Access Private Credit: Invesco And Barings' New Offering For Retail Investors

Table of Contents

What is Private Credit and Why is it Attractive?

Private credit, also known as private debt, refers to loans provided directly to companies outside of the public markets. Unlike public market debt (like corporate bonds traded on exchanges), private credit investments are typically less liquid but can offer several compelling advantages. These alternative investment strategies are attractive due to their potential for higher risk-adjusted returns and lower correlation with public equity markets.

Potential Benefits of Private Credit:

- Higher potential yields: Private credit investments often offer significantly higher yields than traditional bonds.

- Diversification benefits: Private credit investments can diversify a portfolio, reducing overall risk by providing exposure to asset classes that are less correlated with traditional equities and bonds.

- Access to unique investment opportunities: Private credit allows investors access to deals and companies not available through public markets.

- Potential for capital appreciation: While not guaranteed, some private credit strategies aim for both yield and capital appreciation.

Risks Associated with Private Credit:

Despite the potential benefits, private credit investments are not without risks:

- Illiquidity: Private credit investments are generally illiquid, meaning it can be difficult to sell them quickly without incurring losses.

- Complexity: Understanding the intricacies of private credit investments requires a degree of financial sophistication.

- Potential for losses: As with any investment, there is always the risk of losing some or all of your invested capital.

Invesco and Barings' Joint Venture: A Detailed Look

Invesco and Barings, two prominent names in the global investment management industry, have partnered to create a private credit fund specifically designed to be accessible to retail investors. This Invesco Private Credit Fund (a placeholder name – replace with the actual fund name if available) represents a significant step towards democratizing access to this previously exclusive asset class. The fund's investment strategy will likely focus on a diversified portfolio of loans across various sectors, offering exposure to a range of private credit opportunities. The specifics of the fund's investment mandate, including the types of loans and target sectors, will be detailed in the offering documents.

Key Features of the Invesco and Barings Private Credit Fund (Illustrative):

- Investment Mandate: (Describe the fund's investment strategy - e.g., focus on middle-market companies, specific industries, senior secured loans, etc.)

- Target Return Expectations: (State the expected return, emphasizing that it's not guaranteed)

- Investment Timeframe: (Specify the typical investment horizon)

- Risk Assessment and Management Strategies: (Briefly describe the fund's approach to risk management)

- Fee Structure: (Detail the fees associated with investing in the fund)

How Retail Investors Can Access Private Credit Through This Offering

The Invesco and Barings offering aims to make private credit accessible to retail investors by lowering the minimum investment requirements compared to traditional private equity offerings. The exact minimum investment and the specific investment platform used will be detailed in the offering documents. This could involve access through a specialized platform or brokerage account.

Accessing the Investment:

- Step 1: Review the offering documents carefully to understand the investment's risks and potential rewards.

- Step 2: Complete the necessary paperwork and provide required documentation, including KYC (Know Your Customer) verification.

- Step 3: Follow the onboarding process outlined by the investment platform.

- Step 4: Make your investment. (Include contact information if available for further inquiries).

Potential Risks and Considerations for Retail Investors

It's crucial to reiterate that private credit investments carry inherent risks. While the Invesco and Barings offering aims to mitigate these risks through diversification and experienced management, investors should carefully consider their own risk tolerance and financial goals before investing.

Key Risks to Consider:

- Potential for loss of principal: There's a risk of losing some or all of your invested capital.

- Lack of liquidity: It can be challenging to sell your investment quickly.

- Complexity of the investment: Understanding the investment requires a certain level of financial literacy.

- Importance of professional financial advice: Consult with a qualified financial advisor before making any investment decisions. This is especially important for retail investors less experienced with alternative investment strategies. They can assess your risk tolerance and suitability for this type of investment.

