Action Needed: Understanding The Latest HMRC Correspondence For UK Residents

Table of Contents

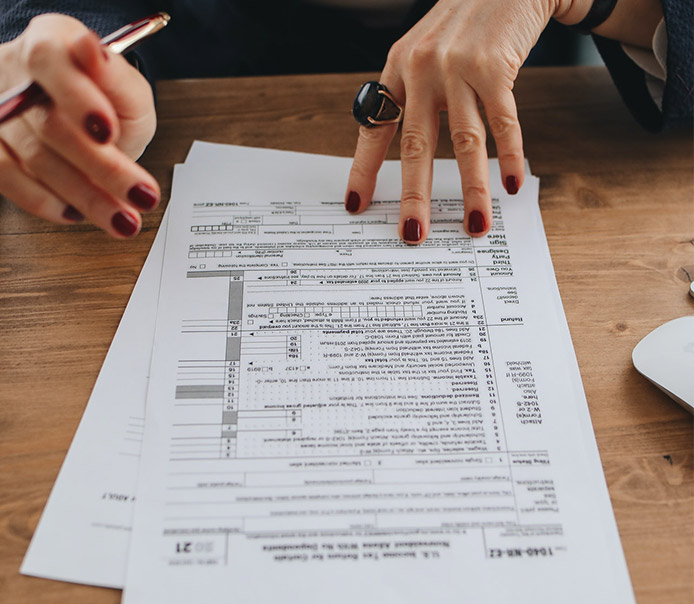

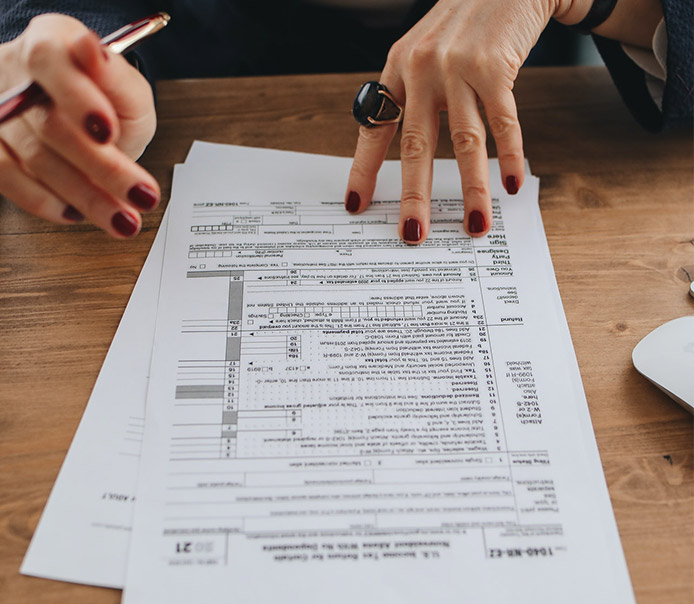

Identifying the Type of HMRC Correspondence

Understanding the type of HMRC correspondence you've received is the first crucial step. Different letters require different responses and levels of attention.

Tax Return Reminders & Updates

HMRC sends reminders to ensure you submit your self-assessment tax return on time. Responding promptly to these reminders is vital. Failure to submit your return by the deadline can result in significant penalties.

- Examples of reminder letters: You'll typically receive email reminders, and potentially postal reminders, leading up to the deadline.

- Deadlines: The self-assessment tax return deadline is usually 31 January following the tax year (6 April to 5 April the following year).

- Online submission options: HMRC's online services provide a convenient way to file your return.

- Penalties for late filing: Penalties for late submission can be substantial and increase the longer you delay.

Tax Assessment Notices

A tax assessment notice details the amount of tax you owe based on your income and other relevant factors. It's a formal notification of your tax liability. If you disagree with the assessment, you have avenues to appeal.

- Understanding the breakdown of the tax assessment: The notice will clearly outline the various components making up your tax bill, including income tax, National Insurance contributions, and any other applicable taxes.

