ABN Amro's Bonus System Under Scrutiny By Dutch Regulator

Table of Contents

Concerns Raised by the Dutch Regulator (DNB)

The DNB's concerns regarding ABN Amro's bonus system are multifaceted, focusing primarily on potential conflicts of interest, inadequate risk management, insufficient oversight of bonus payouts, and the possibility that the current structure incentivizes excessive risk-taking. These concerns are not trivial; they strike at the heart of financial stability and ethical conduct within the banking industry.

- Specific examples cited by the DNB: While the specifics remain partially undisclosed to protect the integrity of the ongoing investigation, reports suggest the DNB has raised concerns about certain high-risk investment strategies seemingly rewarded by the bonus structure, potentially disregarding broader financial risk to the bank.

- Regulatory violations: The investigation hints at potential breaches of regulations designed to curb excessive risk-taking and ensure responsible compensation practices within the Dutch financial sector. These regulations often place limits on bonus payouts and tie them to long-term performance and risk-adjusted returns.

- Impact on reputation and shareholder value: The negative publicity surrounding the investigation is already impacting ABN Amro's reputation and shareholder confidence. Market analysts predict potential short-term losses and a decline in investor trust if the investigation reveals significant flaws in the bank's bonus system.

ABN Amro's Response to the Investigation

ABN Amro has publicly acknowledged the DNB's investigation and issued statements emphasizing their commitment to cooperation. The bank asserts that its bonus system is designed to align with regulatory requirements and promote responsible risk management.

- The bank's defense: ABN Amro maintains that its bonus structure incentivizes long-term performance and appropriately considers risk factors. They argue that the DNB's concerns are based on a misunderstanding of the complexities of their compensation strategy.

- Internal reviews and changes: In response to the investigation, ABN Amro has initiated internal reviews of its bonus system and announced some modifications. These changes likely include enhanced oversight measures, clearer guidelines on risk assessment, and more stringent criteria for bonus eligibility.

- Communication with stakeholders: ABN Amro is actively engaging with employees, shareholders, and other stakeholders to address concerns and maintain transparency throughout the investigation. This proactive communication is crucial in mitigating reputational damage.

Potential Penalties and Consequences for ABN Amro

The potential penalties for ABN Amro, should the DNB find non-compliance, are substantial and far-reaching.

- Fines imposed by the DNB: Significant financial penalties are a likely outcome if irregularities are confirmed. The size of any fine would depend on the severity of the violations and the impact on the financial system.

- Reputational damage and loss of investor confidence: Even without significant fines, the negative publicity associated with the investigation could severely damage ABN Amro's reputation, leading to diminished investor confidence and difficulty in attracting new business.

- Changes to the bank’s compensation strategy: The DNB might mandate significant changes to ABN Amro's compensation strategy, possibly requiring a complete overhaul of its bonus system to comply with regulatory standards.

- Impact on future business operations: The consequences could affect the bank's ability to attract and retain top talent, impacting its operational efficiency and competitiveness within the Dutch banking sector.

Broader Implications for the Dutch Banking Sector

The DNB's scrutiny of ABN Amro's bonus system has far-reaching implications for the entire Dutch banking industry.

- Increased regulatory scrutiny of bonus systems: The investigation sets a precedent for increased scrutiny of compensation practices across the sector. Other Dutch banks can expect similar investigations and potentially stricter regulatory oversight.

- Potential for industry-wide changes in compensation structures: The outcome of this investigation could lead to industry-wide reforms in bonus structures, potentially resulting in less emphasis on short-term gains and more focus on long-term sustainability and risk management.

- Impact on attracting and retaining talent: Changes to bonus systems may affect the Dutch banking sector's ability to attract and retain skilled professionals, especially if new regulations make compensation packages less attractive.

Conclusion

The investigation into ABN Amro's bonus system highlights the critical importance of ethical and compliant compensation practices within the Dutch banking sector. The DNB's concerns underscore the need for robust risk management and transparent bonus structures to prevent excessive risk-taking and safeguard financial stability. ABN Amro's response, while emphasizing cooperation, will be judged by the outcome of the investigation and the potential penalties imposed. The wider implications for the Dutch banking industry are significant, indicating a potential shift towards stricter regulation and a reassessment of compensation strategies. Stay informed about further developments in the investigation of the ABN Amro bonus system and the evolving regulatory landscape for bank compensation in the Netherlands. Continue to follow our coverage for the latest updates on this critical issue and its implications for the future of the ABN Amro bonus system and the Dutch banking sector.

