Ace The Private Credit Interview: 5 Essential Do's & Don'ts

Table of Contents

Do's for a Successful Private Credit Interview

Thoroughly Research the Firm and the Role

Before your private credit interview, meticulous research is paramount. Understanding the firm's investment strategy, recent deals, and team members demonstrates genuine interest and preparedness.

- Analyze the firm's investment strategy: What sectors do they focus on? What's their investment philosophy (e.g., value investing, growth investing)? Their website and press releases are invaluable resources.

- Examine recent deals: Utilize resources like PitchBook and Bloomberg to understand their recent transactions, investment sizes, and portfolio companies. This shows you're engaged with their current activities.

- Research the team: Use LinkedIn to learn about the individuals you'll be interviewing with. Understanding their backgrounds and experience provides valuable conversation starters.

- Understand the role: Carefully review the job description to fully grasp the responsibilities and required skills. Align your responses to directly address these requirements.

Demonstrating this level of preparation significantly elevates your candidacy and shows you're serious about the opportunity. A deep understanding of the firm's activities allows you to ask insightful questions and tailor your answers to resonate with their specific needs.

Showcase Your Financial Modeling Skills and Technical Proficiency

Private credit roles demand strong analytical skills and technical proficiency. Be prepared to showcase your expertise in key areas.

- Master financial modeling: Demonstrate proficiency in LBO modeling, DCF analysis, and credit analysis. Be ready to discuss the nuances of each technique.

- Highlight software skills: Mention your proficiency with Excel, Bloomberg Terminal, and other relevant software used in private credit. Quantify your experience whenever possible (e.g., "Built over 100 LBO models using Excel").

- Prepare examples: Have specific examples ready to illustrate your skills. Discuss projects where you successfully applied these techniques and highlight quantifiable results. For example, "My DCF analysis identified an undervalued asset, leading to a successful investment."

Tailoring your answers to highlight accomplishments and quantifiable results is key. Focus on demonstrating your ability to apply your technical skills to solve real-world problems.

Prepare Compelling Examples to Demonstrate Your Experience

Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions. This framework ensures clear and concise communication of your experience.

- Situation: Describe the context of the situation.

- Task: Outline the task you were responsible for.

- Action: Detail the actions you took.

- Result: Explain the outcome and quantify your achievements whenever possible.

Focus on showcasing your analytical skills, problem-solving abilities, and teamwork within a financial context. Emphasize achievements and their impact – did you save money, increase efficiency, or improve a process? Strong examples are crucial to demonstrating your value.

Ask Thought-Provoking Questions

Asking insightful questions shows initiative and genuine interest. Avoid questions easily answered through online research.

- Focus on strategy: Inquire about the firm's investment strategy, future plans, and potential challenges.

- Explore the deal pipeline: Ask about current opportunities, the types of deals they're pursuing, and the firm's competitive advantages.

- Understand the team culture: Ask about the team dynamics, mentorship opportunities, and the firm's commitment to employee development.

Thoughtful questions demonstrate your engagement and initiative. They provide opportunities for further conversation and demonstrate your proactive approach.

Practice and Prepare

Thorough preparation is critical for a successful private credit interview.

- Mock interviews: Practice with friends, mentors, or career services to refine your answers and build confidence.

- Common questions: Prepare answers to common interview questions related to your experience, skills, and career goals.

- Strengths and weaknesses: Identify your strengths and weaknesses to address potential concerns proactively.

Practicing helps alleviate nerves and ensures a confident and polished delivery during the actual interview. Identify areas for improvement and use the practice sessions to refine your responses.

Don'ts for a Private Credit Interview

Don't Underestimate the Importance of Soft Skills

Technical skills are essential, but soft skills are equally crucial in private credit.

- Communication: Communicate clearly and concisely, actively listen, and tailor your language to the audience.

- Teamwork: Highlight instances of successful collaboration and your ability to work effectively in a team environment.

- Professionalism: Maintain a professional demeanor throughout the interview process.

