ABN Amro Bonus Scheme: Investigation And Potential Penalty From Dutch Authority

Table of Contents

The AFM Investigation: Details and Concerns

The AFM's investigation into the ABN Amro bonus scheme stems from concerns about several key areas. These concerns primarily revolve around the potential link between bonus structures and the encouragement of excessive risk-taking, a lack of transparency in the bonus calculation methodology, and potential breaches of existing financial regulations. The investigation aims to determine whether the ABN Amro bonus scheme incentivized unethical or reckless behavior, ultimately jeopardizing the stability of the financial institution and potentially harming investors.

- Specific examples of alleged irregularities: While specific details remain largely confidential at this stage of the investigation, press reports suggest concerns about the awarding of bonuses despite significant losses in certain departments and potential conflicts of interest in the bonus allocation process. The AFM has not yet publicly disclosed the precise nature of all allegations.

- The scope of the investigation: The investigation encompasses a period of [insert timeframe if available] and involves a thorough review of bonus payments made to a significant number of ABN Amro employees across various departments. The AFM is examining internal documentation, employee records, and financial transactions to build a comprehensive picture.

- The methodology used by the AFM in their investigation: The AFM is utilizing a combination of on-site inspections, document review, employee interviews, and data analysis to gather evidence and assess compliance with relevant regulations. Their methodology is consistent with their standard practice for investigations into potential financial misconduct.

- Quotes from AFM press releases or official statements: [Insert relevant quotes from official AFM communications if available. If not available, state that the AFM has not yet publicly released detailed statements on the specific allegations].

Potential Penalties for ABN Amro

The potential penalties facing ABN Amro are substantial and could significantly impact the bank's financial stability and reputation. The range of potential sanctions imposed by the AFM could include:

- Fines: Significant financial penalties are a likely outcome, the amount of which will depend on the severity of the alleged breaches and the extent of any proven misconduct.

- Restrictions on future bonus payments: The AFM could impose restrictions on the size and structure of future bonus payments, potentially limiting the amount of variable compensation offered to employees. This could involve changes to the ABN Amro bonus scheme itself.

- Reputational damage: The negative publicity surrounding the investigation will undoubtedly damage ABN Amro's reputation, impacting investor confidence and potentially affecting its ability to attract and retain top talent.

- Potential impact on ABN Amro's share price and investor confidence: The ongoing investigation has already caused fluctuations in ABN Amro's share price, and further negative news could lead to a more significant decline. Investor confidence will be heavily impacted by the outcome of the investigation and any subsequent penalties.

Reputational Damage and Impact on Employee Morale

The investigation into the ABN Amro bonus scheme has already inflicted considerable reputational damage. The allegations of potential misconduct have eroded public trust in the bank, creating a negative narrative that could persist for some time.

- Loss of public trust: The association with potentially unethical practices significantly damages ABN Amro's credibility and public image.

- Impact on attracting and retaining talent: Top talent may be reluctant to join a bank facing such serious scrutiny, and existing employees may become demoralized and seek opportunities elsewhere.

- Potential for negative media coverage and public backlash: Ongoing media coverage will likely fuel public dissatisfaction and calls for greater accountability.

Implications for the Dutch Banking Sector

The ABN Amro bonus scheme investigation has significant implications for the entire Dutch banking sector. The AFM's actions could trigger:

- Potential for increased regulatory scrutiny of bonus schemes across the sector: Other Dutch banks are likely to face increased scrutiny of their own bonus structures and compensation practices.

- Review of existing bonus structures and potential reforms: The investigation could spur a widespread review and reform of bonus schemes to ensure greater transparency and alignment with ethical and responsible banking practices.

- Impact on the competitiveness of Dutch banks: Increased regulatory burdens and changes to bonus schemes could affect the competitiveness of Dutch banks in the international market.

- Increased focus on ethical and responsible banking practices: The investigation highlights the need for a greater emphasis on ethical conduct and responsible risk management within the Dutch banking sector.

Conclusion

The investigation into the ABN Amro bonus scheme represents a serious challenge for the bank and raises significant concerns about the wider Dutch banking sector. The potential penalties – substantial fines, restrictions on future bonus payments, and severe reputational damage – underscore the seriousness of the alleged irregularities. This investigation highlights the need for greater transparency and ethical considerations in designing and implementing bonus schemes within the financial industry. The outcome of the AFM’s investigation will have far-reaching consequences, not only for ABN Amro but for the entire Dutch banking landscape.

Call to action: Stay informed about the ongoing investigation into the ABN Amro bonus scheme and its potential impact on the Dutch financial industry. Further research into [link to relevant AFM resources] and related news articles is recommended for a complete understanding of the situation. Continue to monitor developments in the ABN Amro bonus scheme case for updates on the outcome of the AFM's investigation and any subsequent penalties.

