Adani Ports & Eternal: Stock Market Movers & Shakers - Sensex & Nifty Update

Table of Contents

Adani Ports' Performance and Market Influence

Recent Stock Performance of Adani Ports:

Adani Ports' share price has exhibited [insert recent price movement data - e.g., a steady upward trend, significant volatility, etc.]. Analyzing the daily, weekly, and monthly charts reveals [insert specific data points and analysis, e.g., a 10% increase over the last month, a significant dip following a specific news event, etc.]. Several factors have contributed to this performance:

- Increased Cargo Volume: A surge in cargo handling at Adani Ports' various facilities has boosted revenue and profitability.

- Successful Expansion Projects: The successful completion and commissioning of new terminals and infrastructure has expanded the company's capacity and market reach.

- Favorable Government Policies: Government initiatives promoting infrastructure development and easing regulations have created a positive environment for Adani Ports' growth.

[Insert relevant charts and graphs visually representing Adani Ports' share price movement and key performance indicators]. These visuals will significantly enhance the article’s appeal and clarity. Understanding Adani Ports share price movements is crucial for any potential Adani Ports investment.

Adani Ports' Impact on the Sensex:

Adani Ports' significant market capitalization gives it considerable weight within the Sensex index. Its performance directly correlates with overall market sentiment, often acting as a barometer of investor confidence in the infrastructure sector. [Quantify Adani Ports' contribution to Sensex movements – e.g., a recent 1% increase in the Sensex can be attributed to Adani Ports' strong performance]. Its index weightage [Insert Percentage] underscores its importance in the overall health of the Sensex. The correlation between Adani Ports' stock analysis and the Sensex impact is strong, making it a key stock to watch for any Sensex investor.

Eternal's Performance and Market Influence

Recent Stock Performance of Eternal:

Eternal's share price has shown [insert recent price movement data - e.g., fluctuating performance, consistent growth, etc.]. Examining daily, weekly, and monthly data reveals [insert specific data points and analysis, e.g., a 5% dip after a quarterly earnings report, a steady climb driven by strong sales figures, etc.]. Key factors influencing Eternal's performance include:

- Strong Financial Results: Consistent profitability and positive earnings reports have boosted investor confidence.

- Successful New Product Launches: The introduction of innovative products has captured market share and driven revenue growth.

- High Market Demand: Strong demand for Eternal's products or services has fueled sales and contributed to positive stock performance.

[Insert relevant charts and graphs visually representing Eternal's share price movement and key performance indicators]. Analyzing Eternal share price trends is vital for any investor considering an Eternal investment.

Eternal's Impact on the Nifty:

Eternal's contribution to Nifty movements is [quantify Eternal's contribution – e.g., a recent positive shift in the Nifty index can be partially attributed to Eternal's strong performance]. Its performance reflects broader market sentiment within its specific industry sector. The company's weightage in the Nifty index is [Insert Percentage], indicating its relative importance. Similar to Adani Ports, understanding Eternal's impact on the Nifty is essential for those interested in Nifty analysis.

Comparative Analysis: Adani Ports vs. Eternal

Comparing Performance and Market Influence:

Comparing Adani Ports and Eternal reveals contrasting performance patterns and market influences. While Adani Ports' performance is largely tied to infrastructure development and government policies, Eternal's success hinges on [mention Eternal's key drivers, e.g., product innovation, market demand within its specific sector]. Both stocks carry inherent risks and opportunities. Adani Ports' performance is susceptible to economic downturns affecting infrastructure spending, while Eternal faces risks associated with [mention Eternal's specific sector risks, e.g., competition, changing market trends]. However, both offer potential growth prospects in their respective sectors. Conducting a comprehensive Adani Ports vs Eternal comparison is crucial for informed investment decisions.

Sensex and Nifty Outlook: Future Predictions

Predicting Future Trends:

Predicting the future of the Sensex and Nifty is inherently complex. However, based on current market conditions and expert opinions [mention some credible sources and their predictions], we anticipate [insert a cautious outlook – e.g., moderate growth, potential volatility, etc.]. Adani Ports and Eternal are likely to play a role in shaping these trends. [Explain how the future performance of each company could impact the Sensex and Nifty]. The stock market forecast remains uncertain, so a prudent approach is always recommended.

Conclusion: Adani Ports & Eternal – Investing Wisely

Adani Ports and Eternal are significant players in the Indian stock market, exerting considerable influence on the Sensex and Nifty indices. Understanding their individual performance drivers, market correlations, and inherent risks is paramount for making informed investment decisions. This analysis provides valuable insights, but it's crucial to conduct thorough due diligence before committing capital. Remember, investing in Adani Ports, Eternal, or any stock requires careful consideration of your risk tolerance and investment goals. Before making any investment choices related to Adani Ports, Eternal, Sensex, or Nifty, conduct further research and consult with a financial advisor.

Featured Posts

-

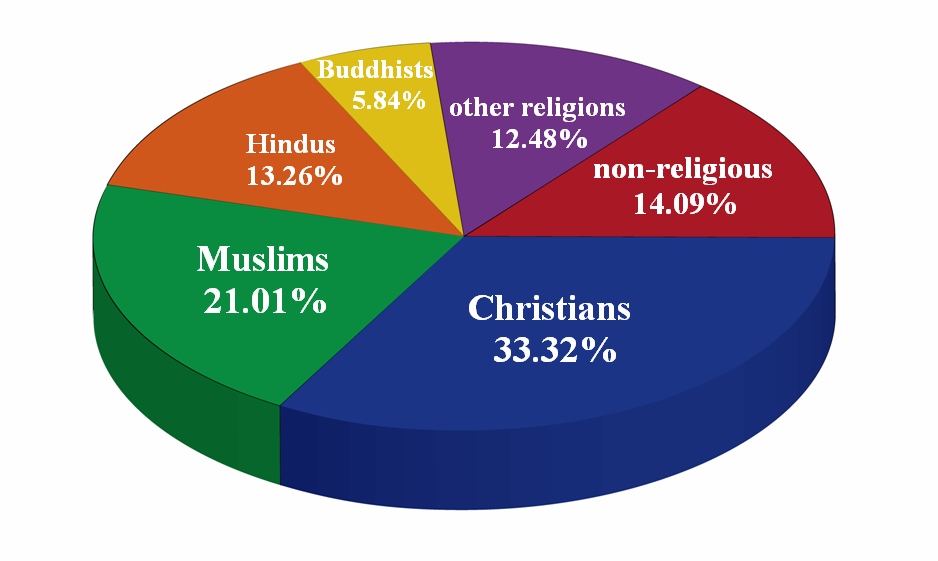

Gods Mercy Across Faiths Religious Beliefs In 1889

May 10, 2025

Gods Mercy Across Faiths Religious Beliefs In 1889

May 10, 2025 -

Analysis Of Lais Ve Day Speech The Totalitarian Threat To Taiwan

May 10, 2025

Analysis Of Lais Ve Day Speech The Totalitarian Threat To Taiwan

May 10, 2025 -

Figma Vs Adobe Word Press And Canva The Ai Advantage

May 10, 2025

Figma Vs Adobe Word Press And Canva The Ai Advantage

May 10, 2025 -

Franko Polskoe Partnerstvo Podrobnosti O Novom Oboronnom Soglashenii

May 10, 2025

Franko Polskoe Partnerstvo Podrobnosti O Novom Oboronnom Soglashenii

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 10, 2025

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 10, 2025