ABN Amro Bonus Payments Under Scrutiny: Potential Fine From Dutch Regulator

Table of Contents

Details of the Bonus Payments Under Investigation

The Dutch regulator's investigation focuses on a range of bonus payments disbursed at ABN Amro, spanning several years. While the precise figures remain undisclosed, sources suggest the investigation encompasses substantial sums, potentially involving millions of euros in annual bonuses, performance-related incentives, and executive compensation packages. The timeframe under scrutiny appears to be from [Insert Year] to [Insert Year], a period marked by [mention relevant economic events or ABN Amro's financial performance during this period].

- Specific examples of bonuses under scrutiny: While details are scarce due to the ongoing investigation, reports suggest that certain exceptionally high bonuses awarded to senior executives are of particular interest to the regulator.

- Breakdown of bonus recipients: The investigation includes bonuses awarded to both senior executives and potentially employees in other departments, though the exact distribution is yet to be publicly revealed.

- Relationship between bonus structure and ABN Amro's recent financial performance: The regulator is likely scrutinizing whether the bonus structure appropriately reflected ABN Amro's financial performance during the period in question. Any discrepancy between performance and awarded bonuses could be a key factor in the investigation.

Reasons for the Dutch Regulator's Investigation

The investigation stems from concerns that ABN Amro may have violated several key regulations governing responsible banking practices and executive compensation. The potential breaches include:

- Specific regulatory breaches suspected: Suspected violations may include exceeding legally mandated bonus caps or failing to adequately link bonus payments to verifiable and sustainable long-term performance.

- Evidence cited by the regulator: While the regulator hasn't publicly released all evidence, leaked documents or internal investigations may have triggered the scrutiny.

- Potential conflict of interest issues: The regulator may be investigating potential conflicts of interest related to the bonus allocation process.

- Comparison to bonus practices of other Dutch banks: The regulator may be comparing ABN Amro's practices to those of other major Dutch banks to determine if there were any significant deviations or irregularities.

Potential Consequences for ABN Amro

The repercussions for ABN Amro could be severe and far-reaching.

- Range of potential fines: The potential financial penalty could range from a significant fine in the millions to potentially tens of millions of euros, depending on the severity of the violations found.

- Possible legal ramifications beyond financial penalties: Beyond financial penalties, ABN Amro could face other legal ramifications, such as reputational damage and further investigations.

- Impact on ABN Amro's stock price: News of the investigation has already likely affected ABN Amro's stock price, and further negative developments could lead to continued volatility.

- Effects on employee morale: The investigation could negatively impact employee morale and trust in the bank's leadership.

Reaction from ABN Amro and the Dutch Regulator

ABN Amro has released a statement [insert a summary of ABN Amro's official statement, including key quotes if available], expressing its full cooperation with the regulator's investigation. The Dutch regulator, [Name of the regulator], has stated that the investigation is ongoing and [Insert statement from the regulator about the investigation's progress, expected timeline, and potential outcomes].

- Direct quotes from press releases or statements: Include relevant quotes from official press releases to ensure accuracy and transparency.

- Summary of the bank's defense: Outline any defense or explanations offered by ABN Amro regarding the bonus payments.

- Timeline of events and future steps expected: Provide a timeline of key events and an outlook on the future steps in the investigation.

ABN Amro Bonus Payments Under Scrutiny: Key Takeaways and Next Steps

The investigation into ABN Amro's bonus payments highlights significant concerns regarding responsible banking practices and regulatory compliance within the Dutch financial sector. The potential financial penalties, reputational damage, and impact on employee morale are substantial. The outcome of this investigation will likely influence future bonus structures not only at ABN Amro but potentially across the entire Dutch banking landscape. Stay updated on this developing "ABN Amro bonus scandal" and the subsequent "Dutch bank bonus investigation" by following our publication and subscribing to our newsletters for continuous coverage of this and other important developments in Dutch finance and ABN Amro regulatory action. This ongoing "ABN Amro bonus controversy" is a crucial development you won't want to miss.

Featured Posts

-

New Images From Echo Valley Tease Sydney Sweeney And Julianne Moores Intense Thriller

May 21, 2025

New Images From Echo Valley Tease Sydney Sweeney And Julianne Moores Intense Thriller