Gaining Access to Private Credit: The Invesco and Barings Opportunity

The Invesco and Barings private credit offering presents a unique opportunity for retail investors to diversify their portfolios and potentially achieve higher returns. However, it's essential to remember that private credit investments are not without risk. The potential for higher yields comes with the inherent illiquidity and complexity of the asset class. Before investing, thorough due diligence is vital, and seeking professional financial advice is strongly recommended.

To learn more about accessing this groundbreaking private credit investment opportunity and its specific terms, please visit the relevant Invesco or Barings website (insert link here). Take advantage of this opportunity to explore the world of private credit investment and potentially enhance your portfolio's diversification and return potential.

Featured Posts

-

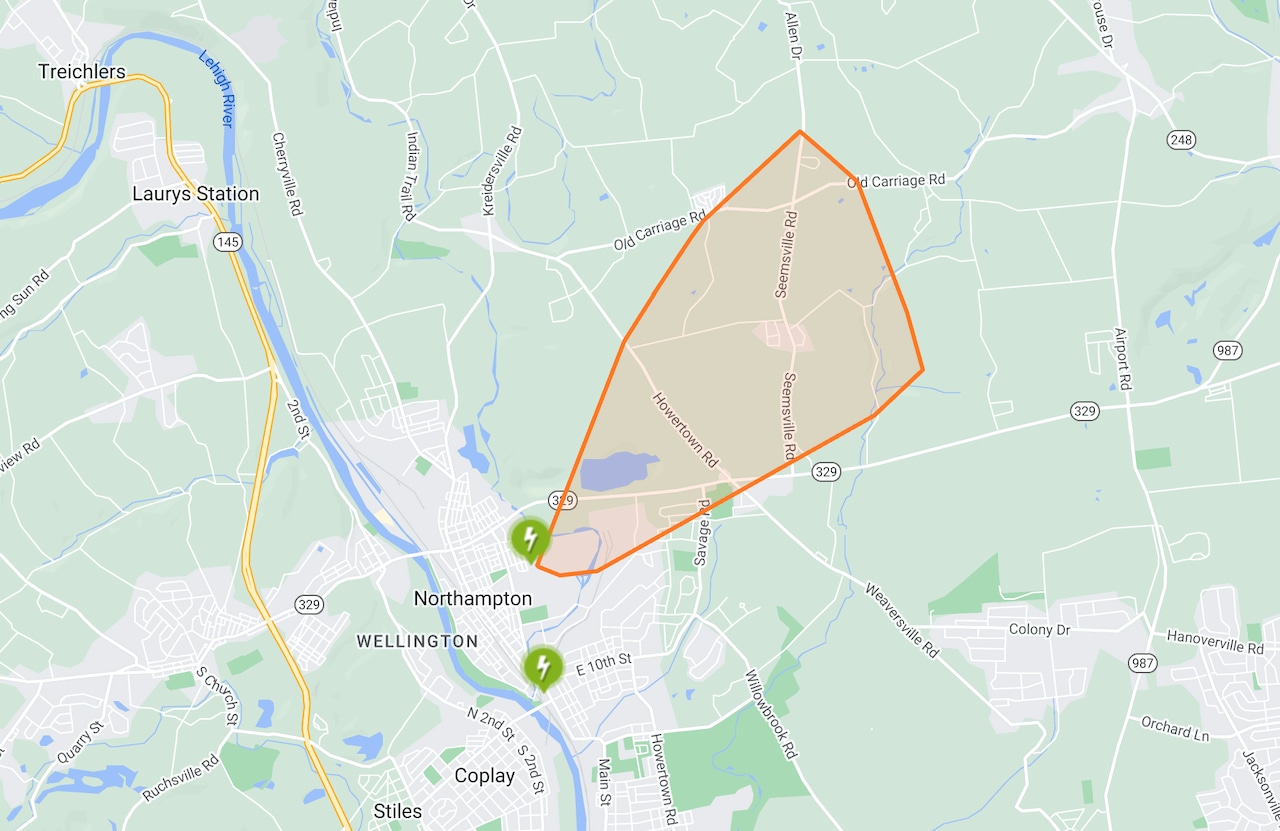

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025 -

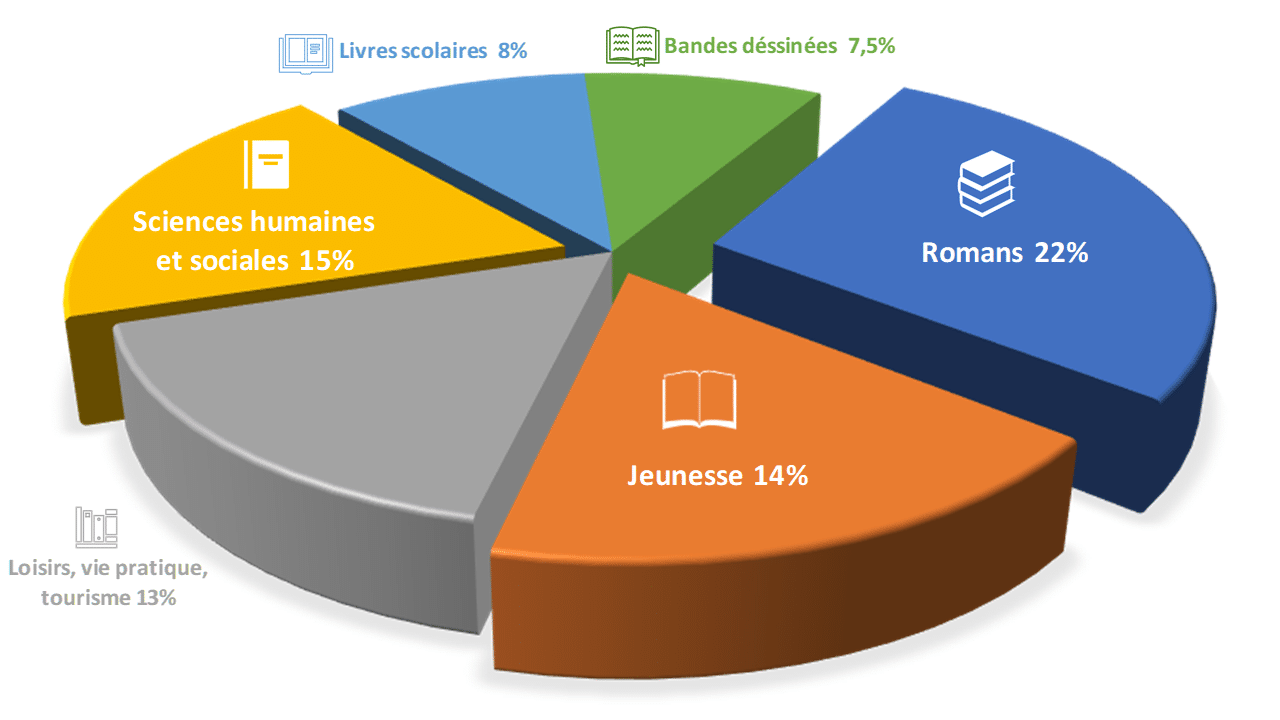

Resume Du 18h Eco Edition Du Lundi 14 Avril

Apr 23, 2025

Resume Du 18h Eco Edition Du Lundi 14 Avril

Apr 23, 2025 -

Anti Trump Rallies Hearing The Voices Of Resistance

Apr 23, 2025

Anti Trump Rallies Hearing The Voices Of Resistance

Apr 23, 2025 -

Strong Bullpen Performance Cole Ragans Leads Royals To Victory Over Brewers

Apr 23, 2025

Strong Bullpen Performance Cole Ragans Leads Royals To Victory Over Brewers

Apr 23, 2025 -

Cy Young Winners April Outing 9 Run Lead And Impressive Strikeout

Apr 23, 2025

Cy Young Winners April Outing 9 Run Lead And Impressive Strikeout

Apr 23, 2025