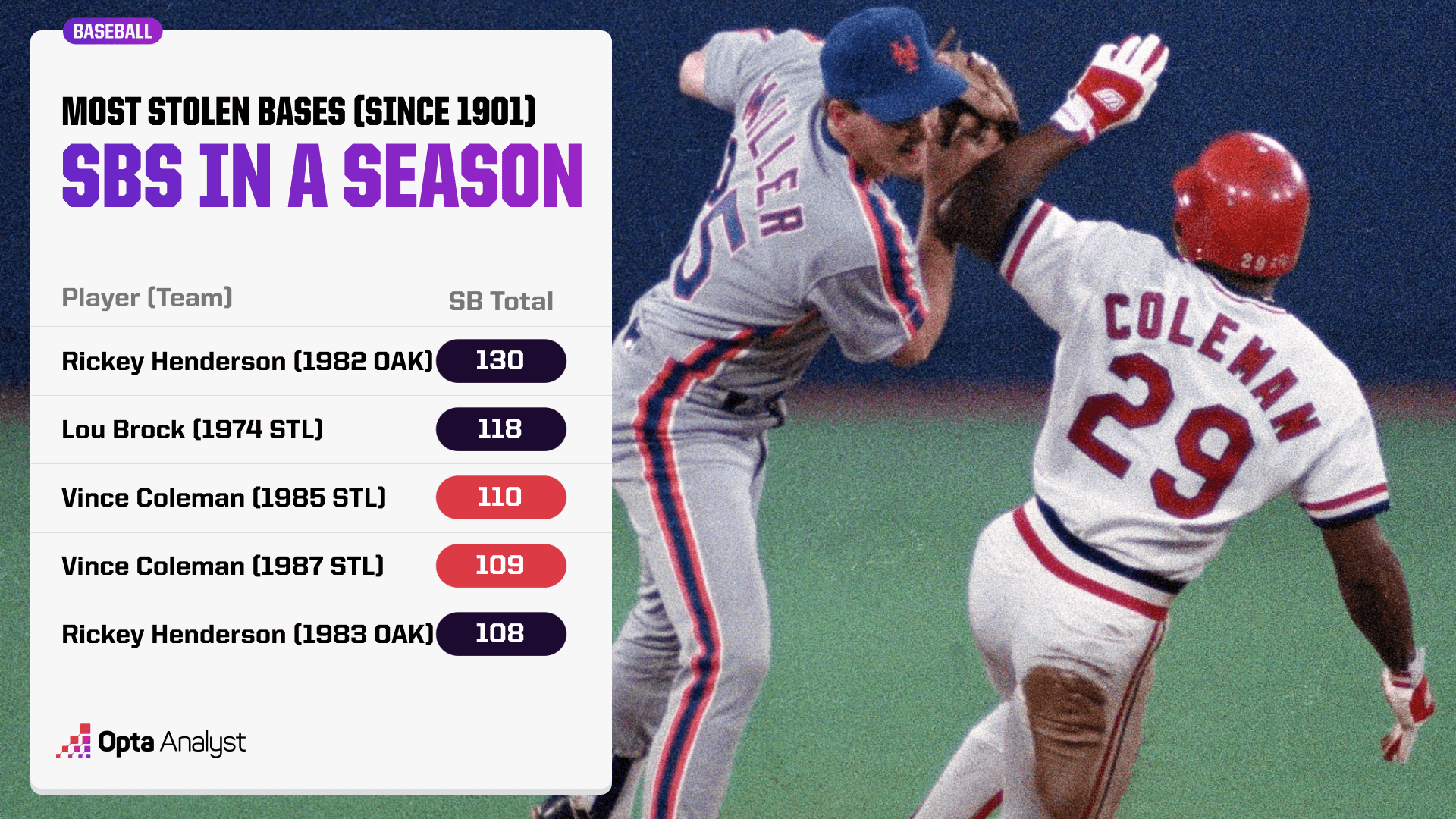

Nine Stolen Bases Brewers Historic Performance Sparks As Rout

Apr 23, 2025

Nine Stolen Bases Brewers Historic Performance Sparks As Rout

Apr 23, 2025