May 21, 2025 -

Trans Australia Run Could A New Record Be Set

May 21, 2025

Trans Australia Run Could A New Record Be Set

May 21, 2025 -

La Haye Fouassiere Haute Goulaine Essai D Une Navette Gratuite

May 21, 2025

La Haye Fouassiere Haute Goulaine Essai D Une Navette Gratuite

May 21, 2025 -

Abn Amro Groeiend Autobezit Stimuleert Occasionverkoop

May 21, 2025

Abn Amro Groeiend Autobezit Stimuleert Occasionverkoop

May 21, 2025 -

Overcoming The Love Monster Finding Lasting Love And Fulfillment

May 21, 2025

Overcoming The Love Monster Finding Lasting Love And Fulfillment

May 21, 2025

Latest Posts

-

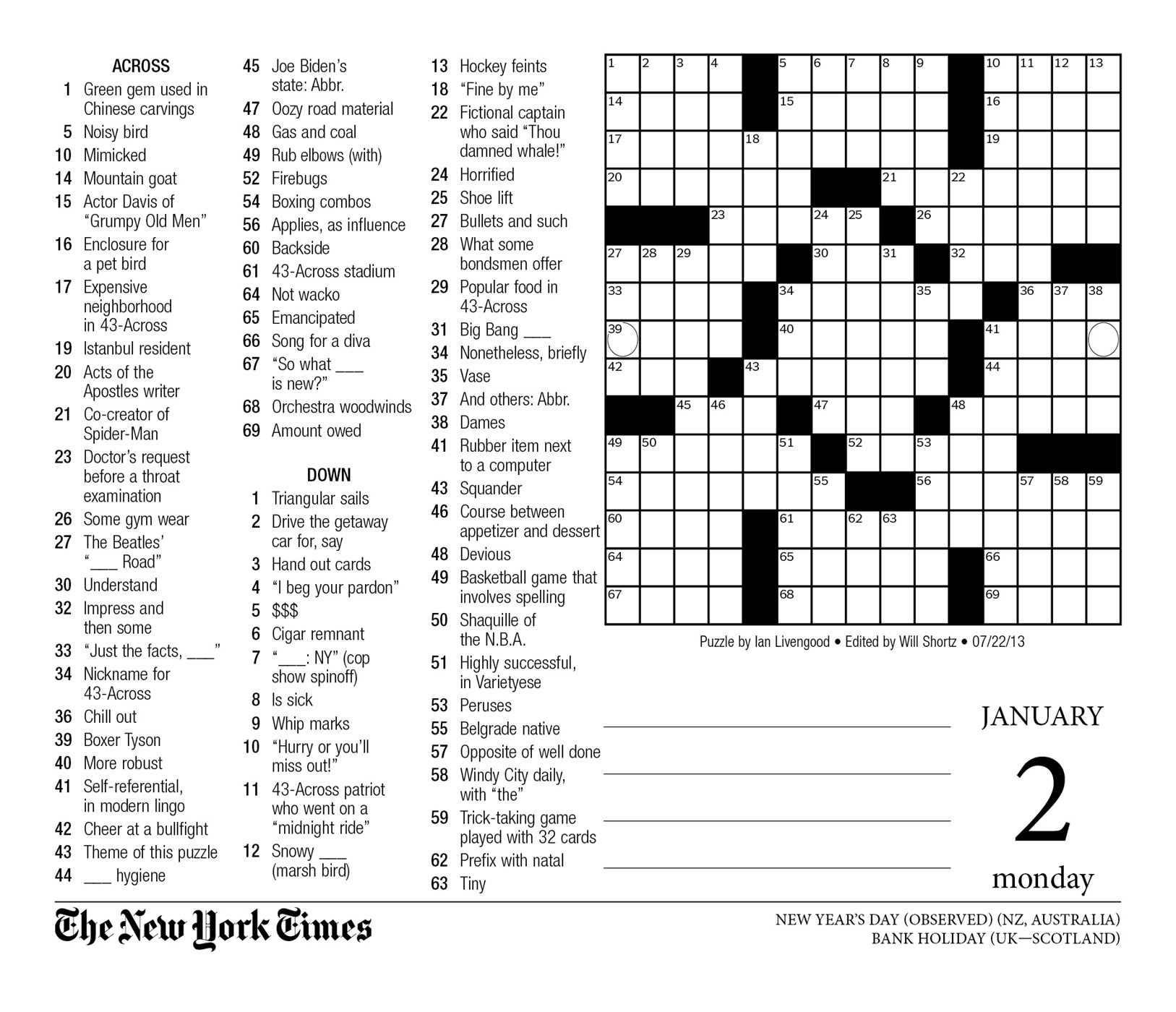

Nyt Crossword Solutions April 25 2025

May 21, 2025

Nyt Crossword Solutions April 25 2025

May 21, 2025 -

Sabalenka And Zverev Top Seeds Advance At Madrid Masters

May 21, 2025

Sabalenka And Zverev Top Seeds Advance At Madrid Masters

May 21, 2025 -

April 18th 2025 Nyt Mini Crossword Answers And Hints

May 21, 2025

April 18th 2025 Nyt Mini Crossword Answers And Hints

May 21, 2025 -

Unexpected Shower Susan Lucci And Michael Strahans Water Throwing Fun

May 21, 2025

Unexpected Shower Susan Lucci And Michael Strahans Water Throwing Fun

May 21, 2025 -

First Atp Title For Flavio Cobolli Bucharest Tournament Victory

May 21, 2025

First Atp Title For Flavio Cobolli Bucharest Tournament Victory

May 21, 2025