Featured Posts

-

Abn Amro Stijgt Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Stijgt Na Positieve Kwartaalresultaten

May 21, 2025 -

The Goldbergs Complete Episode Guide And Season Recaps

May 21, 2025

The Goldbergs Complete Episode Guide And Season Recaps

May 21, 2025 -

The Construction Of Chinas Orbital Supercomputer A Detailed Look

May 21, 2025

The Construction Of Chinas Orbital Supercomputer A Detailed Look

May 21, 2025 -

Half Dome Secures Abn Group Victoria Account Details Of The Successful Pitch

May 21, 2025

Half Dome Secures Abn Group Victoria Account Details Of The Successful Pitch

May 21, 2025 -

Afhankelijkheid Van Goedkope Arbeidsmigranten Abn Amros Analyse Van De Voedingsindustrie

May 21, 2025

Afhankelijkheid Van Goedkope Arbeidsmigranten Abn Amros Analyse Van De Voedingsindustrie

May 21, 2025

Latest Posts

-

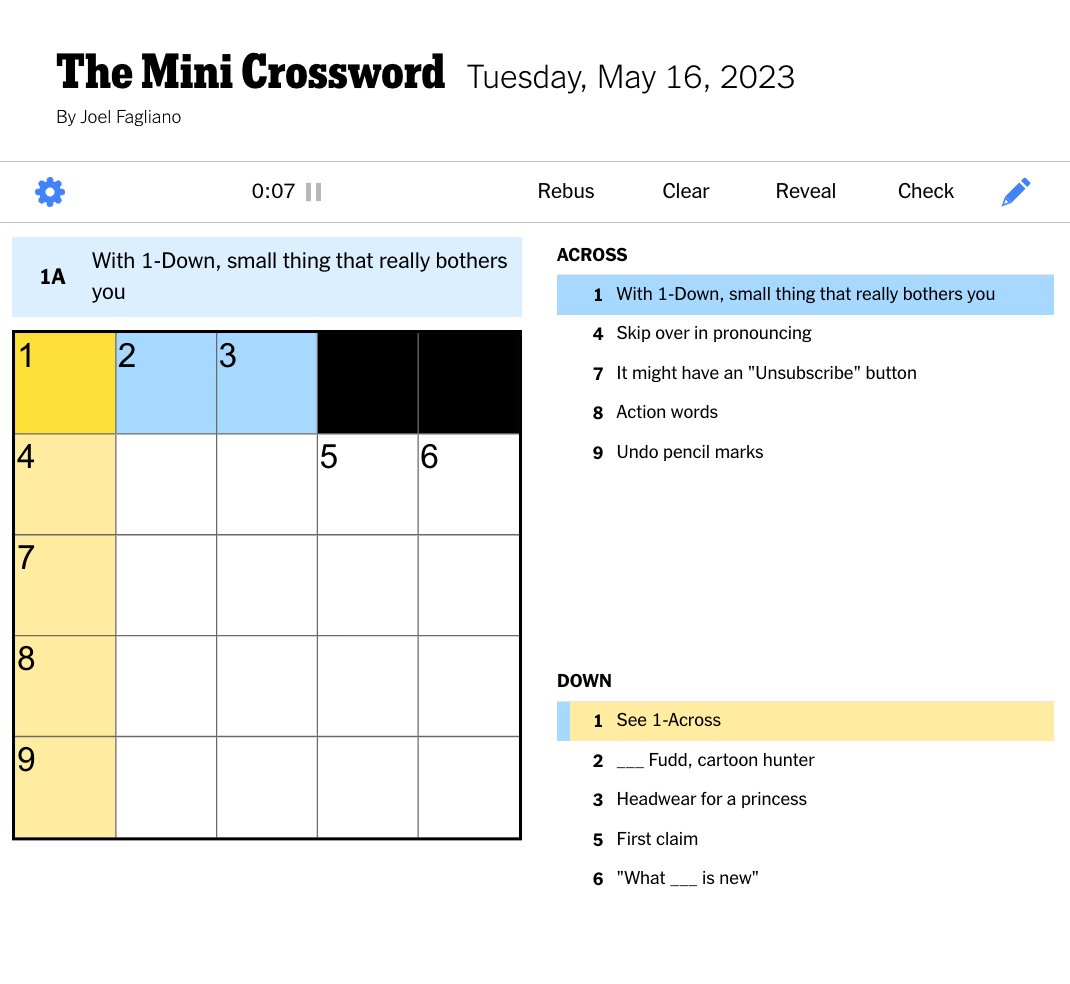

Todays Nyt Mini Crossword Answers March 16 2025

May 21, 2025

Todays Nyt Mini Crossword Answers March 16 2025

May 21, 2025 -

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025 -

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025 -

Nyt Mini Crossword Answers March 16 2025 Find The Solutions Here

May 21, 2025

Nyt Mini Crossword Answers March 16 2025 Find The Solutions Here

May 21, 2025 -

Solve The Nyt Mini Crossword Answers For March 13 2025

May 21, 2025

Solve The Nyt Mini Crossword Answers For March 13 2025

May 21, 2025