Access To Funding: Sustainability Programs For SMEs

Table of Contents

Identifying Suitable Sustainability Programs for Your SME

Before diving into funding options, it's crucial to identify sustainability programs that align with your business objectives and operational capabilities. A well-defined sustainability strategy isn't just about ticking boxes; it should integrate seamlessly into your overall business plan, driving efficiency and innovation.

Different types of sustainability programs cater to various needs:

- Energy Efficiency: Reducing energy consumption through measures like upgrading to energy-efficient equipment, implementing smart energy management systems, and utilizing renewable energy sources.

- Waste Reduction: Implementing strategies to minimize waste generation, improve recycling rates, and promote responsible disposal methods.

- Circular Economy: Adopting a circular approach that focuses on reducing, reusing, and recycling materials to minimize waste and maximize resource utilization.

Here's what to consider when choosing a program:

- Examples of specific programs: Government-backed schemes for renewable energy installation, grants for waste management improvements, subsidies for adopting circular economy practices. These often vary by sector (e.g., agriculture, manufacturing, tourism).

- Eligibility criteria: Each program has specific eligibility criteria based on business size, location, industry, and the type of sustainability project. Carefully review these to avoid wasted effort.

- Funding amounts and reporting requirements: Understand the funding levels available and the reporting requirements associated with each program. This ensures you can realistically plan your project and manage the administrative burden.

- Resources for identifying suitable programs: Government websites (e.g., your national environmental agency's website), industry associations, sustainability consultants, and online databases specializing in green funding opportunities are excellent resources.

Exploring Funding Options for Sustainability Initiatives

Securing funding for your sustainability projects involves exploring diverse avenues. The best option will depend on your project's scale, your business's financial standing, and the nature of the sustainability initiative.

Government Grants and Subsidies

Many governments offer grants and subsidies specifically designed to support SME sustainability initiatives. These programs often prioritize projects with demonstrable environmental and economic benefits. Eligibility criteria vary, but generally include factors like business size, location, and the type of project. Research national and regional programs to find options relevant to your business and location.

Private Sector Investments

Private investors are increasingly interested in sustainable ventures. Several options exist:

- Impact Investing: Investors prioritize both financial returns and positive social and environmental impact.

- Venture Capital: Venture capitalists invest in early-stage companies with high growth potential, including those in the green tech sector. They typically look for strong management teams, innovative technologies, and a clear path to profitability.

- Green Loans: Banks and other financial institutions are offering loans specifically designed to finance sustainable projects. These often come with favorable interest rates and flexible repayment terms.

Investors generally look for:

- A clear and well-defined sustainability strategy.

- Measurable environmental and economic benefits.

- A strong management team with relevant expertise.

- A robust financial plan demonstrating a clear return on investment (ROI).

Crowdfunding and Community Funding

Crowdfunding platforms allow you to raise funds from a large number of individuals through online campaigns. Building a compelling narrative and engaging with potential backers is crucial for success.

Green Bonds and Sustainability-Linked Loans

These financial instruments are specifically designed to finance sustainable projects. Green bonds are debt securities issued to raise capital for environmentally friendly projects, while sustainability-linked loans offer favorable interest rates based on the achievement of pre-defined sustainability goals.

- Advantages and disadvantages: Each funding option has its own set of advantages and disadvantages regarding accessibility, terms, and reporting requirements.

- Tips for creating a strong funding proposal: A clear articulation of your project's goals, measurable outcomes, and financial projections is paramount.

- Demonstrating ROI: Highlighting the financial benefits of your sustainability initiative (e.g., reduced energy costs, increased efficiency) is critical for securing funding.

Developing a Compelling Funding Proposal

A well-structured and persuasive funding proposal is essential for securing the necessary capital. The proposal should clearly articulate your project's goals, demonstrate its impact, and showcase its financial viability.

Defining Your Sustainability Goals

Clearly articulate your sustainability objectives, aligning them directly with your business goals. Demonstrate how the project contributes to the overall success of your business.