- Building rapport: Establish a connection with the interviewer through genuine engagement and active listening.

Soft skills are vital for building relationships, collaborating effectively, and navigating complex situations within a team.

Don't Neglect to Prepare for Behavioral Questions

Behavioral questions assess your personality and problem-solving approaches.

- Common questions: Prepare for questions like "Tell me about a time you failed," "Describe a challenging situation," or "How do you handle conflict?"

- STAR method: Use the STAR method to structure your answers and provide concrete examples.

These questions are designed to assess how you handle challenges and interact within a team. Practice thoughtful answers showcasing your problem-solving skills and ability to learn from mistakes.

Don't Be Afraid to Admit What You Don't Know

It's better to admit unfamiliarity with a topic than to pretend you know something you don't.

- Graceful admissions: Acknowledge your limitations honestly and highlight your eagerness to learn and adapt.

- Focus on learning: Emphasize your commitment to continuous learning and professional development.

Honesty and a willingness to learn are valued traits in the private credit industry.

Don't Focus Solely on Compensation

Discussing compensation too early in the interview process can be detrimental.

- Prioritize interest: Demonstrate genuine interest in the role and the firm before focusing on salary expectations.

- Strategic timing: Wait for the appropriate time in the interview process to discuss compensation.

Showing genuine interest in the opportunity and the firm's work is more important initially.

Don't Forget to Follow Up

A thank-you note after the interview reiterates your interest and key qualifications.

- Professional note: Send a personalized email thanking the interviewer for their time and reiterating your interest in the position.

- Key qualifications: Briefly highlight key skills or experiences that make you a strong candidate.

- Timely delivery: Send the note within 24 hours of the interview.

A timely and professional follow-up demonstrates your continued interest and attention to detail.

Conclusion: Mastering the Private Credit Interview

By following these do's and don'ts, you'll significantly increase your chances of acing your next private credit interview. Remember the importance of thorough preparation, showcasing both technical and soft skills, and demonstrating genuine interest in the firm and the role. Start preparing today and land your dream role in the exciting world of private credit!

