Activision Blizzard Acquisition: FTC's Appeal Against Microsoft

Table of Contents

The FTC's Case Against the Activision Blizzard Acquisition

The FTC's core argument against the Microsoft-Activision Blizzard merger centers on the potential for anti-competitive behavior in the video game market. The commission argues that the acquisition would give Microsoft an unfair advantage, stifling competition and ultimately harming consumers. Their concerns stem from several key areas:

-

Domination of the gaming console market: The FTC contends that combining Microsoft's existing market power with Activision Blizzard's extensive portfolio of popular games, particularly Call of Duty, would create an insurmountable barrier to entry for competitors, potentially leading to a console market dominated by Microsoft. The extremely high popularity of Call of Duty is a central point in the FTC's argument.

-

Concerns about exclusive titles and reduced competition: A key fear is that Microsoft could make Activision Blizzard's popular game titles, such as Call of Duty, World of Warcraft, and Candy Crush, exclusive to its Xbox ecosystem, severely limiting their availability on competing platforms like PlayStation and Nintendo Switch. This exclusivity would harm consumers by limiting their choice and potentially driving up prices on Microsoft's platform.

-

Impact on game prices and subscription services: The FTC worries that the merger could lead to increased prices for games and subscription services like Xbox Game Pass. By controlling more popular titles, Microsoft might have the leverage to raise prices, reducing consumer affordability and harming the broader gaming market.

-

The FTC's proposed remedies: While initially seeking to fully block the merger, the FTC's specific remedies weren't explicitly detailed. However, the underlying goal is to prevent Microsoft from leveraging its increased market power to harm competition.

-

Specific games cited: The FTC's argument heavily emphasizes Call of Duty's immense popularity and its potential for anti-competitive practices. The sheer number of players, the game's consistent popularity, and its strong brand recognition are key factors for the FTC's concerns.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the acquisition, arguing that it benefits consumers and promotes competition. Their counterarguments focus on several points:

-

Arguments regarding continued availability of games on competing platforms: Microsoft has repeatedly pledged to continue making Call of Duty and other Activision Blizzard titles available on PlayStation and other platforms, even offering long-term contractual agreements to guarantee this availability. These commitments aim to directly address the FTC's concerns about exclusivity.

-

Emphasis on benefits for gamers: Microsoft highlights potential benefits for gamers, such as lower prices through bundled offerings and enhanced access to games via Xbox Game Pass. They argue that the merger would broaden the reach and accessibility of popular titles.

-

Discussions of market share and the competitive landscape: Microsoft emphasizes that its market share, even with the acquisition, wouldn't be overwhelmingly dominant, leaving room for healthy competition from other gaming companies. This counters the FTC's argument about creating a monopoly.

-

Proposed commitments to maintain competition: To appease regulatory concerns, Microsoft has made various commitments, including licensing agreements, ensuring the continued availability of Activision Blizzard's titles on multiple platforms.

The Role of International Regulatory Bodies

The Activision Blizzard acquisition isn't just a US issue; it's a global concern. Other regulatory bodies are also examining the merger:

-

UK's CMA decision: The UK's Competition and Markets Authority (CMA) initially blocked the deal, citing concerns similar to the FTC. However, Microsoft subsequently appealed this decision and secured a conditional approval after offering concessions.

-

The EU's stance: The European Union initially reviewed the merger but ultimately approved it after Microsoft made concessions similar to those offered to the UK's CMA, including ensuring long-term access to Call of Duty on PlayStation.

-

Varying international interpretations: The differing approaches of these regulatory bodies highlight the complexities of antitrust law and its varying interpretations across different jurisdictions, demonstrating how national laws and approaches to competition significantly influence the outcome of such mergers.

The Potential Outcomes of the Appeal

Several potential outcomes exist for the FTC's appeal:

-

Probability of the FTC winning: The probability of the FTC winning the appeal remains uncertain, depending on the court's interpretation of the evidence and the arguments presented by both sides.

-

Impact on future mergers in the tech sector: Regardless of the outcome, this case will set a significant precedent for future mergers and acquisitions in the tech sector, particularly within the gaming industry, shaping how regulatory bodies approach similar deals.

-

Consequences for Microsoft and Activision Blizzard: A successful appeal for the FTC could lead to the merger being blocked entirely or significantly modified. Failure could mean the deal proceeds as planned, but the legal battle itself has already cost both Microsoft and Activision Blizzard time and resources.

Long-Term Implications for the Gaming Industry

The FTC's challenge to the Activision Blizzard acquisition has significant long-term implications for the gaming industry:

-

The future of game exclusivity and subscription services: The outcome will influence the future of game exclusivity and the viability of subscription services like Xbox Game Pass, affecting both developers and consumers.

-

Potential changes to competition within the console market: This case will affect the competitive landscape of the console market, potentially reshaping the dynamics between major players like Sony, Nintendo, and Microsoft.

-

Effects on the development and distribution of video games: The ruling will influence how video games are developed, distributed, and priced, impacting the entire ecosystem from game developers to publishers.

-

Long-term impact on game pricing and consumer choice: The long-term effects on game prices and consumer choice are difficult to predict with certainty but the case will undoubtedly influence future pricing models within the industry.

Conclusion

The FTC's appeal against the Microsoft-Activision Blizzard acquisition is a pivotal legal battle with far-reaching consequences for the gaming industry. This case sets a precedent for future mergers and acquisitions in the tech sector, highlighting the increasing scrutiny of large-scale consolidation. The outcome will significantly shape the competitive landscape and access to popular game titles. The ongoing debate over the Activision Blizzard acquisition underscores the complexity of balancing technological innovation with fair competition.

