AAPL Stock: Important Price Levels And Future Predictions

Table of Contents

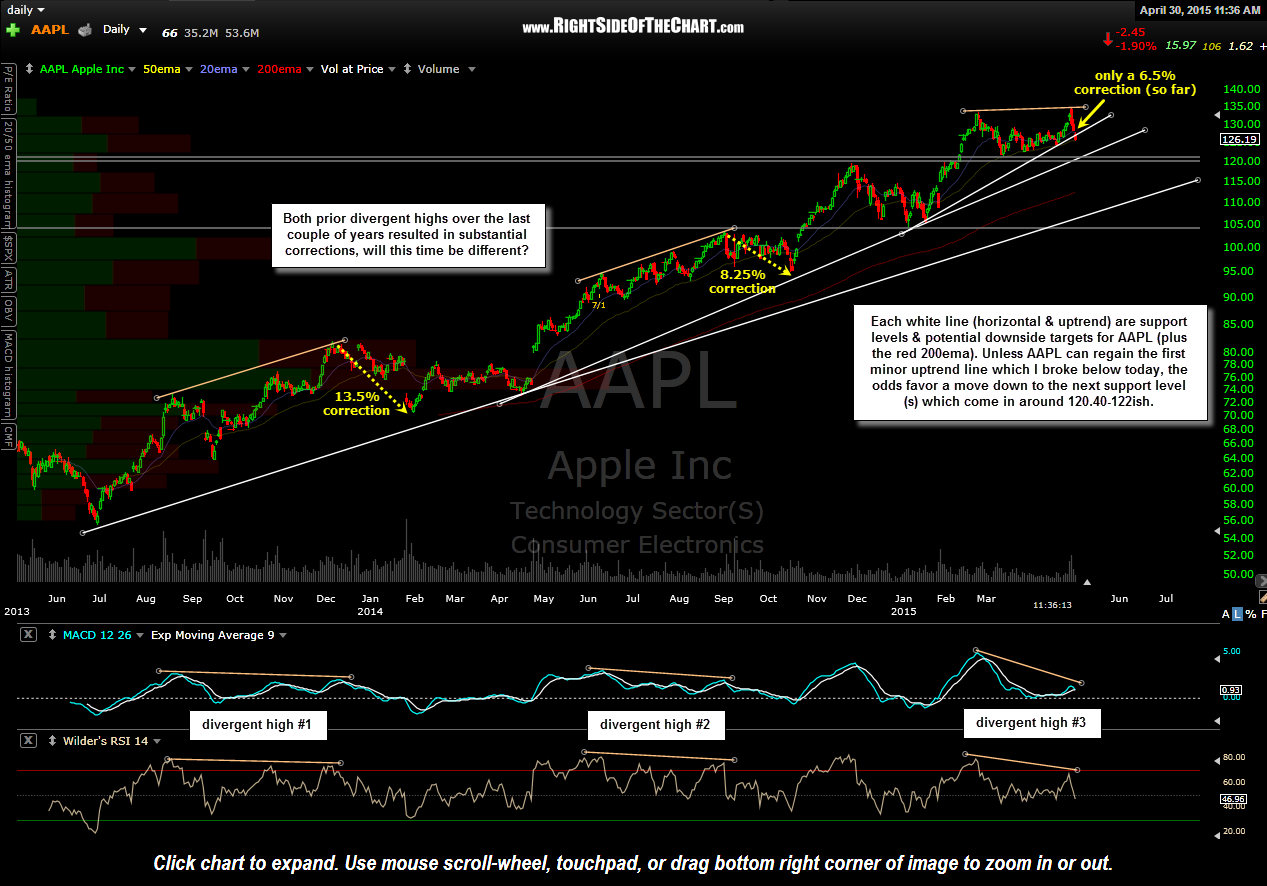

Analyzing Current AAPL Stock Price Levels

Understanding current AAPL stock price levels is essential for any investment strategy. This involves identifying key support and resistance levels and analyzing the prevailing market sentiment.

Key Support and Resistance Levels

Significant historical price points have acted as support (price floor) and resistance (price ceiling) for AAPL stock. Identifying these levels is crucial for predicting potential price reversals and setting appropriate stop-loss orders.

- $150 Support Level (Q3 2023): This level held strong during a period of market uncertainty, indicating strong underlying support for the stock. A break below this level could signal further downward pressure.

- $175 Resistance Level (Q4 2023): This level represented a significant hurdle for the stock price, indicating seller resistance. A sustained break above this level could trigger further upward momentum.

- $200 Psychological Level: Round numbers like $200 often act as significant psychological barriers, influencing investor behavior and potentially causing price fluctuations.

Technical analysis indicators such as moving averages (e.g., 50-day and 200-day moving averages) and Fibonacci retracements can help identify these support and resistance levels more accurately. Monitoring these indicators alongside price action can provide valuable insights into potential price movements.

Current Market Sentiment and its Impact on AAPL

Current news and events significantly impact Apple's stock price. Analyzing market sentiment—whether bullish or bearish—is crucial for making informed investment decisions.

- Recent Product Launches: The launch of the iPhone 15 series and the Apple Watch Series 9 has generally been met with positive reviews, potentially boosting investor confidence and driving the AAPL stock price upward.

- Financial Reports: Strong financial reports with robust revenue and earnings growth will typically boost investor confidence and positively impact the Apple stock price forecast. Conversely, disappointing results can lead to price declines.

