ABN Amro: Dutch Central Bank Investigates Bonus Practices

Table of Contents

The Scope of the DNB Investigation into ABN Amro Bonus Practices

The DNB's investigation into ABN Amro's compensation structure centers on whether the bank's bonus system complies with existing regulations designed to mitigate excessive risk-taking. The investigation is not merely a cursory review; it's a thorough examination of several key aspects of ABN Amro's compensation policies.

Specific areas under scrutiny likely include:

- The magnitude of bonuses awarded: The DNB will likely analyze the size of bonuses paid to employees at all levels, comparing them to industry benchmarks and assessing their proportionality to individual and overall bank performance. The focus will be on identifying any potentially excessive or disproportionate payouts.

- Metrics used to determine bonuses: The investigation will examine the criteria used to calculate bonuses. Are these metrics appropriately aligned with long-term sustainable growth and risk management, or do they inadvertently incentivize short-term gains at the expense of long-term stability? The DNB will scrutinize the weighting of different performance indicators to ensure they accurately reflect risk-adjusted returns.

- Transparency of the bonus structure: The DNB will assess the clarity and transparency of ABN Amro's bonus system. Is the system easily understandable by employees, shareholders, and regulators? A lack of transparency can contribute to a culture of unchecked risk-taking.

The investigation will involve a comprehensive review of historical bonus payments, searching for patterns or irregularities that might indicate systemic flaws in the bank's compensation framework. This includes:

- Review of ABN Amro's internal risk management policies related to compensation.

- Scrutiny of the bank's compliance with DNB guidelines on responsible remuneration.

- Analysis of the link between bonus structures and the bank's risk profile. This will assess if the bonus scheme inadvertently encouraged undue risk-taking to achieve short-term bonus targets.

Potential Implications for ABN Amro: Financial and Reputational Risks

The consequences of the DNB's findings could be substantial for ABN Amro. Depending on the severity of any identified breaches, the bank faces several potential repercussions:

- Significant financial penalties: Non-compliance with DNB regulations could result in hefty fines, potentially impacting the bank's profitability and shareholder value. The size of any penalty will depend on the extent of the violations and the bank's level of cooperation with the investigation.

- Reputational damage: Negative publicity surrounding the investigation could severely damage ABN Amro's reputation, eroding customer trust and impacting investor confidence. This could lead to decreased market share and difficulty attracting and retaining both clients and talent.

- Mandatory changes to bonus structures and internal controls: The DNB might mandate significant changes to ABN Amro's compensation system, requiring the implementation of stricter internal controls and more transparent processes. This would involve substantial costs and resource allocation.

These potential consequences can be summarized as follows:

- Potential fines from the DNB for non-compliance.

- Impact on ABN Amro's share price and investor sentiment.

- Potential legal challenges from employees or shareholders dissatisfied with bonus payouts or perceived unfairness.

Wider Implications for Dutch Banking Regulation and Executive Compensation

The DNB's investigation into ABN Amro's bonus practices has broader implications for the Dutch banking sector and the overall regulatory landscape.

- Increased regulatory scrutiny: The investigation highlights the ongoing focus on responsible remuneration within the financial industry and signals increased regulatory oversight of bank compensation practices.

- Potential legislative changes: The findings could lead to stricter regulations regarding executive compensation within the Dutch banking sector, potentially impacting all financial institutions operating within the Netherlands. This might involve stricter guidelines on bonus structures, increased transparency requirements, and potentially even caps on executive compensation.

- Industry-wide review of bonus schemes: Other Dutch banks are likely to review their own bonus systems in light of the ABN Amro investigation, proactively ensuring compliance and mitigating potential risks.

This could result in:

- Increased regulatory oversight of bank compensation practices across the Dutch banking industry.

- Potential changes to Dutch banking legislation relating to executive compensation and bonus structures.

- Increased pressure on other financial institutions to ensure compliance with DNB guidelines on responsible remuneration and risk management.

Conclusion: The Future of ABN Amro Bonus Practices and Dutch Banking Regulation

The Dutch Central Bank's investigation into ABN Amro bonus practices underscores the critical need for stringent regulation within the financial sector to prevent excessive risk-taking fueled by poorly designed incentive schemes. The outcome of this investigation will significantly impact ABN Amro, influencing its financial stability, reputation, and future compensation strategies. The wider implications for Dutch banking regulation are also substantial, likely resulting in stricter rules and enhanced oversight of bonus schemes across the industry. Stay updated on the developments in this crucial case concerning ABN Amro bonus practices and their impact on the Dutch financial landscape.