Demonstrating Impact

Quantify the environmental and economic benefits of your project using data and metrics. For example, quantify energy savings, waste reduction, or carbon emissions decreased.

Budget and Financial Projections

Develop a realistic budget that includes all project costs and demonstrates the financial viability of your project. Include projected revenue streams and ROI calculations.

Project Timeline and Milestones

Outline a clear timeline with key milestones to show your project's feasibility and progress tracking.

- Key elements of a successful funding proposal: A clear executive summary, a detailed project description, a comprehensive budget, and a strong team description.

- Compelling narratives and data presentation: Use visuals and charts to present data effectively and tell a compelling story about your project.

- Tailoring your proposal: Customize your proposal to each specific funder, highlighting the aspects that align with their priorities and funding criteria.

Securing Access to Funding for Your SME's Sustainability Journey

Successfully securing funding for your SME's sustainability initiatives requires a strategic approach. This involves identifying suitable programs aligning with your business goals, exploring diverse funding options to match your needs, and developing a compelling funding proposal that clearly articulates your project's value. Sustainable practices not only contribute to environmental protection but also improve your brand image, reduce operational costs, and enhance your business's long-term competitiveness. Start your journey towards a more sustainable and profitable future by exploring available access to funding for sustainability programs today! [Link to a relevant government resource here]

