AbbVie (ABBV) Stock Rises On Exceeded Sales & Revised Profit Guidance

Table of Contents

Exceeded Sales Expectations Across Key Therapeutic Areas

AbbVie's sales performance significantly outperformed analyst predictions, demonstrating the strength and resilience of its diverse product portfolio. Stronger-than-projected sales of key drugs played a crucial role in this success. This impressive performance wasn't limited to a single area; instead, it reflects the overall strength of AbbVie's strategic approach.

-

Strong Performance of Rinvoq and Skyrizi: The impressive sales growth of Rinvoq and Skyrizi, AbbVie's key immunology drugs, more than compensated for the impact of Humira biosimilar competition. These newer drugs are rapidly gaining market share, establishing themselves as leading treatments in their respective therapeutic areas.

-

Robust Sales Figures Across Therapeutic Areas: Detailed sales figures revealed consistent growth across several therapeutic areas, including immunology, oncology, and aesthetics. This diverse performance demonstrates the stability and resilience of AbbVie's business model, reducing dependence on any single product. Specific numbers, compared to previous quarters and analyst consensus, will be crucial in further evaluating this performance. [Note: Insert specific sales figures and comparisons here once available from the official earnings report].

-

Geographic Sales Growth: Sales growth was not limited to a specific region; instead, it was observed across multiple geographies, illustrating the global demand for AbbVie's innovative products and the effective execution of its international business strategy.

Upward Revision of Profit Guidance for 2024

The positive sales results directly translated into an upward revision of AbbVie's profit guidance for 2024. This is a strong indicator of the company's confidence in its future performance and its ability to deliver consistent value to shareholders.

-

Increased Earnings Per Share (EPS): The revised guidance projects a significant increase in earnings per share (EPS), exceeding previous forecasts. [Note: Insert specific EPS figures and comparisons here once available from the official earnings report]. This boost in EPS is a direct reflection of the company's strong financial performance.

-

Factors Contributing to the Revision: The upward revision of profit guidance is attributed not only to the strong sales performance but also to effective cost-management strategies implemented by AbbVie. These strategies have helped to improve operational efficiency and enhance profitability.

-

Impact on Shareholder Returns: The revised guidance suggests a promising outlook for shareholder returns, with the potential for increased dividends and share buybacks. This positive outlook is further fueled by the strong sales growth and the mitigation of the Humira biosimilar impact.

Impact of Humira Biosimilar Competition Mitigated

The launch of Humira biosimilars posed a significant challenge for AbbVie. However, the company effectively mitigated the impact through a strategic combination of proactive measures and strong performance of its newer drugs.

-

Successful Navigation of the Competitive Landscape: AbbVie successfully navigated the competitive landscape by leveraging its strong brand reputation, robust sales and marketing infrastructure, and a diversified portfolio. The success of Rinvoq and Skyrizi demonstrated the effectiveness of its strategy to offset Humira's revenue decline.

-

Robust Pipeline of New Drugs: AbbVie's pipeline of innovative drugs is poised to generate future revenue streams, further mitigating the impact of Humira's loss of exclusivity (LOE). These new drugs are expected to drive future growth and enhance the company's competitive edge in the pharmaceutical industry.