Featured Posts

-

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025 -

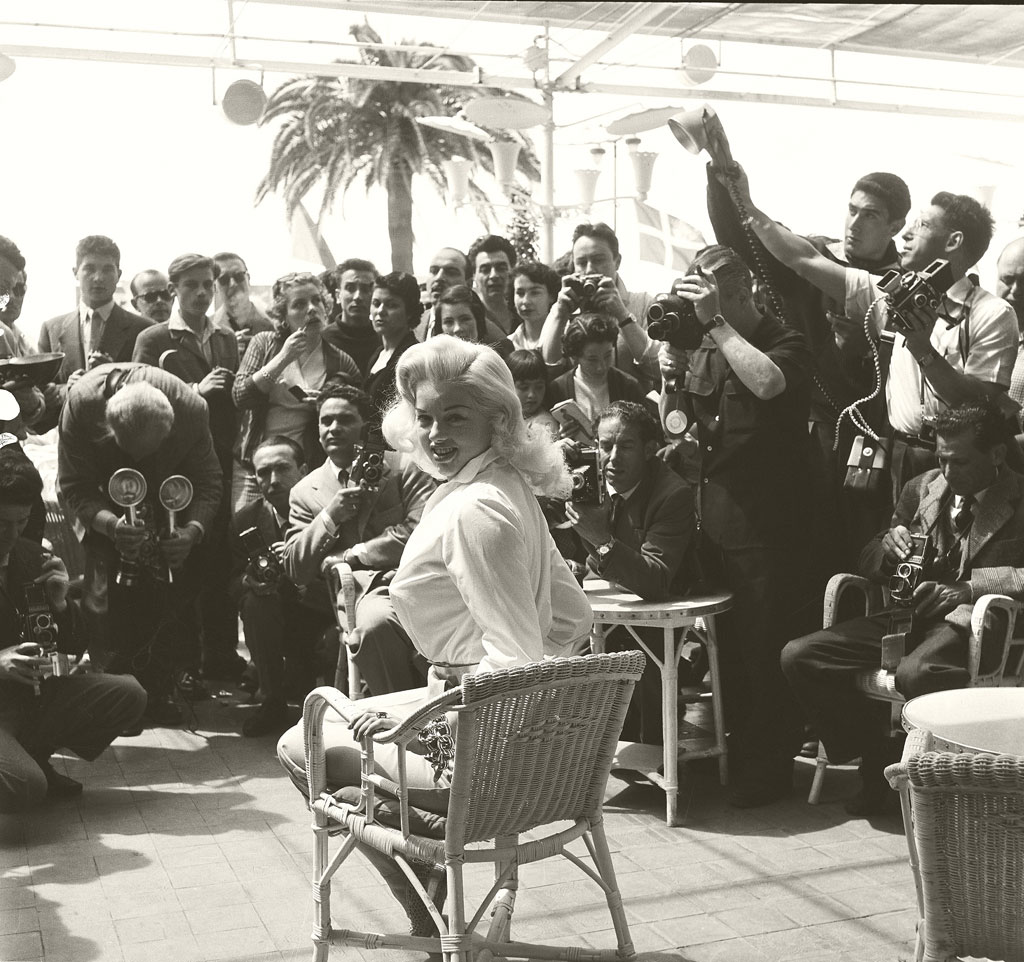

The Traverso Family A Cannes Film Festival Photographic Legacy

May 21, 2025

The Traverso Family A Cannes Film Festival Photographic Legacy

May 21, 2025 -

Tory Wifes Jail Sentence Confirmed Following Southport Migrant Remarks

May 21, 2025

Tory Wifes Jail Sentence Confirmed Following Southport Migrant Remarks

May 21, 2025 -

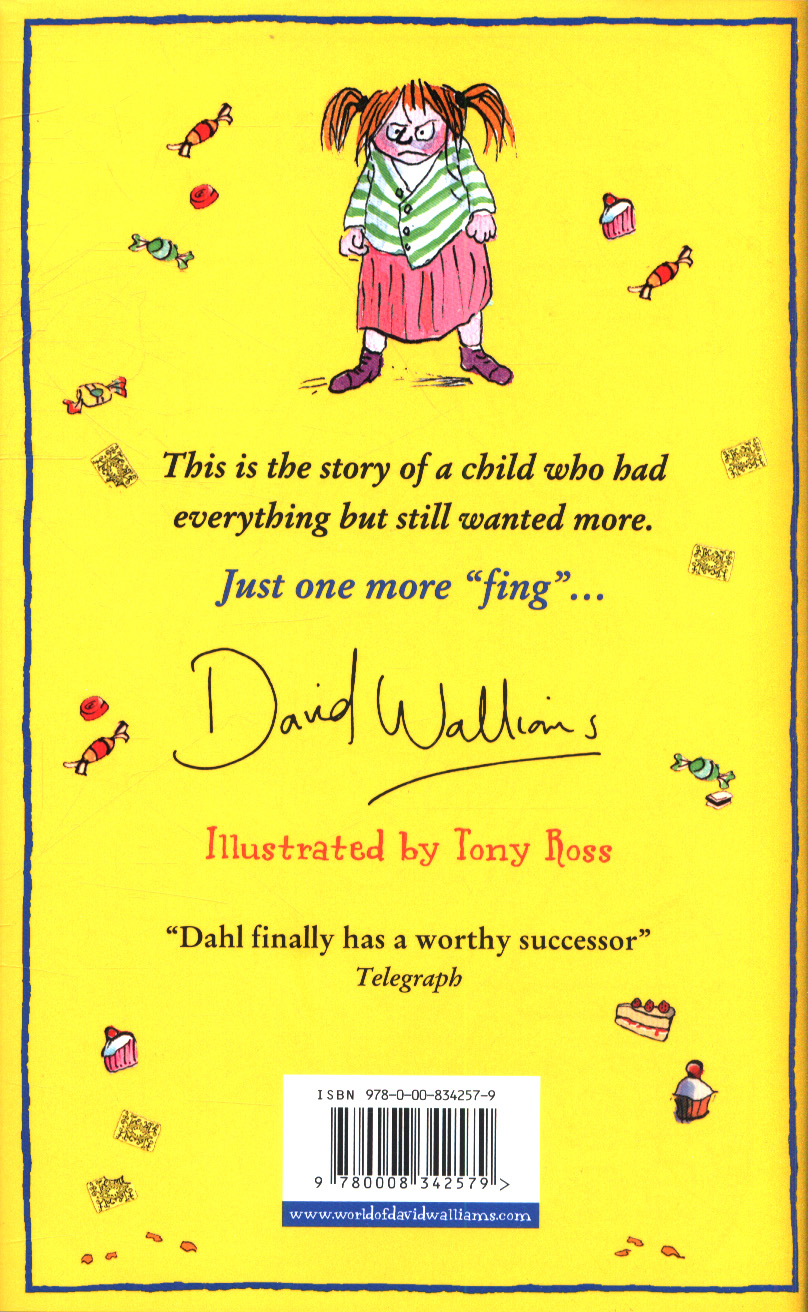

New David Walliams Fantasy Novel Fing Receives Stans Approval

May 21, 2025

New David Walliams Fantasy Novel Fing Receives Stans Approval

May 21, 2025 -

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 21, 2025

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 21, 2025

Latest Posts

-

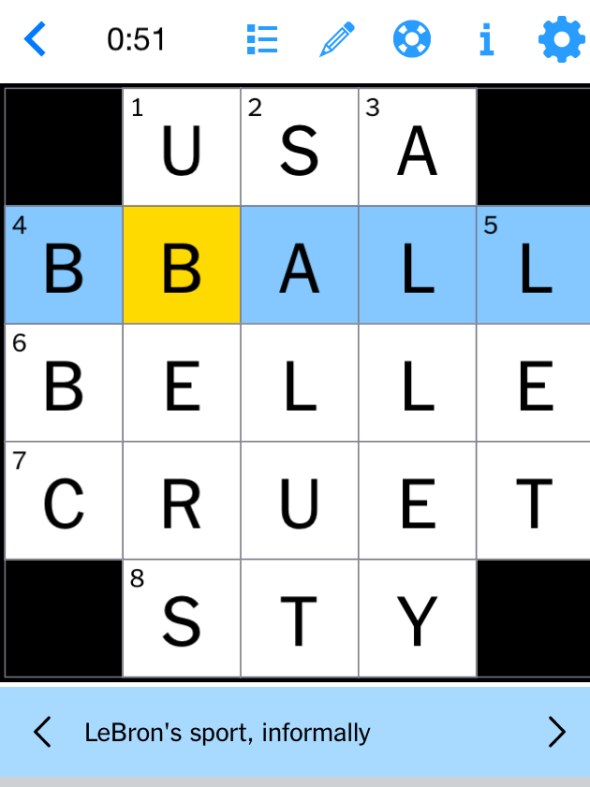

Nyt Mini Daily Puzzle May 13 2025 Answers And Expert Gameplay

May 21, 2025

Nyt Mini Daily Puzzle May 13 2025 Answers And Expert Gameplay

May 21, 2025 -

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025

Solve The Nyt Mini Crossword May 13 2025 Solutions And Strategies

May 21, 2025 -

Tariffs And The Buy Canadian Beauty Movement A Comprehensive Analysis

May 21, 2025

Tariffs And The Buy Canadian Beauty Movement A Comprehensive Analysis

May 21, 2025 -

Analyzing The Buy Canadian Movement The Effect Of Tariffs On Beauty

May 21, 2025

Analyzing The Buy Canadian Movement The Effect Of Tariffs On Beauty

May 21, 2025 -

Is Buy Canadian Sustainable The Role Of Tariffs In The Beauty Sector

May 21, 2025

Is Buy Canadian Sustainable The Role Of Tariffs In The Beauty Sector

May 21, 2025