Featured Posts

-

March Madness Live Streaming Your Guide To Watching Without Cable

May 27, 2025

March Madness Live Streaming Your Guide To Watching Without Cable

May 27, 2025 -

Resume Du Match Laso Chlef Vs Usma Triomphe Chlefi Au Stade Du 5 Juillet

May 27, 2025

Resume Du Match Laso Chlef Vs Usma Triomphe Chlefi Au Stade Du 5 Juillet

May 27, 2025 -

Zamfara Police Foil Bandit Attack Kill Notorious Kingpin

May 27, 2025

Zamfara Police Foil Bandit Attack Kill Notorious Kingpin

May 27, 2025 -

Watch Bad Moms In Hd On Comedy Central

May 27, 2025

Watch Bad Moms In Hd On Comedy Central

May 27, 2025 -

Gwen Stefani Pregnant Is A Baby With Blake Shelton On The Way

May 27, 2025

Gwen Stefani Pregnant Is A Baby With Blake Shelton On The Way

May 27, 2025

Latest Posts

-

La Poderosa Frase Para Marcelo Rios El Ex Numero 3 Del Mundo

May 30, 2025

La Poderosa Frase Para Marcelo Rios El Ex Numero 3 Del Mundo

May 30, 2025 -

French Open Upset Borges Wins After Ruuds Knee Troubles

May 30, 2025

French Open Upset Borges Wins After Ruuds Knee Troubles

May 30, 2025 -

French Open 2024 Swiatek Advances As Top Seeds Ruud And Tsitsipas Fall

May 30, 2025

French Open 2024 Swiatek Advances As Top Seeds Ruud And Tsitsipas Fall

May 30, 2025 -

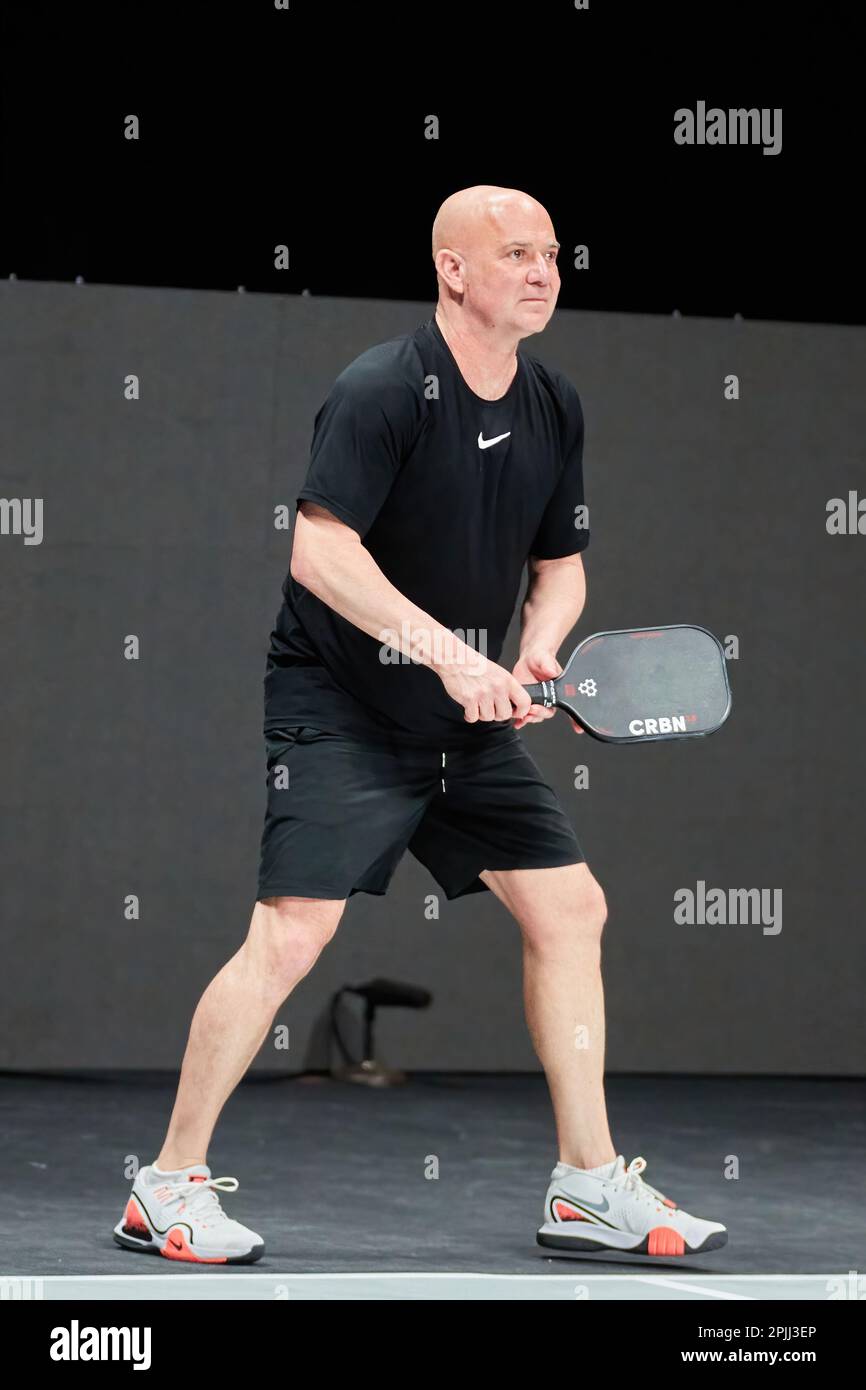

Pickleballs New Star Andre Agassis Debut Match Analyzed

May 30, 2025

Pickleballs New Star Andre Agassis Debut Match Analyzed

May 30, 2025 -

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Continued Success

May 30, 2025

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Continued Success

May 30, 2025