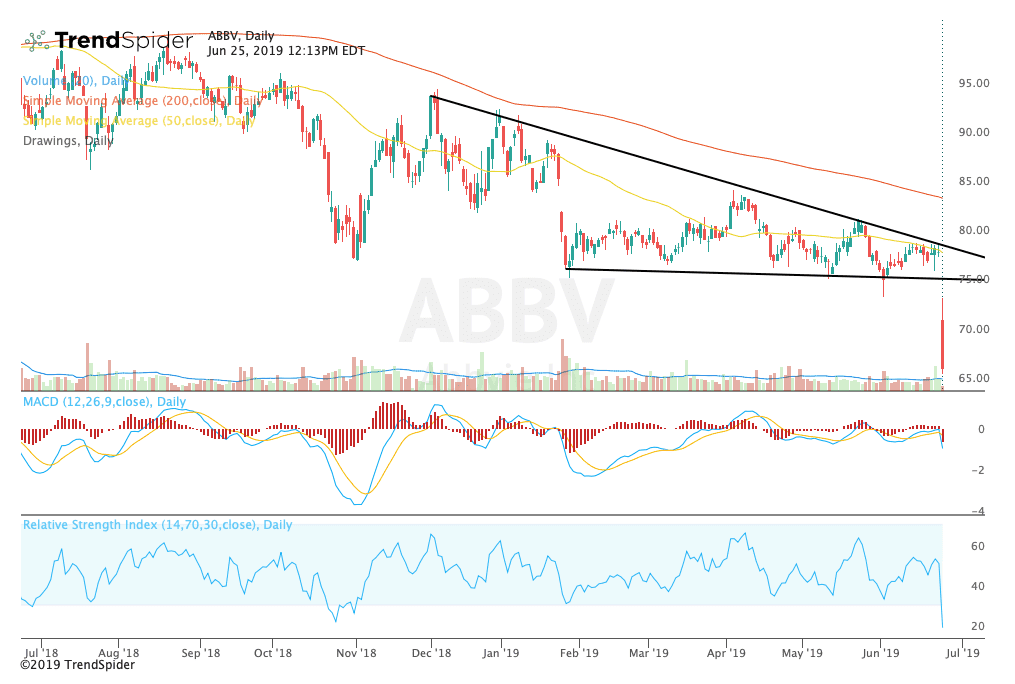

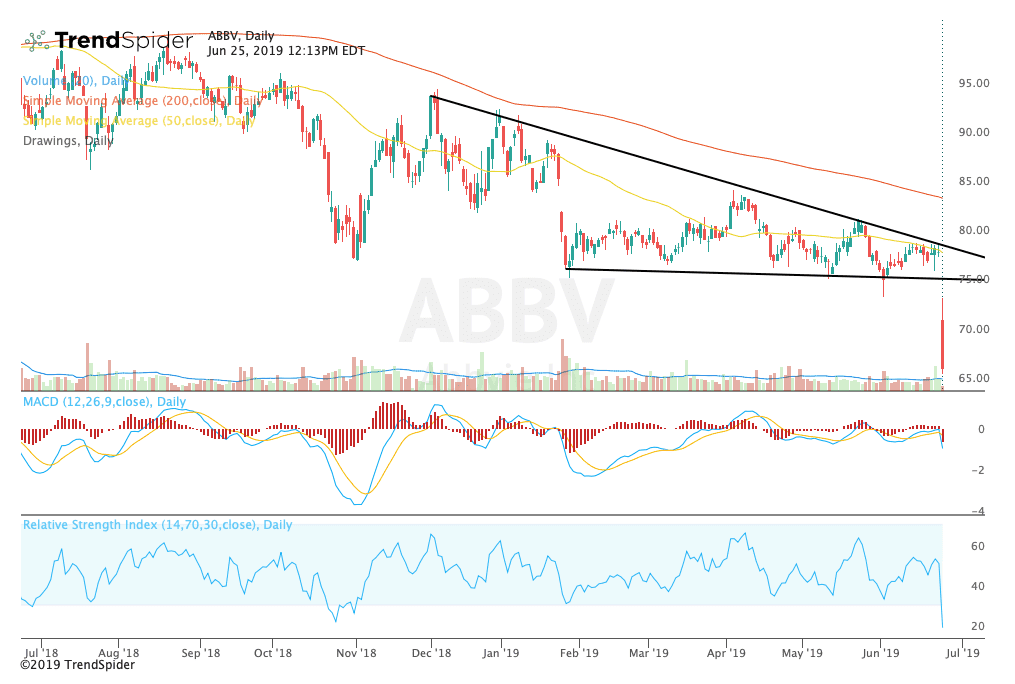

Investor Sentiment and Market Reaction

The positive earnings report generated a strong positive reaction in the market, reflected in a significant surge in ABBV stock price and trading volume.

-

ABBV Stock Price Surge: Following the earnings announcement, ABBV stock price experienced a substantial increase, reflecting the market's confidence in the company's future prospects. [Note: Insert specific stock price movements and percentage changes here].

-

Increased Trading Volume: The increased trading volume indicates heightened investor interest and active participation in the market. This signifies a positive shift in investor sentiment towards ABBV.

-

Positive Analyst Ratings: Many analysts have issued positive ratings and increased price targets for ABBV stock, further reinforcing the optimistic outlook for the company.

Conclusion:

AbbVie's strong Q[Quarter Number] earnings report, featuring exceeded sales and a revised upward profit guidance, has significantly boosted investor confidence and driven a surge in ABBV stock price. The company's successful management of Humira biosimilar competition and the strong performance of its newer drugs highlight a positive outlook for the future. The robust financial results and the upwardly revised guidance suggest that AbbVie is well-positioned for continued growth and success.

Call to Action: Interested in learning more about the investment potential of AbbVie (ABBV) stock following this positive earnings report? Conduct thorough research, consult a financial advisor, and consider ABBV as part of a diversified investment portfolio. Stay updated on future AbbVie stock performance and news for informed investment decisions. Remember, this information is for educational purposes only and not financial advice. Always conduct your own due diligence before making any investment decisions.

Featured Posts

-

Most Plan King Day Celebration But 22 Want Holiday Ended

Apr 26, 2025

Most Plan King Day Celebration But 22 Want Holiday Ended

Apr 26, 2025 -

Nyt Spelling Bee Help Complete Guide To Solving Puzzle 387 March 25th

Apr 26, 2025

Nyt Spelling Bee Help Complete Guide To Solving Puzzle 387 March 25th

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

The Untold Story Of Jennifer Aniston And Chelsea Handlers Broken Friendship

Apr 26, 2025

The Untold Story Of Jennifer Aniston And Chelsea Handlers Broken Friendship

Apr 26, 2025 -

Shedeur Sanders Continued Use Of Nike A Legacy Of Brand Loyalty

Apr 26, 2025

Shedeur Sanders Continued Use Of Nike A Legacy Of Brand Loyalty

Apr 26, 2025