- Options for payment: HMRC provides various payment methods, including online payments through the HMRC payment portal, bank transfers, and other options.

- Appealing an assessment: If you believe the assessment is incorrect, you can formally appeal the decision.

- Contacting HMRC for clarification: If anything is unclear, contact HMRC directly for clarification before the payment deadline.

Tax Enquiry & Investigation Letters

Receiving a tax enquiry or investigation letter is a serious matter. These letters indicate that HMRC is reviewing your tax affairs and may require further information. Seeking professional advice is strongly recommended.

- Understanding the reason for the enquiry: The letter will typically outline the specific areas under review.

- Gathering necessary documentation: Collect all relevant documents to support your tax position.

- Engaging an accountant or tax advisor: A qualified professional can guide you through the process and represent you in your dealings with HMRC.

- Potential penalties: Failure to cooperate fully with an HMRC investigation can lead to significant penalties.

National Insurance Contributions (NIC) Correspondence

Correspondence regarding National Insurance Contributions (NIC) may relate to your NIC statement, contributions, or potential discrepancies.

- Understanding NIC statements: Your NIC statement shows your contributions for the tax year.

- Addressing discrepancies: If you notice discrepancies, contact HMRC immediately to clarify.

- Implications for State Pension entitlement: Your NIC contributions directly impact your State Pension entitlement.

- Contacting the NIC helpline: HMRC offers dedicated helplines for NIC-related queries.

PAYE Correspondence

PAYE (Pay As You Earn) correspondence usually relates to your tax code, potential underpayments, or overpayments.

- Understanding PAYE codes: Your PAYE code determines the amount of tax deducted from your salary.

- Addressing tax code discrepancies: If your tax code is incorrect, it may result in overpayment or underpayment of tax. Correcting this is crucial.

- Claiming tax refunds: If you've overpaid tax, you can claim a refund through the HMRC website.

- Understanding tax repayment methods: HMRC provides various methods for receiving tax refunds.

Understanding the Language of HMRC Correspondence

HMRC correspondence can sometimes use complex terminology. Understanding the language used is critical for taking appropriate action.

Deciphering Jargon and Terminology

HMRC uses specific jargon and terminology. Familiarizing yourself with these terms will help you understand your letters more easily. Refer to the HMRC website for detailed explanations and guidance.

- Examples of common HMRC jargon: Tax year, self-assessment, PAYE, NIC, tax liability, etc. The HMRC website offers a glossary of terms.

- Clear explanations: Seek clarification if you're unsure about any terminology.

Identifying Key Dates and Deadlines

Always pay close attention to dates and deadlines specified in your HMRC correspondence. Missing deadlines can have serious consequences.

- Highlighting where dates are usually found in letters: Dates are typically prominently displayed near the payment due date and other critical information.

- Understanding the consequences of missing deadlines: Missing deadlines can result in penalties and interest charges.

Taking Action on Your HMRC Correspondence

Prompt and appropriate action is key when dealing with HMRC correspondence.

Responding to HMRC

HMRC offers several ways to respond to their communications:

- Online portal login: Manage your tax affairs conveniently through the HMRC online portal.

- Postal addresses for different HMRC departments: Use the correct address for your specific query, as outlined on the HMRC website.

- Telephone numbers: HMRC provides telephone numbers for various queries; however, online communication is generally preferred for record-keeping.

- When to seek professional help: Seek professional help if you are unsure about the contents of any letter or how to respond.

Seeking Professional Advice

Dealing with complex tax matters can be challenging. Don't hesitate to seek professional help from a qualified accountant or tax advisor.

- Reasons to seek professional advice: Seek advice when dealing with tax investigations, complex tax issues, or if you lack confidence in handling the situation yourself.

- Finding a qualified accountant or tax advisor: Use HMRC's online resources to find a qualified professional.