Call to Action: Stay informed about the developments in this crucial case of the Activision Blizzard Acquisition. Follow this space for updates and analysis as the legal battle unfolds. Further research into the Activision Blizzard acquisition and its antitrust implications is highly recommended.

Featured Posts

-

Zendaya Facing Public Accusation Half Sisters Cancer Claim

May 07, 2025

Zendaya Facing Public Accusation Half Sisters Cancer Claim

May 07, 2025 -

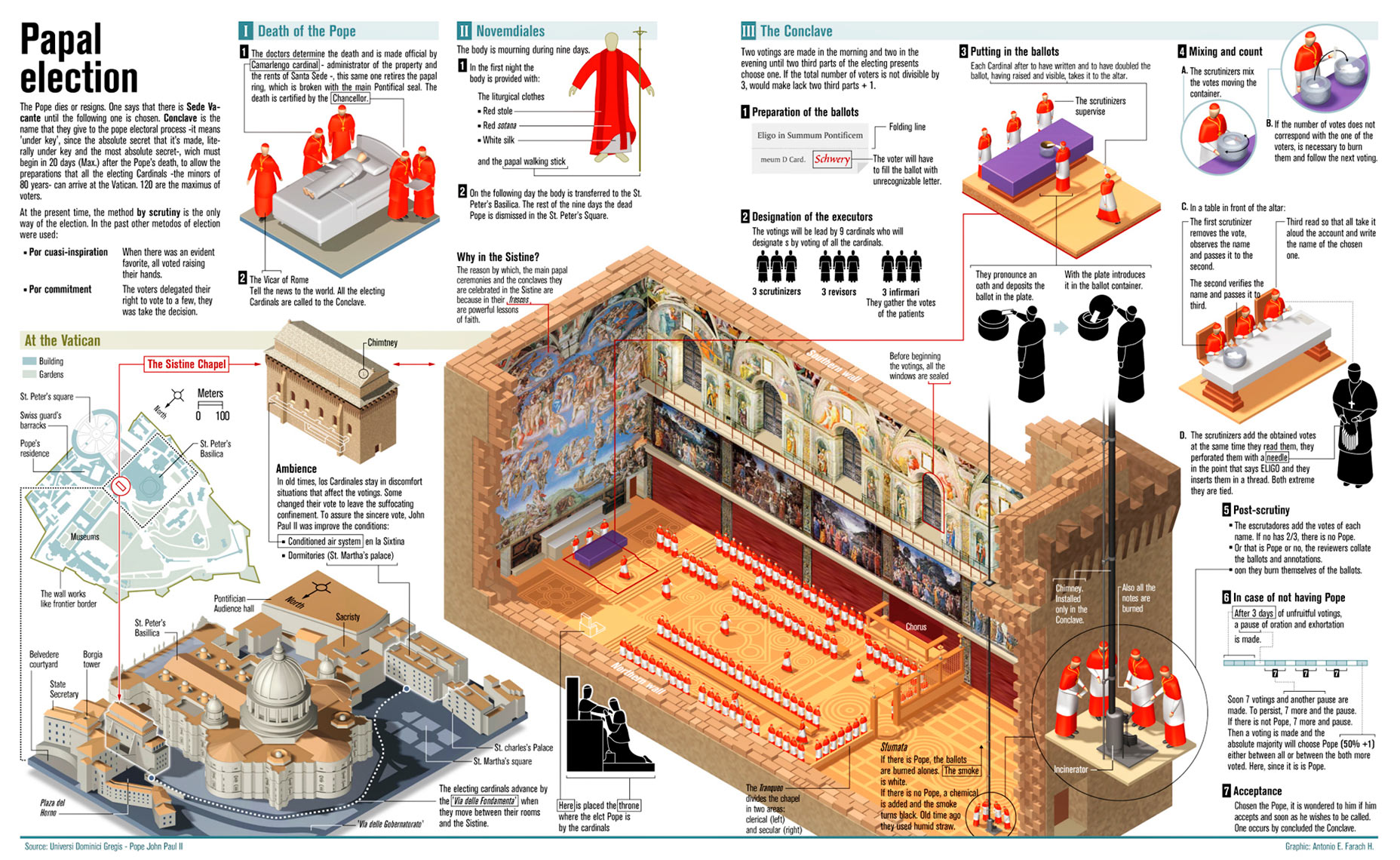

Conclave Explained A Step By Step Guide To The Papal Election

May 07, 2025

Conclave Explained A Step By Step Guide To The Papal Election

May 07, 2025 -

Ed Shiyrn Iznenadvaschi Dumi Za Riana

May 07, 2025

Ed Shiyrn Iznenadvaschi Dumi Za Riana

May 07, 2025 -

Greg Abel Warren Buffetts Successor At Berkshire Hathaway

May 07, 2025

Greg Abel Warren Buffetts Successor At Berkshire Hathaway

May 07, 2025 -

Votre Escapade Au Lioran Hebergements Et Activites A Onet Le Chateau

May 07, 2025

Votre Escapade Au Lioran Hebergements Et Activites A Onet Le Chateau

May 07, 2025

Latest Posts

-

Xrps Potential Record High The Impact Of The Grayscale Etf Application

May 07, 2025

Xrps Potential Record High The Impact Of The Grayscale Etf Application

May 07, 2025 -

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025 -

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 07, 2025

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 07, 2025 -

Sec Review Of Grayscale Etf Could Send Xrp Price To New Heights

May 07, 2025

Sec Review Of Grayscale Etf Could Send Xrp Price To New Heights

May 07, 2025 -

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025