Featured Posts

-

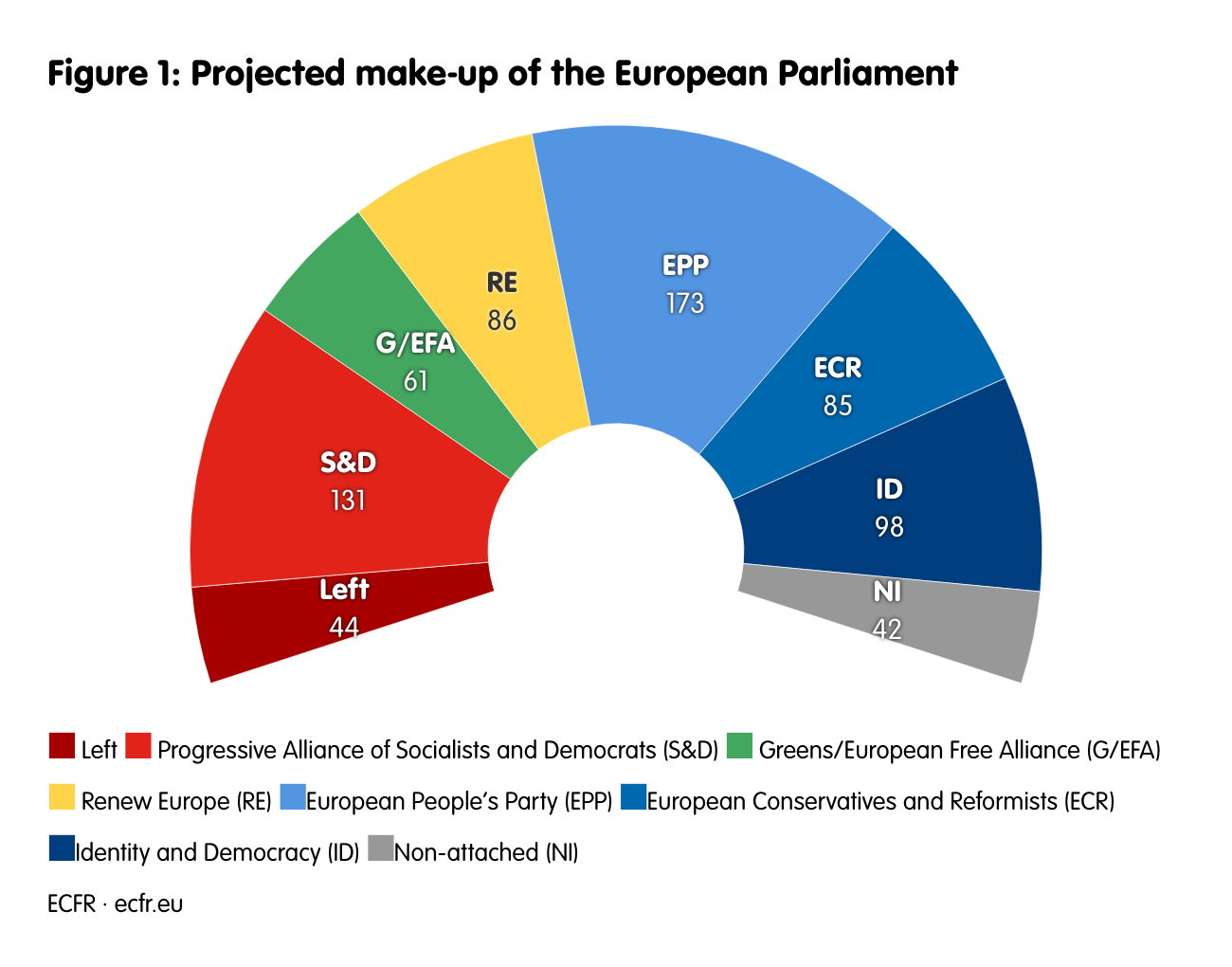

Analyzing Jordan Bardellas Presidential Campaign Strategy

May 19, 2025

Analyzing Jordan Bardellas Presidential Campaign Strategy

May 19, 2025 -

Nyt Mini Crossword Answers And Hints For April 18 2025

May 19, 2025

Nyt Mini Crossword Answers And Hints For April 18 2025

May 19, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Oteli Nde Tanitim

May 19, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Oteli Nde Tanitim

May 19, 2025 -

The Positive Economic Contribution Of Major Rave Festivals

May 19, 2025

The Positive Economic Contribution Of Major Rave Festivals

May 19, 2025 -

Balmain Fall Winter 2025 2026 Runway Show Highlights And Analysis

May 19, 2025

Balmain Fall Winter 2025 2026 Runway Show Highlights And Analysis

May 19, 2025

Latest Posts

-

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025 -

The Stakes Are High Polands Presidential Vote And Its European Impact

May 19, 2025

The Stakes Are High Polands Presidential Vote And Its European Impact

May 19, 2025 -

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices And Algorithmic Bias

May 19, 2025

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices And Algorithmic Bias

May 19, 2025 -

Militia Power Grab In Tripoli Prompts Libyan Pms Action Plan

May 19, 2025

Militia Power Grab In Tripoli Prompts Libyan Pms Action Plan

May 19, 2025 -

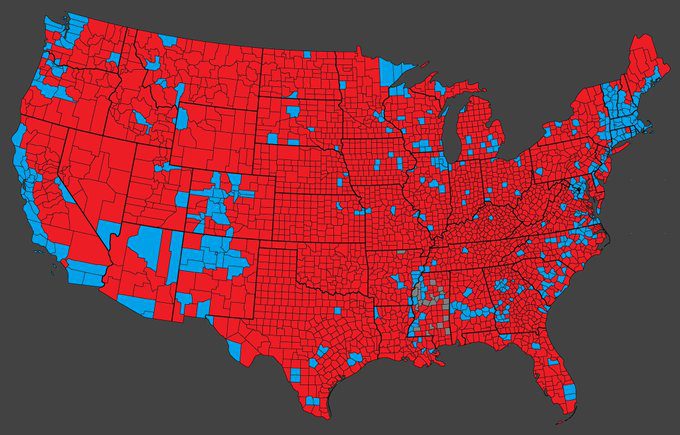

Polish Election 2024 What To Expect And Why It Matters

May 19, 2025

Polish Election 2024 What To Expect And Why It Matters

May 19, 2025