- Economic Indicators: Macroeconomic factors such as inflation, interest rate hikes, and recessionary fears can influence investor risk appetite and significantly impact tech stock performance, including AAPL.

- Competitor Actions: Actions by competitors like Samsung and Google in the smartphone and wearable markets can affect Apple's market share and subsequently its stock price.

Factors Influencing Future AAPL Stock Predictions

Predicting the future of AAPL stock requires considering various factors, including product innovation, economic conditions, and competitive pressures.

Product Innovation and Future Launches

Apple's continued innovation is a key driver of its stock price. Anticipated product launches can significantly impact the AAPL stock forecast.

- New iPhones: Annual iPhone releases are major events that typically influence AAPL stock price movements. Strong sales and positive reviews can boost the stock price, while weak demand can lead to declines.

- Apple Watch and Other Wearables: The Apple Watch continues to grow in popularity, contributing to Apple's overall revenue and potentially impacting its stock valuation.

- AR/VR Devices: The potential launch of augmented reality (AR) and virtual reality (VR) devices could be a major catalyst for Apple's future growth and potentially a major driver for the AAPL stock price.

- Services Revenue Growth: The continued growth of Apple's services revenue stream (Apple Music, iCloud, App Store, etc.) adds stability and potential for long-term growth.

Economic and Geopolitical Factors

Broader economic conditions and geopolitical events can significantly influence Apple's performance and, consequently, its stock price.

- Inflation and Interest Rates: High inflation and rising interest rates can reduce consumer spending and impact Apple's sales, potentially putting downward pressure on AAPL stock.

- Supply Chain Issues: Global supply chain disruptions can impact Apple's production and delivery schedules, influencing its financial performance and stock price.

- International Trade Policies: Changes in international trade policies can affect Apple's global operations and profitability.

- Regulatory Changes: Increased regulatory scrutiny in various markets can impact Apple's business operations and its stock price.

Competition and Market Share

Apple faces competition in various markets, and its market share performance significantly impacts future stock predictions.

- Smartphone Market: Samsung and other Android manufacturers remain strong competitors in the smartphone market, impacting Apple's market share and potentially influencing AAPL stock price.

- Wearables Market: Competition from Fitbit, Samsung, and other wearable device manufacturers impacts Apple's market share in this growing segment.

- Services Market: Competition from streaming services and other software platforms puts pressure on Apple's services revenue growth and might affect its stock valuation.

AAPL Stock Valuation and Investment Strategies

A thorough evaluation of AAPL stock requires analyzing its fundamentals and considering various investment strategies.

Fundamental Analysis of AAPL

Assessing Apple's financial performance and valuation metrics is crucial for determining its intrinsic value.

- Revenue and Earnings Growth: Analyzing Apple's historical revenue and earnings growth provides insights into its profitability and potential for future growth.

- Debt Levels: Assessing Apple's debt levels helps understand its financial health and risk profile.

- P/E Ratio and Price-to-Sales Ratio: Comparing Apple's valuation metrics to its peers and historical averages helps determine whether the stock is undervalued or overvalued.

Potential Investment Strategies for AAPL

Investment strategies for AAPL stock vary depending on risk tolerance and investment goals.

- Buy-and-Hold: A long-term buy-and-hold strategy is suitable for investors with a long-term horizon and a higher risk tolerance.

- Value Investing: Value investors look for undervalued stocks based on fundamental analysis and aim to capitalize on price appreciation.

- Growth Investing: Growth investors focus on companies with high growth potential and are willing to pay a premium for future earnings.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, reducing the risk associated with market timing.

Conclusion

Predicting the future price of AAPL stock requires carefully analyzing current price levels, understanding key support and resistance points, and assessing the impact of various factors such as product innovation, economic conditions, and competition. Both technical and fundamental analyses are crucial for informed decision-making. Remember that this analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to AAPL stock. Stay informed about AAPL stock price levels and future predictions to make wise investment choices and maximize your returns on your Apple stock investment.

Featured Posts

-

Teatr Mossoveta Vecher Pamyati Sergeya Yurskogo

May 25, 2025

Teatr Mossoveta Vecher Pamyati Sergeya Yurskogo

May 25, 2025 -

Crisi Dazi Mercati In Caduta Libera La Risposta Dell Ue

May 25, 2025

Crisi Dazi Mercati In Caduta Libera La Risposta Dell Ue

May 25, 2025 -

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 25, 2025

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 25, 2025 -

17 Celebrities Who Destroyed Their Careers In A Single Day

May 25, 2025

17 Celebrities Who Destroyed Their Careers In A Single Day

May 25, 2025 -

Demna At Gucci Analyzing The Impact On The Brand

May 25, 2025

Demna At Gucci Analyzing The Impact On The Brand

May 25, 2025

Latest Posts

-

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025 -

A Fathers 2 2 Million Row Funding His Sons Life Saving Treatment

May 25, 2025

A Fathers 2 2 Million Row Funding His Sons Life Saving Treatment

May 25, 2025 -

Pandemic Fraud Lab Owner Convicted For False Covid Test Results

May 25, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Results

May 25, 2025 -

The Sutton Hoo Ship New Insights Into Sixth Century Burial Rites And Cremated Remains

May 25, 2025

The Sutton Hoo Ship New Insights Into Sixth Century Burial Rites And Cremated Remains

May 25, 2025 -

Apples Ceo Tim Cook A Year Of Setbacks

May 25, 2025

Apples Ceo Tim Cook A Year Of Setbacks

May 25, 2025