Featured Posts

-

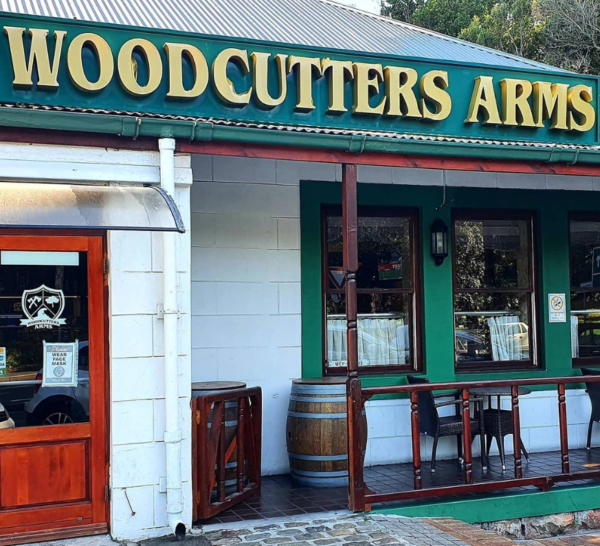

Klopps Coaching Influence Hout Bay Fcs Rise

May 21, 2025

Klopps Coaching Influence Hout Bay Fcs Rise

May 21, 2025 -

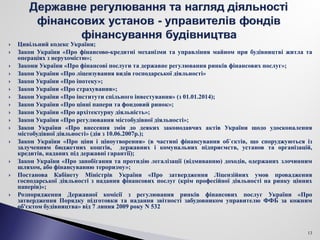

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 21, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 21, 2025 -

Vybz Kartels Skin Bleaching A Struggle With Self Love

May 21, 2025

Vybz Kartels Skin Bleaching A Struggle With Self Love

May 21, 2025 -

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

May 21, 2025

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

May 21, 2025 -

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025

Latest Posts

-

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025 -

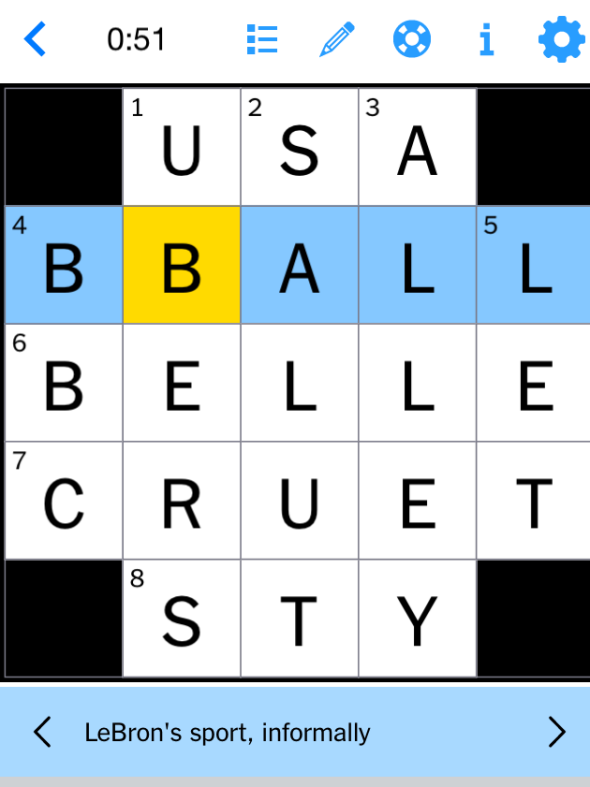

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025 -

Nyt Mini Crossword March 26 2025 Solutions And Clues

May 21, 2025

Nyt Mini Crossword March 26 2025 Solutions And Clues

May 21, 2025 -

Broadcast Networks Abc Cbs And Nbc Under Fire For Handling Of New Mexico Gop Arson Attack

May 21, 2025

Broadcast Networks Abc Cbs And Nbc Under Fire For Handling Of New Mexico Gop Arson Attack

May 21, 2025 -

Wlos Hosts Good Morning Americas Ginger Zee Ahead Of Asheville Rising Special

May 21, 2025

Wlos Hosts Good Morning Americas Ginger Zee Ahead Of Asheville Rising Special

May 21, 2025