Conclusion

Understanding and responding promptly to HMRC correspondence is crucial for avoiding penalties and maintaining your tax affairs in order. Different letters require different actions, from submitting your tax return to appealing a tax assessment or cooperating with a tax enquiry. Always carefully review all correspondence, note key dates, and seek professional advice when necessary. Don't ignore your HMRC correspondence! Take action today to avoid penalties and ensure your tax affairs are in order. For further information and support, visit the official HMRC website. If you need assistance, find a qualified tax advisor using online resources.

Featured Posts

-

Jacob Friis Julkisti Avauskokoonpanonsa Glen Kamara Ja Teemu Pukki Vaihdossa

May 20, 2025

Jacob Friis Julkisti Avauskokoonpanonsa Glen Kamara Ja Teemu Pukki Vaihdossa

May 20, 2025 -

Matheus Cunha To Man United Journalist Offers Concerning Transfer Update

May 20, 2025

Matheus Cunha To Man United Journalist Offers Concerning Transfer Update

May 20, 2025 -

Tadic Sarajevo Ne Vidi Opasnost Od Urusavanja Daytonskog Sporazuma

May 20, 2025

Tadic Sarajevo Ne Vidi Opasnost Od Urusavanja Daytonskog Sporazuma

May 20, 2025 -

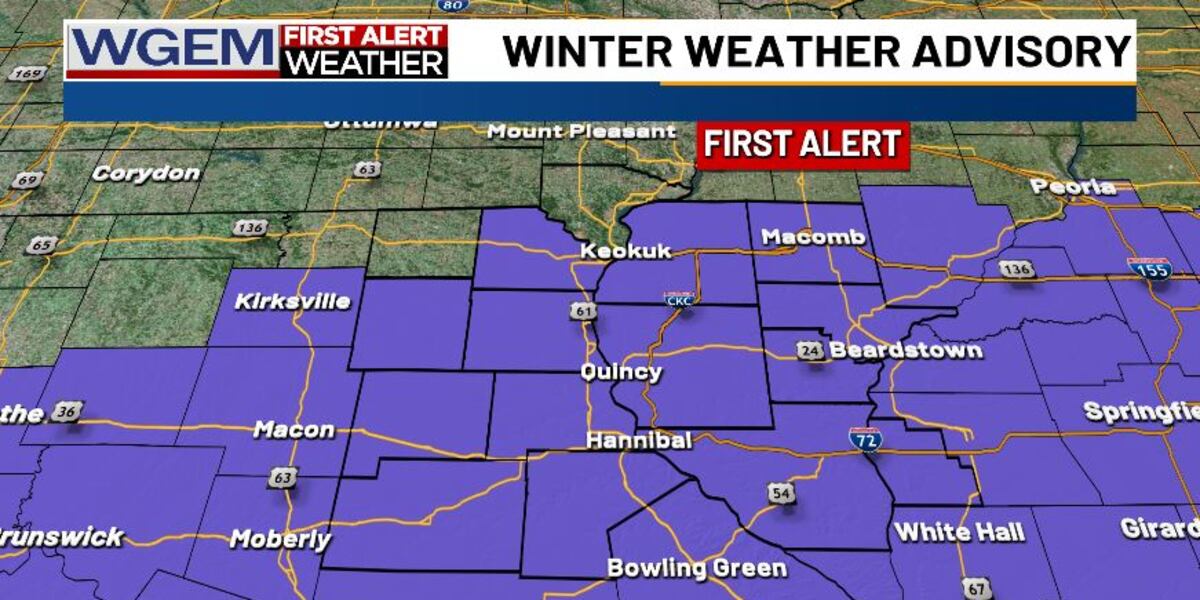

Understanding Winter Weather Advisories And Their Impact On School

May 20, 2025

Understanding Winter Weather Advisories And Their Impact On School

May 20, 2025 -

Jacob Friisin Avauskokoonpano Kamara Ja Pukki Sivussa

May 20, 2025

Jacob Friisin Avauskokoonpano Kamara Ja Pukki Sivussa

May 20, 2025